Showing posts with label CNMD. Show all posts

Showing posts with label CNMD. Show all posts

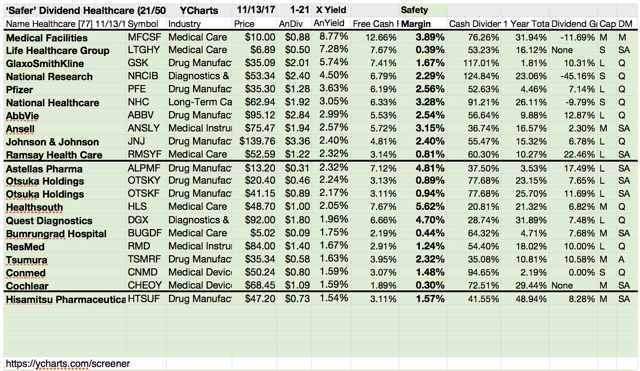

21 Safe Healthcare Dividend Stocks

You see grouped below the green tinted list of 21 that passed the Healthcare dog "safer" check with positive past-year returns and cash flow yield sufficient to cover their anticipated annual dividend yield. The margin of cash excess is shown in the bold face "Safety Margin"column.

17 High Momentum Healthcare Dividend Stocks

Healthcare

dividend stocks with highest beta ratios originally published at long-term-investments.blogspot.com. You know that I am a

conservative investor and try to minimize my risk.

This strategy is necessary if you have a larger amount of money to take care of or you begin to cry when you lose 10 percent on your book value. The second disadvantage is that you lose performance in a strong up moving market.

Since 2009, there were nearly no bigger corrections at the market but with low beta and safe haven stocks, your performance would be only half of the return from the markets. What you need to get a push for your portfolio is a high beta stock. I don’t recommend buying them because it’s a definitely riskier strategy and nobody knows when the market turns into a bearish mood.

However, let’s take a look at the high fly momentum stocks from the healthcare sector. Those are stocks with the highest beta ratio from the sector. They have a beta between 1 and 2. With focus on the dividend paying stocks, only 17 stocks from the healthcare sector pay a dividend and being correlated with the market by a factor of up to 2.

One High-Yield is below the results and 16 have a current buy or better rating by brokerage firms.

This strategy is necessary if you have a larger amount of money to take care of or you begin to cry when you lose 10 percent on your book value. The second disadvantage is that you lose performance in a strong up moving market.

Since 2009, there were nearly no bigger corrections at the market but with low beta and safe haven stocks, your performance would be only half of the return from the markets. What you need to get a push for your portfolio is a high beta stock. I don’t recommend buying them because it’s a definitely riskier strategy and nobody knows when the market turns into a bearish mood.

However, let’s take a look at the high fly momentum stocks from the healthcare sector. Those are stocks with the highest beta ratio from the sector. They have a beta between 1 and 2. With focus on the dividend paying stocks, only 17 stocks from the healthcare sector pay a dividend and being correlated with the market by a factor of up to 2.

One High-Yield is below the results and 16 have a current buy or better rating by brokerage firms.

Ex-Dividend Stocks: Best Dividend Paying Shares On June 13, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks June 13,

2013. In total, 25 stocks and

preferred shares go ex dividend - of which 6 yield more than 3 percent. The

average yield amounts to 3.13%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

UIL

Holdings Corporation

|

1.98B

|

18.53

|

1.73

|

1.26

|

4.43%

|

|

|

DTE

Energy Co.

|

11.65B

|

15.55

|

1.53

|

1.29

|

3.91%

|

|

|

Merck

& Co. Inc.

|

143.61B

|

24.27

|

2.71

|

3.11

|

3.62%

|

|

|

Dr Pepper Snapple Group, Inc.

|

9.52B

|

15.55

|

4.25

|

1.58

|

3.26%

|

|

|

Chesapeake

Utilities Corporation

|

499.47M

|

15.18

|

1.86

|

1.21

|

2.97%

|

|

|

American

Railcar Industries, Inc.

|

720.14M

|

10.31

|

1.89

|

0.99

|

2.96%

|

|

|

H&R

Block, Inc.

|

8.01B

|

24.71

|

12.62

|

2.96

|

2.72%

|

|

|

Broadridge

Financial Solutions

|

3.23B

|

21.00

|

4.17

|

1.37

|

2.70%

|

|

|

Gazit-Globe,

Ltd.

|

2.26B

|

8.58

|

1.13

|

1.18

|

2.64%

|

|

|

Huntington

Bancshares

|

6.44B

|

10.82

|

1.10

|

3.36

|

2.60%

|

|

|

CONMED

Corporation

|

893.74M

|

22.54

|

1.50

|

1.18

|

1.86%

|

|

|

American

Tower Corporation

|

29.99B

|

51.58

|

8.17

|

10.06

|

1.42%

|

|

|

SEI

Investments Co.

|

5.07B

|

22.62

|

4.61

|

4.94

|

1.36%

|

|

|

Brown

Shoe Co. Inc.

|

927.71M

|

33.52

|

2.14

|

0.36

|

1.31%

|

|

|

NewMarket

Corp.

|

3.70B

|

15.46

|

8.84

|

1.66

|

1.30%

|

|

|

Chico's

FAS Inc.

|

2.77B

|

15.94

|

2.59

|

1.06

|

1.29%

|

|

|

Leucadia

National Corp.

|

10.33B

|

11.04

|

1.02

|

1.15

|

0.88%

|

|

|

Thermo

Fisher Scientific, Inc.

|

30.66B

|

23.34

|

1.97

|

2.42

|

0.70%

|

|

|

First

Citizens Bancshares Inc.

|

1.90B

|

12.81

|

0.99

|

1.94

|

0.61%

|

|

|

Air

Lease Corporation

|

2.77B

|

19.54

|

1.17

|

3.87

|

0.37%

|

Subscribe to:

Comments (Atom)