Someone recently asked me to "let them know what my next investment was going to be, so they could get in at the price I pay." I usually keep a running list of dividend stocks that I want to buy, along with target prices, but I hadn't updated the list in a while. So I decided to do a little research and see what sort of compelling buys I could find in today's environment.

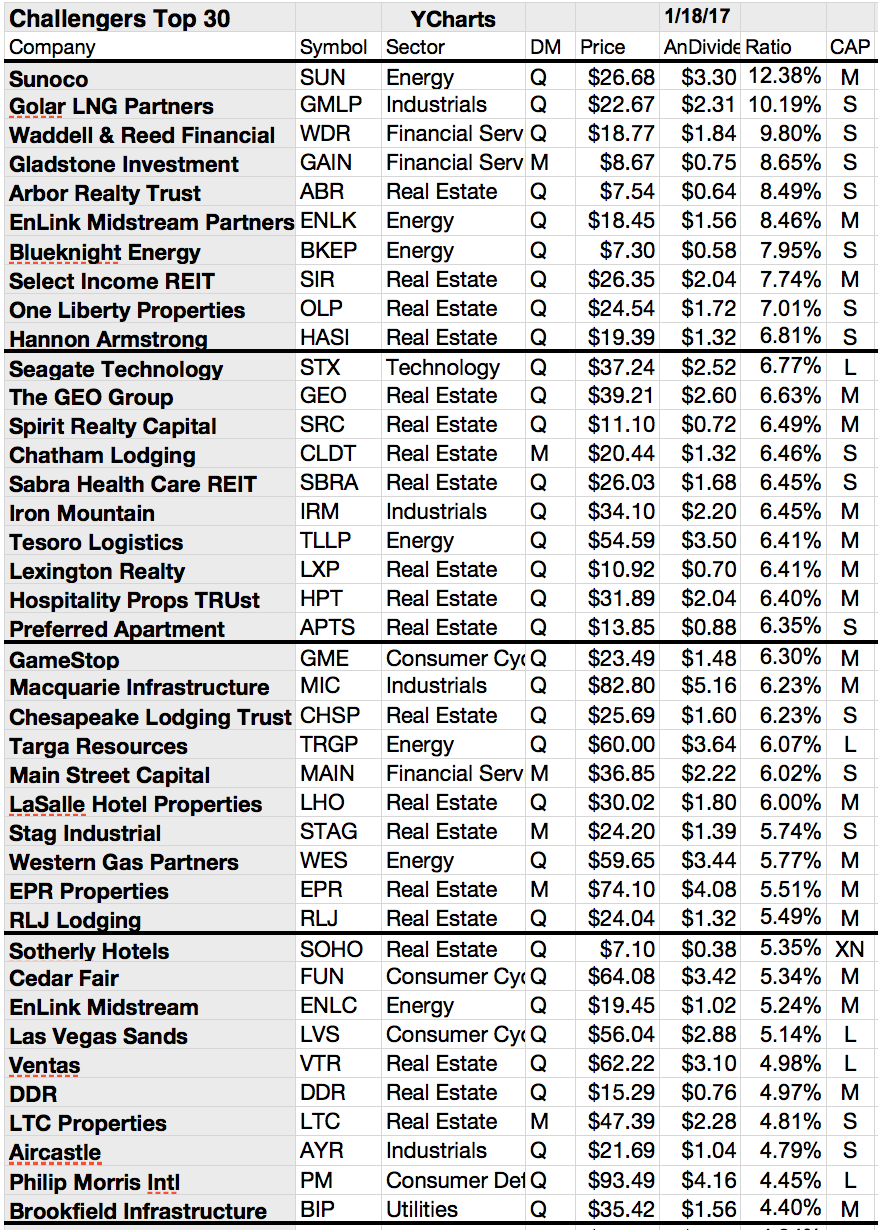

I used the following screening filters to give me a starting list of dividend growth stocks that I might want to consider:

Yield between 4% and 8%

1-year dividend growth rate at least 10%

Recent average dividend growth rate at least 8%

Exclude All MLPs

These were the results...

Showing posts with label HASI. Show all posts

Showing posts with label HASI. Show all posts

6 Cheap REITs With Solid Balance Sheets And Reasonable Debt Loads

With all the major US market indexes making new highs and dividend yields falling in concert, it takes a lot of work to find even a handful of stocks with fair valuations and decent dividend yields.

Bond prices are likewise at all time highs driving bond yields to all time lows. I’m so reluctant to put new money to work in either stock or bond mutual funds today, that I’ve stopped my automatic reinvestment of dividends and capital gains distributions in my fund portfolio. I’m waiting for a better time to add money into the broader stock and bond markets.

This article presents seven REITs and one yieldco that are not yet fully valued, have solid balance sheets and reasonable debt loads, have a history of earnings and dividend growth, and currently pay a respectable dividend.

These are the results...

Bond prices are likewise at all time highs driving bond yields to all time lows. I’m so reluctant to put new money to work in either stock or bond mutual funds today, that I’ve stopped my automatic reinvestment of dividends and capital gains distributions in my fund portfolio. I’m waiting for a better time to add money into the broader stock and bond markets.

This article presents seven REITs and one yieldco that are not yet fully valued, have solid balance sheets and reasonable debt loads, have a history of earnings and dividend growth, and currently pay a respectable dividend.

These are the results...

Subscribe to:

Comments (Atom)