When you purchase individual stocks, risk is inherent. Sometimes bad things happen to good stocks. Eventually, every investor will hold a stock that falls out of favor and endures a double-digit decline. Understanding this from the onset makes it easier to deal with. To minimize the risk of significant declines, your core portfolio should focus on blue-chip dividend growth stocks.

Listed below are companies that have recently elected to raise their payout and yield by increasing their cash dividends to shareholders. In total, there were 28 companies with higher dividend payments.

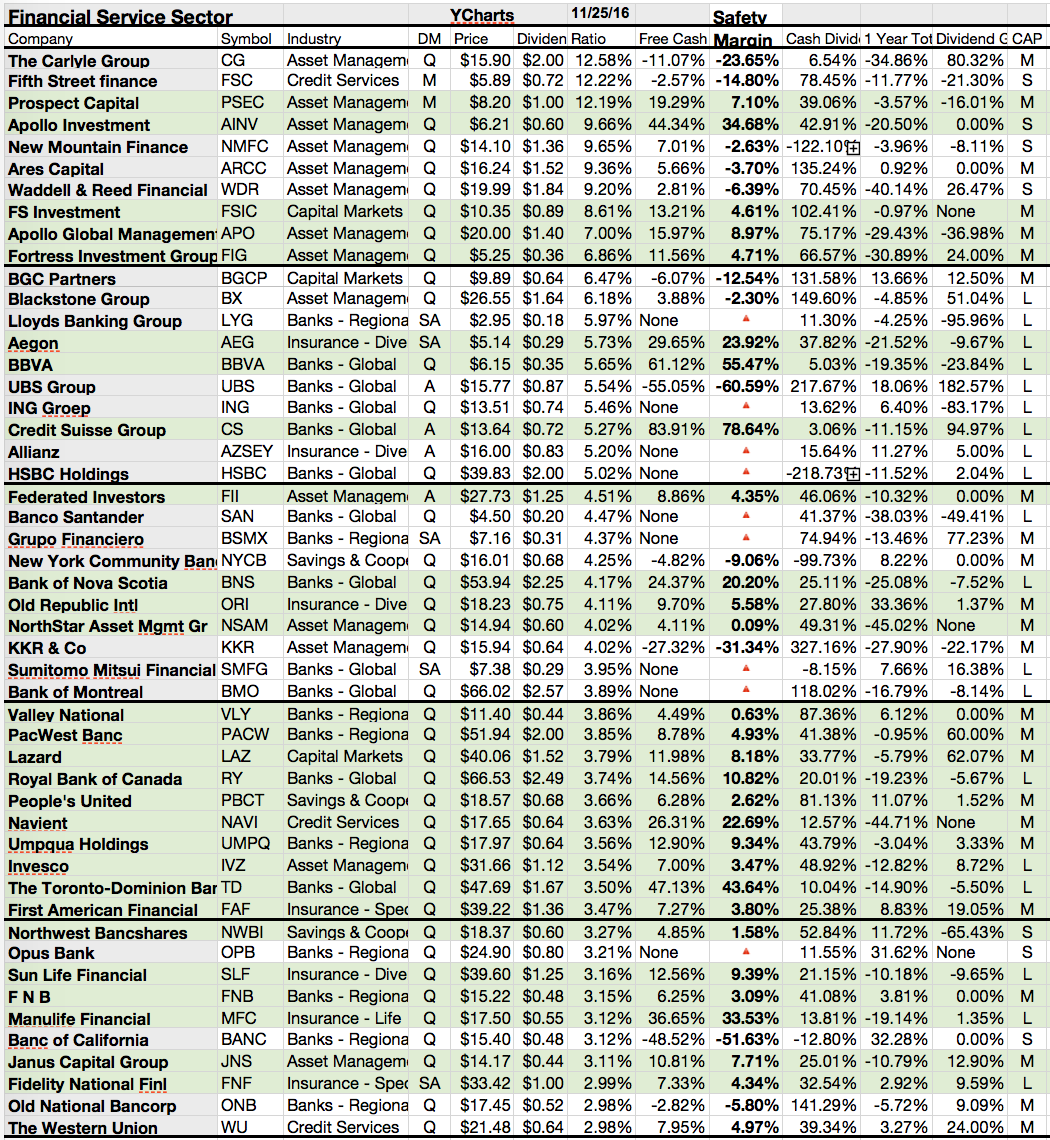

Each month, I’ll be sharing with you, for free, the top dividend growth stocks for the US market. You can find them in the list below:

The 20 Worst Performing Dividend Paying Stocks for 2016

Sometimes, when we try to have our cake and eat it, too, life comes back to bite us. Or, in this case, the market comes back to bite us. Such was the case this year for investors who bought growth stocks that also offered up dividends.

We are looking for the Worst Stocks for 2016. In these times of market turbulence, it’s our job to watch out for the worst investments that can sink your portfolio. Our search is not merely limited to the worst stock in the Dow or S&P.

Below you will find the 20 worst performing dividend paying stocks for the year 2016. Sometimes you will find there really attractive bargains. Oversold companies with a big group of short seller.

Those could be really great investing opportunities. Heathcare stocks is the worst performing group. I like GILD, AMGN, NVO and AZN. Which do you like from the list?

These are the 20 worst performing large cap dividend paying stocks....

We are looking for the Worst Stocks for 2016. In these times of market turbulence, it’s our job to watch out for the worst investments that can sink your portfolio. Our search is not merely limited to the worst stock in the Dow or S&P.

Below you will find the 20 worst performing dividend paying stocks for the year 2016. Sometimes you will find there really attractive bargains. Oversold companies with a big group of short seller.

Those could be really great investing opportunities. Heathcare stocks is the worst performing group. I like GILD, AMGN, NVO and AZN. Which do you like from the list?

These are the 20 worst performing large cap dividend paying stocks....

Safe And High-Yielding Dividend Stocks to Buy

With the markets warming up to the reality of a Donald Trump presidency and administration, some people have become nervous about dividend-paying stocks as they see higher interest rates and inflation ahead.

While the bond proxy sectors like real estate investment trusts and utilities may hold less appeal as they are very slow growers, other sectors like consumer staples and telecoms still make sense since they can continue to grow market share.

We screened the Merrill Lynch research database for stocks with the firms best volatility rating, and solid growing dividends that were rated Buy. We found five that growth and income investors could buy now, and put in their portfolios forever.

What investors will want to not ignore is that some of these are still well off of highs. The post-election rally has been targeting many infrastructure and higher interest rate winners, so some of these may be overlooked.

These are the results...

While the bond proxy sectors like real estate investment trusts and utilities may hold less appeal as they are very slow growers, other sectors like consumer staples and telecoms still make sense since they can continue to grow market share.

We screened the Merrill Lynch research database for stocks with the firms best volatility rating, and solid growing dividends that were rated Buy. We found five that growth and income investors could buy now, and put in their portfolios forever.

What investors will want to not ignore is that some of these are still well off of highs. The post-election rally has been targeting many infrastructure and higher interest rate winners, so some of these may be overlooked.

These are the results...

Dividend Growth Stocks With Return Promise

Dividend growth stocks generally act as a hedge against economic or political uncertainty as these belong to mature companies, which are less susceptible to large swings in the market while simultaneously offer downside protection with their consistent increase in payouts.

Additionally, these stocks have superior fundamentals that make dividend growth a quality and promising investment for the long term. These include a sustainable business model, a long track of profitability, rising cash flows, good liquidity, strong balance sheet and some value characteristics. Further, a history of strong dividend growth indicates that a future hike is likely, which makes the portfolio safer.

Although these stocks do not necessarily have the highest yields, they have outperformed for a longer period than the broader stock market or any other dividend-paying stock.

Here are the screening results of our latest dividend growth screen of stock that could deliver solid returns for the mid- and long-term:

Additionally, these stocks have superior fundamentals that make dividend growth a quality and promising investment for the long term. These include a sustainable business model, a long track of profitability, rising cash flows, good liquidity, strong balance sheet and some value characteristics. Further, a history of strong dividend growth indicates that a future hike is likely, which makes the portfolio safer.

Although these stocks do not necessarily have the highest yields, they have outperformed for a longer period than the broader stock market or any other dividend-paying stock.

Here are the screening results of our latest dividend growth screen of stock that could deliver solid returns for the mid- and long-term:

Subscribe to:

Posts (Atom)