This

blog is mainly focused on high-quality dividend paying stocks that delivered a

solid trustful dividend growth history in the past.

This

blog is mainly focused on high-quality dividend paying stocks that delivered a

solid trustful dividend growth history in the past.

I'm also focused on higher yielding stocks because I

do believe that those companies offer a better risk compensation and their

business model allows it to generate a higher amount of free cash which could

be distributed to shareholders.

But you need to look more into the balance sheets and

income statements of a company in order to identify such a cash flow strength.

A high yield doesn't mean that you will also get a high total return. If you get big dividends but the stock price falls, your return will turn negative.

A high yield doesn't mean that you will also get a high total return. If you get big dividends but the stock price falls, your return will turn negative.

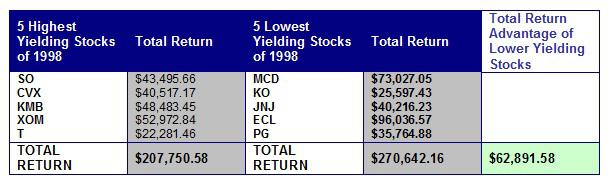

The attached chart spells out the cost to the investor of focusing on yield over a long period of investing history.

Investors who emphasized yield when purchasing stocks from this group of beloved cherry-picked Dividend Growth stocks missed out on earning the equivalent of a year's worth of a nice middle-class salary over the 18 years studied here.

You might see that a portfolio with lower yielding stocks delivered more total return due to a larger stock price appreciation than higher yielding stocks with lower growth possibilities.

Today I would like to introduce a few lower yielding Dividend Achievers with a fantastic future prediction. The attached list ranks midcap plus Dividend Achievers by its future EPS growth forecast. Only stocks with a debt to equity ratio under 1 were observed.

Here are the 20 top results, sorted by growth...

|

| 20 Low Yielding Dividend Achievers That Might Deliver A Better Total Return Than High-Yield Stocks (click to enlarge) |