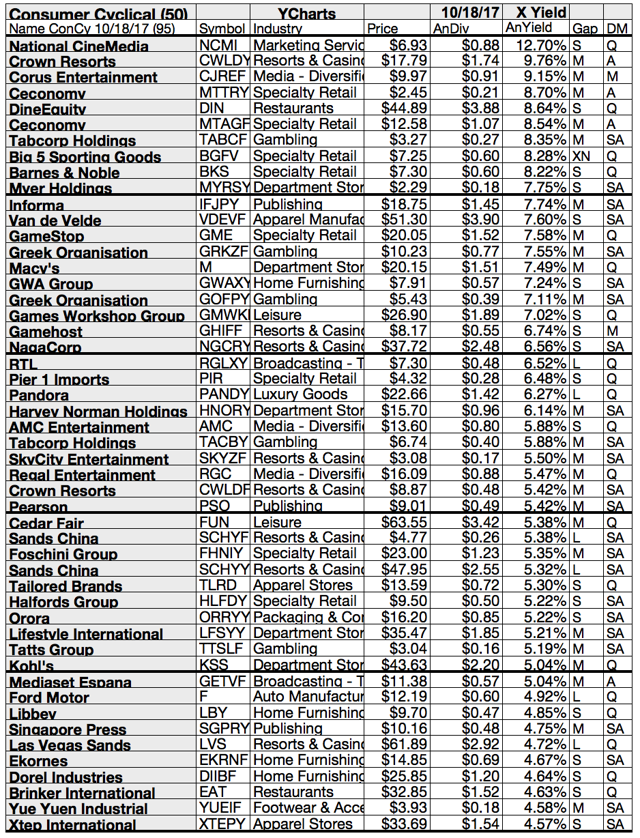

Best Yielding Dividend Growth Interruper By Yield. Only stocks with over 2 billion Mcap were observed.

This is only a small part of the full Dividend Yield Fact Book Collection. You can get these books for a small donation.

The full package contains excel sheets with essential financial ratios from all 113 Dividend Champions, 204 Dividend Contenders and 500+ Dividend Challengers. It's an open version with over 800 high-quality long-term dividend growth stocks. You can work with this database easily and screen with your own criteria to match the best results for you.

In addition, you will also receive a Fact book with content tables of the highest yielding stocks from the most important economies in the world.

| Ticker | Company | P/E | Fwd P/E | P/S | P/B | Dividend |

| EEP | Enbridge Energy Partners, L.P. | 19.81 | 14.78 | 1.55 | 3.34 | 12.14% |

| SUN | Sunoco LP | 78.42 | 9.87 | 0.15 | 2.47 | 12.06% |

| NRZ | New Residential Investment Corp. | 4.66 | 7.98 | 2.53 | 1.09 | 10.85% |

| ARLP | Alliance Resource Partners, L.P. | 6.95 | 8.77 | 1.4 | 2.14 | 10.22% |

| ETP | Energy Transfer Partners, L.P. | - | 15.09 | 0.81 | 1.06 | 9.75% |

| CTL | CenturyLink, Inc. | 41.86 | 19.24 | 1.16 | 1.11 | 9.05% |

| GEL | Genesis Energy, L.P. | - | 18.84 | 1.06 | 1.56 | 8.87% |

| SRC | Spirit Realty Capital, Inc. | 58.19 | 32.23 | 6.59 | 1.35 | 8.59% |

| ENLK | EnLink Midstream Partners, LP | 77.64 | 46.82 | 0.94 | 2.48 | 8.48% |

| PEGI | Pattern Energy Group Inc. | 15.66 | 28.91 | 4.43 | 1.71 | 8.18% |

| SBRA | Sabra Health Care REIT, Inc. | 11.05 | 17.79 | 6.72 | 1.21 | 7.77% |

| LXP | Lexington Realty Trust | 164.64 | 58.35 | 5.31 | 1.95 | 7.70% |

| CLNY | Colony Capital, Inc. | - | - | 1.05 | 0.48 | 7.25% |

| SNP | China Petroleum & Chemical Corporation | 14.62 | 9.34 | 0.32 | 1.14 | 7.07% |

| FUN | Cedar Fair, L.P. | 23.01 | 16.49 | 2.27 | - | 6.80% |

| MPLX | MPLX LP | 21.34 | 14.95 | 5.82 | 4.37 | 6.70% |

| MPW | Medical Properties Trust, Inc. | 15.64 | 14.06 | 6.92 | 1.42 | 6.69% |

| KIM | Kimco Realty Corporation | 31.69 | 27.37 | 5.91 | 1.34 | 6.50% |

| WGP | Western Gas Equity Partners, LP | 21.69 | 15.64 | 3.77 | 7.95 | 6.46% |

| IRM | Iron Mountain Incorporated | 55.66 | 30.37 | 2.51 | 5.09 | 6.43% |

This is only a small part of the full Dividend Yield Fact Book Collection. You can get these books for a small donation.

The full package contains excel sheets with essential financial ratios from all 113 Dividend Champions, 204 Dividend Contenders and 500+ Dividend Challengers. It's an open version with over 800 high-quality long-term dividend growth stocks. You can work with this database easily and screen with your own criteria to match the best results for you.

In addition, you will also receive a Fact book with content tables of the highest yielding stocks from the most important economies in the world.

For a small donation, we send you every update from the Fact Books direct to your donation e-mail address.

A donation from you helps us to develop this books and improve the

quality of our work. Together we can make the world a better and smarter place.

A place with no information advantages between poor and rich persons who have

enough budget to buy the expensive data from Reuters and Bloomberg.

The Dividend Yield Fact Book compilation contains the following books and one excel file with financial ratios from all Dividend Growth Stocks. Here is what you get for your donation:

- Foreign Yield Fact Book (updated weekly) - 42 Pages PDF

- Dividend Growth Stock Fact Book (updated monthly) 32 Pages PDF

- Dividend Growth Excel Sheet (updated

weekly) - 800+ Stock Database

There is no donation minimum or limit. You can choose the donation amount you want to give. The more you support us, the more we can create and give back to you. We think this is a fair deal.

Every donation, even a tiny one, helps us to keep this blog free available for everyone. Help us now and support people with no income or big budgets to get free and easy information on the web.

For your donation, you'll get all these PDF's and Excels updated every month via e-mail. It's a one donation-lifetime service, as long as we can create it. These books and databases need much time to create and we make them unsalaried, only for little donations.

Here is a view of the content tables:

Thank you very much for your help. Thank You, Thank you, Thank you. It's a great pleasure!!!