| Ex-Dividend Stocks As Of | |||||

| Company | Symbol | % Yield | Amount | Period | Get the… |

| Eagle Point Credit | ECC | 12.97 | 0.2 | Monthly | Stock Report |

| Buckeye Partners | BPL | 12.71 | 1.2625 | Quarterly | Stock Report |

| Virtus Global Dividend | ZTR | 11.29 | 0.113 | Monthly | Stock Report |

| AllianzGI Conv&Incm II | NCZ | 11.29 | 0.0575 | Monthly | Stock Report |

| Virtus Glbl MultiSector | VGI | 11.12 | 0.126 | Monthly | Stock Report |

| PIMCO HiInco | PHK | 10.95 | 0.0807 | Monthly | Stock Report |

| CS X 2x Alerian MLP ETN | AMJL | 10.14 | 0.1734 | Monthly | Stock Report |

| Global Net Lease | GNL | 9.59 | 0.1775 | Monthly | Stock Report |

| Duff&Phelps Sel Energy | DSE | 9.52 | 0.15 | Quarterly | Stock Report |

| Calamos Dyn Conv&Incm | CCD | 9.14 | 0.167 | Monthly | Stock Report |

| PIMCO Global StocksPLUS | PGP | 8.99 | 0.122 | Monthly | Stock Report |

| PIMCO Inco Str Fd | PFL | 8.89 | 0.09 | Monthly | Stock Report |

| PIMCO Incm Strategy Fd II | PFN | 8.87 | 0.08 | Monthly | Stock Report |

| Icahn Enterprises | IEP | 8.72 | 1.75 | Quarterly | Stock Report |

| PIMCO Corporate&Incm | PTY | 8.66 | 0.13 | Monthly | Stock Report |

| Lazard Div&Income Fd | LOR | 8.44 | 0.07409 | Monthly | Stock Report |

| PIMCO Income Opportunity | PKO | 8.28 | 0.19 | Monthly | Stock Report |

| CLSeligmn Prem Tech Gr Fd | STK | 8.2 | 0.4625 | Quarterly | Stock Report |

| AllianzGI Div Incm | ACV | 8.2 | 0.167 | Monthly | Stock Report |

| PIMCO Dynamic Credit | PCI | 8.16 | 0.16406 | Monthly | Stock Report |

| PIMCO Dynamic Income ... | PDI | 8 | 0.2205 | Monthly | Stock Report |

| John Hancock Pfd Inc III | HPS | 7.91 | 0.1222 | Monthly | Stock Report |

| John Hancock Pfd II | HPF | 7.81 | 0.14 | Monthly | Stock Report |

| Eagle Point Credit Pfd | ECCA | 7.6 | 0.16146 | Monthly | Stock Report |

| John Hancock Pfd Income | HPI | 7.59 | 0.14 | Monthly | Stock Report |

| Lazard Global TR Fund | LGI | 7.57 | 0.11556 | Monthly | Stock Report |

| Eagle Point Credit Pfd. B | ECCB | 7.34 | 0.16146 | Monthly | Stock Report |

| PIMCO Corporate&Incm | PCN | 7.32 | 0.1125 | Monthly | Stock Report |

| CS XLinks Month Pay 2xLev | REML | 7.15 | 0.1587 | Monthly | Stock Report |

| HnckJohn TxAdv | HTD | 7.04 | 0.138 | Monthly | Stock Report |

| ING Groep ADR | ING | 6.9 | 0.27989 | Special | Stock Report |

| Viper Energy Partners Un | VNOM | 6.68 | 0.6 | Quarterly | Stock Report |

| EtnVncLtdFd | EVV | 6.36 | 0.067 | Monthly | Stock Report |

| Eaton Vance Hi Incm 2021 | EHT | 5.97 | 0.0475 | Monthly | Stock Report |

| AllianzGI Conv&Inc 2024 | CBH | 5.94 | 0.046 | Monthly | Stock Report |

| Pimco Muni Inc II | PML | 5.91 | 0.065 | Monthly | Stock Report |

| Eaton Vance Sr Incm Tr | EVF | 5.81 | 0.031 | Monthly | Stock Report |

| Commerce Bcshs Dep Pfd B | CBSHP | 5.8 | 0.375 | Quarterly | Stock Report |

| PIMCO Muni Inc III | PMX | 5.74 | 0.05575 | Monthly | Stock Report |

| Eaton Vance FR 2022 | EFL | 5.52 | 0.043 | Monthly | Stock Report |

| PIMCO NY Muni II | PNI | 5.48 | 0.05069 | Monthly | Stock Report |

| Eaton Vance Mun Income | EVN | 5.48 | 0.0541 | Monthly | Stock Report |

| PIMCO MuniFd | PMF | 5.4 | 0.05967 | Monthly | Stock Report |

| PIMCO California Muni | PCQ | 5.39 | 0.077 | Monthly | Stock Report |

| PIMCO NY Muni | PNF | 5.36 | 0.057 | Monthly | Stock Report |

| PIMCO NY Muni III | PYN | 5.1 | 0.04225 | Monthly | Stock Report |

| PIMCO California Mun III | PZC | 5.05 | 0.045 | Monthly | Stock Report |

| PIMCO California Mun II | PCK | 5 | 0.035 | Monthly | Stock Report |

| Janus Henderson Group | JHG | 4.98 | 0.36 | Quarterly | Stock Report |

| Eaton NY Trust | EVY | 4.9 | 0.05 | Monthly | Stock Report |

| Eaton NJ | EVJ | 4.66 | 0.0457 | Monthly | Stock Report |

| Ultrapar Part ADR | UGP | 4.62 | 0.14909 | Special | Stock Report |

| Amer Campus Communities | ACC | 4.44 | 0.46 | Quarterly | Stock Report |

| Eaton CA Trust | CEV | 4.41 | 0.0421 | Monthly | Stock Report |

| Eaton PA Trust | EVP | 4.34 | 0.0421 | Monthly | Stock Report |

| Eaton OH Trsut | EVO | 4.21 | 0.0451 | Monthly | Stock Report |

| NorthStar Realty Europe | NRE | 4.16 | 0.15 | Quarterly | Stock Report |

| Och-Ziff Capital Mgmt | OZM | 4.04 | 0.02 | Quarterly | Stock Report |

| Carlyle Group | CG | 3.66 | 0.22 | Quarterly | Stock Report |

| Eaton MA Trust | MMV | 3.66 | 0.0388 | Monthly | Stock Report |

| Eaton MI Trust | EMI | 3.65 | 0.0391 | Monthly | Stock Report |

| GasLog | GLOG | 3.63 | 0.15 | Quarterly | Stock Report |

| CS X-Links Multi-Asset Hi | MLTI | 3.46 | 0.0811 | Monthly | Stock Report |

| Murphy Oil | MUR | 3.08 | 0.25 | Quarterly | Stock Report |

| CNA Financial | CNA | 3.02 | 0.35 | Quarterly | Stock Report |

| Artesian Resources Cl A | ARTNA | 2.58 | 0.2387 | Quarterly | Stock Report |

| ONE Gas | OGS | 2.39 | 0.46 | Quarterly | Stock Report |

| Papa John's Intl | PZZA | 2.31 | 0.225 | Quarterly | Stock Report |

| WCF Bancorp | WCFB | 2.21 | 0.05 | Quarterly | Stock Report |

| Rockwell Automation | ROK | 2.08 | 0.92 | Quarterly | Stock Report |

| National Instruments | NATI | 2.06 | 0.23 | Quarterly | Stock Report |

| Marlin Business Services | MRLN | 2.03 | 0.14 | Quarterly | Stock Report |

| BOK Financial | BOKF | 2.01 | 0.5 | Quarterly | Stock Report |

| WVS Financial | WVFC | 1.94 | 0.08 | Quarterly | Stock Report |

| Southern Natl Bncp of VA | SONA | 1.83 | 0.08 | Quarterly | Stock Report |

| U.S. Global Investors A | GROW | 1.81 | 0.0025 | Monthly | Stock Report |

| Enterprise Bancorp | EBTC | 1.58 | 0.145 | Quarterly | Stock Report |

| WW Grainger | GWW | 1.54 | 1.36 | Quarterly | Stock Report |

| Apple | AAPL | 1.41 | 0.73 | Quarterly | Stock Report |

| Park-Ohio Holdings | PKOH | 1.36 | 0.125 | Quarterly | Stock Report |

| Systemax | SYX | 1.19 | 0.11 | Quarterly | Stock Report |

| United Insurance Holdings | UIHC | 1.15 | 0.06 | Quarterly | Stock Report |

| Global Brass&Copper | BRSS | 1.01 | 0.09 | Quarterly | Stock Report |

| Astec Industries | ASTE | 0.95 | 0.11 | Quarterly | Stock Report |

| BJ's Restaurants | BJRI | 0.7 | 0.11 | Quarterly | Stock Report |

| Comfort Systems USA | FIX | 0.61 | 0.085 | Quarterly | Stock Report |

| Landstar System | LSTR | 0.57 | 0.165 | Quarterly | Stock Report |

| Gold Resource | GORO | 0.35 | 0.00167 | Monthly | Stock Report |

Showing posts with label ROK. Show all posts

Showing posts with label ROK. Show all posts

Ex-Dividend Stocks By #Yield As Of August 10, 2018

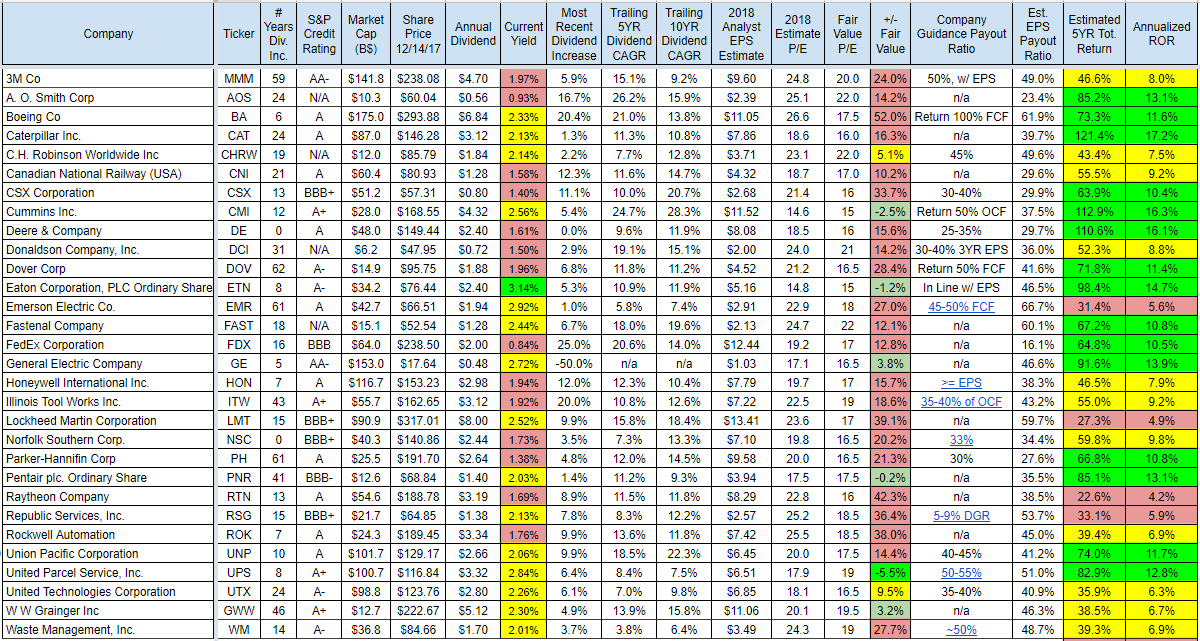

An Overview Of The Best Industrial Dividend Income Stocks Q4/2017

The companies on this list were originally selected based on their track records of dividend growth, financial ratings, and earnings growth.

With the industrials being cyclical in nature, I've found that this sector is one of the more difficult ones to forecast, both in putting valuations on companies and in predicting future dividend growth.

The following table contains historical dividend growth information as well as current dividend rate, dividend yield, analyst earnings expectations, and the corresponding PE ratio and payout ratio from these numbers.

20 Stocks With A Billion Dollar Buyback Program And Yields Over 2%

Let me ask you this: Would you rather buy a 10-year Treasury, which currently yields about 2%, or would you rather buy a large-cap stock with a 2% dividend yield, a billion-dollar stock buyback program, and share appreciation potential?

With bond yields as low as they are, there's no contest. The Fed's zero interest rate policy has created a situation where there's nowhere to go except the stock market.

Of course, the story will change once the Fed raises interest rates, which will make it more expensive for companies to borrow on the bond market. So there is a raging debate about when that will happen.

It is always better to own stocks in such situations. Those can hedge you against inflation. Fur sure, stocks are risky but if you look at the values of a company, and you avoid the big risks by not taking very cyclic stocks into your portfolio, you should be rewarded with a solid return.

Here are some alternatives with yields over 2% and a current buyback program worth over a billion dollar...

With bond yields as low as they are, there's no contest. The Fed's zero interest rate policy has created a situation where there's nowhere to go except the stock market.

Of course, the story will change once the Fed raises interest rates, which will make it more expensive for companies to borrow on the bond market. So there is a raging debate about when that will happen.

It is always better to own stocks in such situations. Those can hedge you against inflation. Fur sure, stocks are risky but if you look at the values of a company, and you avoid the big risks by not taking very cyclic stocks into your portfolio, you should be rewarded with a solid return.

Here are some alternatives with yields over 2% and a current buyback program worth over a billion dollar...

These 20 Stocks Could Benefit From Higher Rates

The current problem on the market

could be descried with the following sentence: Rising rates could let to a

falling dollar.

In contraction,

Investors expect the US Dollar to rally, undermining equities and furthering

headwinds to S&P 500 EPS and also amplified stress for EM borrowers (USD

denom. debt).

History says that

the consensus is wrong and counters intuitively, when the Fed moves to neutral

from easy (11 most recent cycles), USD weakened 55% of the time, with a median

decline of 7% in the first year.

Below I've implemented

screen results of stocks that might benefit from rising rate hikes. Stocks from

the screen have fulfilled the following criteria:

Stock selection

criteria...

(i) Stock’s price

correlation to the USD (DXY Index) from 5/2014 – 3/2015 is less than -0.40

(ii) Mean implied

upside based on analyst target prices is positive

(iii) P/E (‘15E

and ‘16E) is below 25X but consensus EPS is positive

(iv) FCF yield is

above 3%

(v) Company beat

consensus EPS expectations the last 2 quarters.

Here are the 20

best yielding results in detail....

Subscribe to:

Comments (Atom)