Dividend-paying stocks that have gotten left behind in the rally now feature higher dividend yields, which may be attractive to investors.

But buyer beware: Many yields are high because some investors fear the stocks. But if you do extra research on specific companies and reach a certain comfort level, you may be looking at some bargains.

Long-time income investors are constantly facing the problem of how to replace income lost when older and higher-yielding bonds and callable preferred stocks are redeemed. And more than eight years into the bull market, while interest rates are still historically low, the problem keeps getting worse.

We have featured the S&P High-Yield Dividend Aristocrats, which are companies included in the S&P 1500 Composite Index that have raised dividends for at least 20 consecutive years.

But many have yields that aren’t attractive.

We also put together a list of dividend stocks culled with rather stringent criteria for free cash flow and sales growth. This time around, we are taking a far less stringent approach.

A total of 33 companies among the S&P 1500 met these criteria:

• Dividend yields of at least 5%.

• No cuts of regular dividends over the past five years

• A free cash flow yield, for the past 12 months, exceeding the current dividend yield.

These are the results...

Showing posts with label WDR. Show all posts

Showing posts with label WDR. Show all posts

20 Oversold And Cheap Dividend With Yields Over 3%

The only thing better than oversold stocks are oversold dividend stocks. The dividend, even if it’s a small one, acts as a hedge if you decide to purchase the stock and the trade moves against you.

I do a screen for oversold dividend stocks from time to time, not only because I’m hunting for value, but because oftentimes some names turn up that I’ve never heard of. There’s nothing I like more than a new stock with either a really boring name or one that piques my interest.

As an investor who finds value stocks to be less risky with higher chances of yielding market-beating returns, I’m always on the lookout for stocks that are oversold. Sometimes a lousy stock gets rightfully sold off and you should avoid it.

However, sometimes a stock gets taken down because investors are reacting emotionally. They sell first and ask questions later. That can create great opportunities for investors who are seeking a good stock at an undervalued price.

Other times, you have a stock that is subject to things like fluctuating commodity prices, but is likely to get back up once external factors stabilize.

Sometimes you might get lucky, and find that oversold stock that also pays a dividend. If you are correct in your assessment, you may get paid that dividend while you wait for the market to realize how wrong it was and send the stock back up.

Here are 20 interesting oversold dividend stocks worthy of consideration:

I do a screen for oversold dividend stocks from time to time, not only because I’m hunting for value, but because oftentimes some names turn up that I’ve never heard of. There’s nothing I like more than a new stock with either a really boring name or one that piques my interest.

As an investor who finds value stocks to be less risky with higher chances of yielding market-beating returns, I’m always on the lookout for stocks that are oversold. Sometimes a lousy stock gets rightfully sold off and you should avoid it.

However, sometimes a stock gets taken down because investors are reacting emotionally. They sell first and ask questions later. That can create great opportunities for investors who are seeking a good stock at an undervalued price.

Other times, you have a stock that is subject to things like fluctuating commodity prices, but is likely to get back up once external factors stabilize.

Sometimes you might get lucky, and find that oversold stock that also pays a dividend. If you are correct in your assessment, you may get paid that dividend while you wait for the market to realize how wrong it was and send the stock back up.

Here are 20 interesting oversold dividend stocks worthy of consideration:

5 Value Dividend Stocks With Yields Over 5%

The search for dividends, however, is more involved than picking a Chance card on the Monopoly board.

Bigger isn't always better, and just because a stock has a high dividend yield -- annual dividend divided by share price -- that doesn't necessarily mean that it is a better investment than one with a lower yield.

For example, the dividend yield could increase if a stock price drops, which could be a red flag for financial struggles in the underlying business.

A company's payout ratio, which is the relationship between what it pays to shareholders and how much profit it generates, is another key metric. Too high a payout ratio could limit a company's ability to buy back shares, build the underlying operation or raise dividends.

A healthy dividend is one that will grow over time and provide a solid stream of income for the investor.

Here are five picks with dividend yields exceeding 5%. All the stocks on the below not only carry high yields but also have price appreciation potential, so investors could get a double benefit from being selective and thinking like a value stock picker when looking at these names.

These are the results....

Bigger isn't always better, and just because a stock has a high dividend yield -- annual dividend divided by share price -- that doesn't necessarily mean that it is a better investment than one with a lower yield.

For example, the dividend yield could increase if a stock price drops, which could be a red flag for financial struggles in the underlying business.

A company's payout ratio, which is the relationship between what it pays to shareholders and how much profit it generates, is another key metric. Too high a payout ratio could limit a company's ability to buy back shares, build the underlying operation or raise dividends.

A healthy dividend is one that will grow over time and provide a solid stream of income for the investor.

Here are five picks with dividend yields exceeding 5%. All the stocks on the below not only carry high yields but also have price appreciation potential, so investors could get a double benefit from being selective and thinking like a value stock picker when looking at these names.

These are the results....

Russell 2000 Dogs With Hard Safe Yields

Dividend investors face a constant battle of choosing between dividend yield and sustainability.

Generally speaking, low yields are often sustainable but may be undesirable for investors looking to pad their portfolio with dividend income or reinvestment opportunities.

On the other end of the spectrum, high yields (let's say 5% and higher) are extremely attractive for income-seeking investors, but they're also often far more dangerous than lower yields due to a possible lack of sustainability.

Remember that dividend yields are a function of payout divided by share price, and if a stock's share price has been tumbling, its yield will rise. Thus, dividend investors have to be diligent to ensure that a yield isn't inflated solely because a company's business model is in trouble.

Attached you will find a list of stocks from the Russell 2000 with high yields. Most of them have free cashflow yield exceeding the dividend yield.

Here are the results...

Generally speaking, low yields are often sustainable but may be undesirable for investors looking to pad their portfolio with dividend income or reinvestment opportunities.

On the other end of the spectrum, high yields (let's say 5% and higher) are extremely attractive for income-seeking investors, but they're also often far more dangerous than lower yields due to a possible lack of sustainability.

Remember that dividend yields are a function of payout divided by share price, and if a stock's share price has been tumbling, its yield will rise. Thus, dividend investors have to be diligent to ensure that a yield isn't inflated solely because a company's business model is in trouble.

Attached you will find a list of stocks from the Russell 2000 with high yields. Most of them have free cashflow yield exceeding the dividend yield.

Here are the results...

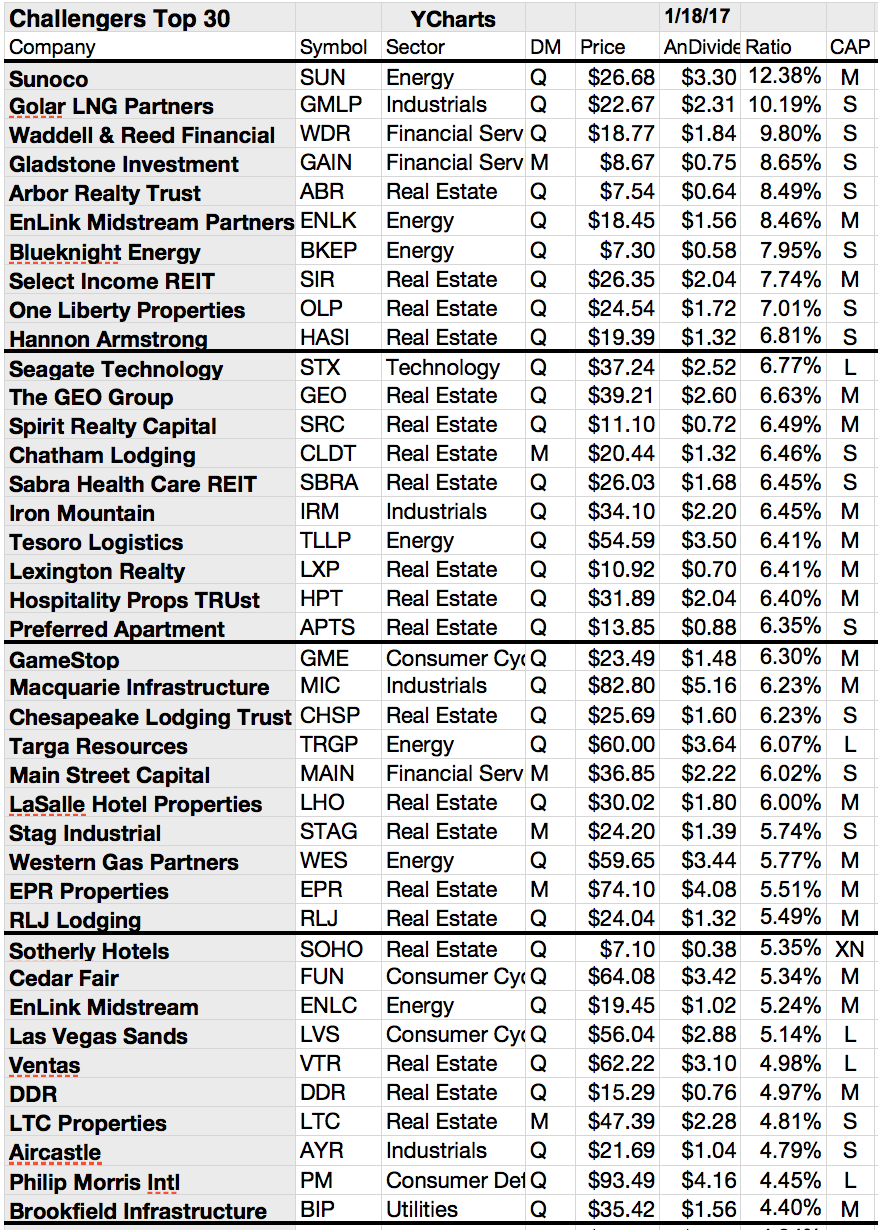

20 Cheap Dividend Challenger Dogs With Yields Up To 11.79%

If income is your investment objective, the deck is stacked against you, as interest rates remain velcroed to record lows. But there are attractive dividend stocks out there, provided you can commit for the long run.

The Dividend Growth stocks from 5 to 50 years of consecutive dividend growth are the most popular stocks within the long-term income asset class.

I often write about stocks with a longer investment period and one basic approach is to look at the past performance of a business in order to develop future prospects of the firm.

I believe that a good past performance tells us something about the quality of the business, the market barriers, brands and consumer loyalty. It also tells us something about volume products and the art of business, the magic formula about selling a product.

Today I like to introduce some of the highest yielding stocks with cheap price mutiples from the Dividend Challengers list. Each of the stocks has increased dividends by more than 5 years in a row.

These are the best dogs from the Dividend Challengers list...

The Dividend Growth stocks from 5 to 50 years of consecutive dividend growth are the most popular stocks within the long-term income asset class.

I often write about stocks with a longer investment period and one basic approach is to look at the past performance of a business in order to develop future prospects of the firm.

I believe that a good past performance tells us something about the quality of the business, the market barriers, brands and consumer loyalty. It also tells us something about volume products and the art of business, the magic formula about selling a product.

Today I like to introduce some of the highest yielding stocks with cheap price mutiples from the Dividend Challengers list. Each of the stocks has increased dividends by more than 5 years in a row.

These are the best dogs from the Dividend Challengers list...

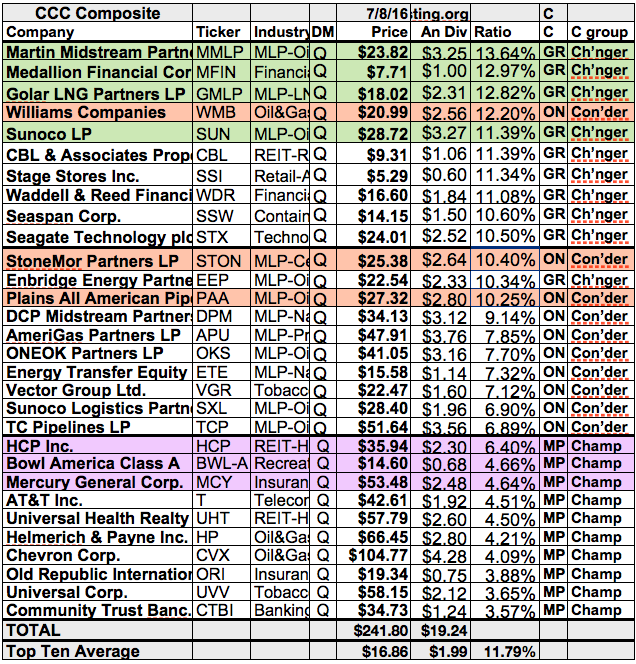

20 Cheapest High-Yield Dividend Challengers

Today's screen is focused on high yields and low P/E within the Dividend Challengers space. Those stocks managed to raise dividends by more than 5 years in a row.

Challengers jumped over the first level of dividend growth barriers. One day they could become a Dividend Contender, Achiever, Champion, Aristocrat or even a Dividend King.

Most Challengers have in common that they could fail to raise dividends in the future. There are more cyclic stocks on the list. The top yielding results com the credit services, REIT and oil and gas sector.

My favorites are GMLP, SSW, STX, WDR, SSI, and SAFT. Which stocks do you like from the screen? Please let me know some of your thoughts by leaving a comment. Here are the 20 cheapest high-yield Dividend Challengers….

Here are the 20 cheapest high-yield Dividend Challengers…

Challengers jumped over the first level of dividend growth barriers. One day they could become a Dividend Contender, Achiever, Champion, Aristocrat or even a Dividend King.

Most Challengers have in common that they could fail to raise dividends in the future. There are more cyclic stocks on the list. The top yielding results com the credit services, REIT and oil and gas sector.

My favorites are GMLP, SSW, STX, WDR, SSI, and SAFT. Which stocks do you like from the screen? Please let me know some of your thoughts by leaving a comment. Here are the 20 cheapest high-yield Dividend Challengers….

Here are the 20 cheapest high-yield Dividend Challengers…

Oversold Dividend Growth Stocks As Buying Opportunity? Check out These 11 Stocks

A lot of people like to “cheer” for higher prices in the short-term.

Yet for the long-term net buyer, it’s lower prices that can provide the ultimate benefit.

This allows you to purchase more shares, which creates more income and a greater underlying earnings claim. Personally when I see lower prices, that’s when I tend to get more interested.

It's a first step to discover those stocks that might get cheaper but you need to discover carefully if there is a reason for the cheapness.

Attached you will find a selection of stocks from the dividend growth space that become cheaper over the recent year.

Here are the stocks I'm talking from...

This allows you to purchase more shares, which creates more income and a greater underlying earnings claim. Personally when I see lower prices, that’s when I tend to get more interested.

It's a first step to discover those stocks that might get cheaper but you need to discover carefully if there is a reason for the cheapness.

Attached you will find a selection of stocks from the dividend growth space that become cheaper over the recent year.

Here are the stocks I'm talking from...

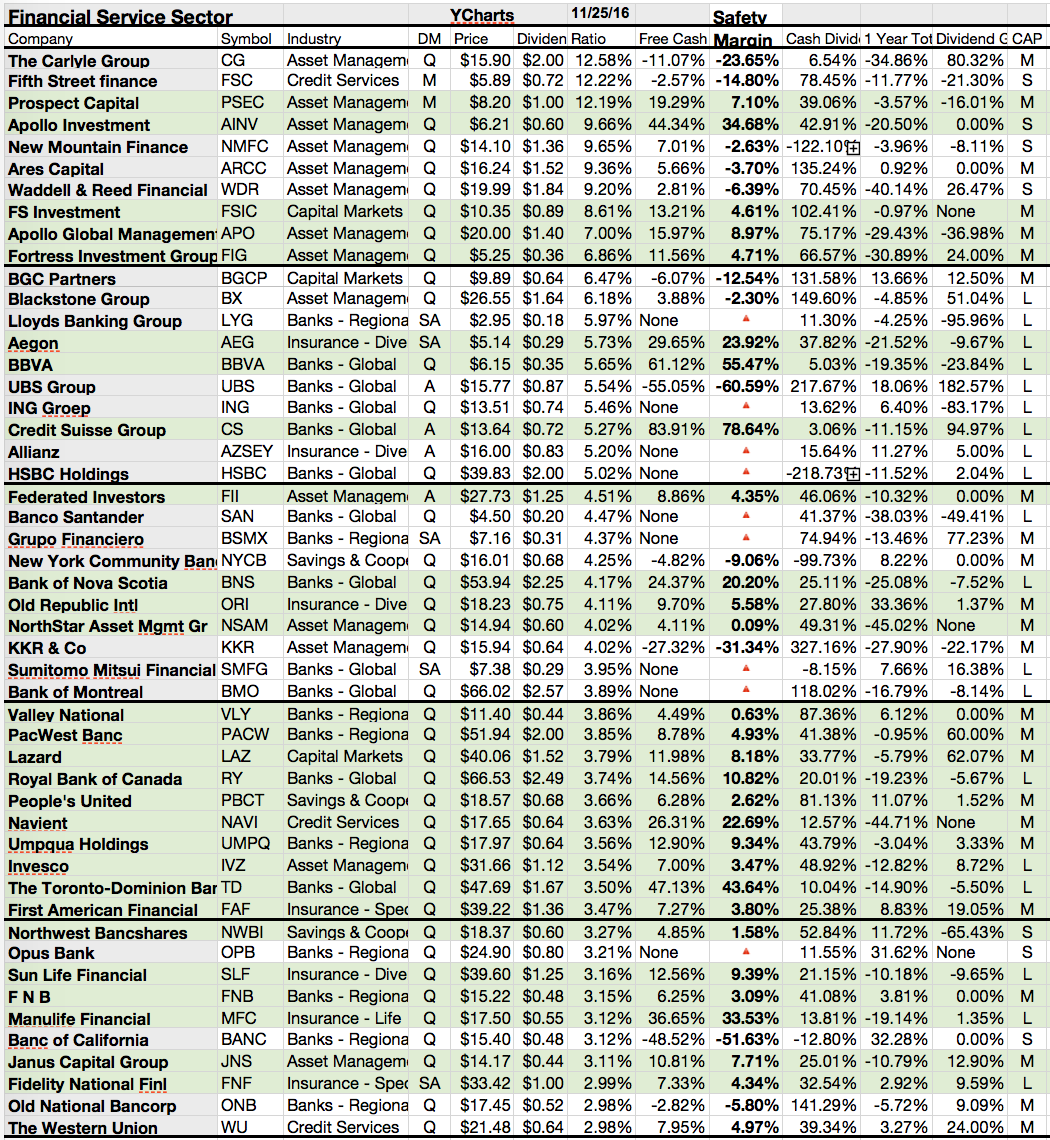

16 High-Yield Dividend Growth Stocks Good Enough To Buy

Just because a stock pays a high dividend doesn't necessarily make it a good long-term investment. But it could make sense to put small amounts of money into high yielding stocks in order to boost your dividend income.

Attached you will find a compilation of stocks with high-yields that might boost your portfolio cash income in the futre. I hope you will find some new ideas on the list. Do you like any of them or do you still own a few of the selected stocks?

Here are a few great long-term investments with yields above 5%...

19 Cheap Stocks With A Free Cashflow Yield Over 6.67%

Everyone needs cheap stocks for a

solid return. But what cheap really means depends on your growth expectations.

Everyone needs cheap stocks for a

solid return. But what cheap really means depends on your growth expectations.

I tell you that

earnings are not equal to free cash flow. Some companies need much money to

grow or they put large amounts of cash into the business to keep them alive due

to high amortizations.

If you look for

cheap stocks, you also need to cheap price to free cash flow ratios.

Today I would like

to introduce a few dozen or and a few more stocks with a cheap price to free cash

flow ratio (less than 15). A ratio under 15 indicates that the potential payout

yield is over 6.67%.

In addition, I've

only listed those stocks with a positive earnings growth outlook for the next

five years. That's in my view a method to filter only well-running business.

Despite the tight

criteria, the screen also produced some struggling companies like BHP or Rio

Tinto. I like them for sure but I do believe that they are not worth investing

while the commodity price still low or at multi-year lows.

Here are the

results from my screen...

5 High Yield Dividend Stocks With High Beta Ratios

While investing in

stocks with high dividends may be a good scheme to reinforce your loss-aversion

principle, playing the market to dodge volatility requires some extra cautious

steps. Beta measures the extent to which a fund’s return may be affected or how

much the price fluctuates owing to market conditions.

While investing in

stocks with high dividends may be a good scheme to reinforce your loss-aversion

principle, playing the market to dodge volatility requires some extra cautious

steps. Beta measures the extent to which a fund’s return may be affected or how

much the price fluctuates owing to market conditions.

A high beta shows

normally how the performance of a single stock differs from the overall market.

The higher the ratio, the bigger the out- or underperformance develops.

It's great if you

like to be different, a star or a looser on the market.

Today I like to

show you those higher capitalized dividend stocks with beta ratios over 1.5 and

dividend yields over 5%. In order to keep the over levered stocks off the list,

I only observed stocks with a debt to equity ratio under 1.

14 stocks

fulfilled my criteria of which eight have a low forward P/E.

Here are the results...

Here are the results...

11 Dividend Growth Stocks With Low Debt, Solid Growth And Yields Over 4%

All too often, yield-starved investors give in to the temptation of high yield dividend stocks. Dividend yields greater than 5% look like an easy way to grab more current income on the surface, but dividend income is just part of the total return equation.

All too often, yield-starved investors give in to the temptation of high yield dividend stocks. Dividend yields greater than 5% look like an easy way to grab more current income on the surface, but dividend income is just part of the total return equation.If a stock with a 6% dividend yield sees its price cut in half, an investor living off dividends in retirement would have been better off purchasing a lower yielding stock with less business risk and volatility, occasionally selling shares to meet his or her cash flow needs.

That's the reason for my today's screen. I've tried to catch some companies with high dividends which are not at risk to cut.

The total amount of debt is one important criterion for a dividend cut. Growth is also an important issue.

Each stock I've researched has a dividend yield over 4% and positive 5 year EPS growth forecasts. In addition, debt-to-equity ratios are under 0.4. Eleven stocks fulfilled my tight criteria of which 3 got a buy or better rating by analysts.

Here are the best yielding results from my research...

7 Mispriced And Dividend Paying Stocks Each Investor Should Know

Buying a stock is easy but you will

have only a chance to make money with your investment when you look at the valuation

and growth perspectives of the corporate.

If you invest into

undervalued stocks, you will more likely have a higher return in the future.

Today I like to discuss a few stocks that seem to be undervalued in terms of

price to earnings and growth. Please leave comments in the box at the end of

the article if you agree with me or disagree.

Here are the results...

Here are the results...

Ex-Dividend Dogs Of The Next Week

Attached is a sheet of higher capitalized ex-dividend stocks with a cheap forward P/E. Potash, AT&T, GAP, Cisco and Comcast are my favorites.

The initial yield of the 20 top yielding cheap ex-dividend stocks starts at 3.56% and ends at 14.35%.

Here are the results. Please let me know if you have some comments about the list. Do you like some of the ex-dividend dogs?

The initial yield of the 20 top yielding cheap ex-dividend stocks starts at 3.56% and ends at 14.35%.

Here are the results. Please let me know if you have some comments about the list. Do you like some of the ex-dividend dogs?

|

| Ex-Dividend Dogs Of The Next Week October 05 - 11, 2015 (click to enlarge) |

Ex-Dividend Stocks: Best Dividend Paying Shares On October 09, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 33 stocks go ex dividend

- of which 10 yield more than 3 percent. Here is a full list of all stocks with ex-dividend

date within the current week.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

MFA

Financial, Inc.

|

2.72B

|

9.52

|

0.86

|

5.51

|

11.70%

|

|

|

Linn

Energy, LLC

|

6.23B

|

-

|

1.47

|

3.41

|

11.54%

|

|

|

Sasol

Ltd.

|

29.88B

|

11.40

|

1.98

|

1.64

|

4.61%

|

|

|

Kraft

Foods Group, Inc.

|

31.99B

|

17.37

|

7.44

|

1.74

|

3.90%

|

|

|

Sovran

Self Storage Inc.

|

2.35B

|

38.31

|

2.94

|

9.18

|

2.82%

|

|

|

General

Dynamics Corp.

|

30.26B

|

-

|

2.57

|

0.97

|

2.60%

|

|

|

Accenture

plc

|

46.47B

|

14.86

|

9.37

|

1.53

|

2.57%

|

|

|

Aviva

plc

|

20.04B

|

-

|

1.29

|

0.36

|

2.57%

|

|

|

Marsh

& McLennan Companies

|

23.68B

|

18.44

|

3.49

|

1.96

|

2.33%

|

|

|

Waddell

& Reed Financial Inc.

|

4.51B

|

21.44

|

8.01

|

3.62

|

2.13%

|

|

|

Yum!

Brands, Inc.

|

32.43B

|

23.42

|

14.58

|

2.46

|

2.07%

|

|

|

Smith

& Nephew plc

|

11.11B

|

20.25

|

2.85

|

2.66

|

1.69%

|

|

|

WPP

plc

|

25.41B

|

20.36

|

2.04

|

1.48

|

1.64%

|

|

|

Patterson

Companies Inc.

|

4.03B

|

19.66

|

2.89

|

1.11

|

1.60%

|

|

|

Masco

Corporation

|

7.15B

|

93.09

|

20.08

|

0.91

|

1.46%

|

|

|

Kyocera

Corp.

|

36.17B

|

42.68

|

1.00

|

2.68

|

1.36%

|

|

|

Coty

Inc.

|

6.13B

|

38.10

|

4.10

|

1.32

|

1.25%

|

|

|

CLARCOR

Inc.

|

2.76B

|

28.39

|

2.83

|

2.45

|

1.23%

|

|

|

Morningstar

Inc.

|

3.56B

|

31.42

|

4.97

|

5.26

|

0.65%

|

|

|

Roper

Industries Inc.

|

12.88B

|

26.16

|

3.31

|

4.18

|

0.51%

|

Ex-Dividend Stocks: Best Dividend Paying Shares On July 09, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks with payment dates can be found here: Ex-Dividend Stocks July 09, 2013. In total, 10 stocks and preferred shares go ex dividend - of which 2 yield more than 3 percent. The average yield amounts to 2.89%.

A full list of all stocks with payment dates can be found here: Ex-Dividend Stocks July 09, 2013. In total, 10 stocks and preferred shares go ex dividend - of which 2 yield more than 3 percent. The average yield amounts to 2.89%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Huntingdon

Capital Corp

|

166.59M

|

-

|

0.95

|

2.76

|

8.88%

|

|

Gold

Resource Corp

|

440.40M

|

17.06

|

4.92

|

3.21

|

4.31%

|

|

Waddell

& Reed Financial Inc.

|

3.87B

|

19.39

|

7.00

|

3.22

|

2.48%

|

|

OGE

Energy Corp.

|

6.79B

|

19.97

|

2.47

|

1.82

|

2.45%

|

|

Marsh

& McLennan

|

22.44B

|

18.45

|

3.38

|

1.87

|

2.44%

|

|

Franco-Nevada

Corporation

|

5.01B

|

54.14

|

1.60

|

11.62

|

2.11%

|

|

Patterson

Companies Inc.

|

3.84B

|

18.70

|

2.76

|

1.06

|

1.69%

|

|

Kadant

Inc.

|

357.10M

|

12.64

|

1.44

|

1.10

|

1.56%

|

|

NetApp,

Inc.

|

13.90B

|

28.09

|

2.95

|

2.19

|

1.55%

|

|

Aetna

Inc.

|

20.50B

|

12.93

|

1.92

|

0.55

|

1.28%

|

Subscribe to:

Comments (Atom)