|

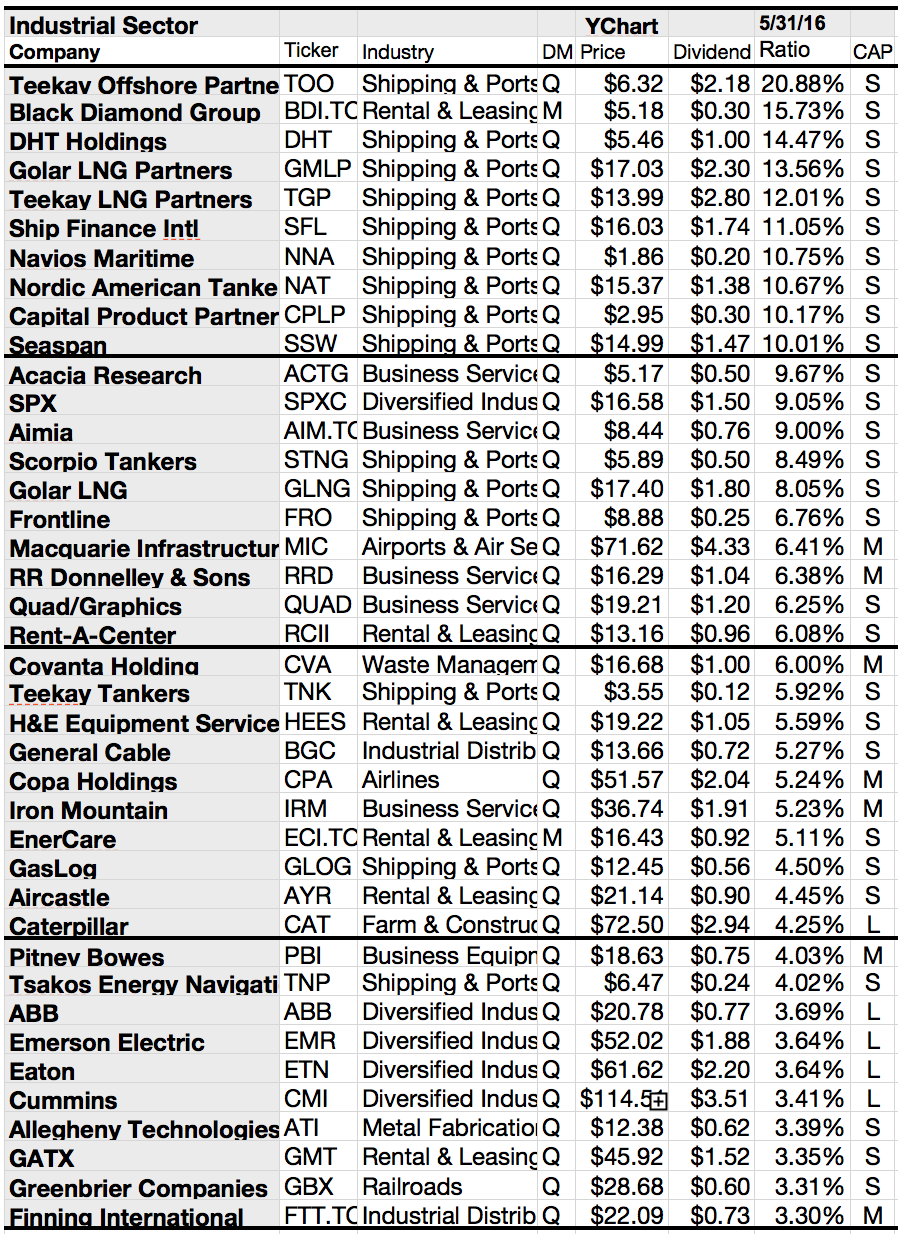

| The Highest Yielding Industrial Dogs; Source: Seeking Alpha |

Showing posts with label ATI. Show all posts

Showing posts with label ATI. Show all posts

Warren Buffett Buys Precision Castparts. These Are 11 Dividend Alternatives From The Industry

Warren Buffett used his trigger to shoot a white elephant. He announced to buy Precision Castparts, a metal fabrication company with focus on the aero plane industry.

PCP is a huge investment for Warren Buffett.

Today I like to introduce some alternatives from the same industry. 18 public listed companies are located to the metal fabricaton industry but only 6 stocks have a market capitalization of more than 1 billion USD.

There is a huge conentration in the industry. PCP next competitor, Tenaris, has a 15 billion market cap, nealy half the value Warren Buffett paid for PCP.

However, here are the best dividend picks from the metal fabrication industry...

PCP is a huge investment for Warren Buffett.

Today I like to introduce some alternatives from the same industry. 18 public listed companies are located to the metal fabricaton industry but only 6 stocks have a market capitalization of more than 1 billion USD.

There is a huge conentration in the industry. PCP next competitor, Tenaris, has a 15 billion market cap, nealy half the value Warren Buffett paid for PCP.

However, here are the best dividend picks from the metal fabrication industry...

Labels:

ATI,

CRS,

MLI,

Monthly Dividends,

TS,

VMI,

Warren Buffett

Ex-Dividend Stocks: Best Dividend Paying Shares On August 19, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors should

have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks August 19,

2013. In total, 45 stocks go ex

dividend - of which 12 yield more than 3 percent. The average yield amounts to 5.23%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

Main

Street Capital Corporation

|

1.01B

|

9.28

|

1.55

|

9.88

|

6.39%

|

|

|

Westpac

Banking Corporation

|

88.48B

|

15.60

|

2.19

|

2.77

|

6.11%

|

|

|

Hawaiian

Electric Industries Inc.

|

2.58B

|

18.92

|

1.59

|

0.78

|

4.75%

|

|

|

Microchip

Technology Inc.

|

7.76B

|

63.56

|

3.97

|

4.59

|

3.60%

|

|

|

Invesco

Ltd.

|

14.42B

|

19.23

|

1.77

|

3.29

|

2.80%

|

|

|

Allegheny

Technologies Inc.

|

2.95B

|

50.20

|

1.18

|

0.64

|

2.61%

|

|

|

Target

Corp.

|

44.36B

|

16.22

|

2.68

|

0.61

|

2.49%

|

|

|

Autoliv,

Inc.

|

7.90B

|

15.26

|

2.03

|

0.95

|

2.42%

|

|

|

Marathon

Petroleum Corporation

|

22.76B

|

7.18

|

1.90

|

0.25

|

2.38%

|

|

|

AFLAC

Inc.

|

28.09B

|

8.39

|

2.05

|

1.10

|

2.32%

|

|

|

Snyder's-Lance,

Inc.

|

1.92B

|

33.06

|

2.17

|

1.14

|

2.30%

|

|

|

Marathon

Oil Corporation

|

24.60B

|

15.61

|

1.29

|

1.50

|

2.19%

|

|

|

Assured

Guaranty Ltd.

|

4.12B

|

8.64

|

0.87

|

3.56

|

1.88%

|

|

|

Murphy

Oil Corporation

|

13.20B

|

14.43

|

1.44

|

0.47

|

1.79%

|

|

|

DST

Systems Inc.

|

3.15B

|

11.10

|

2.70

|

1.20

|

1.67%

|

|

|

Littelfuse

Inc.

|

1.75B

|

23.40

|

2.81

|

2.54

|

1.12%

|

|

|

Employers

Holdings, Inc.

|

849.54M

|

7.94

|

1.55

|

1.38

|

0.87%

|

|

|

Callaway

Golf Co.

|

497.07M

|

-

|

1.40

|

0.62

|

0.57%

|

20 Industrials With Highest Bets On A Falling Stock Price

Industrial dividend stocks with highest float

short ratio originally published at "long-term-investments.blogspot.com". Today I like to discover

the industrial goods sector by stocks with the highest float short ratio. The figure

shows the amount of short selling transactions.

Industrial dividend stocks with highest float

short ratio originally published at "long-term-investments.blogspot.com". Today I like to discover

the industrial goods sector by stocks with the highest float short ratio. The figure

shows the amount of short selling transactions. In order to exclude stocks with a damaged business model or higher risk, I observe only companies with a market capitalization above the USD 2 billion mark and positive dividend payments. The dividend payments are not necessary but they are focus of my blog. Dividend stocks are less often shorted.

The 20 top results have a float short ratio between

4.0 and 17.44 percent. Industrials are not popular for short selling compared to stocks from the financial sector. Lennar, the

residential construction firm, is the highest shorted company on the list.

Ex-Dividend Stocks: Best Dividend Paying Shares On May 20, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks May 20,

2013. In total, 22 stocks and

preferred shares go ex dividend - of which 8 yield more than 3 percent. The

average yield amounts to 2.79%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

Park

National Corp.

|

1.10B

|

16.73

|

1.69

|

3.98

|

5.25%

|

|

|

Eni

SpA

|

88.27B

|

30.75

|

1.10

|

0.54

|

4.61%

|

|

|

Hawaiian

Electric Industries Inc.

|

2.75B

|

19.55

|

1.72

|

0.82

|

4.43%

|

|

|

Highwoods

Properties Inc.

|

3.26B

|

64.97

|

2.77

|

6.16

|

4.29%

|

|

|

Regency

Centers Corporation

|

5.28B

|

-

|

3.69

|

10.63

|

3.21%

|

|

|

Maxim

Integrated Products Inc.

|

9.11B

|

21.14

|

3.49

|

3.74

|

3.07%

|

|

|

AFLAC

Inc.

|

25.33B

|

8.58

|

1.63

|

1.00

|

2.58%

|

|

|

Autoliv,

Inc.

|

7.48B

|

14.78

|

1.97

|

0.91

|

2.56%

|

|

|

Allegheny

Technologies Inc.

|

3.08B

|

28.28

|

1.24

|

0.63

|

2.52%

|

|

|

Snyder's-Lance,

Inc.

|

1.84B

|

28.60

|

2.09

|

1.12

|

2.41%

|

|

|

Valero

Energy Corporation

|

21.60B

|

6.97

|

1.21

|

0.16

|

2.02%

|

|

|

Assured

Guaranty Ltd.

|

4.64B

|

46.08

|

0.93

|

4.77

|

1.67%

|

|

|

Xylem

Inc.

|

5.31B

|

19.35

|

2.60

|

1.42

|

1.64%

|

|

|

Tenaris

SA

|

25.53B

|

15.18

|

2.18

|

2.34

|

1.20%

|

|

|

Employers

Holdings, Inc.

|

788.30M

|

7.47

|

1.44

|

1.36

|

0.94%

|

|

|

Luxottica

Group SpA

|

25.83B

|

34.34

|

4.58

|

2.78

|

0.90%

|

|

|

Gerdau

S.A.

|

11.47B

|

16.27

|

0.84

|

0.61

|

0.60%

|

Ex-Dividend Stocks: Best Dividend Paying Shares On March 11, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks March 11,

2013. In total, 22 stocks and

preferred shares go ex dividend - of which 6 yield more than 3 percent. The

average yield amounts to 3.97%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Triangle

Capital Corporation

|

815.23M

|

13.44

|

1.95

|

9.74

|

7.10%

|

|

Ameren

Corporation

|

8.26B

|

-

|

1.25

|

1.21

|

4.70%

|

|

Newmont

Mining Corp.

|

19.63B

|

99.83

|

1.48

|

1.93

|

4.26%

|

|

UniSource

Energy Corporation

|

1.97B

|

21.51

|

1.83

|

1.35

|

3.62%

|

|

Parkway

Properties Inc.

|

986.63M

|

-

|

1.43

|

4.36

|

3.40%

|

|

Kohl's

Corp.

|

10.62B

|

10.97

|

1.76

|

0.55

|

2.77%

|

|

Hewlett-Packard

Company

|

40.71B

|

-

|

1.78

|

0.34

|

2.54%

|

|

Texas

Roadhouse Inc.

|

1.37B

|

20.19

|

2.54

|

1.11

|

2.43%

|

|

State

Auto Financial Corp.

|

681.99M

|

7.53

|

0.92

|

0.54

|

2.37%

|

|

PS

Business Parks Inc.

|

1.83B

|

97.79

|

1.27

|

5.27

|

2.34%

|

|

Allegheny

Technologies Inc.

|

3.46B

|

22.70

|

1.40

|

0.69

|

2.23%

|

|

Magna

International, Inc.

|

12.92B

|

9.09

|

1.37

|

0.42

|

1.99%

|

|

T. Rowe Price Group, Inc.

|

19.29B

|

22.26

|

5.00

|

6.38

|

1.82%

|

|

Mead

Johnson Nutrition

|

15.13B

|

25.25

|

830.33

|

3.88

|

1.61%

|

|

Pool

Corp.

|

2.20B

|

27.70

|

7.82

|

1.13

|

1.36%

|

|

Employers

Holdings, Inc.

|

683.93M

|

6.52

|

1.27

|

1.18

|

1.08%

|

|

Public

Storage

|

25.84B

|

39.28

|

3.19

|

14.14

|

0.73%

|

|

Aegean Marine Petroleum Network

|

311.69M

|

13.38

|

0.63

|

0.04

|

0.60%

|

|

Amphenol

Corporation

|

11.58B

|

21.39

|

4.79

|

2.70

|

0.58%

|

|

News

Corp.

|

69.64B

|

17.72

|

2.48

|

2.03

|

0.57%

|

Subscribe to:

Comments (Atom)