I've often said that dividend stocks are the foundation of a great retirement portfolio -- and for good reason.

For starters, companies that pay dividends usually have a long history of profitability and a sound long-term outlook. A business that doesn't have a clear path to growth typically isn't going to pay a dividend.

In other words, buying dividend stocks often means buying into high-quality, profitable companies with long histories of success.

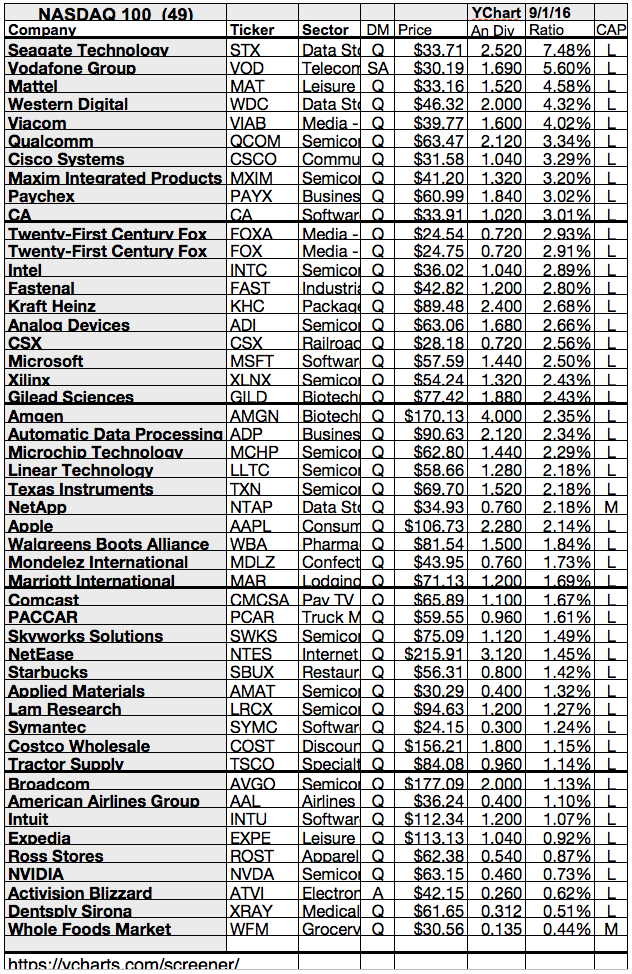

But some of the best dividend stocks can be found floating well below investors' radars. Today I screened the market by the cheapest long-term dividend growth stocks. Each of the attached stocks managed to raise dividends by more than 25 years in a row.

In addition to the selection criteria, the forward P/E should be under 15. Only 9 stocks are still cheap by forward P/E if you look at the market nice of long-term dividend raiser. That's sad but good to get an impression about how hot valuated the market is.

Here are 9 bargain bin high-yielding dividend champions....