|

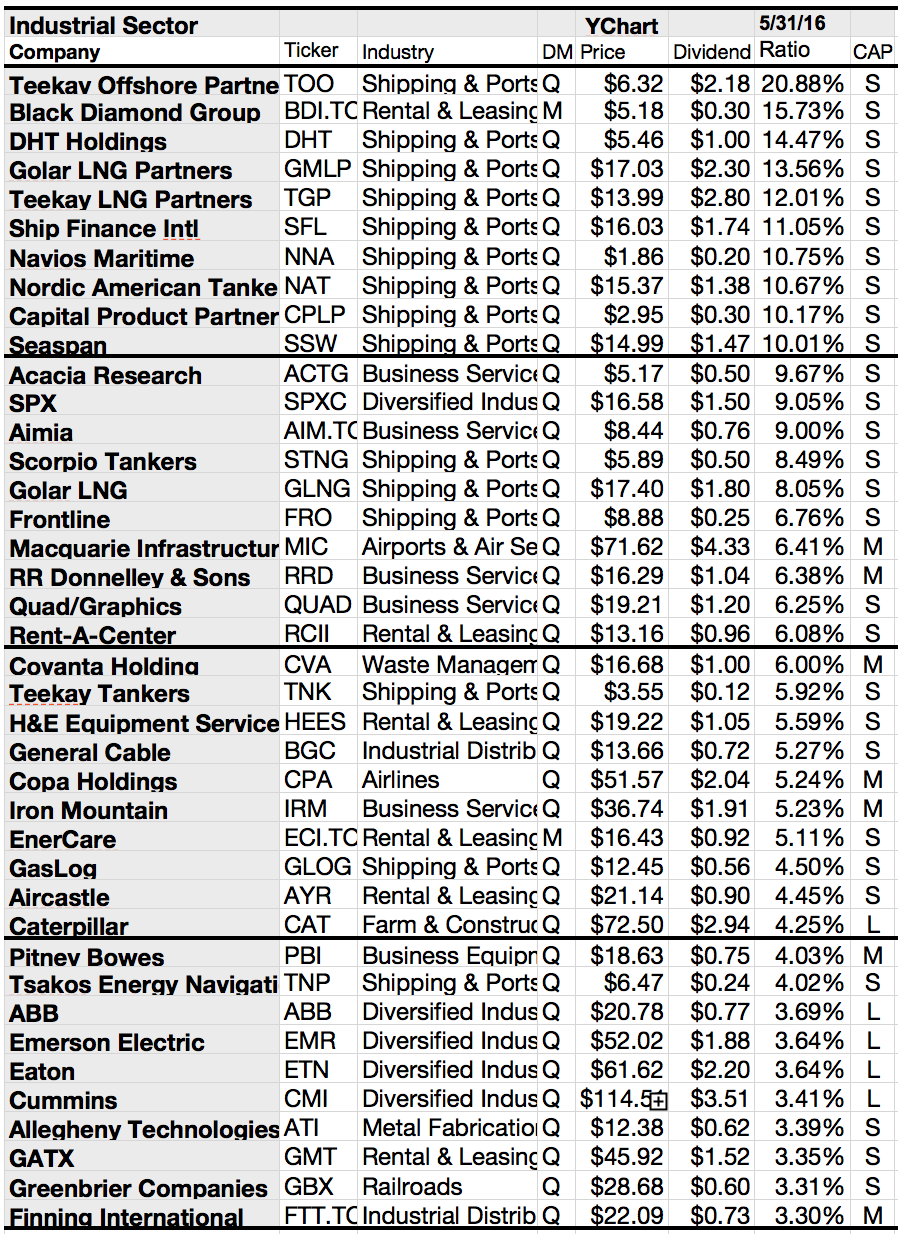

| The Highest Yielding Industrial Dogs; Source: Seeking Alpha |

Showing posts with label GMT. Show all posts

Showing posts with label GMT. Show all posts

20 Best Yielding Profitable Growing Buyback Kings And My 8 Favorite Stocks

Today's screen discovers stocks

with recent buyback announcements. I've compiled those stocks with a recent

buyback program announcement.

Those buybacks are paid from a

profitable operating business that is growing, not only in the past but should

also go forward in the near future.

A consequence is

that each of the attached stocks has a positive 5 years past sales performance,

positive return on assets and positive expected 5 year EPS growth predictions

as well.

Attached you will find the 20

best yielding results.

These are my personal favorites...

These are my personal favorites...

Ex-Dividend Stocks: Best Dividend Paying Shares On September 11, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 258 stocks go ex dividend

- of which 80 yield more than 3 percent. The average yield amounts to 5.49%.

Here is a full list of all stocks with ex-dividend

date within the current week.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Valley

National Bancorp

|

2.04B

|

14.45

|

1.34

|

3.22

|

6.34%

|

|

Digital

Realty Trust Inc.

|

6.76B

|

36.58

|

2.37

|

4.78

|

5.92%

|

|

Golar

LNG Ltd.

|

3.06B

|

3.25

|

1.59

|

10.81

|

4.73%

|

|

Leggett

& Platt

|

4.41B

|

17.58

|

3.09

|

1.18

|

3.97%

|

|

Validus

Holdings, Ltd.

|

3.65B

|

10.53

|

1.01

|

1.73

|

3.39%

|

|

Domtar

Corporation

|

2.20B

|

28.60

|

0.83

|

0.41

|

3.34%

|

|

BRE

Properties Inc.

|

3.88B

|

43.05

|

2.28

|

9.67

|

3.14%

|

|

Packaging

Corp. of America

|

5.24B

|

23.44

|

4.99

|

1.74

|

2.94%

|

|

GATX

Corp.

|

2.19B

|

15.33

|

1.80

|

1.72

|

2.63%

|

|

The Hanover Insurance Group

|

2.23B

|

21.95

|

0.89

|

0.47

|

2.60%

|

|

XL

Group plc

|

8.75B

|

10.35

|

0.88

|

1.17

|

1.85%

|

|

Airgas

Inc.

|

7.72B

|

24.30

|

4.78

|

1.55

|

1.82%

|

|

Worthington

Industries, Inc.

|

2.36B

|

17.60

|

2.84

|

0.90

|

1.79%

|

|

First

Horizon National

|

2.71B

|

18.54

|

1.26

|

3.53

|

1.77%

|

|

Nasdaq

OMX Group Inc.

|

5.10B

|

17.13

|

0.87

|

1.67

|

1.70%

|

|

URS

Corporation

|

3.74B

|

11.92

|

1.04

|

0.32

|

1.66%

|

|

Comerica

Incorporated

|

7.55B

|

15.01

|

1.09

|

4.18

|

1.65%

|

|

Albemarle

Corp.

|

5.23B

|

17.52

|

3.86

|

1.99

|

1.54%

|

|

Service

Corp. International

|

3.87B

|

25.03

|

2.76

|

1.56

|

1.53%

|

|

Alcoa,

Inc.

|

8.64B

|

80.80

|

0.68

|

0.37

|

1.49%

|

Ex-Dividend Stocks: Best Dividend Paying Shares On February 27, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors should

have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks February

27, 2013. In total, 91 stocks and

preferred shares go ex dividend - of which 32 yield more than 3 percent. The

average yield amounts to 4.03%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

TransAlta

Corp.

|

4.07B

|

-

|

1.36

|

1.81

|

7.25%

|

|

Lorillard,

Inc.

|

6.10B

|

14.52

|

-

|

0.92

|

5.39%

|

|

Lockheed

Martin Corporation

|

28.44B

|

10.51

|

732.33

|

0.60

|

5.23%

|

|

Realty

Income Corp.

|

7.94B

|

58.37

|

2.45

|

16.69

|

4.89%

|

|

Northeast

Utilities

|

12.88B

|

21.48

|

1.37

|

2.05

|

3.58%

|

|

Brookfield

Properties Corporation

|

8.39B

|

7.45

|

0.73

|

3.68

|

3.37%

|

|

NextEra

Energy, Inc.

|

30.55B

|

15.73

|

1.90

|

2.14

|

3.32%

|

|

McDonald's

Corp.

|

96.52B

|

17.94

|

6.95

|

3.50

|

3.20%

|

|

Cullen/Frost

Bankers, Inc.

|

3.69B

|

15.59

|

1.53

|

5.85

|

3.20%

|

|

SLM

Corporation

|

8.67B

|

9.73

|

1.68

|

1.42

|

3.20%

|

|

The

Wendy's Company

|

2.13B

|

-

|

1.08

|

0.85

|

2.94%

|

|

L-3

Communications Holdings

|

7.08B

|

9.41

|

1.31

|

0.54

|

2.92%

|

|

Pepsico,

Inc.

|

116.00B

|

19.18

|

5.21

|

1.77

|

2.86%

|

|

Compass

Minerals International

|

2.49B

|

28.16

|

4.93

|

2.65

|

2.64%

|

|

GATX

Corp.

|

2.30B

|

16.98

|

1.85

|

1.85

|

2.53%

|

|

Sealed

Air Corporation

|

4.10B

|

-

|

2.41

|

0.53

|

2.47%

|

|

CH

Robinson Worldwide Inc.

|

9.15B

|

15.47

|

6.08

|

0.81

|

2.47%

|

|

Weyerhaeuser

Co.

|

15.66B

|

40.54

|

3.84

|

2.22

|

2.36%

|

|

Flowers

Foods, Inc.

|

3.84B

|

3.99

|

4.48

|

1.26

|

2.30%

|

|

Associated

Banc-Corp

|

2.38B

|

14.03

|

0.82

|

3.31

|

2.26%

|

Subscribe to:

Comments (Atom)