According to analysts, North America needs to invest $641 billion in energy infrastructure by 2035 to meet growing demand.

That is expected to triple the annual investment rate, which should drive strong growth for pipeline stocks over the next few decades.

While there should be many winners, in my opinion, the best five stocks to invest in the growth of pipeline infrastructure in North America are below. Meanwhile, if you are looking for a more updated article, check out this piece on the best pipeline stocks.

Oil & gas pipeline operators transport fuel through pipelines, often over great distances. Most of these companies are structured as Master Limited Partnerships (MLPs), which helps limit costs by passing tax obligations along to shareholders.

Since MLPs are required to distribute the vast majority of their earnings to shareholders, these stocks usually offer very high dividend yields.

The oil and gas pipeline stocks included in the portfolio computations are: BWP, BPL, ENB, EEP, ETE, ETP, EPD, GEL, HEP, MMP, NS, NSH, OKS, PAA, TCP and TLP. Others are ARCX, BKEP, CQP, ENBL, JPEP, KMI, PSXP, PAGP, SEP, TEP, TLLP, VLP and WES.

Showing posts with label OKS. Show all posts

Showing posts with label OKS. Show all posts

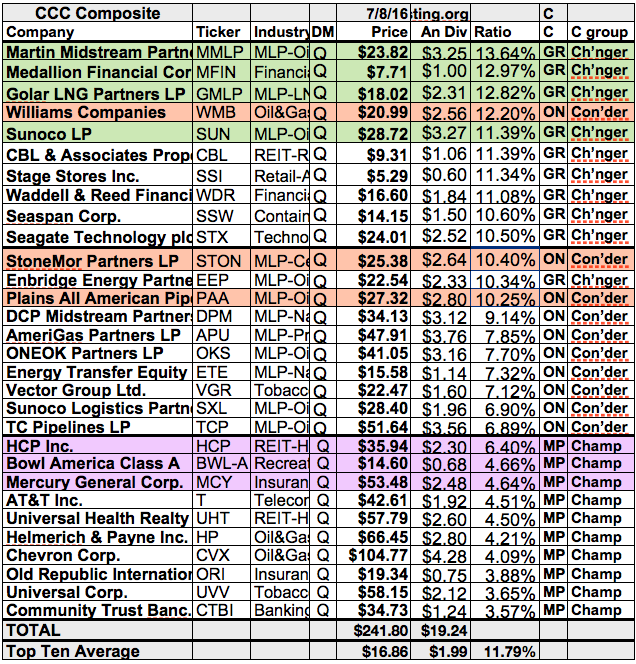

15 Best Energy Dividend Growth Stocks With Yields Up To 8.65%

While it is easy to get caught up in dividend stocks with a high yield, investors tend to earn higher returns by investing in companies that pay a growing dividend.

While several energy stocks have managed to grow their dividends in good times, only the best handful have succeeded in raising their payout throughout more than one energy cycle.

For sure engery dividend stocks are cyclic but some of them have strong assets and cash flows, generated by these assets.

Here are 15 dividend achievers that have delivered consistent dividend growth for more than a decade:

While several energy stocks have managed to grow their dividends in good times, only the best handful have succeeded in raising their payout throughout more than one energy cycle.

For sure engery dividend stocks are cyclic but some of them have strong assets and cash flows, generated by these assets.

Here are 15 dividend achievers that have delivered consistent dividend growth for more than a decade:

15 Rapidly Growing Dividend Achievers

Exposure to fast-growing dividend payers should excite even the most conservative investors.

Instead of just buying a stock that’s cheap, or one that’s growing earnings fast, we look for stocks that appear decently priced with respect to year-over-year growth.

By focusing only on the consistent growers, you score bigger checks every year (or more shares bought when reinvesting).

More importantly, steady dividend increases bode well for a stock's future. Today I'd like to share a few specific dividend stocks with you that seems to be attractive in terms of price to growth.

For example, a company growing 15% annually with a price-to-earnings (P/E) ratio of 15 or less would be considered really cheap but also very rare.

Attached you will find a couple of Dividend Achievers with a P/E under 20 and five year expected earnings growth of more than 10%.

These are the top yielding results in detail...

Instead of just buying a stock that’s cheap, or one that’s growing earnings fast, we look for stocks that appear decently priced with respect to year-over-year growth.

By focusing only on the consistent growers, you score bigger checks every year (or more shares bought when reinvesting).

More importantly, steady dividend increases bode well for a stock's future. Today I'd like to share a few specific dividend stocks with you that seems to be attractive in terms of price to growth.

For example, a company growing 15% annually with a price-to-earnings (P/E) ratio of 15 or less would be considered really cheap but also very rare.

Attached you will find a couple of Dividend Achievers with a P/E under 20 and five year expected earnings growth of more than 10%.

These are the top yielding results in detail...

34 Best Dividend Stocks With A 100 Year Long History

Blue chip stocks are established large-cap businesses that pay reliable dividends.

They have long corporate histories and provide well-known products and/or services.

This article examines every business in the S&P 500 with a 3% yield and a 100+ year corporate history. These are my criteria:

- Stocks with yields at or above 3%

- Low P/E ratios

- Strong competitive advantage

- Over 100 Years in Business

These are the best ideas that came into my minds...

They have long corporate histories and provide well-known products and/or services.

This article examines every business in the S&P 500 with a 3% yield and a 100+ year corporate history. These are my criteria:

- Stocks with yields at or above 3%

- Low P/E ratios

- Strong competitive advantage

- Over 100 Years in Business

These are the best ideas that came into my minds...

A Compilation Of High-Yield MLP Oil And Gas Pipeline Stocks

Oil & gas pipeline operators transport fuel through pipelines, often over great distances.

Most of these companies are structured as Master Limited Partnerships (MLPs), which helps limit costs by passing tax obligations along to shareholders.

Since MLPs are required to distribute the vast majority of their earnings to shareholders, these stocks usually offer very high dividend yields.

Master Limited Partnerships have the same liquid trading characteristics as common stock, yet they are very different from common stocks. The most obvious difference is that MLP's are 'pass through' investment vehicles--they pass through the income to you the investor.

The Partnership pays no taxes at the company level--instead passing the income to you (and of course you likely pay taxes on the income). Thus one level of taxation is removed allowing the investor to receive a larger distribution.

Today I like to show you some of the highest yielding oil and gas pipeline stocks on the market. Pipelines generate stable revenues while having a clear benefit compared to railroad and transportation stocks in terms of CO2 emissions.

Here is a table of 15 high-yield oil and gas pipeline partnerships...

Most of these companies are structured as Master Limited Partnerships (MLPs), which helps limit costs by passing tax obligations along to shareholders.

Since MLPs are required to distribute the vast majority of their earnings to shareholders, these stocks usually offer very high dividend yields.

Master Limited Partnerships have the same liquid trading characteristics as common stock, yet they are very different from common stocks. The most obvious difference is that MLP's are 'pass through' investment vehicles--they pass through the income to you the investor.

The Partnership pays no taxes at the company level--instead passing the income to you (and of course you likely pay taxes on the income). Thus one level of taxation is removed allowing the investor to receive a larger distribution.

Today I like to show you some of the highest yielding oil and gas pipeline stocks on the market. Pipelines generate stable revenues while having a clear benefit compared to railroad and transportation stocks in terms of CO2 emissions.

Here is a table of 15 high-yield oil and gas pipeline partnerships...

18 Dividend Growth Stocks With 4% Yields And The Lowest Beta Ratios

Defensive Investors are defined as

investors who are not able or willing to do substantial research into

individual investments, and therefore need to select only the companies that

present the least amount of risk.

Risk taking should

be rewarded with higher yields. Most investors don't get paid for their

investments or risk preference. Dividend stocks could offer a small risk

compensation. Each dividend payment reduces your initial investment cost which

is really nice. Over years, you will have a large risk buffer.

Today I like to

show you some stocks with a long dividend growth history, high yields and low

beta ratios. I guess this should be a great middle way. My research focus is

limited to stocks with a consecutive dividend growth history of more than 10

years. Each stock should have a yield over 4% and a beta ratio under 0.5.

18 companies fulfilled my criteria of which eight are high-yields. 5 Master Limited

Partnerships lead the list of the results. Do you like any of the results?

Please leave a comment in the box below the article and we discuss it. Thank

you for reading and commenting.

Here are the top

yielding results in detail...

19 High-Yielding Dividend Growth Stocks For High Income Seeking Investors

Each income orientated investor

need a high cash source in order to satisfy his needs of income. Major sources

on the capital market are dividends. Those are payments by the corporate to its

shareholders.

Dividends should

be reliable and grow. That's a major reason why dividend growth has an

essential meaning for investors. A long history of rising dividends and

sustainable payments increases the trust relationship to the owners of the

company.

Today I want to

show you the highest yielding dividend growth stocks with a consecutive dividend growth history

of more than 10 years in a row.

19 stocks with

yields above the High-Yield mark 5 percent fulfilled my criteria of which three

have a low forward P/E.

If you like more ideas, please look at the list of High-Yield Large Caps of the stock market. There are a lot of solid dividend growth and value companies on it.

Which stocks do

you like from the screen?

Next Week's 20 Top Yielding Large Cap Ex-Dividend Shares

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview about stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading week.

In total, 175 stocks go ex dividend

- of which 89 yield more than 3 percent. Here is a full list of all stocks with ex-dividend

date within the current week.

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

Telefonica

Brasil, S.A.

|

25.37B

|

13.29

|

1.29

|

1.60

|

6.82%

|

|

|

Energy

Transfer Partners LP

|

19.09B

|

30.41

|

1.60

|

0.54

|

6.61%

|

|

|

Kinder

Morgan Energy Partners

|

34.70B

|

25.54

|

2.59

|

3.30

|

6.28%

|

|

|

Cheniere

Energy Partners LP.

|

10.24B

|

-

|

5.66

|

38.30

|

5.48%

|

|

|

ONEOK

Partners, L.P.

|

11.99B

|

21.97

|

2.80

|

1.12

|

5.29%

|

|

|

Southern

Company

|

37.11B

|

21.44

|

2.06

|

2.20

|

4.78%

|

|

|

Plains All American Pipeline, L.P.

|

18.19B

|

19.17

|

2.66

|

0.46

|

4.49%

|

|

|

Kinder

Morgan

|

37.80B

|

37.23

|

2.77

|

2.87

|

4.38%

|

|

|

Telefonica,

S.A.

|

79.56B

|

14.72

|

3.15

|

0.97

|

4.28%

|

|

|

Enterprise

Products Partners LP

|

57.33B

|

23.28

|

4.05

|

1.30

|

4.22%

|

|

|

Bank

of Montreal

|

45.16B

|

11.54

|

1.57

|

3.50

|

4.11%

|

|

|

Energy Transfer Equity, L.P.

|

19.23B

|

51.17

|

12.99

|

0.53

|

3.82%

|

|

|

Paychex,

Inc.

|

15.71B

|

27.22

|

8.98

|

6.67

|

3.26%

|

|

|

The

Clorox Company

|

11.65B

|

20.52

|

79.86

|

2.07

|

3.20%

|

|

|

ConAgra

Foods, Inc.

|

13.36B

|

20.08

|

2.49

|

0.82

|

3.15%

|

|

|

NiSource

Inc.

|

10.09B

|

22.92

|

1.77

|

1.88

|

3.09%

|

|

|

Texas

Instruments Inc.

|

44.37B

|

22.35

|

4.01

|

3.61

|

2.98%

|

|

|

Weyerhaeuser

Co.

|

17.35B

|

28.80

|

2.96

|

2.21

|

2.80%

|

|

|

Norfolk

Southern Corp.

|

27.53B

|

16.17

|

2.70

|

2.52

|

2.37%

|

|

|

Eaton

Corporation

|

33.91B

|

21.64

|

2.20

|

1.77

|

2.35%

|

13 High-Yield Large Capitalized Stocks With Buy Recommendation

Stocks

with high dividend yields and buy ratings originally published at long-term-investments.blogspot.com. Today I would like to

give you an update of the higher capitalized stocks with buy ratings by

brokerage firms. I personally prefer stocks with lower yields and better growth

perspectives because I don’t need high yields to live-off.

Only 13 stocks fulfilled these two criteria but the most of the results have an extraordinary high debt. It’s very risky to buy stocks with large amounts of debt because debt owners got money before share owners. If there should develop some trouble, the dividends must keep flat or needed to reduce.

Stocks from the basic material sector as well as telecoms are the dominating categories. But there are also some good names on the list like Williams Partners or Altria.

Only 13 stocks fulfilled these two criteria but the most of the results have an extraordinary high debt. It’s very risky to buy stocks with large amounts of debt because debt owners got money before share owners. If there should develop some trouble, the dividends must keep flat or needed to reduce.

Stocks from the basic material sector as well as telecoms are the dominating categories. But there are also some good names on the list like Williams Partners or Altria.

81 Stocks With A Higher Dividend Payment

Stocks with dividend hikes from last week originally

published at long-term-investments.blogspot.com.

Dividend growth comes back. Last week, 81 stocks announced a higher dividend

payment in the future. Six of them have now a double-digit dividend yield and

38 are low valuated with a forward P/E of less than 15.

It’s good to see that the number of dividend growers

have risen within the recent week. It’s a sign that the economy is doing well

and companies are more confident about the future.

In average, stocks from the list of the latest dividend growth stocks have increased their dividend payments by 20.73 percent.

A value between 5 and 30 is good because your passive income grows faster than

the inflation. A too high dividend growth ratio shows that there is something wrong.

If not, they have paid very low dividends in the past and let the dividend jump.

The most important thing you need to remember is that you receive dividends that

are not paid from the substance of the corporate. It means that dividends should

be significant lower than the earnings or the corporate. Special dividends are all

right but they are only one-time items.

20 Of The Safest Dividend Challengers On The Market

Dividend Challengers with lowest beta ratios originally

published at "long-term-investments.blogspot.com". I love high-quality

dividend growth stocks and the stocks with the longest history of consecutive

payments are definitely Dividend Kings and Dividend Champions. But the big

disadvantage of them is that they are also highly priced.

You cannot make a greater return with stocks

that have a P/E ratio of 22 and grows only at 5 percent. You need real bargains

to make big profit with your asset.

This problem can be solved when you look into

the dividend potentials. Those stocks haven’t yet reached a longer dividend

payment history but they can become a great Dividend Champion within the next

years. The price ratios are also lower for some companies and you have a better

choice to find good investments because out there are around 160 stocks with

five or more years of consecutive dividend payments and 207 with a payment

between 10 to 25 years.

Today I like to screen the third class of

dividend growth stocks by the safest alternatives. The 20 safest dividend growth stocks have a beta ratio between 0.18 and 0.55. All three top picks come from the

oil & gas pipeline industry, a branch with very stable sales and future growth

perspectives due to the shale gas boom in the United States.

From the 20 safest Dividend Challengers have nine

a current buy or better rating.

34 Stocks Increased Dividends Recently | 10 High-Yields

Stocks with dividend hikes from last week originally

published at “long-term-investments.blogspot.com”.

For all dividend seekers out there: I am publishing each week a list of stocks and

funds that have raised their dividend payments within the recent week.

Dividend growth is a very important item when you are active

in the field of dividend investing. Growth creates wealth and nothing else. All

you need is time and patience.

This week, 34 stocks increased their dividend payments

of which 10 are High-Yields and 19 are currently recommended to buy. The

average dividend growth amounts to 25.29 percent.

Popular stocks from the list are the railroad company CSX

or the pipeline operator Kinder Morgan. A stock that I personally love is the Dividend King

Procter & Gamble who hiked its dividends by 7 percent. The results are very

mixed but oil and gas pipeline companies still dominating the screen.

20 Basic Material Dividend Stocks With Top Yields And Low Volatility

Basic material dividend stocks with low betas and

large market capitalization originally published at "long-term-investments.blogspot.com". When I buy stocks I

ever take a look at the risk fundamentals of a company. Beside the market capitalization,

the beta ratio is a meaningful ratio. The ratio shows investors how volatile a stock

is compared to the overall market. A beta value of 1.2 means: The stock has a 20

percent higher volatility than the market. I use this tool to identify the underlying

risks of a business model. For sure, it’s not perfect but a good first step to evaluate

the risk situation.

Today I like to run my screen for the safest basic

material stocks. These are my criteria:

- Market Capitalization

over USD 10 billion

- Beta ratio below 1

Linked are the 20 best yielding stocks. 14 of them

have a current buy or better recommendation and five are high-yields. Oil and gas

companies are the dominating category.

20 Safest Dividend Income Growth Stocks From The Early Stage

Dividend Challengers with low beta ratios originally

published at "long-term-investments.blogspot.com". Some investors are greedy

and tend to overlook risks. Others are too anxious and avoid to buy stocks in

a larger amount. They could “lose money” or they “can get quick rich” are two psychological

factors that investors prevent to make real money with investing. Both are not true and only an illusion.

Dividend Challengers with low beta ratios originally

published at "long-term-investments.blogspot.com". Some investors are greedy

and tend to overlook risks. Others are too anxious and avoid to buy stocks in

a larger amount. They could “lose money” or they “can get quick rich” are two psychological

factors that investors prevent to make real money with investing. Both are not true and only an illusion.

If you invest money into the stock market and you

do it wisely and diversified, you should only count with a return close to the performance

of the broad market. I believe that a return of 8 percent is realistic and good

enough to beat inflation and grow wealth.

Today I like to screen a category of stocks with

a longer dividend growth history, the Dividend Challengers. Those stocks have achieved

to raise dividends over a period of more than five years in a row but less than

10 years. 167 companies have fulfilled these dividend growth criteria.

Below is a list of the safest stocks from the investment category "Challengers". They have a beta ratio of less than 0.5 as well as a market capitalization over USD 2.0 billion.

Below is a list of the safest stocks from the investment category "Challengers". They have a beta ratio of less than 0.5 as well as a market capitalization over USD 2.0 billion.

20 Dividend Challengers are on the list of the safest dividend income growth stocks and six of them have a high

yield; Nine are recommended to buy.

17 High-Yield Oil And Gas Pipeline Stocks

Oil

& gas pipeline operators with highest dividend yields originally published

at "long-term-investments.blogspot.com". Stocks from the

basic material sector could complement your portfolio and hedge it against

strong commodity price increases. One industry from the basic material sector

with the highest yielding stocks is the oil and gas pipeline industry.

39 companies are linked to the industry of which 37 pay dividends. Combined they have a total market capitalization of USD 800 billion. Nearly 60 percent of the industry players have a yield over 5 percent and some have a really great dividend history. Thanks to the share gas boom it’s now possible that more pipeline infrastructure is needed. The average industry yield amounts to 4.72% and the P/E ratio is 33.40.

You should have seen some interesting pipeline companies on my blog in the past. Normally I am no fan of real estate companies because of the huge amounts of money they need for growing. But pipeline operators look different. They pay huge dividends and have the ability to grow dividends year over year. Their business model works but I don’t know how long. Pipeline operators are better than real estate stocks but it could be possible that the time brings some changes, especially when the energy demand and supply is changing.

Oil and gas pipeline stocks are real asset companies and they have a huge leverage on their balance sheet. The average industry long-term debt to equity ratio is over 123 percent but as long as revenue and cash flow streams are stable, this figure is still healthy.

Linked is a list of all higher capitalized oil and gas pipeline operators (over USD 2 billion market cap) with a yield over 5 percent. Seventeen stocks fulfilled these criteria of which eight have a current buy or better recommendation.

39 companies are linked to the industry of which 37 pay dividends. Combined they have a total market capitalization of USD 800 billion. Nearly 60 percent of the industry players have a yield over 5 percent and some have a really great dividend history. Thanks to the share gas boom it’s now possible that more pipeline infrastructure is needed. The average industry yield amounts to 4.72% and the P/E ratio is 33.40.

You should have seen some interesting pipeline companies on my blog in the past. Normally I am no fan of real estate companies because of the huge amounts of money they need for growing. But pipeline operators look different. They pay huge dividends and have the ability to grow dividends year over year. Their business model works but I don’t know how long. Pipeline operators are better than real estate stocks but it could be possible that the time brings some changes, especially when the energy demand and supply is changing.

Oil and gas pipeline stocks are real asset companies and they have a huge leverage on their balance sheet. The average industry long-term debt to equity ratio is over 123 percent but as long as revenue and cash flow streams are stable, this figure is still healthy.

Linked is a list of all higher capitalized oil and gas pipeline operators (over USD 2 billion market cap) with a yield over 5 percent. Seventeen stocks fulfilled these criteria of which eight have a current buy or better recommendation.

Best Dividend Paying Stocks As Of February 2013 | 25 Top Stock Buy List

Best Dividend Paying

Stocks Lists By Dividend Yield – Stock, Capital, Investment. Each month, I discover the best growth income picks with attractive dividend

payments and growth figures. I’ve tried to summarize some significant

fundamentals in order to screen the whole capital markets by interesting investment

opportunities.

These are my criteria:

Market Capitalization: > 1 Billion

Price/Earnings Ratio: > 0 < 100

Dividend Yield: > 3 < 20

Return on Investment: > 10 < 100

Operating Margin: > 10 < 100

10 Year Revenue Growth: > 8 < 200

10 Year EPS Growth: > 10 < 100

The results from the screen

are distinguished compared to the normal screens I made every day. Here is long-term

growth a major aspect and some new names are on the list. The stocks are not typically

Dividend Champions or stocks with a very long dividend growth history but they have

managed a stronger growth of sales and income.

For me, the best

equity investment is a stock with good fundamentals and a convincing equity

story. If this stock is also attractive valuated with a P/E below 15 or even 20

if the debt is low, it could promise good returns. This month, 25 companies fulfilled

my screening criteria of which six have a high yield.

Best Dividend Paying Ex-Dividend Shares On January 29, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks January 29,

2013. In total, 44 stocks and

preferred shares go ex dividend - of which 35 yield more than 3 percent. The

average yield amounts to 5.58%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Prospect

Capital Corporation

|

2.38B

|

6.49

|

1.05

|

6.11

|

11.62%

|

|

Atlantic

Power Corporation

|

4.35B

|

4.75

|

1.82

|

0.50

|

9.11%

|

|

Hospitality

Properties Trust

|

3.21B

|

27.62

|

1.16

|

2.53

|

7.24%

|

|

Omega

Healthcare Investors Inc.

|

2.92B

|

25.83

|

2.86

|

8.81

|

6.90%

|

|

Copano

Energy LLC

|

2.64B

|

-

|

2.81

|

1.92

|

6.88%

|

|

El Paso Pipeline Partners

|

8.83B

|

19.04

|

4.45

|

5.83

|

5.96%

|

|

Kinder

Morgan Energy Partners

|

32.48B

|

53.94

|

2.87

|

3.76

|

5.80%

|

|

Baytex

Energy Corp.

|

5.55B

|

19.38

|

4.18

|

5.14

|

5.80%

|

|

National

Retail Properties

|

3.53B

|

32.12

|

1.54

|

11.06

|

4.92%

|

|

ONEOK

Partners, L.P.

|

13.14B

|

16.43

|

2.94

|

1.26

|

4.75%

|

|

Enterprise

Products Partners LP

|

50.08B

|

19.52

|

3.89

|

1.16

|

4.74%

|

|

Alliant

Energy Corporation

|

5.08B

|

16.30

|

1.53

|

1.58

|

4.10%

|

|

Kinder

Morgan, Inc.

|

38.62B

|

40.93

|

2.89

|

3.87

|

3.97%

|

|

Brookfield

Office Properties CA

|

2.73B

|

-

|

3.35

|

5.40

|

3.72%

|

|

ConAgra

Foods, Inc.

|

13.42B

|

19.96

|

2.84

|

0.97

|

3.09%

|

|

ONEOK

Inc.

|

9.70B

|

28.74

|

4.70

|

0.74

|

3.04%

|

|

Texas

Instruments Inc.

|

36.76B

|

21.72

|

3.32

|

2.87

|

2.56%

|

|

Eldorado

Gold Corp.

|

8.18B

|

26.05

|

1.41

|

7.43

|

1.22%

|

|

AO

Smith Corp.

|

3.23B

|

20.00

|

2.71

|

1.67

|

1.14%

|

Subscribe to:

Comments (Atom)