Dividend investors face a constant battle of choosing between dividend yield and sustainability.

Generally speaking, low yields are often sustainable but may be undesirable for investors looking to pad their portfolio with dividend income or reinvestment opportunities.

On the other end of the spectrum, high yields (let's say 5% and higher) are extremely attractive for income-seeking investors, but they're also often far more dangerous than lower yields due to a possible lack of sustainability.

Remember that dividend yields are a function of payout divided by share price, and if a stock's share price has been tumbling, its yield will rise. Thus, dividend investors have to be diligent to ensure that a yield isn't inflated solely because a company's business model is in trouble.

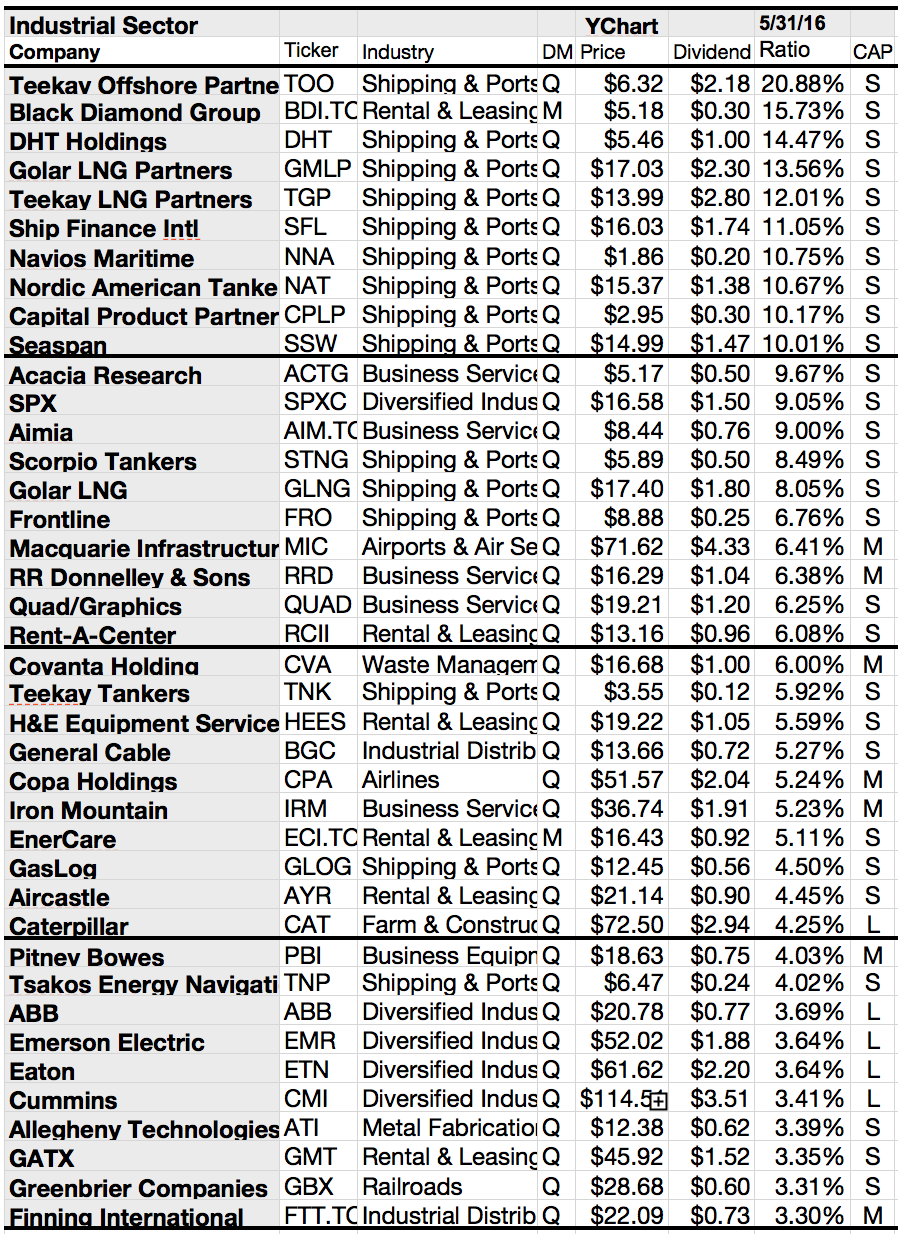

Attached you will find a list of stocks from the Russell 2000 with high yields. Most of them have free cashflow yield exceeding the dividend yield.

Here are the results...

Showing posts with label TNK. Show all posts

Showing posts with label TNK. Show all posts

19 Shipping Stocks Far Below Book Value; Yields Still Up To 32%

If I screen the market by

interesting investing ideas, one industry often popped on my screen: The

shipping industry.

For sure, the global

trade slows down and commodity costs are at the lowest level for decades. What

looks like bad news for shipping stocks but also a great opportunity for long

term investors?

Let's try a look.

Ships are not equal. These are container ships, tanker etc. and each industry

has a different cyclic.

The recent

correction in share prices across shipping stocks, barring tanker operators,

has transpired into attractive valuations.

While investors

are skeptical of catching falling knives, sitting on the cash means missing

good bargains.

Investors should

adopt a diversified portfolio within the maritime space, to insulate from

heightened uncertainty in the sector.

We have followed

top-down approach to build our model portfolio, while considering company-specific

factors such as the balance sheet strength, financial performance and

management profile for stock selection.

It is important to

note that shipping is a high-beta sector and tends to underperform/outperform

the financial markets by a wide alpha on both sides.

Attached I've

tried to compile a few dividend paying shipping stocks that might look like

bargains due to low price to book ratios and earnings multiples. What du you

think? Are shipping stocks worth an investment? Leave a comment and we discuss

the idea.

Here are the

results...

Ex-Dividend Stocks: Best Dividend Paying Shares On October 11, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 8 stocks go ex dividend

- of which 3 yield more than 3 percent. Here is a full list of all stocks with ex-dividend

date within the current week.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Teekay

Tankers Ltd.

|

218.17M

|

-

|

0.75

|

1.21

|

4.60%

|

|

Wayne

Savings Bancshares Inc.

|

30.04M

|

15.16

|

0.78

|

2.06

|

3.06%

|

|

Teekay

Corporation

|

2.94B

|

-

|

2.35

|

1.58

|

3.04%

|

|

Gap

|

18.48B

|

14.57

|

5.34

|

1.14

|

2.03%

|

|

Stewart

Enterprises Inc.

|

1.12B

|

25.38

|

2.44

|

2.13

|

1.36%

|

|

ChipMOS

TECHNOLOGIES

|

500.44M

|

10.78

|

1.18

|

0.76

|

0.82%

|

|

Alamo

Group, Inc.

|

549.21M

|

17.54

|

1.70

|

0.86

|

0.61%

|

|

Aetrium

Inc.

|

3.67M

|

-

|

0.92

|

0.85

|

-

|

Ex-Dividend Date Reminder For February 16, 2012

Here is a current overview of best yielding stocks with a market capitalization above USD 300 million that have their ex-dividend date on the next trading day. If your broker settles your trade today, you will receive the next dividend. A full list of all stocks with ex-dividend date can be found here: Ex-Dividend Stocks February 16, 2012. In total, 23 stocks and preferred shares go ex-dividend of which 11 yielding above 3 percent. The average yield amounts to 4.34 percent.

Subscribe to:

Comments (Atom)