Showing posts with label ADI. Show all posts

Showing posts with label ADI. Show all posts

24 Dividend Growth Stocks With Solid Yields To Consider

Dividend growth is a wonderful thing, but you should also require the stocks you buy to look cheap. Here I seek out stocks trading at multiples of price to sales, earnings, and cash flow lower than five-year averages.

Stocks that trade at discounted valuations can be cheap for a reason, so I also require expected sales growth for the year ahead to be positive. Using these criteria, the 24 stocks shown in the table have proven themselves to be “dividend growth superstars” that kept on paying and even raising their dividends through the 2008-2009 financial crisis. They also trade at historically cheap valuations on at least two of the three ratios I use to determine value: price/sales, price/earnings, and price/cash flow.

If you follow a strategy of investing in temporarily cheap stocks of companies that habitually hike their dividends, not only will you experience significant capital gains when the stock falls back into favor with the market, but the yield you earn on your original investment can balloon to downright plump proportions.

These are the results...

Stocks that trade at discounted valuations can be cheap for a reason, so I also require expected sales growth for the year ahead to be positive. Using these criteria, the 24 stocks shown in the table have proven themselves to be “dividend growth superstars” that kept on paying and even raising their dividends through the 2008-2009 financial crisis. They also trade at historically cheap valuations on at least two of the three ratios I use to determine value: price/sales, price/earnings, and price/cash flow.

If you follow a strategy of investing in temporarily cheap stocks of companies that habitually hike their dividends, not only will you experience significant capital gains when the stock falls back into favor with the market, but the yield you earn on your original investment can balloon to downright plump proportions.

These are the results...

20 Stocks With A Billion Dollar Buyback Program And Yields Over 2%

Let me ask you this: Would you rather buy a 10-year Treasury, which currently yields about 2%, or would you rather buy a large-cap stock with a 2% dividend yield, a billion-dollar stock buyback program, and share appreciation potential?

With bond yields as low as they are, there's no contest. The Fed's zero interest rate policy has created a situation where there's nowhere to go except the stock market.

Of course, the story will change once the Fed raises interest rates, which will make it more expensive for companies to borrow on the bond market. So there is a raging debate about when that will happen.

It is always better to own stocks in such situations. Those can hedge you against inflation. Fur sure, stocks are risky but if you look at the values of a company, and you avoid the big risks by not taking very cyclic stocks into your portfolio, you should be rewarded with a solid return.

Here are some alternatives with yields over 2% and a current buyback program worth over a billion dollar...

With bond yields as low as they are, there's no contest. The Fed's zero interest rate policy has created a situation where there's nowhere to go except the stock market.

Of course, the story will change once the Fed raises interest rates, which will make it more expensive for companies to borrow on the bond market. So there is a raging debate about when that will happen.

It is always better to own stocks in such situations. Those can hedge you against inflation. Fur sure, stocks are risky but if you look at the values of a company, and you avoid the big risks by not taking very cyclic stocks into your portfolio, you should be rewarded with a solid return.

Here are some alternatives with yields over 2% and a current buyback program worth over a billion dollar...

20 Best Yielding Profitable Growing Buyback Kings And My 8 Favorite Stocks

Today's screen discovers stocks

with recent buyback announcements. I've compiled those stocks with a recent

buyback program announcement.

Those buybacks are paid from a

profitable operating business that is growing, not only in the past but should

also go forward in the near future.

A consequence is

that each of the attached stocks has a positive 5 years past sales performance,

positive return on assets and positive expected 5 year EPS growth predictions

as well.

Attached you will find the 20

best yielding results.

These are my personal favorites...

These are my personal favorites...

20 Stocks With At Least One Billion Share Buyback Plan In 2016

When corporations are profitable and established, they tend to return capital to shareholders.

This can be achieved via stock buybacks to shrink the float and to support the stock, or it can be done via one-time dividends or by raising their annualized quarterly dividends.

In my blog, I often cover successful long-term dividend growth stocks. Those companies managed to raise dividends over a decade or half century.

I also talk a little about buyback stocks. Those gave more money back vie share repurchases which is in the end the same.

Today I would give you a short introduction into the biggest share buyback announced from the current fiscal year 2016.

As of now, we've noticed 94 companies with fresh, new, or increased buyback plans.

Here are the biggest announcements from fiscal 2016 to date...

This can be achieved via stock buybacks to shrink the float and to support the stock, or it can be done via one-time dividends or by raising their annualized quarterly dividends.

In my blog, I often cover successful long-term dividend growth stocks. Those companies managed to raise dividends over a decade or half century.

I also talk a little about buyback stocks. Those gave more money back vie share repurchases which is in the end the same.

Today I would give you a short introduction into the biggest share buyback announced from the current fiscal year 2016.

As of now, we've noticed 94 companies with fresh, new, or increased buyback plans.

Here are the biggest announcements from fiscal 2016 to date...

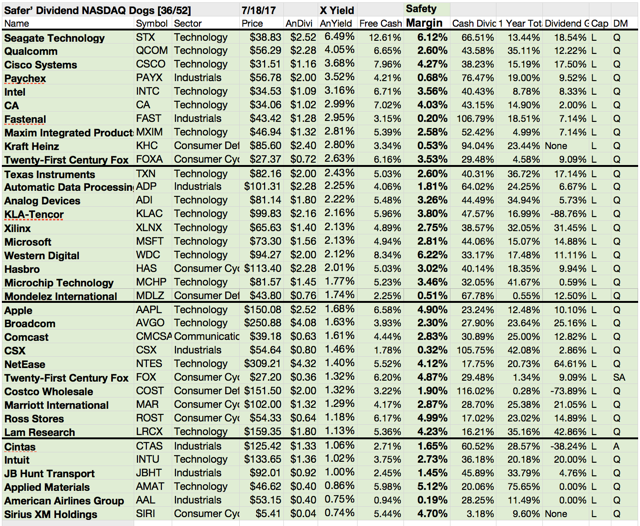

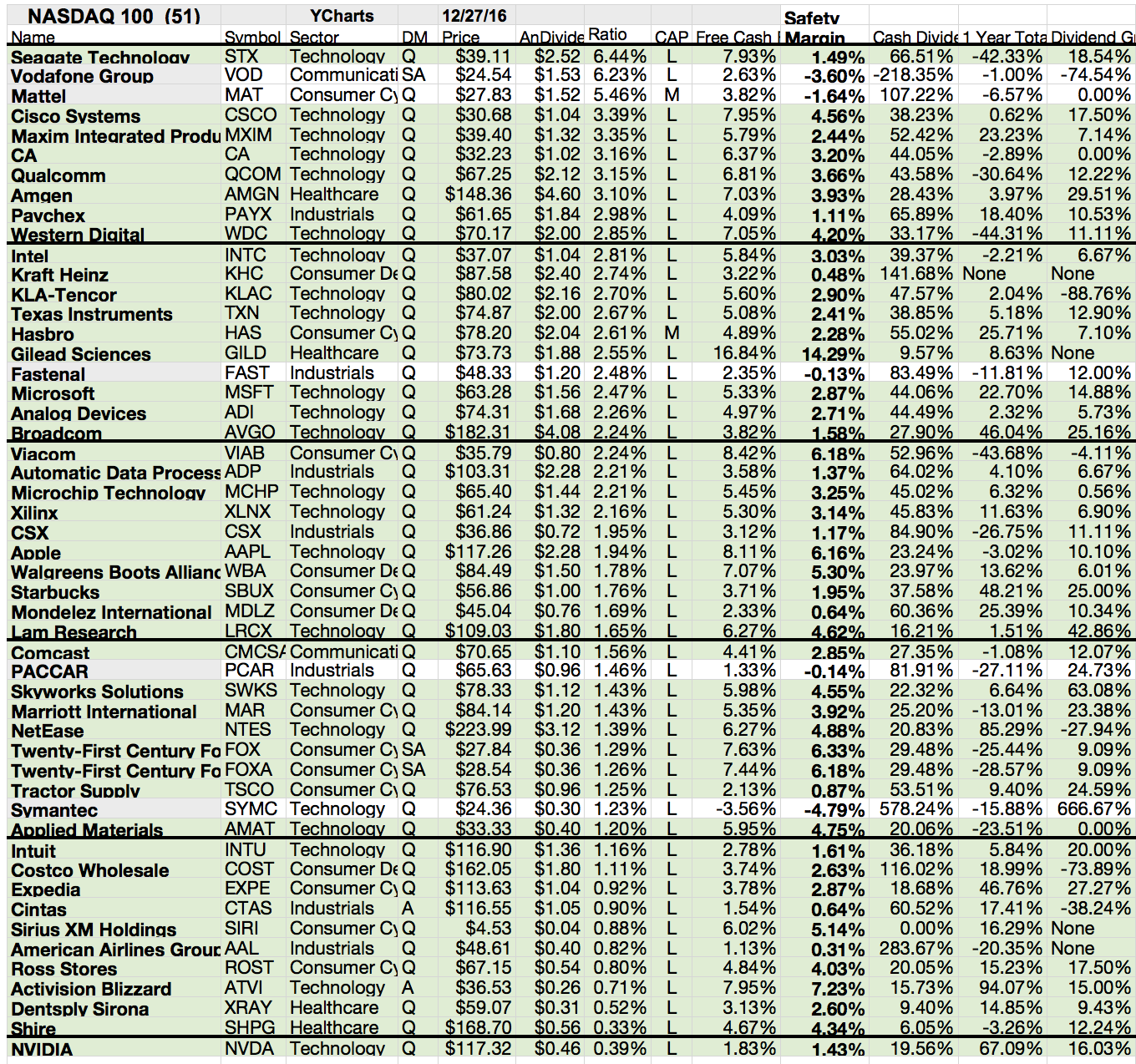

A List Of The Top Dividend Payer From The Nasdaq 100

You might not think of “Nasdaq” as synonymous with big dividends. The Nasdaq Composite index, which essentially consists of every domestic and foreign stock that trades on the exchange, has long been heavy on technology.

And technology companies have historically shown a bias for reinvesting their profits to finance future growth, rather than returning cash to shareholders. None of the FANGs — Facebook (symbol FB), Amazon.com (AMZN), Netflix (NFLX) and Google (GOOGL), now called Alphabet — pays a dividend but delivered one of the best returns in the past decade.

But dividends could give you a small hedge if a new game changer destroys the business model.

If you own a great Amazon or Facebook for a decade and you don't get money from them, you might be happy for a while if your stock positing skyrocked but what if your investment comes back to your initial investment amount? Right, you have nothing earned. That's the reason why dividends matter.

I've attached a list of the highest yielding stocks from the Nasdaq 100. If you like my news and dividend yield lists, you can easily subscribe my daily dividend newsletter for free. Just put your email in the subscription box and confirm the first mail.

And technology companies have historically shown a bias for reinvesting their profits to finance future growth, rather than returning cash to shareholders. None of the FANGs — Facebook (symbol FB), Amazon.com (AMZN), Netflix (NFLX) and Google (GOOGL), now called Alphabet — pays a dividend but delivered one of the best returns in the past decade.

But dividends could give you a small hedge if a new game changer destroys the business model.

If you own a great Amazon or Facebook for a decade and you don't get money from them, you might be happy for a while if your stock positing skyrocked but what if your investment comes back to your initial investment amount? Right, you have nothing earned. That's the reason why dividends matter.

I've attached a list of the highest yielding stocks from the Nasdaq 100. If you like my news and dividend yield lists, you can easily subscribe my daily dividend newsletter for free. Just put your email in the subscription box and confirm the first mail.

17 Oversold Dividend Achievers Trading At Very Attractive Levels

The market pullback is serving up a yield bonanza, and investors who rely on dividends to supplement their income have a wide variety of stocks to choose from.

The market pullback is serving up a yield bonanza, and investors who rely on dividends to supplement their income have a wide variety of stocks to choose from. Super-sized payouts should probably be avoided because they come with higher risks and you don’t want to step in just before the distribution gets a nasty haircut. There are, however, a handful of stocks with rock-solid dividends that are now trading at very attractive levels.

Each of the attached stocks have a long dividend growth history of more than 10 years. In addition, the forward P/E is under 15, the debt to equity under 1 and earnigs should grow by more than 5 percent yearly for the next 5 years.

Finally every stock in the attached list is oversold by a RSI value of 0.4.

Here are some of my current ideas....

The Best Yielding Income Opportunities From The Nasdaq

Investors always like stocks that pay large dividends. Yet for years, those who focused on the tech-heavy Nasdaq 100 Index didn't expect much in the way of dividends, since many high-growth companies didn't pay any dividends at all to their shareholders.

Investors always like stocks that pay large dividends. Yet for years, those who focused on the tech-heavy Nasdaq 100 Index didn't expect much in the way of dividends, since many high-growth companies didn't pay any dividends at all to their shareholders.Now, even tech companies have gotten on the dividend bandwagon, and you'll find some impressive yields among the Nasdaq's top 100 stocks. Let's take a look at the highest yielding stocks from the technology and growth dominated index.

The attached list is a compilation of next years estimated dividend and their estimated yields from the Nasdas index members. If you find some values in the list, please share it with your social connections.

If you like to receive more high-quality dividend income ideas, just subscribe my free newsletter.

Here are the top yielding results from the Nasdaq ...

Highest Yielding Dividend Stocks From Nasdaq 100

Did you notice that the Nasdaq hit the 5,000 yesterday?

Congratulations, what a number. The Nasdaq index compromises many growth stocks, more than the Dow Jones did.

That's also one of the reasons why the index is well-know for technology and innovation firms.

But the technology sector isn't particularly known for finding good dividends. Indeed, many of the most exciting technology stocks don't pay a dividend at all.

Assuming they're profitable (an assumption that doesn't always hold), technology companies often funnel their cash back into their business rather than pay shareholders a dividend.

You may also like my articles related to technology dividend stocks. There are a few great ideas in it. Cash, innovations and growth are main topics.

Today I would like to celebrate the 5,000 mark by highlighting some of the highest yielding stocks from the index.

Around half of the index members pay a dividend and of them has a high yield of more than 5 percent. Attached is a list of the highest yielding top 20 stocks from the Nasdaq 100.

Here are my favorites in detail:

Congratulations, what a number. The Nasdaq index compromises many growth stocks, more than the Dow Jones did.

That's also one of the reasons why the index is well-know for technology and innovation firms.

But the technology sector isn't particularly known for finding good dividends. Indeed, many of the most exciting technology stocks don't pay a dividend at all.

Assuming they're profitable (an assumption that doesn't always hold), technology companies often funnel their cash back into their business rather than pay shareholders a dividend.

You may also like my articles related to technology dividend stocks. There are a few great ideas in it. Cash, innovations and growth are main topics.

Today I would like to celebrate the 5,000 mark by highlighting some of the highest yielding stocks from the index.

Around half of the index members pay a dividend and of them has a high yield of more than 5 percent. Attached is a list of the highest yielding top 20 stocks from the Nasdaq 100.

Here are my favorites in detail:

18 Cool Dividend Growth Large Caps For A Hot Market

I'm really scared

about the ease to trade stocks at such high levels. Markets are valuated far

above 20 P/E multiples and the Dollar becomes more and more attractive for

foreign investors.

When I look into

my dividend stock database, I also see skyrocket price ratios. For sure there

are some pretty good stocks in my sheets with deep values but normal investors

don't should expect such a big growth for the near future that can justify this

valuation.

Today I like to

give you some ideas about good growing stocks with a solid dividend growth

history and a low debt figure as well.

These are my

criteria:

- Large Capitalization

(+ 10 Billion USD)

- Expected EPS

Growth over 10%

- P/E below 20

- Debt-To-Equity

under 0.5

- Consecutive

Dividend Payments over 10 years

18 stocks fulfilled my criteria.

Not much but some ideas. Would I buy them? I'm not sure. I think that more and

more volatility is coming into the market and this could also mean that it is

possible to buy them in the near future at a cheaper price.

If you would like to receive more dividend stock ideas, you should subscribe to my free e-mail list. Alternatively, you can follow me on Facebook or Twitter.

High yielding stocks are old-fashioned which is also reasonable to QE programs, overseas crises and the low interest environment as well.

These are my 4 favorite results:

If you would like to receive more dividend stock ideas, you should subscribe to my free e-mail list. Alternatively, you can follow me on Facebook or Twitter.

High yielding stocks are old-fashioned which is also reasonable to QE programs, overseas crises and the low interest environment as well.

These are my 4 favorite results:

These Dividend Contenders May Rise Dividends Within The Next 3 Months

Recently, I wrote about DividendChampions that may rise dividends within the next 3 months in order to keep

their status as dividend grower alive.

It's fantstic to know what companies should hike it's dividends because the current yields are so low that each investor get tears in his eyes.

A potential dividend hike could lift the current dividend yield on a new level.

Today I like to

introduce some Dividend Contenders with potential to hike dividends over the

next quarter. As a result, I found 20 companies; nine of them yield over 3

percent.

Dividend Growth is a wonderful investing space on which I personally spend a lot of time.

I love it to see dividends grow but it's only possible if a company grows and has low debt ratios.

These are my 6 highlights...

23 Stocks With Expected Dividend Growth Over The Next 3 Months

Consecutive

dividend growth measures the number of years in which the corporate has

increased dividends. Everything that a company needs to do is to hike dividends

each 12 months or less.

Today I will highlight some special stocks that must

increase dividends within the next 3 months in order to keep its dividend

grower status alive. 23 companies are on the attached list of which 12 are

recommended to buy. The bad thing is that only 4 have a really attractive

forward looking P/E ratio of less than 15. The market is still

expensive!

Labels:

ADI,

CHD,

CVS,

d,

Dividend Challengers,

Dividend Champions,

Dividend Contenders,

Dividend Growth,

Dividends,

LLL,

LNT; GSA; RHI,

NEE; TRI,

NU,

PII,

PRE,

ROL,

ROST

Ex-Dividend Stocks: Best Dividend Paying Shares On August 28, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 154 stocks go ex dividend

- of which 59 yield more than 3 percent. The average yield amounts to 4.49%.

Here is a full list of all stocks with ex-dividend

date within the upcoming week.

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

Lorillard,

Inc.

|

16.35B

|

13.51

|

-

|

2.42

|

5.06%

|

|

|

Eni

SpA

|

83.52B

|

28.46

|

1.01

|

0.49

|

4.86%

|

|

|

CRH

plc

|

15.88B

|

30.32

|

1.17

|

0.66

|

4.17%

|

|

|

NextEra

Energy, Inc.

|

33.98B

|

22.19

|

2.05

|

2.37

|

3.28%

|

|

|

Weyerhaeuser

Co.

|

15.46B

|

25.65

|

2.64

|

1.97

|

3.15%

|

|

|

Analog

Devices Inc.

|

14.60B

|

22.59

|

3.14

|

5.51

|

2.88%

|

|

|

Corning

Inc.

|

21.67B

|

11.35

|

1.01

|

2.72

|

2.71%

|

|

|

Ford

Motor Co.

|

64.54B

|

10.80

|

3.36

|

0.45

|

2.44%

|

|

|

Time

Warner Cable Inc.

|

31.33B

|

14.97

|

4.67

|

1.43

|

2.40%

|

|

|

CSX

Corp.

|

26.01B

|

13.83

|

2.70

|

2.20

|

2.36%

|

|

|

The

Allstate Corporation

|

22.83B

|

10.42

|

1.17

|

0.67

|

2.05%

|

|

|

Union

Pacific Corporation

|

72.83B

|

17.81

|

3.55

|

3.41

|

2.02%

|

|

|

TE

Connectivity Ltd.

|

20.72B

|

16.48

|

2.63

|

1.57

|

2.00%

|

|

|

Whirlpool

Corp.

|

10.62B

|

16.62

|

2.34

|

0.58

|

1.88%

|

|

|

Time

Warner Inc.

|

57.66B

|

17.01

|

1.94

|

1.96

|

1.85%

|

|

|

Broadcom

Corp.

|

14.46B

|

35.73

|

1.83

|

1.74

|

1.76%

|

|

|

Dover

Corp.

|

14.90B

|

16.37

|

2.99

|

1.78

|

1.72%

|

|

|

Magna

International, Inc.

|

18.57B

|

12.41

|

1.97

|

0.57

|

1.59%

|

|

|

Silver

Wheaton Corp.

|

10.08B

|

20.16

|

3.13

|

12.28

|

1.41%

|

|

|

Barclays

PLC

|

56.31B

|

23.69

|

0.71

|

0.93

|

1.35%

|

100 Guru Stock Buy List | The Most Bought Stocks

100 most bought stocks by investment professionals originally published

on Dividend Yield – Stock,

Capital, Investment. Covering investment professionals does make sense to get inspired. I look

at Warren Buffett’s investment choices. Guru stock buys are only one point of hundreds

in the selection process of an investment target.

Investment gurus are asset or fund managers with big amounts of cash

under management. They became popular by big returns and spectacular investment

strategies. I also talk about investors like George Soros. They all have one

thing in common: The average return beats the market and if they invest, the

market follows.

Today I create a screen of the biggest stock buys from 49 super investors

over the recent six months and rank them in my 100 best guru buy list. They

all combined bought 571 stocks within the recent half year.

The most wanted stock was Berkshire Hathaway. The company was bought by 14

investment professionals over the recent six months. Microsoft and AIG were also

very popular with 13 and 12 guru buys.

69 stocks from the list pay dividends and 68 have a buy or better recommendation.

20 Of Americas Biggest Technology Dividend Stocks

Largest

Technology Dividend Stocks Researched By “long-term-investments.blogspot.com”. The technology sector is

a place to search for fast growing stocks. Within this sector, it is possible to

tenfold your investment in a decade. Microsoft, Oracle, Facebook and Google are

only a few names that attest the rapid growth. Investors of the early stage are

multi-millionaires. However, I made a screen of the 20 biggest dividend payer

within the technology sector. I excluded stocks from abroad and all with a market

capitalization below USD 10 billion. 28 companies remained.

The whole sector has a total market capitalization of USD 123.53 billion and includes 878 stocks of which 201 pay dividends. The average sector yield amounts to 2.74 percent and the average P/E is 17.86. Computer based systems and long distance carriers as well as domestic telecoms are the best dividend paying industries.

The whole sector has a total market capitalization of USD 123.53 billion and includes 878 stocks of which 201 pay dividends. The average sector yield amounts to 2.74 percent and the average P/E is 17.86. Computer based systems and long distance carriers as well as domestic telecoms are the best dividend paying industries.

Subscribe to:

Comments (Atom)