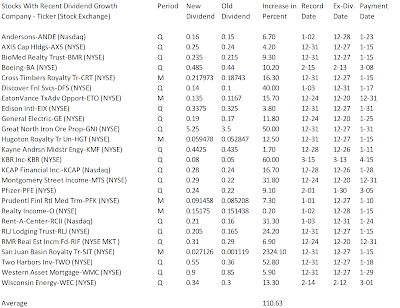

I love dividends and dividend

growth stocks. That’s the main reason why I make a regular screen of the latest

stocks with dividend growth on my blog “long-term-investments.blogspot.com”. I believe that those companies could have a well running business and

could have a better performance in the long-run. Below is a current list of

companies that have announced a dividend increase within the recent week. In

total, 22 stocks and funds raised dividends of which 15 have a dividend growth

of more than 10 percent. The average dividend growth amounts to 110.63 percent.

Twelve of the dividend growth

stocks/funds from last week are currently recommended to buy; fifteen yielding over

three percent.

Here are my favorite dividend growth stocks:

Financial Analysis: The total debt represents 20.72 percent of the company’s assets and the total debt in relation to the equity amounts to 47.39 percent. Due to the financial situation, a return on equity of 10.24 percent was realized. Twelve trailing months earnings per share reached a value of $1.25. Last fiscal year, the company paid $0.80 in the form of dividends to shareholders. PFE announced to raise dividends by 9.1 percent.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 20.03, the P/S ratio is 2.74 and the P/B ratio is finally 2.31. The dividend yield amounts to 3.83 percent and the beta ratio has a value of 0.70.

| Long-Term Stock History Chart Of Pfizer (PFE) |

| Long-Term Dividends History of Pfizer (PFE) |

| Long-Term Dividend Yield History of Pfizer (PFE) |

General Electric (NYSE:GE) has a market capitalization of $218.95 billion. The company employs 301,000 people, generates revenue of $147.300 billion and has a net income of $14.366 billion. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $31.015 billion. The EBITDA margin is 21.06 percent (the operating margin is 13.64 percent and the net profit margin 9.75 percent).

Financial Analysis: The total debt represents 63.22 percent of the company’s assets and the total debt in relation to the equity amounts to 389.43 percent. Due to the financial situation, a return on equity of 11.06 percent was realized. Twelve trailing months earnings per share reached a value of $1.35. Last fiscal year, the company paid $0.61 in the form of dividends to shareholders. GE announced to raise dividends by 11.8 percent.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 15.50, the P/S ratio is 1.49 and the P/B ratio is finally 1.90. The dividend yield amounts to 3.64 percent and the beta ratio has a value of 1.61.

| Long-Term Stock History Chart Of General Electric (GE) |

| Long-Term Dividends History of General Electric (GE) |

| Long-Term Dividend Yield History of General Electric (GE) |

KBR (NYSE:KBR) has a market capitalization of $4.36 billion. The company employs 27,000 people, generates revenue of $9.261 billion and has a net income of $540.00 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $658.00 million. The EBITDA margin is 7.11 percent (the operating margin is 6.34 percent and the net profit margin 5.83 percent).

Financial Analysis: The total debt represents 1.75 percent of the company’s assets and the total debt in relation to the equity amounts to 3.97 percent. Due to the financial situation, a return on equity of 20.16 percent was realized. Twelve trailing months earnings per share reached a value of $1.36. Last fiscal year, the company paid $0.20 in the form of dividends to shareholders. KBR announced to raise dividends by 60.0 percent.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 21.73, the P/S ratio is 0.47 and the P/B ratio is finally 1.76. The dividend yield amounts to 1.08 percent and the beta ratio has a value of 1.29.

| Long-Term Stock History Chart Of KBR (KBR) |

| Long-Term Dividends History of KBR (KBR) |

| Long-Term Dividend Yield History of KBR (KBR) |

Take a closer look at the full table of stocks with recent dividend hikes. The average dividend growth amounts to 110.63 percent and the average dividend yield amounts to 6.10 percent. Stocks from the sheet are valuated with a P/E ratio of 16.43.The average P/S ratio is 5.05 and P/B 4.79.

|

| Dividend Growth Stocks From Last Week (Click to enlarge) |

Here are the market ratios:

Ticker

|

Company

|

P/E

|

P/S

|

P/B

|

Dividend Yield

|

GNI

|

Great Northern Iron Ore Properties

|

4.94

|

4.22

|

8.35

|

18.52%

|

WMC

|

Western Asset Mortgage Capital Corporation

|

0.00

|

0.00

|

0.42

|

15.78%

|

TWO

|

Two Harbors Investment Corp.

|

13.64

|

8.76

|

1.01

|

12.42%

|

KCAP

|

Kohlberg Capital Corporation

|

32.52

|

7.27

|

1.21

|

10.18%

|

CRT

|

Cross Timbers Royalty Trust

|

10.50

|

10.24

|

12.77

|

9.11%

|

HGT

|

Hugoton Royalty Trust

|

9.33

|

8.83

|

2.66

|

8.31%

|

ETO

|

Eaton Vance Tax-Advantaged Global Dividend

Opportunities

|

0.00

|

0.00

|

0.00

|

6.88%

|

SJT

|

San Juan Basin Royalty Trust

|

12.02

|

11.63

|

48.08

|

6.72%

|

MTS

|

Montgomery Street Income Securities Inc.

|

16.81

|

21.55

|

0.95

|

5.18%

|

O

|

Realty Income Corp.

|

47.89

|

11.71

|

2.22

|

4.46%

|

BMR

|

BioMed Realty Trust Inc.

|

321.67

|

6.06

|

1.19

|

4.46%

|

WEC

|

Wisconsin Energy Corp.

|

15.56

|

2.01

|

2.07

|

3.63%

|

PFE

|

Pfizer Inc.

|

20.06

|

3.04

|

2.26

|

3.51%

|

RLJ

|

RLJ Lodging Trust

|

79.33

|

2.47

|

1.13

|

3.47%

|

GE

|

General Electric Company

|

15.47

|

1.50

|

1.79

|

3.26%

|

EIX

|

Edison International

|

0.00

|

1.17

|

1.27

|

2.84%

|

AXS

|

Axis Capital Holdings Limited

|

7.26

|

1.08

|

0.69

|

2.78%

|

BA

|

Boeing Co.

|

13.43

|

0.73

|

7.57

|

2.31%

|

RCII

|

Rent-A-Center Inc.

|

11.35

|

0.68

|

1.42

|

1.81%

|

ANDE

|

The Andersons, Inc.

|

9.60

|

0.17

|

1.41

|

1.36%

|

DFS

|

Discover Financial Services

|

8.91

|

2.94

|

2.14

|

1.04%

|

Average

|

30.97

|

5.05

|

4.79

|

6.10%

|

Related Stock Ticker:

ANDE, AXS, BMR, BA, CRT, DFS, ETO, EIX, GE, GNI,

HGT, KMF, KBR, KCAP, MTS, PFE, PFK, O, RCII, RLJ, RIF, SJT, TWO, WMC, WEC

* I am long GE. I receive no

compensation to write about these specific stocks, sector or theme. I don't

plan to increase or decrease positions or obligations within the next 72 hours.

For the other stocks: I

have no positions in any stocks mentioned, and no plans to initiate any

positions within the next 72 hours. I receive no compensation to write about

any specific stock, sector or theme.