Wallace R. Weitz - Weitz Value Q4-2011 Fund Investing Strategies By Dividend Yield – Stock Capital, Investment. Here is a current portfolio update of Wallace R. Weitz’s - Weitz Value - portfolio movements as of Q4/2011 (December 31, 2011). In total, he held 29 stocks with a total portfolio worth of USD 744,184,000.

Strategy:

We have one primary objective: To earn superior investment returns on our clients', and our own, capital without taking unnecessary risks.

The strategy is to try to understand what a rational buyer would be willing to pay for 100% of a given company. Our valuation may focus on asset values, earning power, the intangible value of a company's "franchise" in its market, or a combination of these variables. We then try to buy shares of the company's stock at a significant discount to this "private market value". It is this discount that provides the "margin of safety" that minimizes the risk of permanent loss of capital.

The beauty of this approach is that it depends on common sense and patience rather than special sources of information or predictions of (essentially unpredictable) future events. Applied intelligently, it reduces the chances of permanent loss of capital, and can produce good long-term returns.

Lest this process sound too simple, it is important to remember that investing is still more art than science, and we have very little control over short-term investment results. Emotions tend to determine stock prices in the short run, and our job is to take advantage of the irrational price changes that occur. Short-term declines can be great opportunities to invest capital, and periods of euphoria sometimes allow us to earn our returns sooner than expected.

We will sometimes seem to be out of sync with the Market, but the key is to be disciplined about the application of our investment criteria. When we have trouble finding stocks to buy at reasonable prices, we may hold significant cash reserves. The price of this discipline is sometimes missed opportunity, and we accept that.

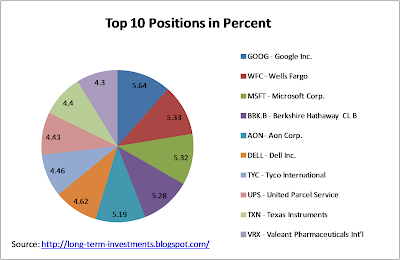

Wallace R. Weitz - Weitz Value – Q4/2011 fund positions with actual share movements:

| Sym - Stock | Portfolio Weight | Recent activity | Reported Price* |

| GOOG - Google Inc. | 5.64 | Reduce 6.74% | $645.91 |

| WFC - Wells Fargo | 5.33 | 0 | $27.56 |

| MSFT - Microsoft Corp. | 5.32 | Reduce 7.58% | $25.96 |

| BRK.B - Berkshire Hathaway CL B | 5.28 | Reduce 1.90% | $76.30 |

| AON - Aon Corp. | 5.19 | Reduce 10.81% | $46.80 |

| DELL - Dell Inc. | 4.62 | Reduce 6.00% | $14.63 |

| TYC - Tyco International | 4.46 | 0 | $46.71 |

| UPS - United Parcel Service | 4.43 | Reduce 10.00% | $73.19 |

| TXN - Texas Instruments | 4.4 | Reduce 13.46% | $29.11 |

| VRX - Valeant Pharmaceuticals Int'l | 4.3 | Add 37.00% | $46.69 |

| LBTYK - Liberty Global Inc. C | 4.12 | Reduce 3.13% | $39.52 |

| LINTA - Liberty Media Interactive | 3.92 | 0 | $16.22 |

| CMCSK - Comcast Corp. CL A Spl | 3.8 | Reduce 4.00% | $23.56 |

| MLM - Martin Marietta | 3.65 | Reduce 10.00% | $75.41 |

| HPQ - Hewlett-Packard | 3.46 | Add 42.86% | $25.76 |

| TGT - Target Corp. | 3.44 | Reduce 13.04% | $51.22 |

| OMC - Omnicom Group | 3.44 | 0 | $44.58 |

| CVS - CVS Caremark Corp. | 3.42 | 0 | $40.78 |

| BUD - Anheuser-Busch InBev | 3.28 | 0 | $60.99 |

| WMT - Wal-Mart Stores | 2.89 | Reduce 20.00% | $59.76 |

| LMT - Lockheed Martin Corp. | 2.61 | 0 | $80.90 |

| DEO - Diageo plc | 2.06 | 0 | $87.42 |

| DIS - Walt Disney Co. | 2.02 | 0 | $37.50 |

| COP - ConocoPhillips | 1.96 | Reduce 60.00% | $72.87 |

| SWN - Southwestern Energy | 1.93 | 0 | $31.94 |

| PX - Praxair Inc. | 1.8 | Reduce 7.41% | $106.90 |

| APA - Apache Corp. | 1.22 | Buy | $90.58 |

| ACN - Accenture | 1.18 | Add 10.00% | $53.23 |

| MOS - Mosaic Co. | 0.85 | 0 | $50.43 |

Related Stock Ticker of Wallace R. Weitz - Weitz Value’s Fund Portfolio:

MSFT, AON, BRK.B, GOOG, DELL, WFC, TXN, COP, UPS, TYC, TGT, LBTYK, LINTA, CMCSK, MLM, WMT, BUD, OMC, CVS, VRX, LMT, HPQ, SWIN, DEO, PX, DIS, CAN, CMC, MOS, APA