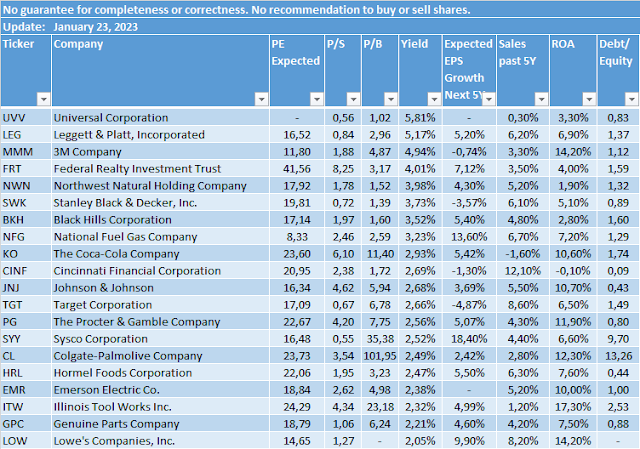

The 30 Best Yielding Dividend Kings as of January 2023

Dividend growth stocks, also known as dividend reinvestment stocks, have become increasingly popular among investors as they provide a steady stream of income and the potential for capital appreciation. These stocks are characterized by their ability to consistently increase their dividends over time. In this article, we will explore some of the key advances in dividend growth stocks and how they can benefit investors.

One of the main advances in dividend growth stocks is the ability for investors to automate their dividend reinvestment. This allows investors to automatically reinvest their dividends back into the stock, rather than receiving cash payments. This can be a powerful tool for long-term investors as it allows them to compound their returns and potentially increase their overall returns.

Another advance in dividend growth stocks is the increased transparency and availability of information. With the rise of technology, investors now have access to a wealth of information about dividend growth stocks, including historical dividend data, financial statements, and analyst recommendations. This allows investors to make more informed decisions and helps to reduce the risk of investing in a stock that may not be able to sustain its dividend growth.

In addition, dividend growth stocks have also become more diversified in recent years. While traditionally, dividend growth stocks were primarily found in mature, stable industries such as utilities and consumer goods, they can now be found in a variety of sectors including technology and healthcare. This diversification allows investors to potentially spread their risk across multiple sectors and industries, which can be beneficial for long-term portfolio management.

Finally, dividend growth stocks have also become more accessible to a wider range of investors. With the rise of exchange-traded funds (ETFs) and other investment vehicles, investors can now gain exposure to a basket of dividend growth stocks with a single investment. This can be especially useful for investors who may not have the time or expertise to research individual stocks.

In conclusion, dividend growth stocks have seen a number of advances in recent years, including automation of reinvestment, increased transparency and information availability, diversification of sectors, and increased accessibility through investment vehicles. These advances have made dividend growth stocks an attractive investment option for a wide range of investors looking for a steady stream of income and potential for capital appreciation. However, it is always important to do your own research and seek professional financial advice before making any investment decisions.

by the way...if you like this list and you want more tables like the above published, please help us now. Please read the following text to understand why we need your help. Thank you.

I've been working on this blog for years, without much success. But many people got a lot of inspirational information from my work - for free. I think that's good, but unfortunately I have my own expenses, a wife and children. That's why I need your support to keep the blog up and running.

You can easily support our project on the crowdfunding platform Steady. It's an alternative to Patreon.

As a small gift for your support, you will receive monthly updated lists of the best dividend growth stocks in the world -- stock lists from USA, Canada and Japan with over 1.100 long-term dividend growth stocks.

You can use these lists to display, modify, calculate and sort important key figures such as the dividend yield, return on equity ratio, FCF-Yield or price-to-book-ratio. Over 40 ratios are available for sorting. The lists are updated once a month and will be free to use for all supporter on Steady.

If you want to know how the Excel-Spreadsheet looks like, you can view a sample file on Google Spreadsheets. Just follow the link and you get an idea how it works for you.

You can use these lists to display, modify, calculate and sort important key figures such as the dividend yield, return on equity ratio, FCF-Yield or price-to-book-ratio. Over 40 ratios are available for sorting. The lists are updated once a month and will be free to use for all supporter on Steady.

As I said, this is just a sample file. With your help, these Excel-Spreadsheets can be developed further. All I need is a support from you. Please participate in one of the programs listed below and support our project.

INSERT_STEADY_CHECKOUT_HERE

With your support, the project can remain financially independent and can be further developed without annoying advertising or paywalls.

Thank you so much for your support! If you don't have the financial flexibility to help me, you can easily share this project or post with your social connections on Facebook, Twitter, Instagam, Pinterest or TikToc. It could be a great way to keep this site alive. Thank you so much.

INSERT_STEADY_CHECKOUT_HERE

With your support, the project can remain financially independent and can be further developed without annoying advertising or paywalls.

Thank you so much for your support! If you don't have the financial flexibility to help me, you can easily share this project or post with your social connections on Facebook, Twitter, Instagam, Pinterest or TikToc. It could be a great way to keep this site alive. Thank you so much.

Why Steady?

Steady is a crowdfunding platform for creatives,

photographers, journalists and content creators. All of these groups have the

same problem: they do an honest job but have no way to monetize it. At the same

time, they do not advertise or get support from partners in order to maintain

their independence.

Steady gives us the opportunity to receive regular

support for project implementation. In this way, the internet can continue to

exist as a free medium of opinion.

If you are unable to support us financially, we are

not worry. You can also help us by telling your friends about us on Facebook,

Twitter, Instagram, Tik Tok or another social channel. The more support we

have, the more we can invest in the content and expand the database. Thank you

so much!