Dividend Growth Stocks Of The Past Week

If you like to receive the full book each week with all dividend fresh dividend hikes and dividend growth stocks (over 800), just make a small donation to keep this work and blog alive. After you made the donation, we send you the pdf book to your donation e-mail adress. Thank you!

Take A Look At This Reatil Growth Machine

Associated British Foods PLC is a British consortium that has assorted into the agro-meals enterprise and.... style, with its well-known brand Primark.

like several massive conglomerates, its valuation is particularly nicely suitable for the ‘sum of the parts’ approach.

These are the business segments of Associated British Foods PLC:

Groceries

This primary division regroups popular patron brands in Europe (like Twinings tea, Jordans cereal, and so on.), in the Usa (Mazola corn oil, etc.) and in Australia (Don charcuterie, KRC manufacturers, etc.).

The division generates 3,4 billion GBP in sales and about 300 million GBP income before taxes in 2017. aggressive however developing (7,5% annualized considering the fact that 2014), we price this division at fifteen instances its earnings earlier than taxes, at 4,5billion GBP.

Sugar

Through its British Sugar division, associated British foods is the second one biggest sugar producer international (four million heaps), just in the back of the German corporation Suedzucker(4,2 million tons). Its competitive role in both Europe and Africa is outstanding. The interest generates 2,2 billion GBP in revenue and approximately 220 million GBP in earnings earlier than taxes in 2017.

This capital extreme, cyclical and little profitable interest barely grows. but, the enterprise is extremely fragmented (British Sugar represents best 1% of the worldwide manufacturing) and consolidation opportunities could stand up.

We be aware that the German organisation Suedzucker (listed on the change) has on average been valued at half of of its income for the beyond ten years. We advise to hold the identical more than one for British Sugar and hence cost this division at 1 billion GBP.

Agriculture

This department affords products (protein, seeds, fertilizers, and so forth.) and services (agribusiness and brokerage, etc.) to experts inside the agro-meals area in sixty five nations.

Considering that 2014, its turnover stagnates at 1,2 billion GBP even as its income earlier than taxes stays unchanged at greater or much less 50 million GBP. We maintain a valuation of ten instances this earnings or 500 million GBP.

Substances

This department gives baked items in 25 countries and produces all sorts of enzymes, flower extracts and cereal specialties destined for bakers as well as the enterprise.

No matter a slight boom, that is the consortium's least profitable activity (the go back on its very own capital is less than 10%). With 1,6 billion GBP in sales and around one hundred million GBP in earnings, we price this department at 1 billion GBP (a a couple of that equals ten times the income).

Retail

This division consists of all Primark operations and is a true crown jewel. The logo is overwhelmingly famous amongst its customers way to an original commercial enterprise version: 0 advertising fees and a tireless optimization of its commercial spaces indeed permit the organization to reverberate extensive savings on the selling expenses of the clothes, which are excellent low.

With ‘most effective’ 345 stores, the increase capacity remains intact and largely unexploited, however related British obviously prefers to auto-finance its improvement and doesn’t want to get into debt – like SuperGroup. We appreciate this prudence and observe that on the subject of consolidation related British foods keeps an admirable financial field.

The department is a ways from being the most profitable one of the 5 divisions of the consortium and has a go back on its personal capital among 25-30%. It generates 7 billion GBP in sales (10% of annualized increase seeing that 2014) and round 700 million GBP of profit before taxes.

So long as the boom maintains, it makes feel to value Primark at no less than twenty times its earnings earlier than taxes, or 14 billion GBP.

The sum of those five valuations is 21 billion GBP. The coins (1,5 billion GBP) covers all the long-time period liabilities (1,2 billion GBP) but, out of prudence, we don’t rely the extra the various belongings.

Pronounced at a market capitalization of just about 23 billion GBP, we notice that the modern-day valuation doesn’t provide a sizeable cut price. So strictly, this isn’t a stock to get quick rich, but it can emerge as one at some point if the percentage rate is going below the two 500 pence limit – that means a market capitalization of 20 billion GBP, a ‘honest’ valuation but probably an awesome entry point if the growth trajectory of Primark were to be showed.

So, we’ll comply with this case carefully and received’t hesitate to inform our readers of a potential development.

like several massive conglomerates, its valuation is particularly nicely suitable for the ‘sum of the parts’ approach.

These are the business segments of Associated British Foods PLC:

Groceries

This primary division regroups popular patron brands in Europe (like Twinings tea, Jordans cereal, and so on.), in the Usa (Mazola corn oil, etc.) and in Australia (Don charcuterie, KRC manufacturers, etc.).

The division generates 3,4 billion GBP in sales and about 300 million GBP income before taxes in 2017. aggressive however developing (7,5% annualized considering the fact that 2014), we price this division at fifteen instances its earnings earlier than taxes, at 4,5billion GBP.

Sugar

Through its British Sugar division, associated British foods is the second one biggest sugar producer international (four million heaps), just in the back of the German corporation Suedzucker(4,2 million tons). Its competitive role in both Europe and Africa is outstanding. The interest generates 2,2 billion GBP in revenue and approximately 220 million GBP in earnings earlier than taxes in 2017.

This capital extreme, cyclical and little profitable interest barely grows. but, the enterprise is extremely fragmented (British Sugar represents best 1% of the worldwide manufacturing) and consolidation opportunities could stand up.

We be aware that the German organisation Suedzucker (listed on the change) has on average been valued at half of of its income for the beyond ten years. We advise to hold the identical more than one for British Sugar and hence cost this division at 1 billion GBP.

Agriculture

This department affords products (protein, seeds, fertilizers, and so forth.) and services (agribusiness and brokerage, etc.) to experts inside the agro-meals area in sixty five nations.

Considering that 2014, its turnover stagnates at 1,2 billion GBP even as its income earlier than taxes stays unchanged at greater or much less 50 million GBP. We maintain a valuation of ten instances this earnings or 500 million GBP.

Substances

This department gives baked items in 25 countries and produces all sorts of enzymes, flower extracts and cereal specialties destined for bakers as well as the enterprise.

No matter a slight boom, that is the consortium's least profitable activity (the go back on its very own capital is less than 10%). With 1,6 billion GBP in sales and around one hundred million GBP in earnings, we price this department at 1 billion GBP (a a couple of that equals ten times the income).

Retail

This division consists of all Primark operations and is a true crown jewel. The logo is overwhelmingly famous amongst its customers way to an original commercial enterprise version: 0 advertising fees and a tireless optimization of its commercial spaces indeed permit the organization to reverberate extensive savings on the selling expenses of the clothes, which are excellent low.

With ‘most effective’ 345 stores, the increase capacity remains intact and largely unexploited, however related British obviously prefers to auto-finance its improvement and doesn’t want to get into debt – like SuperGroup. We appreciate this prudence and observe that on the subject of consolidation related British foods keeps an admirable financial field.

The department is a ways from being the most profitable one of the 5 divisions of the consortium and has a go back on its personal capital among 25-30%. It generates 7 billion GBP in sales (10% of annualized increase seeing that 2014) and round 700 million GBP of profit before taxes.

So long as the boom maintains, it makes feel to value Primark at no less than twenty times its earnings earlier than taxes, or 14 billion GBP.

The sum of those five valuations is 21 billion GBP. The coins (1,5 billion GBP) covers all the long-time period liabilities (1,2 billion GBP) but, out of prudence, we don’t rely the extra the various belongings.

Pronounced at a market capitalization of just about 23 billion GBP, we notice that the modern-day valuation doesn’t provide a sizeable cut price. So strictly, this isn’t a stock to get quick rich, but it can emerge as one at some point if the percentage rate is going below the two 500 pence limit – that means a market capitalization of 20 billion GBP, a ‘honest’ valuation but probably an awesome entry point if the growth trajectory of Primark were to be showed.

So, we’ll comply with this case carefully and received’t hesitate to inform our readers of a potential development.

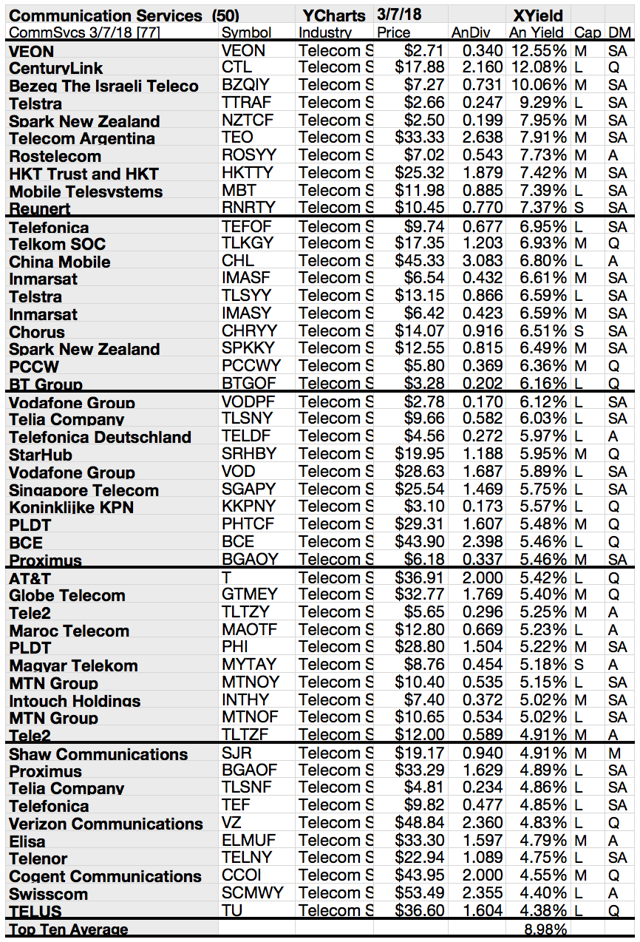

High-Yield Dividend Growth Stocks

If you like to receive the full book each month with all dividend growth stocks (over 800), just make a small donation to keep this work and blog alive. After you made the donation, we send you the pdf book to your donation e-mail adress. Thank you!

A Cheap Payment Services Provider With A P/E Under 16 And Strong Growth

French organization Ingenico is a worldwide pioneer in installment frameworks. Its outer development procedure – the center of the gathering's DNA – is both a wellspring of hazard and opportunity.

The gathering was established in 1980 and has created itself with incredible flourish through a progression of acquisitions (the organization's Wikipedia page demonstrates a manufactured history of this 'chasing board').

Really moored in the gathering's DNA, this outside development methodology is – of course – a wellspring of hazard and opportunity in the meantime.

The two exercises of Ingenico are the administration of card terminals (1,6 billion Euros in income, 10% annualized development since 2012) and the administration of online exchanges (728 million in income in 2016, 30% annualized development since 2012).

Nearly in a duopoly with the American organization Verifone, the gathering holds over 40% of the worldwide market in the action of overseeing terminals. The passage obstructions are high and the innovation requesting in light of the fact that it includes the bearing of a large number of streams issued by means of a few systems (Visa, MasterCard, PayPal, and so on.) towards the frameworks of national banks.

Albeit develop, this action lays along these lines on an upper hand ("the system impact") and still harbors an extensive development potential, a fortiori in developing markets where governments push regular people and organizations to relinquish money and utilize installment strategies that are traceable.

Nonetheless, Ingenico's latest acquisitions plan to fortify its quality in its second division of movement: online exchanges. This segment has a more grounded development and the French gathering has 5% of the worldwide piece of the overall industry here.

The viewpoints here are promising, yet the opposition is wild and various 'troublesome' players tries to get their foot in the entryway – from players like Stripe or PayPal to more customary opponents, for example, the British Worldpay or the German Wirecard.

American innovation goliaths like Apple and Google have likewise demonstrated their advantage and keep on exploring distinctive systems to overcome.

Ingenico centers specifically around the market of 'consistent installments', this implies completely computerized online installments, as Uber has for instance, where the customer needn't bother with money nor card to pay the driver.

The business is still to a great extent divided. The littler contenders are characteristic procurement targets in light of the fact that the best way to thrive here is to achieve a scale that is sufficiently substantial to weaken the exchange cost however much as could reasonably be expected keeping in mind the end goal to produce edges.

The little ones in this way need to hold tight and hang on firmly (particularly because of the tolerant budgetary markets) while the greater ones need to get admirably – meaning the correct innovation at the opportune time and at the correct cost.

Ingenico has made a few many acquisitions the previous couple of years. Among the more surprising ones was the Dutch firm Global Collect in 2014 for 820 million Euros (under three times the turnover) and the Swedish Bambora in July 2017 for 1,5 billion Euros (just about 8 times the turnover).

There's a combination wave going ahead by the route in the highest point of the business: Worldpay has been procured by Vanity for very nearly six times the turnover (subsequent to being pursued by Ingenico); the Danish organization Nets has been gained by private value firm Hellman and Friedman for around four times the turnover; and as indicated by specific bits of gossip, the other French organization Worldline (backup of Atos) would have demonstrated its commitment to… Ingenico notwithstanding the last being greater.

Up until this point, its outer development system has functioned admirably for Ingenico: the gathering has made its progressive acquisitions productive and duplicated its turnover by just about four of every ten years time (from 568 million of every 2007 to right around 2,5 billion expected in 2017).

The productivity has enhanced and the money benefit ('free income') before acquisitions has duplicated by five in the vicinity of 2007 and 2016 (from 50 million to 240 million Euros).

The monetary record is of sensibly great quality with 2 billion of excellent fluid resources (money and receivables) and 2 billion of immaterial settled resources (for the most part the contrast between acquired acquisitions and the different repurchases of organizations) against around 3,5 billion of proforma liabilities (estimation by the creator while sitting tight for the distribution of the income), right around 2 billion of which is long haul obligation following the procurement of Bambora.

At 92 Euros for every offer and on a weakened base of 64 million offers, Ingenico is presently esteemed on the trade at 6 billion, or 25 times its trade benefit out 2016 – an arrival on profit of 4% for the new investor.

This valuation is sensible for an organization that is developing intensely… yet unsafe if by chance this development battles to appear.

The wager in this regard is clear: if Ingenico incorporates Global Collect and Bambora well and succeeds its future acquisitions, the present valuation is supported and ought to take after an indistinguishable upward direction from the previous ten years.

Along these lines the financing conditions should remain great (the present conjuncture is no ifs ands or buts perfect) and the acquisitions need to occur at sensible products, with a specific end goal to have the capacity to deliver a decent yield after some time. This is a significant test on the grounds that the purchaser rivalry is (as we've seen) bounty and aspiring.

These hopeful points of view would be tested if the gathering were assumed control by better-promoted contenders, missed a mechanical turn, or experienced difficulty to coordinate a major, 'transformational' securing.

On the off chance that by chance such a disappointment happened, the best alternative for Ingenico is offer itself (like Gemalto did) without a doubt for a different of its turnover that is in any event equivalent to its present valuation (under three times the turnover).

With the exception of a noteworthy seismic tremor in the business (like a total surrender of installment cards), the hazard appears to be in this manner restricted, and the open door is unmistakably recognized for financial specialists who are genuinely centered around the long haul. Unless a key purchaser exploits the current, incredibly gentle, financing conditions to make a powerful offer for the time being.

The gathering was established in 1980 and has created itself with incredible flourish through a progression of acquisitions (the organization's Wikipedia page demonstrates a manufactured history of this 'chasing board').

Really moored in the gathering's DNA, this outside development methodology is – of course – a wellspring of hazard and opportunity in the meantime.

The two exercises of Ingenico are the administration of card terminals (1,6 billion Euros in income, 10% annualized development since 2012) and the administration of online exchanges (728 million in income in 2016, 30% annualized development since 2012).

Nearly in a duopoly with the American organization Verifone, the gathering holds over 40% of the worldwide market in the action of overseeing terminals. The passage obstructions are high and the innovation requesting in light of the fact that it includes the bearing of a large number of streams issued by means of a few systems (Visa, MasterCard, PayPal, and so on.) towards the frameworks of national banks.

Albeit develop, this action lays along these lines on an upper hand ("the system impact") and still harbors an extensive development potential, a fortiori in developing markets where governments push regular people and organizations to relinquish money and utilize installment strategies that are traceable.

Nonetheless, Ingenico's latest acquisitions plan to fortify its quality in its second division of movement: online exchanges. This segment has a more grounded development and the French gathering has 5% of the worldwide piece of the overall industry here.

The viewpoints here are promising, yet the opposition is wild and various 'troublesome' players tries to get their foot in the entryway – from players like Stripe or PayPal to more customary opponents, for example, the British Worldpay or the German Wirecard.

American innovation goliaths like Apple and Google have likewise demonstrated their advantage and keep on exploring distinctive systems to overcome.

Ingenico centers specifically around the market of 'consistent installments', this implies completely computerized online installments, as Uber has for instance, where the customer needn't bother with money nor card to pay the driver.

The business is still to a great extent divided. The littler contenders are characteristic procurement targets in light of the fact that the best way to thrive here is to achieve a scale that is sufficiently substantial to weaken the exchange cost however much as could reasonably be expected keeping in mind the end goal to produce edges.

The little ones in this way need to hold tight and hang on firmly (particularly because of the tolerant budgetary markets) while the greater ones need to get admirably – meaning the correct innovation at the opportune time and at the correct cost.

Ingenico has made a few many acquisitions the previous couple of years. Among the more surprising ones was the Dutch firm Global Collect in 2014 for 820 million Euros (under three times the turnover) and the Swedish Bambora in July 2017 for 1,5 billion Euros (just about 8 times the turnover).

There's a combination wave going ahead by the route in the highest point of the business: Worldpay has been procured by Vanity for very nearly six times the turnover (subsequent to being pursued by Ingenico); the Danish organization Nets has been gained by private value firm Hellman and Friedman for around four times the turnover; and as indicated by specific bits of gossip, the other French organization Worldline (backup of Atos) would have demonstrated its commitment to… Ingenico notwithstanding the last being greater.

Up until this point, its outer development system has functioned admirably for Ingenico: the gathering has made its progressive acquisitions productive and duplicated its turnover by just about four of every ten years time (from 568 million of every 2007 to right around 2,5 billion expected in 2017).

The productivity has enhanced and the money benefit ('free income') before acquisitions has duplicated by five in the vicinity of 2007 and 2016 (from 50 million to 240 million Euros).

The monetary record is of sensibly great quality with 2 billion of excellent fluid resources (money and receivables) and 2 billion of immaterial settled resources (for the most part the contrast between acquired acquisitions and the different repurchases of organizations) against around 3,5 billion of proforma liabilities (estimation by the creator while sitting tight for the distribution of the income), right around 2 billion of which is long haul obligation following the procurement of Bambora.

At 92 Euros for every offer and on a weakened base of 64 million offers, Ingenico is presently esteemed on the trade at 6 billion, or 25 times its trade benefit out 2016 – an arrival on profit of 4% for the new investor.

This valuation is sensible for an organization that is developing intensely… yet unsafe if by chance this development battles to appear.

The wager in this regard is clear: if Ingenico incorporates Global Collect and Bambora well and succeeds its future acquisitions, the present valuation is supported and ought to take after an indistinguishable upward direction from the previous ten years.

Along these lines the financing conditions should remain great (the present conjuncture is no ifs ands or buts perfect) and the acquisitions need to occur at sensible products, with a specific end goal to have the capacity to deliver a decent yield after some time. This is a significant test on the grounds that the purchaser rivalry is (as we've seen) bounty and aspiring.

These hopeful points of view would be tested if the gathering were assumed control by better-promoted contenders, missed a mechanical turn, or experienced difficulty to coordinate a major, 'transformational' securing.

On the off chance that by chance such a disappointment happened, the best alternative for Ingenico is offer itself (like Gemalto did) without a doubt for a different of its turnover that is in any event equivalent to its present valuation (under three times the turnover).

With the exception of a noteworthy seismic tremor in the business (like a total surrender of installment cards), the hazard appears to be in this manner restricted, and the open door is unmistakably recognized for financial specialists who are genuinely centered around the long haul. Unless a key purchaser exploits the current, incredibly gentle, financing conditions to make a powerful offer for the time being.

Subscribe to:

Posts (Atom)