Bill Gates is not only a self made billionaire who got his wealth from Microsoft. He is a much more diversified guy as you might think. A few years earlier, Bill Gates founded the Bill & Melinda Gates Foundation Trust which has a current portfolio value of around USD 17.8 billion.

The trust owns only 21 stocks of which around half of the value comes from the incurance company led by Warren Buffett, Berkshire Hathaway.

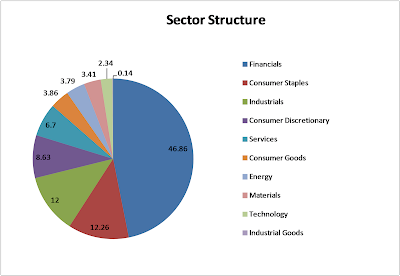

Financial service is a big theme for Bill Gates. Other important industries he prefers are defensive consumer stocks and industrials. All three sectors combined represent around 80.7 percent of Bill Gates's full asset allocation.

Bill Gates has a similar investment style like his friend Warren Buffett. He is a passive long-term investor but with some different ideas and views about stocks and earnings growth. Why should it be otherwise? He’s a old tech guy.

Last Quarter, Bill Gates made only one stock purchase and sold six companies. Five of them were closed completely. The biggest impact had the reduction of the current Berkshire stake which impacted his portfolio by 3.59 percent.

Five of his seven portfolio moves pay dividends.