Finding the Best Dividend Kings is difficult. Nevertheless, I would like to give you a try today and introduce you to the Best Dividend Kings.

Today I focused on the dividend kings category. Such stocks have increased their dividends uninterruptedly over a period of 50+ years dividends. There are currently exactly 29 stocks that match this.

Best Dividend Kings

Best Dividend Kings are some of the following stocks:

Altria

3M

Johnson & Johnson

Emerson Electric

Lowe’s

...

As a supporter of my work, you can view the full list for free. It took me a lot of work to create it. It would be nice if you would support me so that I can continue to do good work for you in the future.

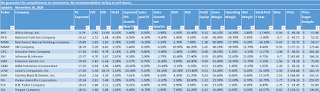

The table consists of 29 Best Dividend Kings and is also available as an Excel download. At the end of the article you will find the link that will allow you to download the file of all Dividend Kings.

As an active supporter, you get further every month a sheet with the best long-term dividend growth stocks in the World (USA, CANADA and JAPAN). That’s an Excel-File with over 1,000 long-term dividend growth stocks.

Analyse the best Dividend Kings by the following criteria:

Ticker

Company

Industry

Market Capitalization

Forward P/E

P/S

P/B

Dividend Yield

EPS next 5 Years

Sales past 5 Years

Sales Q/Q

Return on Assets

Return on Equity

Debt/Equity

Gross Margin

Oper Margin

Profit Margin

One Year Performance

Beta

Price

Analyst Target Price

You might like this articles too:

Please support my work and see the full table about the best Dividend Kings....

___STEADY_PAYWALL___

Here is a preview of the table.

Top Results by Yield

| Ticker | Company | Yield |

| MO | Altria Group, Inc. | 8.52% |

| FRT | Federal Realty Investment Trust | 4.66% |

| NFG | National Fuel Gas Company | 4.18% |

| NWN | Northwest Natural Holding Company | 3.78% |

| MMM | 3M Company | 3.32% |

| GPC | Genuine Parts Company | 3.19% |

| KO | The Coca-Cola Company | 3.10% |

| CINF | Cincinnati Financial Corporation | 3.06% |

| JNJ | Johnson & Johnson | 2.81% |

| EMR | Emerson Electric Co. | 2.58% |

| SYY | Sysco Corporation | 2.51% |

| PG | The Procter & Gamble Company | 2.28% |

| CL | Colgate-Palmolive Company | 2.08% |

| HRL | Hormel Foods Corporation | 1.98% |

| SJW | SJW Group | 1.90% |

| ABM | ABM Industries Incorporated | 1.84% |

| AWR | American States Water Company | 1.76% |

| LANC | Lancaster Colony Corporation | 1.75% |

| CWT | California Water Service Group | 1.67% |

| DOV | Dover Corporation | 1.60% |

| CBSH | Commerce Bancshares, Inc. | 1.56% |

| LOW | Lowe's Companies, Inc. | 1.55% |

| TGT | Target Corporation | 1.51% |

| SWK | Stanley Black & Decker, Inc. | 1.50% |

| PH | Parker-Hannifin Corporation | 1.28% |

| FUL | H.B. Fuller Company | 1.22% |

| TR | Tootsie Roll Industries, Inc. | 1.14% |

| SCL | Stepan Company | 1.03% |

| NDSN | Nordson Corporation | 0.77% |

Best Dividend Kings by forward P/E

| Ticker | Company | PE Expected |

| MO | Altria Group, Inc. | 8.79 |

| FRT | Federal Realty Investment Trust | 45.52 |

| NFG | National Fuel Gas Company | 10.12 |

| NWN | Northwest Natural Holding Company | 19.89 |

| MMM | 3M Company | 18.74 |

| GPC | Genuine Parts Company | 17.18 |

| KO | The Coca-Cola Company | 25.09 |

| CINF | Cincinnati Financial Corporation | 20.60 |

| JNJ | Johnson & Johnson | 15.97 |

| EMR | Emerson Electric Co. | 19.89 |

| SYY | Sysco Corporation | 22.63 |

| PG | The Procter & Gamble Company | 23.45 |

| CL | Colgate-Palmolive Company | 26.27 |

| HRL | Hormel Foods Corporation | 25.65 |

| SJW | SJW Group | 28.04 |

| ABM | ABM Industries Incorporated | 17.39 |

| AWR | American States Water Company | 31.71 |

| LANC | Lancaster Colony Corporation | 29.28 |

| CWT | California Water Service Group | 29.64 |

| DOV | Dover Corporation | 20.11 |

| CBSH | Commerce Bancshares, Inc. | 20.01 |

| LOW | Lowe's Companies, Inc. | 17.64 |

| TGT | Target Corporation | 21.30 |

| SWK | Stanley Black & Decker, Inc. | 19.63 |

| PH | Parker-Hannifin Corporation | 19.34 |

| FUL | H.B. Fuller Company | 16.53 |

| TR | Tootsie Roll Industries, Inc. | - |

| SCL | Stepan Company | 18.91 |

| NDSN | Nordson Corporation | 31.54 |

Stocks with best P/S Ratio

| Ticker | Company | P/S |

| ABM | ABM Industries Incorporated | 0.44 |

| SYY | Sysco Corporation | 0.76 |

| GPC | Genuine Parts Company | 0.85 |

| FUL | H.B. Fuller Company | 1.00 |

| TGT | Target Corporation | 1.01 |

| SCL | Stepan Company | 1.46 |

| LOW | Lowe's Companies, Inc. | 1.58 |

| CINF | Cincinnati Financial Corporation | 1.83 |

| NWN | Northwest Natural Holding Company | 2.03 |

| SWK | Stanley Black & Decker, Inc. | 2.16 |

| NFG | National Fuel Gas Company | 2.52 |

| HRL | Hormel Foods Corporation | 2.60 |

| PH | Parker-Hannifin Corporation | 2.61 |

| DOV | Dover Corporation | 2.70 |

| EMR | Emerson Electric Co. | 2.83 |

| MO | Altria Group, Inc. | 2.91 |

| MMM | 3M Company | 3.20 |

| CWT | California Water Service Group | 3.23 |

| SJW | SJW Group | 3.44 |

| LANC | Lancaster Colony Corporation | 3.51 |

| TR | Tootsie Roll Industries, Inc. | 4.28 |

| CL | Colgate-Palmolive Company | 4.51 |

| JNJ | Johnson & Johnson | 4.70 |

| PG | The Procter & Gamble Company | 4.73 |

| NDSN | Nordson Corporation | 5.48 |

| AWR | American States Water Company | 5.82 |

| KO | The Coca-Cola Company | 6.86 |

| FRT | Federal Realty Investment Trust | 8.14 |

| CBSH | Commerce Bancshares, Inc. | 8.69 |

Stocks with best P/B Ratio

| Ticker | Company | P/B |

| CINF | Cincinnati Financial Corporation | 1.30 |

| NFG | National Fuel Gas Company | 1.68 |

| NWN | Northwest Natural Holding Company | 1.82 |

| ABM | ABM Industries Incorporated | 1.86 |

| SJW | SJW Group | 2.11 |

| FUL | H.B. Fuller Company | 2.12 |

| CBSH | Commerce Bancshares, Inc. | 2.31 |

| TR | Tootsie Roll Industries, Inc. | 2.75 |

| CWT | California Water Service Group | 2.84 |

| SCL | Stepan Company | 2.89 |

| FRT | Federal Realty Investment Trust | 3.17 |

| SWK | Stanley Black & Decker, Inc. | 3.29 |

| HRL | Hormel Foods Corporation | 4.03 |

| AWR | American States Water Company | 4.42 |

| GPC | Genuine Parts Company | 4.74 |

| PH | Parker-Hannifin Corporation | 5.40 |

| DOV | Dover Corporation | 5.51 |

| EMR | Emerson Electric Co. | 5.56 |

| LANC | Lancaster Colony Corporation | 5.87 |

| JNJ | Johnson & Johnson | 5.87 |

| NDSN | Nordson Corporation | 6.60 |

| TGT | Target Corporation | 7.15 |

| PG | The Procter & Gamble Company | 7.29 |

| MMM | 3M Company | 8.61 |

| KO | The Coca-Cola Company | 12.22 |

| MO | Altria Group, Inc. | 23.89 |

| LOW | Lowe's Companies, Inc. | 26.75 |

| SYY | Sysco Corporation | 28.11 |

| CL | Colgate-Palmolive Company | 111.51 |

Dividend Kings By EPS-Growth Expected

| Ticker | Company | Expected EPS Growth Next 5Y |

| SYY | Sysco Corporation | 25.13% |

| LOW | Lowe's Companies, Inc. | 20.58% |

| ABM | ABM Industries Incorporated | 16.00% |

| SJW | SJW Group | 13.70% |

| TGT | Target Corporation | 13.05% |

| NDSN | Nordson Corporation | 13.00% |

| CWT | California Water Service Group | 10.75% |

| TR | Tootsie Roll Industries, Inc. | 9.00% |

| PH | Parker-Hannifin Corporation | 8.82% |

| NFG | National Fuel Gas Company | 8.50% |

| PG | The Procter & Gamble Company | 8.47% |

| FUL | H.B. Fuller Company | 8.01% |

| SWK | Stanley Black & Decker, Inc. | 7.81% |

| FRT | Federal Realty Investment Trust | 6.70% |

| CL | Colgate-Palmolive Company | 6.67% |

| MO | Altria Group, Inc. | 5.60% |

| AWR | American States Water Company | 4.85% |

| SCL | Stepan Company | 4.40% |

| JNJ | Johnson & Johnson | 4.38% |

| MMM | 3M Company | 3.66% |

| DOV | Dover Corporation | 3.45% |

| KO | The Coca-Cola Company | 3.34% |

| NWN | Northwest Natural Holding Company | 3.10% |

| LANC | Lancaster Colony Corporation | 3.00% |

| EMR | Emerson Electric Co. | 2.97% |

| HRL | Hormel Foods Corporation | 1.00% |

| GPC | Genuine Parts Company | -1.10% |

| CINF | Cincinnati Financial Corporation | -3.33% |

| CBSH | Commerce Bancshares, Inc. | -8.70% |

Stocks with best Sales Growth

| Ticker | Company | Sales past 5Y |

| CINF | Cincinnati Financial Corporation | 9.90% |

| CBSH | Commerce Bancshares, Inc. | 7.40% |

| ABM | ABM Industries Incorporated | 6.90% |

| FUL | H.B. Fuller Company | 6.60% |

| FRT | Federal Realty Investment Trust | 6.40% |

| SJW | SJW Group | 5.60% |

| NDSN | Nordson Corporation | 5.20% |

| LOW | Lowe's Companies, Inc. | 5.10% |

| SWK | Stanley Black & Decker, Inc. | 5.00% |

| GPC | Genuine Parts Company | 4.80% |

| LANC | Lancaster Colony Corporation | 3.90% |

| CWT | California Water Service Group | 3.60% |

| JNJ | Johnson & Johnson | 2.00% |

| SYY | Sysco Corporation | 1.70% |

| TGT | Target Corporation | 1.50% |

| PH | Parker-Hannifin Corporation | 1.50% |

| EMR | Emerson Electric Co. | 0.70% |

| MO | Altria Group, Inc. | 0.50% |

| HRL | Hormel Foods Corporation | 0.40% |

| AWR | American States Water Company | 0.30% |

| MMM | 3M Company | 0.20% |

| PG | The Procter & Gamble Company | 0.10% |

| NWN | Northwest Natural Holding Company | -0.20% |

| TR | Tootsie Roll Industries, Inc. | -0.60% |

| SCL | Stepan Company | -0.70% |

| DOV | Dover Corporation | -1.60% |

| CL | Colgate-Palmolive Company | -1.90% |

| KO | The Coca-Cola Company | -4.10% |

| NFG | National Fuel Gas Company | -4.30% |

Highest Return on Assets

| Ticker | Company | ROA |

| LANC | Lancaster Colony Corporation | - |

| CL | Colgate-Palmolive Company | 17.70% |

| PG | The Procter & Gamble Company | 11.50% |

| MMM | 3M Company | 10.90% |

| HRL | Hormel Foods Corporation | 10.80% |

| JNJ | Johnson & Johnson | 10.60% |

| LOW | Lowe's Companies, Inc. | 10.30% |

| NDSN | Nordson Corporation | 9.10% |

| EMR | Emerson Electric Co. | 9.00% |

| KO | The Coca-Cola Company | 9.00% |

| SCL | Stepan Company | 7.60% |

| DOV | Dover Corporation | 7.50% |

| TGT | Target Corporation | 6.20% |

| TR | Tootsie Roll Industries, Inc. | 6.00% |

| PH | Parker-Hannifin Corporation | 5.90% |

| AWR | American States Water Company | 4.80% |

| SWK | Stanley Black & Decker, Inc. | 4.30% |

| CINF | Cincinnati Financial Corporation | 3.20% |

| FUL | H.B. Fuller Company | 2.90% |

| CWT | California Water Service Group | 2.80% |

| FRT | Federal Realty Investment Trust | 2.30% |

| NWN | Northwest Natural Holding Company | 1.70% |

| MO | Altria Group, Inc. | 1.50% |

| NFG | National Fuel Gas Company | 1.40% |

| SJW | SJW Group | 1.30% |

| CBSH | Commerce Bancshares, Inc. | 1.10% |

| ABM | ABM Industries Incorporated | -0.10% |

| SYY | Sysco Corporation | -0.10% |

| GPC | Genuine Parts Company | -1.40% |

Excel-File Download Best Dividend Kings: Download.

See the file in the Cloud: Top Dividend Kings.

You may also like:

Did you enjoy reading my article about Best Dividend Kings? If so, then please help us and share this article as a basis for discussion. We are already looking forward to an exciting and controversial discussion.