Showing posts with label SDLP. Show all posts

Showing posts with label SDLP. Show all posts

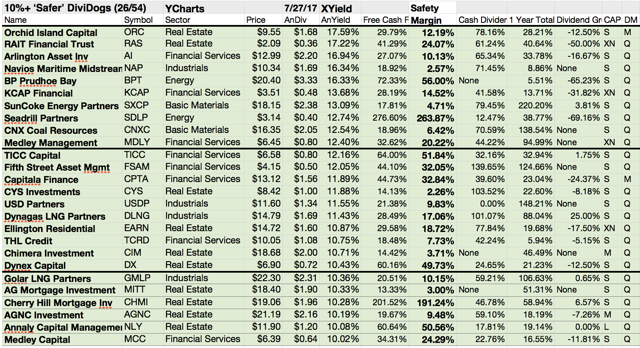

20 Great Dividend Stocks With Yields Between 10.20% and 20.63%

Any income investor is aware that with interest rates being so low for so long, market prices for bonds and dividend stocks are likely to fall as the Federal Reserve raises interest rates.

But even after the Fed changes direction and begins raising the federal funds rate above the range of zero to 0.25%, where it has been locked since late 2008, rates are likely to remain quite low for a long time.

So the market prices of income-producing securities may not fall as much as many investors fear, or maybe they’ll stage a recovery after the hysteria of the Fed’s likely near-term policy change wears off.

High-growth momentum stocks are nice, but many investors these days are more interested in stability and dependable dividends.

If you’re an income-oriented investor, the attached list of high yielding dividend stocks is ideal for further research. Each of the stocks has a double-digit dividend yield with positive ROA and positive 5 year earnings growth forecasts.

Some of these stocks may be boring, some of the yields may not be thrilling and some may not have impressive earnings growth in their future.

But all of the 20 dividend stocks are worth a deeper look when it comes to preserving capital and making regular dividend payments. Check out the list below and sort by company, yield or dividend history.

Here is the list...

But even after the Fed changes direction and begins raising the federal funds rate above the range of zero to 0.25%, where it has been locked since late 2008, rates are likely to remain quite low for a long time.

So the market prices of income-producing securities may not fall as much as many investors fear, or maybe they’ll stage a recovery after the hysteria of the Fed’s likely near-term policy change wears off.

High-growth momentum stocks are nice, but many investors these days are more interested in stability and dependable dividends.

If you’re an income-oriented investor, the attached list of high yielding dividend stocks is ideal for further research. Each of the stocks has a double-digit dividend yield with positive ROA and positive 5 year earnings growth forecasts.

Some of these stocks may be boring, some of the yields may not be thrilling and some may not have impressive earnings growth in their future.

But all of the 20 dividend stocks are worth a deeper look when it comes to preserving capital and making regular dividend payments. Check out the list below and sort by company, yield or dividend history.

Here is the list...

20 Really Cheap Value Income Stocks With Yields Up To 32.21%

Dividend investing has always had a certain appeal with investors. Over time, dividend income has comprised a significant portion of long-term stock gains. That's what I've ever told on this blog.

Even better, over the long run, dividend-paying stocks have delivered better total return performance than non-dividend payers and generally have done so with lower volatility.

But the big gain or retirement contribution comes from capital gains. If your income doubles, your investment amount should also double. If the market pays a higher multiple, you could even gain more.

Today I would like to navigate the focus to the cheapest stocks by fundamentals. Price to book and price to sales are two additional important criteria to evalueate the cheapness of a stock.

Attached you will find a list of stocks with solid future earnings growth while P/B and P/S are below the magic 1. The forward P/E is expected below 15. Damn Cheap how we would say.

Here are the results....

Even better, over the long run, dividend-paying stocks have delivered better total return performance than non-dividend payers and generally have done so with lower volatility.

But the big gain or retirement contribution comes from capital gains. If your income doubles, your investment amount should also double. If the market pays a higher multiple, you could even gain more.

Today I would like to navigate the focus to the cheapest stocks by fundamentals. Price to book and price to sales are two additional important criteria to evalueate the cheapness of a stock.

Attached you will find a list of stocks with solid future earnings growth while P/B and P/S are below the magic 1. The forward P/E is expected below 15. Damn Cheap how we would say.

Here are the results....

20 MLPs To Get Money From Without Filling K-1

For investing purposes, MLPs and LLCs can be a great way to maximize the amount of cash that can be paid to investors, because these organizational structures don't pay income tax, but pass that burden along to those who are invested in it. The same goes for some trust structures.

In other words, because these entities don't pay corporate taxes, the full burden falls on those receiving income from them. This differs from dividend income paid to shareholders by a typical corporation in that regular dividends are taxed as long-term capital gains, while much of the income paid and shown on a Schedule K-1 can be classified as regular income. That means it's taxed at your effective income-tax rate, which is often much higher than the 15% or 20% long-term capital gains rate for corporate dividends.

In summary, a Schedule K-1 issuing entity may be able to pass more income along to you, the investor, but you may end up giving more of it back in taxes than if you'd received regular dividends from a corporation. It really boils down to your tax rate, and how much more income the LLC, MLP, or trust is able to pay.

In order to have less effort with your portfolio allocation and your investment, you could avoid such stocks with K-1 schedules.

Nevertheless, if you like to invest into stocks with a master limited status, you could look at the following list. Each of the stocks are MLP's with status Partnership "C" corporation. Those companies create a classical 1099 Filling and don't send you K-1's.

Here is the list...enjoy it and share it with your social friends...

In other words, because these entities don't pay corporate taxes, the full burden falls on those receiving income from them. This differs from dividend income paid to shareholders by a typical corporation in that regular dividends are taxed as long-term capital gains, while much of the income paid and shown on a Schedule K-1 can be classified as regular income. That means it's taxed at your effective income-tax rate, which is often much higher than the 15% or 20% long-term capital gains rate for corporate dividends.

In summary, a Schedule K-1 issuing entity may be able to pass more income along to you, the investor, but you may end up giving more of it back in taxes than if you'd received regular dividends from a corporation. It really boils down to your tax rate, and how much more income the LLC, MLP, or trust is able to pay.

In order to have less effort with your portfolio allocation and your investment, you could avoid such stocks with K-1 schedules.

Nevertheless, if you like to invest into stocks with a master limited status, you could look at the following list. Each of the stocks are MLP's with status Partnership "C" corporation. Those companies create a classical 1099 Filling and don't send you K-1's.

Here is the list...enjoy it and share it with your social friends...

10 High-Yielding Small Caps For A Portfolio Return Boost

I'm a big fan of large capitalized

stocks because most of them offer a huge diversification. But the great lack of

bigger companies is that they do not grow at a fast pace. I'm not talking about

Apple, those are exceptions.

The reason is

simple: A company with a market cap of $500 million will simply have more room

to grow than a company with a market cap of $50 billion. If it makes it to $1

billion, and you've invested, you double your money; if the large cap company

adds $500 million to its market cap, you've only made 1%.

Today I would like

to introduce 10 stocks with a yield higher than 3 percent and P/E valuations in an acceptable area while the market capitalization doesn’t reach the 2 billion levels.

These are my results:

Subscribe to:

Comments (Atom)