For deep value investors, the U.S. stock market offers slim pickings. A quick glance at the Russell 1000 Value Index will tell you that large capitalization, U.S., companies are not cheap at a price-to-earnings ratio of 19 times.

The S&P 500 is up almost 2.8% since the beginning of February and up over 8% since Donald Trump was elected President. Consequently, it is important to focus on stocks with two characteristics: an attractive relative valuation and sensitivity to policy changes.

The Trump administration has promised to cut corporate regulations and tax rates, and engage in massive fiscal stimulus. Assuming those policy changes can be implemented they are naturally bullish for the stock market. The key is to find companies that are likely to be benefit asymmetrically for those policy changes and which do not already carry unreasonable valuations.

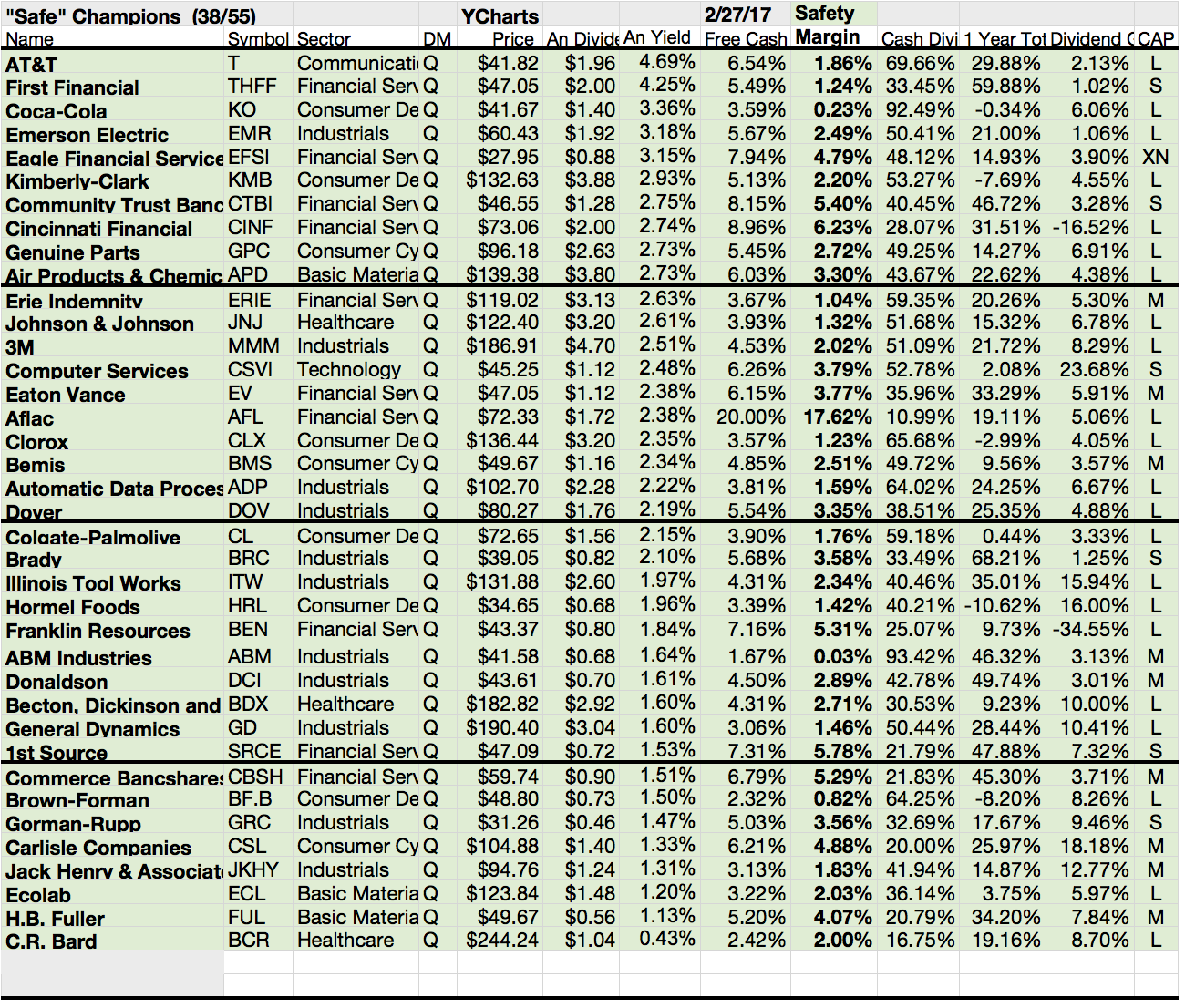

Attached you will find a couple of stocks that might be interesting in this enviroment. I run a screen with a main focus on valuation and growth.

These were my results...maybe you agree. There are some names on the list that are not popular but might be interesting in terms of free cash flow.

Here are the results...

My Favorite Dividend Contenders For March 2017

With a new month close at hand, it is time, once again, for me to lay out some of my stock considerations for the next several weeks of March.

The point of these posts is to help take some of the guesswork out of where I plan to allocate my fresh capital going forward. By making my selections ahead of time, I find it easier to commit to buys, as all the homework and investment theses have already been completed on my end.

All that's left to do is pull the "buy" trigger. These days, it seems easier said than done as the market - and many stocks I am considering - continue to march higher. I am finding it increasingly difficult to decide where I'd like to allocate my fresh capital.

Rest assured, I will be making at least one buy in March, as I aim to stick to my own mantra of remaining consistent with my buys during all market conditions.

I have no intentions of breaking my streak of making monthly buys. That being said, as I look at my portfolio, I am left with a handful of potential choices for the month of March.

Here are my favorite Dividend Contenders...

The point of these posts is to help take some of the guesswork out of where I plan to allocate my fresh capital going forward. By making my selections ahead of time, I find it easier to commit to buys, as all the homework and investment theses have already been completed on my end.

All that's left to do is pull the "buy" trigger. These days, it seems easier said than done as the market - and many stocks I am considering - continue to march higher. I am finding it increasingly difficult to decide where I'd like to allocate my fresh capital.

Rest assured, I will be making at least one buy in March, as I aim to stick to my own mantra of remaining consistent with my buys during all market conditions.

I have no intentions of breaking my streak of making monthly buys. That being said, as I look at my portfolio, I am left with a handful of potential choices for the month of March.

Here are my favorite Dividend Contenders...

My Favorite Dividend Champions As Of March 2017

In the beginning of the first Quarter of the year, many investors review their portfolios and adjust the basic risks. We all hope for a good year on the market and, most importantly, steady dividend growth increase among our portfolio.

I selected a couple of companies with long-term dividend growth growth of which I think they will perform well in 2017 and will increase their dividend payouts.

My main criteria are the following onces:

- Dividend Champion

- Debt-to-Equity under 1

- 5 Year EPS Growth over 5%

- Forward P/E under 20

- Positive Past Sales growth

18 Stocks from the Dividend Champs List remain. Maybe you agree or not. Please leave a comment about your thoughts related to the list.

Here are my favorite Dividend Champs for March 2017...

I selected a couple of companies with long-term dividend growth growth of which I think they will perform well in 2017 and will increase their dividend payouts.

My main criteria are the following onces:

- Dividend Champion

- Debt-to-Equity under 1

- 5 Year EPS Growth over 5%

- Forward P/E under 20

- Positive Past Sales growth

18 Stocks from the Dividend Champs List remain. Maybe you agree or not. Please leave a comment about your thoughts related to the list.

Here are my favorite Dividend Champs for March 2017...

Subscribe to:

Posts (Atom)