|

| Source: Seeking Alpha |

Showing posts with label BKEP. Show all posts

Showing posts with label BKEP. Show all posts

A Compilation Of High-Yield MLP Oil And Gas Pipeline Stocks

Oil & gas pipeline operators transport fuel through pipelines, often over great distances.

Most of these companies are structured as Master Limited Partnerships (MLPs), which helps limit costs by passing tax obligations along to shareholders.

Since MLPs are required to distribute the vast majority of their earnings to shareholders, these stocks usually offer very high dividend yields.

Master Limited Partnerships have the same liquid trading characteristics as common stock, yet they are very different from common stocks. The most obvious difference is that MLP's are 'pass through' investment vehicles--they pass through the income to you the investor.

The Partnership pays no taxes at the company level--instead passing the income to you (and of course you likely pay taxes on the income). Thus one level of taxation is removed allowing the investor to receive a larger distribution.

Today I like to show you some of the highest yielding oil and gas pipeline stocks on the market. Pipelines generate stable revenues while having a clear benefit compared to railroad and transportation stocks in terms of CO2 emissions.

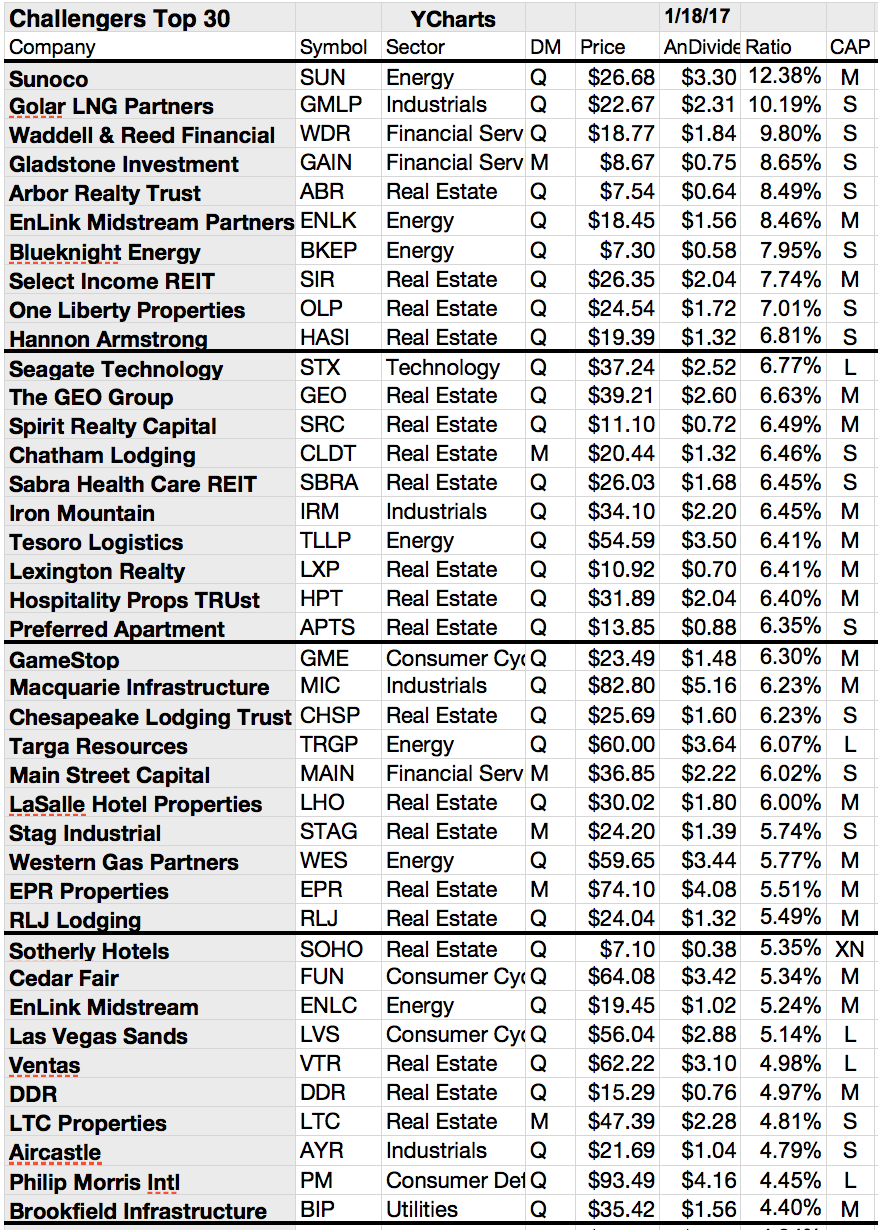

Here is a table of 15 high-yield oil and gas pipeline partnerships...

Most of these companies are structured as Master Limited Partnerships (MLPs), which helps limit costs by passing tax obligations along to shareholders.

Since MLPs are required to distribute the vast majority of their earnings to shareholders, these stocks usually offer very high dividend yields.

Master Limited Partnerships have the same liquid trading characteristics as common stock, yet they are very different from common stocks. The most obvious difference is that MLP's are 'pass through' investment vehicles--they pass through the income to you the investor.

The Partnership pays no taxes at the company level--instead passing the income to you (and of course you likely pay taxes on the income). Thus one level of taxation is removed allowing the investor to receive a larger distribution.

Today I like to show you some of the highest yielding oil and gas pipeline stocks on the market. Pipelines generate stable revenues while having a clear benefit compared to railroad and transportation stocks in terms of CO2 emissions.

Here is a table of 15 high-yield oil and gas pipeline partnerships...

Williams Partners (WPZ) Hiked Dividends By 1.77% And 7 Others Followed

Yesterday was a good day in terms

of dividend growth. Eight companies raised their dividend payments. The biggest

stock was the specialty chemical company Williams Partners. WPZ announced a

1.76 percent dividend hike and yields at 6.67 percent. The company has a rosy

future. Analysts are expecting earnings per share to grow by at least 12

percent over the next five years. Only the high debt to equity ratio of 4.20

gives investors a bad taste.

Seven of eight

companies with dividend growth on the last trading day have a market

capitalization of more than USD 1 billion. Oil and gas companies are the most

represented stocks.

The highest

yielding stock is the drilling and explorations company Legacy Reserves with a

8.22 percent dividend yield. LGCY

raised its quarterly dividends by 0.87 percent, yesterday.

The latest Dividend Growth Stock List

Company

|

Dividend Yield in %

|

Dividend Growth

|

Payment Period

|

Ex-Dividend Date

|

Dividend Payment Date

|

Blueknight Engy Ptrs GP

|

5.50

|

2.13%

|

Quarterly

|

7/31/2013

|

8/14/2013

|

Calumet Specialty Prdts

|

8.25

|

0.74%

|

Quarterly

|

7/31/2013

|

8/14/2013

|

Crane Co

|

1.90

|

7.14%

|

Quarterly

|

8/28/2013

|

9/10/2013

|

Legacy Reserves LP

|

8.29

|

0.87%

|

Quarterly

|

7/30/2013

|

8/14/2013

|

Northwest Bancorp

|

3.66

|

8.33%

|

Quarterly

|

7/30/2013

|

8/15/2013

|

Oiltanking Partners LP

|

3.55

|

4.94%

|

Quarterly

|

7/31/2013

|

8/14/2013

|

Rayonier Inc.

|

3.34

|

11.36%

|

Quarterly

|

9/12/2013

|

9/30/2013

|

Williams Partners

|

6.67

|

1.77%

|

Quarterly

|

7/31/2013

|

8/9/2013

|

Do you like this article? If yes, please support us and hit the button for a Facebook Like, make a tweet or post a comment in the Dividend Yield

community! Thank you so much, we really appreciate it.

Labels:

BKEP,

CLMT,

CR,

Dividend,

Dividend Growth,

Growth,

High Yield,

LGCY,

NWBI,

Oil and Gas,

OILT,

RYN,

WPZ

Subscribe to:

Posts (Atom)