|

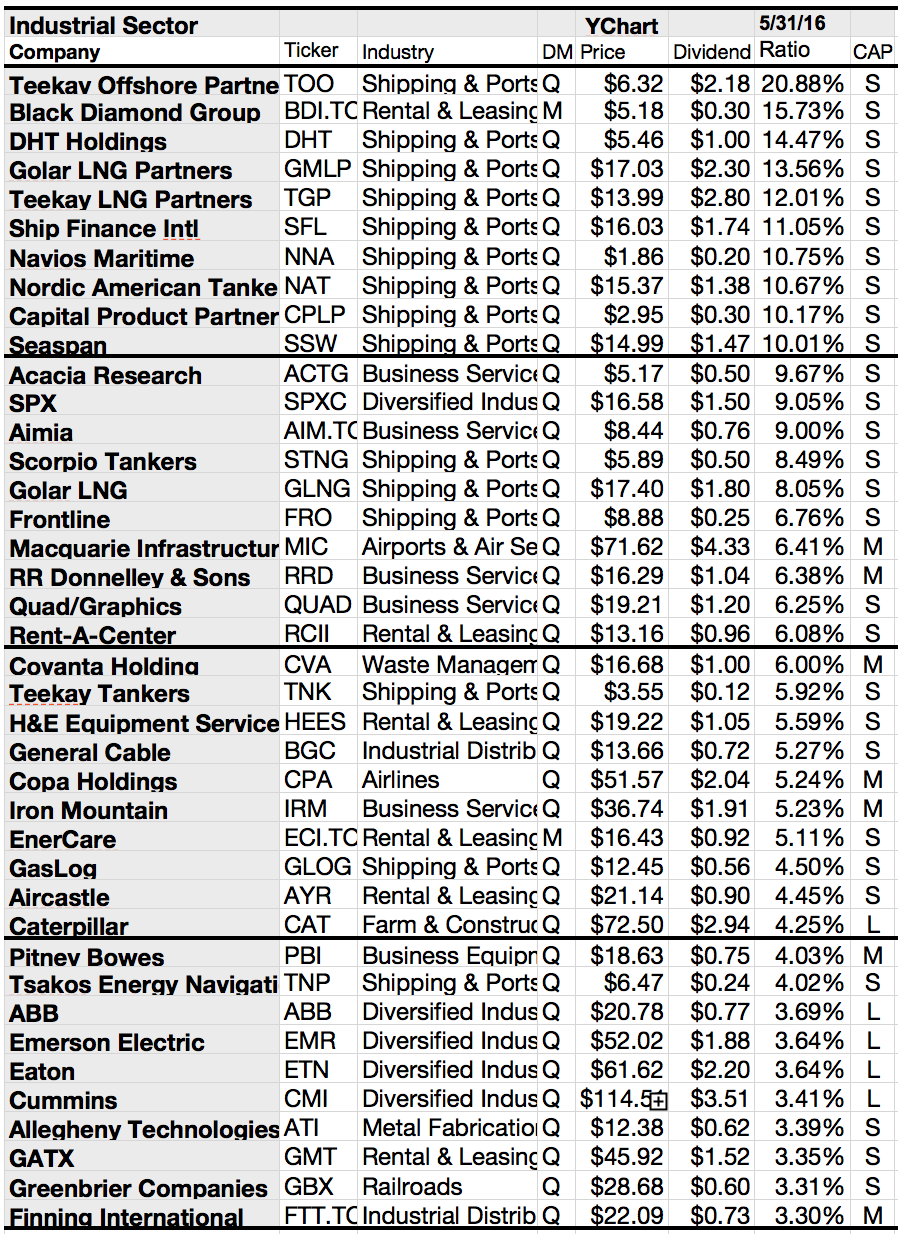

| The Highest Yielding Industrial Dogs; Source: Seeking Alpha |

Showing posts with label TOO. Show all posts

Showing posts with label TOO. Show all posts

19 Shipping Stocks Far Below Book Value; Yields Still Up To 32%

If I screen the market by

interesting investing ideas, one industry often popped on my screen: The

shipping industry.

For sure, the global

trade slows down and commodity costs are at the lowest level for decades. What

looks like bad news for shipping stocks but also a great opportunity for long

term investors?

Let's try a look.

Ships are not equal. These are container ships, tanker etc. and each industry

has a different cyclic.

The recent

correction in share prices across shipping stocks, barring tanker operators,

has transpired into attractive valuations.

While investors

are skeptical of catching falling knives, sitting on the cash means missing

good bargains.

Investors should

adopt a diversified portfolio within the maritime space, to insulate from

heightened uncertainty in the sector.

We have followed

top-down approach to build our model portfolio, while considering company-specific

factors such as the balance sheet strength, financial performance and

management profile for stock selection.

It is important to

note that shipping is a high-beta sector and tends to underperform/outperform

the financial markets by a wide alpha on both sides.

Attached I've

tried to compile a few dividend paying shipping stocks that might look like

bargains due to low price to book ratios and earnings multiples. What du you

think? Are shipping stocks worth an investment? Leave a comment and we discuss

the idea.

Here are the

results...

20 Really Cheap Value Income Stocks With Yields Up To 32.21%

Dividend investing has always had a certain appeal with investors. Over time, dividend income has comprised a significant portion of long-term stock gains. That's what I've ever told on this blog.

Even better, over the long run, dividend-paying stocks have delivered better total return performance than non-dividend payers and generally have done so with lower volatility.

But the big gain or retirement contribution comes from capital gains. If your income doubles, your investment amount should also double. If the market pays a higher multiple, you could even gain more.

Today I would like to navigate the focus to the cheapest stocks by fundamentals. Price to book and price to sales are two additional important criteria to evalueate the cheapness of a stock.

Attached you will find a list of stocks with solid future earnings growth while P/B and P/S are below the magic 1. The forward P/E is expected below 15. Damn Cheap how we would say.

Here are the results....

Even better, over the long run, dividend-paying stocks have delivered better total return performance than non-dividend payers and generally have done so with lower volatility.

But the big gain or retirement contribution comes from capital gains. If your income doubles, your investment amount should also double. If the market pays a higher multiple, you could even gain more.

Today I would like to navigate the focus to the cheapest stocks by fundamentals. Price to book and price to sales are two additional important criteria to evalueate the cheapness of a stock.

Attached you will find a list of stocks with solid future earnings growth while P/B and P/S are below the magic 1. The forward P/E is expected below 15. Damn Cheap how we would say.

Here are the results....

20 MLPs To Get Money From Without Filling K-1

For investing purposes, MLPs and LLCs can be a great way to maximize the amount of cash that can be paid to investors, because these organizational structures don't pay income tax, but pass that burden along to those who are invested in it. The same goes for some trust structures.

In other words, because these entities don't pay corporate taxes, the full burden falls on those receiving income from them. This differs from dividend income paid to shareholders by a typical corporation in that regular dividends are taxed as long-term capital gains, while much of the income paid and shown on a Schedule K-1 can be classified as regular income. That means it's taxed at your effective income-tax rate, which is often much higher than the 15% or 20% long-term capital gains rate for corporate dividends.

In summary, a Schedule K-1 issuing entity may be able to pass more income along to you, the investor, but you may end up giving more of it back in taxes than if you'd received regular dividends from a corporation. It really boils down to your tax rate, and how much more income the LLC, MLP, or trust is able to pay.

In order to have less effort with your portfolio allocation and your investment, you could avoid such stocks with K-1 schedules.

Nevertheless, if you like to invest into stocks with a master limited status, you could look at the following list. Each of the stocks are MLP's with status Partnership "C" corporation. Those companies create a classical 1099 Filling and don't send you K-1's.

Here is the list...enjoy it and share it with your social friends...

In other words, because these entities don't pay corporate taxes, the full burden falls on those receiving income from them. This differs from dividend income paid to shareholders by a typical corporation in that regular dividends are taxed as long-term capital gains, while much of the income paid and shown on a Schedule K-1 can be classified as regular income. That means it's taxed at your effective income-tax rate, which is often much higher than the 15% or 20% long-term capital gains rate for corporate dividends.

In summary, a Schedule K-1 issuing entity may be able to pass more income along to you, the investor, but you may end up giving more of it back in taxes than if you'd received regular dividends from a corporation. It really boils down to your tax rate, and how much more income the LLC, MLP, or trust is able to pay.

In order to have less effort with your portfolio allocation and your investment, you could avoid such stocks with K-1 schedules.

Nevertheless, if you like to invest into stocks with a master limited status, you could look at the following list. Each of the stocks are MLP's with status Partnership "C" corporation. Those companies create a classical 1099 Filling and don't send you K-1's.

Here is the list...enjoy it and share it with your social friends...

Next Week's 20 Top Yielding Ex-Dividend Shares

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 33 stocks go ex dividend

- of which 18 yield more than 3 percent. Here is a full list of all stocks with ex-dividend

date within the current week.

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

Teekay

LNG Partners LP.

|

2.96B

|

18.05

|

2.39

|

7.57

|

6.37%

|

|

|

Teekay

Offshore Partners LP

|

2.75B

|

19.31

|

3.46

|

3.13

|

6.32%

|

|

|

Hospitality

Properties Trust

|

4.21B

|

37.23

|

1.60

|

2.97

|

6.23%

|

|

|

Pembina

Pipeline Corporation

|

10.15B

|

32.08

|

2.12

|

2.21

|

4.98%

|

|

|

CommonWealth

REIT

|

2.96B

|

60.93

|

0.97

|

2.76

|

4.00%

|

|

|

Royal

Bank of Canada

|

97.53B

|

12.97

|

2.34

|

4.81

|

3.82%

|

|

|

HSBC

Holdings plc

|

204.44B

|

13.34

|

1.17

|

3.87

|

3.62%

|

|

|

Williams-Sonoma

Inc.

|

5.14B

|

19.56

|

4.21

|

1.22

|

2.34%

|

|

|

Sinopec Shanghai Petrochemical

|

2.81B

|

177.64

|

1.04

|

0.18

|

2.10%

|

|

|

Fastenal

Company

|

14.60B

|

32.58

|

8.35

|

4.47

|

2.03%

|

|

|

Unum

Group

|

8.48B

|

9.70

|

1.01

|

0.81

|

1.82%

|

|

|

Tyco

International Ltd.

|

16.65B

|

-

|

3.54

|

1.57

|

1.78%

|

|

|

Xylem

Inc.

|

5.16B

|

22.26

|

2.51

|

1.38

|

1.69%

|

|

|

Pentair,

Inc.

|

13.19B

|

-

|

2.26

|

2.08

|

1.53%

|

|

|

Lowe's

Companies Inc.

|

50.85B

|

24.07

|

3.89

|

0.98

|

1.51%

|

|

|

Pier

1 Imports, Inc.

|

2.23B

|

18.30

|

4.24

|

1.26

|

0.95%

|

|

|

West

Pharmaceutical Services

|

3.17B

|

32.88

|

4.04

|

2.42

|

0.88%

|

|

|

SM

Energy Company

|

5.78B

|

-

|

3.78

|

3.09

|

0.11%

|

Ex-Dividend Stocks: Best Dividend Paying Shares On October 21, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 9 stocks go ex dividend

- of which 5 yield more than 3 percent. Here is a full list of all stocks with ex-dividend

date within the current week.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stock:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Compass

Diversified Holdings

|

894.52M

|

-

|

2.35

|

0.94

|

7.78%

|

|

Teekay

LNG Partners LP.

|

2.93B

|

17.86

|

2.37

|

7.50

|

6.43%

|

|

Teekay

Offshore Partners LP

|

2.77B

|

19.49

|

3.49

|

3.16

|

6.26%

|

|

Costamare

Inc.

|

1.34B

|

14.40

|

2.26

|

3.50

|

6.05%

|

|

LTC

Properties Inc.

|

1.28B

|

24.99

|

2.15

|

12.88

|

5.23%

|

|

Xylem

Inc.

|

5.10B

|

21.99

|

2.48

|

1.36

|

1.71%

|

|

Lowe's

Companies Inc.

|

52.30B

|

24.76

|

4.00

|

1.01

|

1.47%

|

|

Pier

1 Imports, Inc.

|

2.15B

|

17.65

|

4.08

|

1.22

|

0.99%

|

|

West

Pharmaceutical Services

|

3.16B

|

32.71

|

4.02

|

2.41

|

0.88%

|

Best Dividend Paying Ex-Dividend Shares On January 30, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks January 30,

2013. In total, 31 stocks and

preferred shares go ex dividend - of which 12 yield more than 3 percent. The

average yield amounts to 3.95%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Hi-Crush

Partners LP

|

500.32M

|

6.22

|

5.43

|

6.94

|

10.36%

|

|

PAA Natural Gas Storage

|

1.20B

|

20.40

|

1.38

|

2.76

|

7.08%

|

|

Teekay

Offshore Partners LP

|

2.32B

|

-

|

3.65

|

2.41

|

7.04%

|

|

Teekay

LNG Partners LP.

|

2.91B

|

24.96

|

2.36

|

7.44

|

6.44%

|

|

Unitil

Corp.

|

369.59M

|

15.43

|

1.46

|

1.06

|

5.14%

|

|

People's

United Financial

|

4.35B

|

18.95

|

0.85

|

4.11

|

5.12%

|

|

Genesis

Energy LP

|

3.26B

|

39.77

|

3.52

|

0.90

|

4.83%

|

|

Bank

of Montreal

|

41.81B

|

10.48

|

1.44

|

3.08

|

4.49%

|

|

Plains All American Pipeline

|

17.54B

|

21.88

|

2.71

|

0.47

|

4.28%

|

|

Pinnacle

West Capital

|

5.83B

|

15.80

|

1.44

|

1.78

|

4.09%

|

|

Pfizer

Inc.

|

197.61B

|

21.47

|

2.42

|

3.26

|

3.58%

|

|

Donegal

Group Inc.

|

466.31M

|

12.10

|

1.57

|

1.43

|

2.35%

|

|

Coca-Cola Bottling Co.

|

604.10M

|

27.38

|

3.95

|

0.38

|

1.53%

|

|

Brookfield

Asset Management

|

21.72B

|

18.04

|

1.17

|

1.29

|

1.49%

|

|

The

AES Corporation

|

8.07B

|

-

|

1.98

|

0.46

|

1.47%

|

|

Brinks

Co.

|

1.46B

|

18.82

|

2.98

|

0.37

|

1.31%

|

|

AZZ

Incorporated

|

1.09B

|

18.55

|

3.32

|

1.96

|

1.31%

|

|

Wausau

Paper Corp.

|

480.38M

|

-

|

2.35

|

0.54

|

1.23%

|

|

Aon

Corporation

|

18.31B

|

19.95

|

2.21

|

1.61

|

1.10%

|

|

Fastenal

Company

|

14.57B

|

34.58

|

9.34

|

4.65

|

Subscribe to:

Comments (Atom)