|

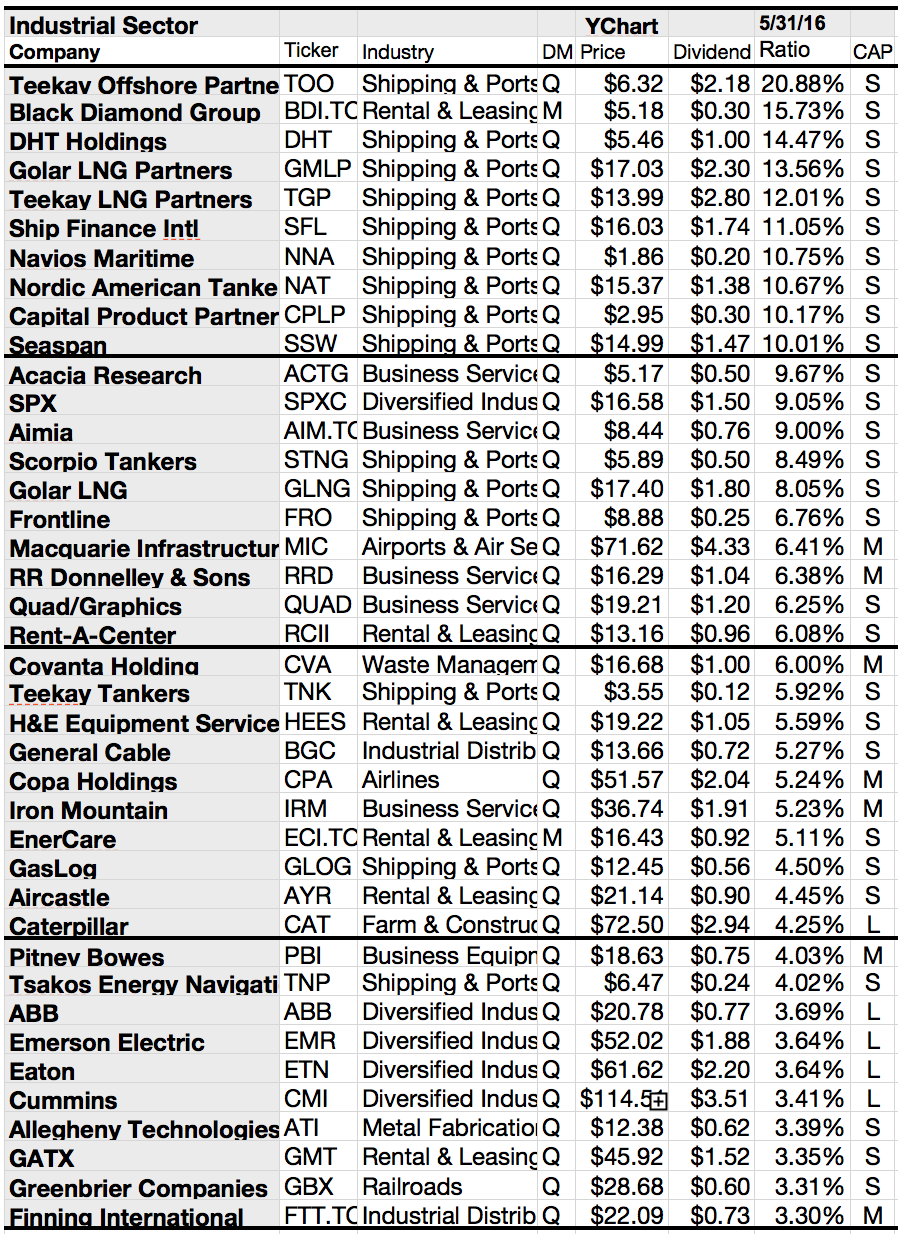

| The Highest Yielding Industrial Dogs; Source: Seeking Alpha |

Showing posts with label TGP. Show all posts

Showing posts with label TGP. Show all posts

19 Shipping Stocks Far Below Book Value; Yields Still Up To 32%

If I screen the market by

interesting investing ideas, one industry often popped on my screen: The

shipping industry.

For sure, the global

trade slows down and commodity costs are at the lowest level for decades. What

looks like bad news for shipping stocks but also a great opportunity for long

term investors?

Let's try a look.

Ships are not equal. These are container ships, tanker etc. and each industry

has a different cyclic.

The recent

correction in share prices across shipping stocks, barring tanker operators,

has transpired into attractive valuations.

While investors

are skeptical of catching falling knives, sitting on the cash means missing

good bargains.

Investors should

adopt a diversified portfolio within the maritime space, to insulate from

heightened uncertainty in the sector.

We have followed

top-down approach to build our model portfolio, while considering company-specific

factors such as the balance sheet strength, financial performance and

management profile for stock selection.

It is important to

note that shipping is a high-beta sector and tends to underperform/outperform

the financial markets by a wide alpha on both sides.

Attached I've

tried to compile a few dividend paying shipping stocks that might look like

bargains due to low price to book ratios and earnings multiples. What du you

think? Are shipping stocks worth an investment? Leave a comment and we discuss

the idea.

Here are the

results...

Next Week's 20 Top Yielding Ex-Dividend Shares

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 33 stocks go ex dividend

- of which 18 yield more than 3 percent. Here is a full list of all stocks with ex-dividend

date within the current week.

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

Teekay

LNG Partners LP.

|

2.96B

|

18.05

|

2.39

|

7.57

|

6.37%

|

|

|

Teekay

Offshore Partners LP

|

2.75B

|

19.31

|

3.46

|

3.13

|

6.32%

|

|

|

Hospitality

Properties Trust

|

4.21B

|

37.23

|

1.60

|

2.97

|

6.23%

|

|

|

Pembina

Pipeline Corporation

|

10.15B

|

32.08

|

2.12

|

2.21

|

4.98%

|

|

|

CommonWealth

REIT

|

2.96B

|

60.93

|

0.97

|

2.76

|

4.00%

|

|

|

Royal

Bank of Canada

|

97.53B

|

12.97

|

2.34

|

4.81

|

3.82%

|

|

|

HSBC

Holdings plc

|

204.44B

|

13.34

|

1.17

|

3.87

|

3.62%

|

|

|

Williams-Sonoma

Inc.

|

5.14B

|

19.56

|

4.21

|

1.22

|

2.34%

|

|

|

Sinopec Shanghai Petrochemical

|

2.81B

|

177.64

|

1.04

|

0.18

|

2.10%

|

|

|

Fastenal

Company

|

14.60B

|

32.58

|

8.35

|

4.47

|

2.03%

|

|

|

Unum

Group

|

8.48B

|

9.70

|

1.01

|

0.81

|

1.82%

|

|

|

Tyco

International Ltd.

|

16.65B

|

-

|

3.54

|

1.57

|

1.78%

|

|

|

Xylem

Inc.

|

5.16B

|

22.26

|

2.51

|

1.38

|

1.69%

|

|

|

Pentair,

Inc.

|

13.19B

|

-

|

2.26

|

2.08

|

1.53%

|

|

|

Lowe's

Companies Inc.

|

50.85B

|

24.07

|

3.89

|

0.98

|

1.51%

|

|

|

Pier

1 Imports, Inc.

|

2.23B

|

18.30

|

4.24

|

1.26

|

0.95%

|

|

|

West

Pharmaceutical Services

|

3.17B

|

32.88

|

4.04

|

2.42

|

0.88%

|

|

|

SM

Energy Company

|

5.78B

|

-

|

3.78

|

3.09

|

0.11%

|

Ex-Dividend Stocks: Best Dividend Paying Shares On October 21, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 9 stocks go ex dividend

- of which 5 yield more than 3 percent. Here is a full list of all stocks with ex-dividend

date within the current week.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stock:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Compass

Diversified Holdings

|

894.52M

|

-

|

2.35

|

0.94

|

7.78%

|

|

Teekay

LNG Partners LP.

|

2.93B

|

17.86

|

2.37

|

7.50

|

6.43%

|

|

Teekay

Offshore Partners LP

|

2.77B

|

19.49

|

3.49

|

3.16

|

6.26%

|

|

Costamare

Inc.

|

1.34B

|

14.40

|

2.26

|

3.50

|

6.05%

|

|

LTC

Properties Inc.

|

1.28B

|

24.99

|

2.15

|

12.88

|

5.23%

|

|

Xylem

Inc.

|

5.10B

|

21.99

|

2.48

|

1.36

|

1.71%

|

|

Lowe's

Companies Inc.

|

52.30B

|

24.76

|

4.00

|

1.01

|

1.47%

|

|

Pier

1 Imports, Inc.

|

2.15B

|

17.65

|

4.08

|

1.22

|

0.99%

|

|

West

Pharmaceutical Services

|

3.16B

|

32.71

|

4.02

|

2.41

|

0.88%

|

20 Of The Safest Dividend Challengers On The Market

Dividend Challengers with lowest beta ratios originally

published at "long-term-investments.blogspot.com". I love high-quality

dividend growth stocks and the stocks with the longest history of consecutive

payments are definitely Dividend Kings and Dividend Champions. But the big

disadvantage of them is that they are also highly priced.

You cannot make a greater return with stocks

that have a P/E ratio of 22 and grows only at 5 percent. You need real bargains

to make big profit with your asset.

This problem can be solved when you look into

the dividend potentials. Those stocks haven’t yet reached a longer dividend

payment history but they can become a great Dividend Champion within the next

years. The price ratios are also lower for some companies and you have a better

choice to find good investments because out there are around 160 stocks with

five or more years of consecutive dividend payments and 207 with a payment

between 10 to 25 years.

Today I like to screen the third class of

dividend growth stocks by the safest alternatives. The 20 safest dividend growth stocks have a beta ratio between 0.18 and 0.55. All three top picks come from the

oil & gas pipeline industry, a branch with very stable sales and future growth

perspectives due to the shale gas boom in the United States.

From the 20 safest Dividend Challengers have nine

a current buy or better rating.

Best Yielding Dividend Challengers | 30 High-Yield Dividend Growth Stocks

Dividend Challengers with the highest dividend

yields originally published at "long-term-investments.blogspot.com". Dividend

Challengers are the third class of the best dividend growth stocks. They raised

cash distributions to shareholders in form of dividends over a period between 5

and 10 years without a break.

Exactly 175 stocks raised dividends over this

period. Today, I like to present the best yielding Challengers. The list below

shows all High-Yield stocks. In total, there are 30 companies with a yield of

more than 5 percent and nearly half of the results are recommended to buy.

Some Challengers have the potential to grow

dividends to real Champions but most of them will fail over the next five or

ten years. I personally would not use the dividend growth criteria as a big

requirement. The biggest capital gains will be made with good growth picks. The

payments will come from alone in the end.

Next Week's 20 Best Ex-Dividend Stocks

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading week.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks between Jan. 28 – Feb. 03 2013. In

total, 100 stocks and preferred shares go ex dividend - of which 60 yield more

than 3 percent. The average yield amounts to 4.75%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Prospect

Capital Corporation

|

2.38B

|

6.49

|

1.05

|

6.11

|

11.62%

|

|

Atlantic

Power Corporation

|

4.35B

|

4.75

|

1.82

|

0.50

|

9.26%

|

|

Calumet Specialty Products Partners

|

2.08B

|

9.98

|

2.23

|

0.47

|

7.90%

|

|

Hospitality

Properties Trust

|

3.21B

|

27.62

|

1.16

|

2.53

|

7.24%

|

|

Teekay

Offshore Partners LP

|

2.35B

|

-

|

3.69

|

2.43

|

6.92%

|

|

Omega

Healthcare Investors

|

2.92B

|

25.83

|

2.86

|

8.81

|

6.90%

|

|

Copano

Energy LLC

|

2.64B

|

-

|

2.81

|

1.92

|

6.88%

|

|

Teekay

LNG Partners LP.

|

2.90B

|

24.83

|

2.35

|

7.40

|

6.47%

|

|

El Paso Pipeline Partners, L.P.

|

8.83B

|

19.04

|

4.48

|

5.83

|

5.96%

|

|

Baytex

Energy Corp.

|

5.55B

|

19.14

|

4.15

|

5.06

|

5.89%

|

|

Kinder

Morgan Energy Partners

|

32.48B

|

53.94

|

2.98

|

3.76

|

5.80%

|

|

People's

United Financial Inc.

|

4.33B

|

18.89

|

0.82

|

4.10

|

5.13%

|

|

Genesis

Energy LP

|

3.18B

|

38.77

|

3.43

|

0.88

|

4.95%

|

|

National

Retail Properties, Inc.

|

3.53B

|

32.12

|

1.54

|

11.06

|

4.92%

|

|

ONEOK

Partners, L.P.

|

13.14B

|

16.43

|

2.94

|

1.26

|

4.75%

|

|

Enterprise

Products Partners

|

50.08B

|

19.52

|

3.89

|

1.16

|

4.74%

|

|

Bank

of Montreal

|

41.55B

|

10.28

|

1.43

|

3.02

|

4.54%

|

|

Southern

Company

|

38.85B

|

17.57

|

1.97

|

2.35

|

4.41%

|

|

Plains All American Pipeline

|

17.23B

|

21.49

|

2.67

|

0.46

|

4.36%

|

|

Alliant

Energy Corporation

|

5.08B

|

16.30

|

1.53

|

1.58

|

Subscribe to:

Comments (Atom)