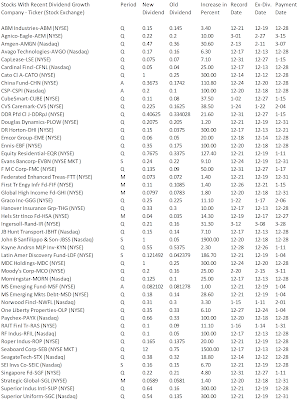

22 of the dividend growth

stocks/funds from last week are currently recommended to buy. Last Week’s dividend

hikes are also affected by the fiscal cliff. Companies try to hedge against automated

tax increases on dividends and pay extraordinary dividends before 2013.

Here are my favorite dividend growth stocks:

Amgen (NASDAQ:AMGN) has a market capitalization of $68.45 billion. The company employs 17,500 people, generates revenue of $15.582 billion and has a net income of $3.683 billion. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $6.612 billion. The EBITDA margin is 42.43 percent (the operating margin is 27.67 percent and the net profit margin 23.64 percent).

Financial Analysis: The total debt represents 43.85 percent of the company’s assets and the total debt in relation to the equity amounts to 112.61 percent. Due to the financial situation, a return on equity of 17.14 percent was realized. Twelve trailing months earnings per share reached a value of $5.59. Last fiscal year, the company paid $0.56 in the form of dividends to shareholders. AMGN announced to raise dividends by 30.6 percent.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 15.95, the P/S ratio is 4.39 and the P/B ratio is finally 3.73. The dividend yield amounts to 2.11 percent and the beta ratio has a value of 0.41.

| Long-Term Stock History Chart Of Amgen (AMGN) |

| Long-Term Dividends History of Amgen (AMGN) |

| Long-Term Dividend Yield History of Amgen (AMGN) |

CVS Caremark (NYSE:CVS) has a market capitalization of $61.39 billion. The company employs 202,000 people, generates revenue of $107.100 billion and has a net income of $3.488 billion. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $7.898 billion. The EBITDA margin is 7.37 percent (the operating margin is 5.91 percent and the net profit margin 3.26 percent).

Financial Analysis: The total debt represents 15.52 percent of the company’s assets and the total debt in relation to the equity amounts to 26.32 percent. Due to the financial situation, a return on equity of 9.22 percent was realized. Twelve trailing months earnings per share reached a value of $2.98. Last fiscal year, the company paid $0.50 in the form of dividends to shareholders. CVS announced to raise dividends by 38.5 percent.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 16.53, the P/S ratio is 0.57 and the P/B ratio is finally 1.68. The dividend yield amounts to 1.83 percent and the beta ratio has a value of 0.74.

| Long-Term Stock History Chart Of CVS Caremark (CVS) |

| Long-Term Dividends History of CVS Caremark (CVS) |

| Long-Term Dividend Yield History of CVS Caremark (CVS) |

Roper Industries (NYSE:ROP) has a market capitalization of $10.82 billion. The company employs 8,570 people, generates revenue of $2.797 billion and has a net income of $427.25 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $795.22 million. The EBITDA margin is 28.43 percent (the operating margin is 23.62 percent and the net profit margin 15.27 percent).

Financial Analysis: The total debt represents 20.40 percent of the company’s assets and the total debt in relation to the equity amounts to 33.96 percent. Due to the financial situation, a return on equity of 14.37 percent was realized. Twelve trailing months earnings per share reached a value of $4.65. Last fiscal year, the company paid $0.47 in the form of dividends to shareholders. ROP announced to raise dividends by 20.0 percent.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 23.67, the P/S ratio is 3.87 and the P/B ratio is finally 3.33. The dividend yield amounts to 0.60 percent and the beta ratio has a value of 0.81.

| Long-Term Stock History Chart Of Roper Industries (ROP) |

| Long-Term Dividends History of Roper Industries (ROP) |

| Long-Term Dividend Yield History of Roper Industries (ROP) |

Take a closer look at the full

table of stocks with recent dividend hikes. The average dividend growth amounts

to 129.26 percent and the average dividend yield amounts to 2.81 percent.

Stocks from the sheet are valuated with a P/E ratio of 17.21. The average P/S

ratio is 7.61 and P/B 2.84.

Here is the full list of last week's dividend growth stocks:

|

| Dividend Growth I (Click to enlarge) |

|

| Dividend Growth II (Click to enlarge) |

If you like this list, please give us a Facebook

Like!

Or post a comment

on Twitter!

Here are the market price ratios of the companies:

Ticker

|

Company

|

P/E

|

P/S

|

P/B

|

Dividend Yield

|

GHI

|

Global High Income Fund, Inc.

|

31.24

|

15.11

|

0.97

|

7.65%

|

KYN

|

Kayne Anderson MLP Investment Company

|

7.47

|

81.72

|

0.93

|

7.05%

|

OLP

|

One Liberty Properties Inc.

|

22.75

|

6.41

|

1.22

|

6.67%

|

RAS

|

RAIT Financial Trust

|

0.00

|

1.25

|

0.34

|

6.30%

|

PLOW

|

Douglas Dynamics, Inc.

|

22.60

|

1.74

|

1.89

|

6.05%

|

STX

|

Seagate Technology PLC

|

3.66

|

0.66

|

3.07

|

5.50%

|

UBA

|

Urstadt Biddle Properties Inc.

|

35.15

|

6.66

|

1.42

|

5.31%

|

LSE

|

CapLease, Inc.

|

20.35

|

2.25

|

0.83

|

5.29%

|

UHT

|

Universal Health Realty Income Trust

|

7.81

|

12.32

|

3.35

|

5.14%

|

SGL

|

Strategic Global Income Fund Inc.

|

0.00

|

0.00

|

0.00

|

4.83%

|

EBF

|

Ennis Inc.

|

17.82

|

0.74

|

1.06

|

4.73%

|

SGC

|

Superior Uniform Group Inc.

|

21.60

|

0.60

|

1.11

|

4.72%

|

MSD

|

Morgan Stanley Emerging Markets Debt Fund Inc.

|

10.97

|

16.20

|

0.99

|

4.68%

|

RFIL

|

RF Industries Ltd.

|

24.11

|

1.17

|

1.57

|

4.61%

|

NWFL

|

Norwood Financial Corp.

|

11.22

|

3.27

|

1.06

|

4.05%

|

TY

|

Tri-Continental Corporation

|

13.98

|

27.35

|

0.85

|

3.92%

|

PAYX

|

Paychex, Inc.

|

22.18

|

5.46

|

7.41

|

3.92%

|

HAS

|

Hasbro Inc.

|

14.16

|

1.16

|

3.16

|

3.90%

|

CATO

|

Cato Corp.

|

11.95

|

0.82

|

1.91

|

3.82%

|

SUP

|

Superior Industries International, Inc.

|

7.51

|

0.62

|

1.06

|

3.40%

|

THG

|

The Hanover Insurance Group Inc.

|

11.53

|

0.37

|

0.62

|

3.20%

|

MDC

|

MDC Holdings Inc.

|

122.21

|

1.59

|

1.84

|

2.92%

|

ABM

|

ABM Industries Inc.

|

20.87

|

0.26

|

1.33

|

2.87%

|

EVBN

|

Evans Bancorp Inc.

|

9.04

|

1.99

|

0.90

|

2.75%

|

WPO

|

The Washington Post Company

|

18.29

|

0.67

|

1.01

|

2.68%

|

WDFC

|

WD-40 Company

|

21.05

|

2.12

|

3.92

|

2.50%

|

EQR

|

Equity Residential

|

89.50

|

8.27

|

2.80

|

2.43%

|

CUBE

|

CubeSmart

|

0.00

|

6.70

|

1.89

|

2.27%

|

AVGO

|

Avago Technologies Limited

|

13.96

|

3.22

|

3.15

|

2.06%

|

CSPI

|

CSP Inc.

|

11.63

|

0.23

|

0.97

|

1.87%

|

GGG

|

Graco Inc.

|

22.74

|

3.19

|

7.27

|

1.76%

|

AMGN

|

Amgen Inc.

|

15.96

|

4.07

|

3.44

|

1.61%

|

SWZ

|

The Swiss Helvetia Fund Inc.

|

0.00

|

30.83

|

0.96

|

1.59%

|

AEM

|

Agnico-Eagle Mines Ltd.

|

0.00

|

4.77

|

2.71

|

1.50%

|

SGF

|

The Singapore Fund, Inc.

|

0.00

|

0.00

|

0.00

|

1.48%

|

SEIC

|

SEI Investments Co.

|

20.17

|

4.01

|

3.55

|

1.35%

|

IR

|

Ingersoll-Rand Plc

|

14.38

|

1.02

|

1.93

|

1.34%

|

MCO

|

Moody's Corp.

|

17.45

|

4.22

|

34.65

|

1.33%

|

CVS

|

CVS Caremark Corporation

|

16.52

|

0.51

|

1.66

|

1.32%

|

LDF

|

Latin American Discovery Fund Inc.

|

0.00

|

29.10

|

0.99

|

1.24%

|

TTC

|

Toro Co.

|

19.92

|

1.27

|

7.99

|

1.04%

|

CFNL

|

Cardinal Financial Corp.

|

11.65

|

4.06

|

1.59

|

1.02%

|

JBHT

|

JB Hunt Transport Services Inc.

|

22.84

|

1.37

|

8.62

|

0.98%

|

DHI

|

DR Horton Inc.

|

6.89

|

1.41

|

1.67

|

0.80%

|

CHN

|

The China Fund, Inc.

|

0.00

|

42.55

|

0.95

|

0.73%

|

FMC

|

FMC Corp.

|

18.80

|

2.13

|

5.48

|

0.63%

|

MORN

|

Morningstar Inc.

|

31.32

|

4.71

|

4.06

|

0.62%

|

EME

|

EMCOR Group Inc.

|

16.61

|

0.36

|

1.69

|

0.60%

|

MSF

|

Morgan Stanley Emerging Markets Fund Inc.

|

0.00

|

47.76

|

0.99

|

0.54%

|

ROP

|

Roper Industries Inc.

|

23.66

|

3.70

|

3.02

|

0.50%

|

SEB

|

Seaboard Corp.

|

10.23

|

0.50

|

1.28

|

0.12%

|

JBSS

|

John B Sanfilippo & Son Inc.

|

8.80

|

0.27

|

0.92

|

0.00%

|

VCI

|

Valassis Communications Inc.

|

9.81

|

0.49

|

2.29

|

0.00%

|

Average

|

17.21

|

7.61

|

2.84

|

2.81%

|

Related Stock Ticker:

ABM, AEM, AMGN, AVGO, LSE, CFNL, CATO, CHN, CSPI,

CUBE, CVS, DDEpJ, PLOW, DHI, EME, EBF, EQR, EVBN, FMC, FTT, FIF, GHI, GGG, THG,

HAS, IR, JBHT, JBSS, KYN, LDF, MDC, MCO, MORN, MSF, MSD, NWFL, OLP, PAYX, RAS, RFIL,

ROP, SEB, STX, SEIC, SGF, SGL, SUP, SGC, SWZ, TTC, TY, UHT, UBA, VCI, WPO, WDFC

*I am long HAS. I

receive no compensation to write about these specific stocks, sector or theme.

I don't plan to increase or decrease positions or obligations within the next

72 hours.

For the other stocks: I

have no positions in any stocks mentioned, and no plans to initiate any

positions within the next 72 hours. I receive no compensation to write about

any specific stock, sector or theme.