Companies that aggressively repurchase their shares tend to outperform the market.

A portfolio made up of the 10% of stocks with the highest buyback yields, rebalanced each year, was the best performer over the long term.

It gained an average of 13.7% annually from 1927 through to the end of 2009. In comparison, the market gained 10.5% per year over the same period and stocks with the lowest 10% of buyback yields climbed only 5.9% per year.

Buybacks, also called share repurchases, are a controversial financial tool. Some companies truly have more cash then they need so they return it to shareholders by buying existing shares in the open market.

This buying support and reduction in outstanding shares helps increase the value of remaining shares, in a fairly tax efficient manner.

However, companies may also use buybacks as a means to boost earnings per share in order to please short-term investors, analyst estimates, and executives looking to increase their bonuses. Nonetheless, the buyback trend is still going strong.

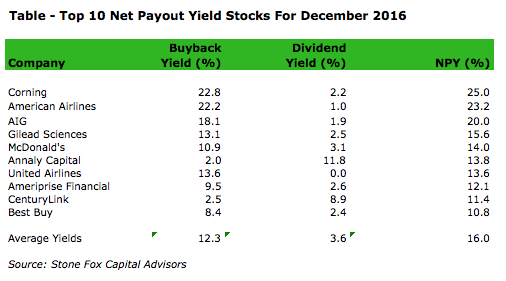

Attached I've compiled 10 of the S&P 500 stocks with the biggest Buyback Yield.

Here are the best companies by buyback yield...

|

Source: Seeking Alpha

|

| Souce: Factset |