Showing posts with label SPLS. Show all posts

Showing posts with label SPLS. Show all posts

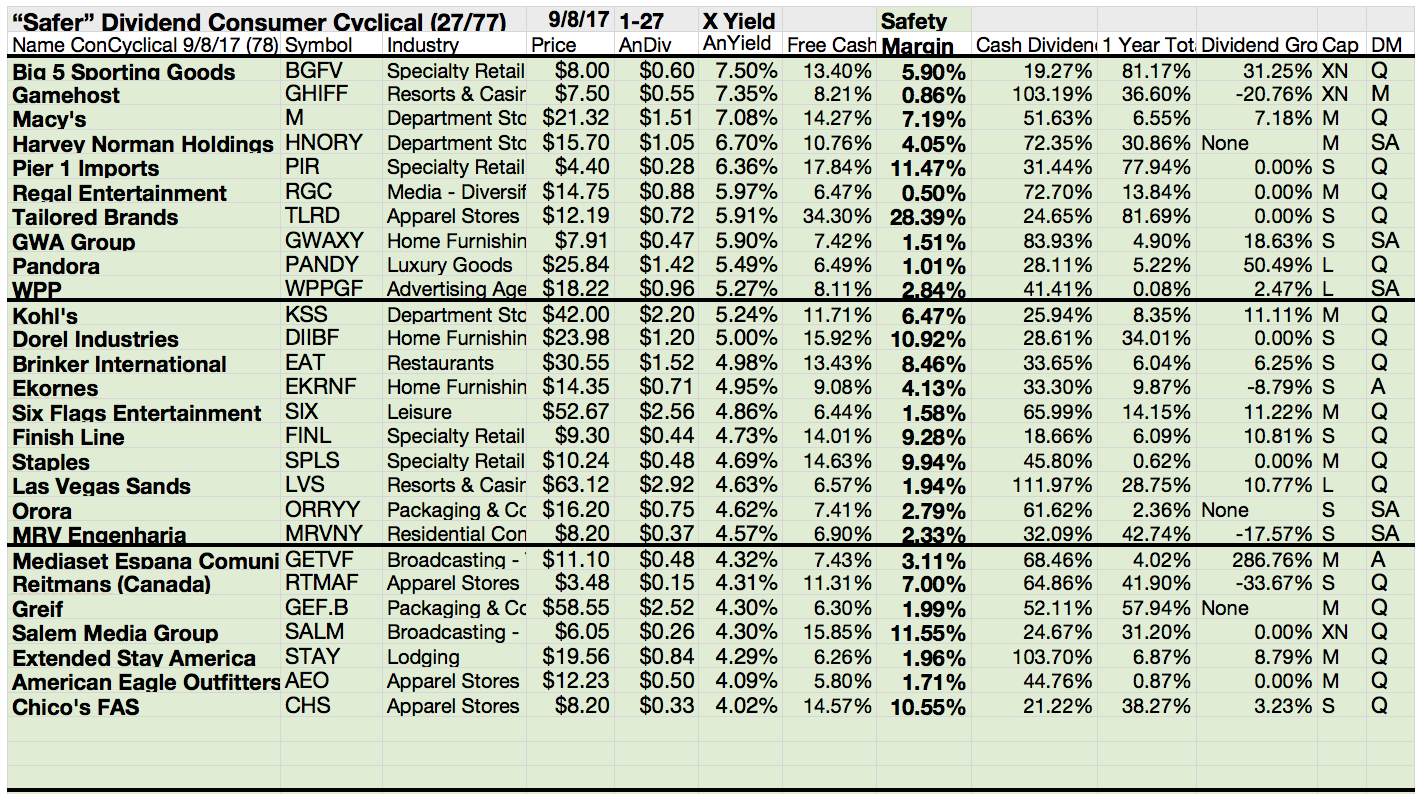

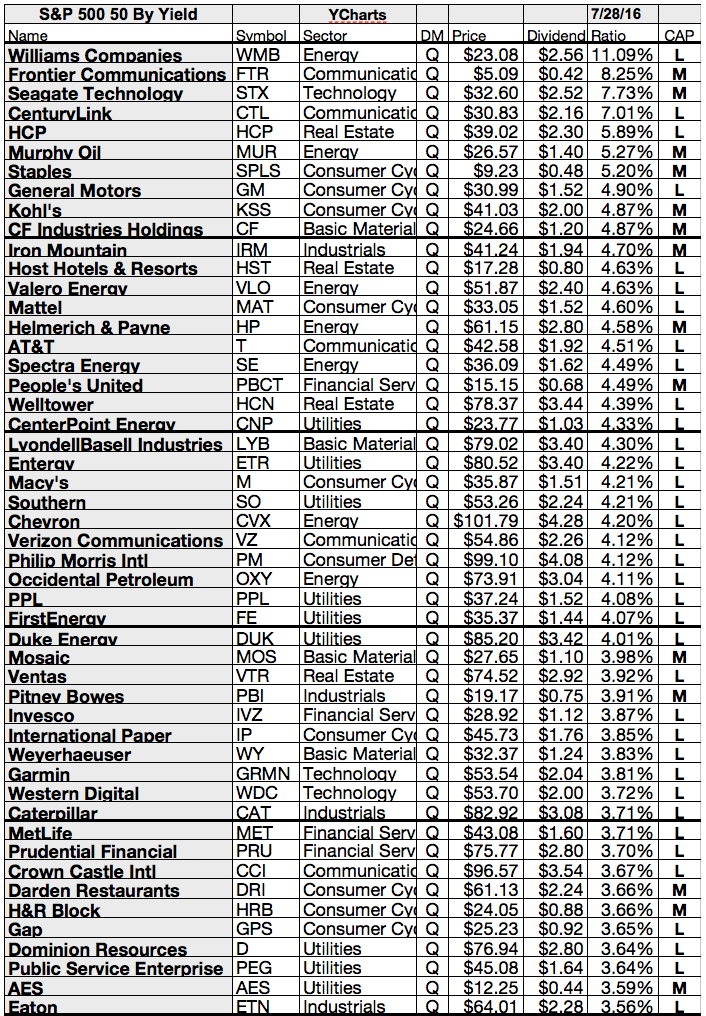

The Highest Yielding S&P 500 And The Dogs of the S&P 500

While you wait—and wait—for the Federal Reserve to raise interest rates, you can collect generous checks by investing in dividend stocks. And you don’t have to wander far to find attractive payers. Just look at Standard & Poor’s 500-stock index.

Of its 500 member companies, 84% pay dividends, up from 75% a decade ago. On top of that, many of the index’s constituents are rewarding shareholders by boosting their payouts; so far this year, 169 S&P companies have done so.

There are stocks on the S&P 500 that pay nearly 10%, but that doesn't make them great investments.

The average stock on the S&P 500 index pays a dividend yield of 2.41%, but some are paying much more. Here's a chart of the 10 highest-paying dividend stocks on the S&P 500, and which ones might be the best choices to buy and hold for the long term.

Here are the highest yielding S&P 500 and the Dogs of the S&P 500...

Of its 500 member companies, 84% pay dividends, up from 75% a decade ago. On top of that, many of the index’s constituents are rewarding shareholders by boosting their payouts; so far this year, 169 S&P companies have done so.

There are stocks on the S&P 500 that pay nearly 10%, but that doesn't make them great investments.

The average stock on the S&P 500 index pays a dividend yield of 2.41%, but some are paying much more. Here's a chart of the 10 highest-paying dividend stocks on the S&P 500, and which ones might be the best choices to buy and hold for the long term.

Here are the highest yielding S&P 500 and the Dogs of the S&P 500...

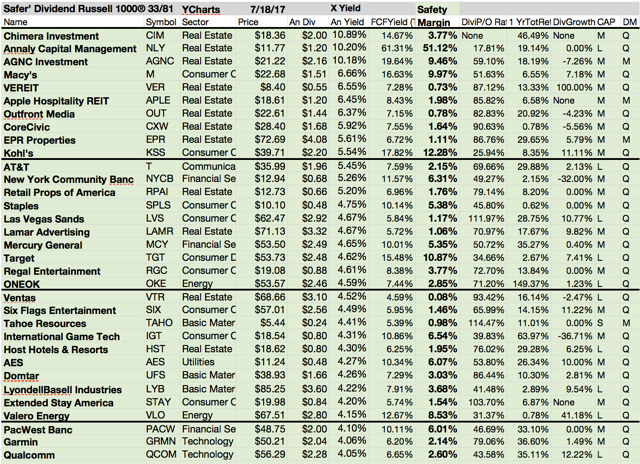

32 Of 60 S&P 500 Dogs Have Cash Margins To Cover Dividends

“Dogs of the Dow” is a popular investment strategy.

There are thousands other or similar strategies out there trying to beat the

market by finding undervalued stocks without deep research.

The approach is simple and easy. On seeking alpha,

there are many writers creating great screens with attractive stocks.

Attached you will find a list of dogs from the

S&P500. A dog by definition from the article is a stock from the S&P

500 with a dividend yield higher than their peers and lower than their

historical average.

High yields also under pressure of dividend cuts. In

order to eliminate those risks, the author created the safety margin rule. This

ratio shows how much of the dividend yield is covered by the free cash flow

yield. A ratio below 100% tells us that the dividend is paid with free cash,

generated by operating activities.

Check out the dogs with high safety margins here...

10 Highest Dividend Stocks on the S&P 500

The average stock on the S&P 500 index pays a dividend yield of 2.41%, but some are paying much more. Here's a chart of the 10 highest-paying dividend stocks on the S&P 500, and which ones might be the best choices to buy and hold for the long term.

Before moving on, it's important to mention that a high dividend doesn't necessarily translate into a good stock to invest in.

For example, Frontier Communications (NASDAQ: FTR), the highest-paying company in the S&P 500, has struggled to turn a profit for several years now. In my opinion, it's at serious risk of a dividend cut in the near future.

With that in mind, there are a few stocks on this list worth buying. Here are my three favorites in no particular order.

These are the results...

Before moving on, it's important to mention that a high dividend doesn't necessarily translate into a good stock to invest in.

For example, Frontier Communications (NASDAQ: FTR), the highest-paying company in the S&P 500, has struggled to turn a profit for several years now. In my opinion, it's at serious risk of a dividend cut in the near future.

With that in mind, there are a few stocks on this list worth buying. Here are my three favorites in no particular order.

These are the results...

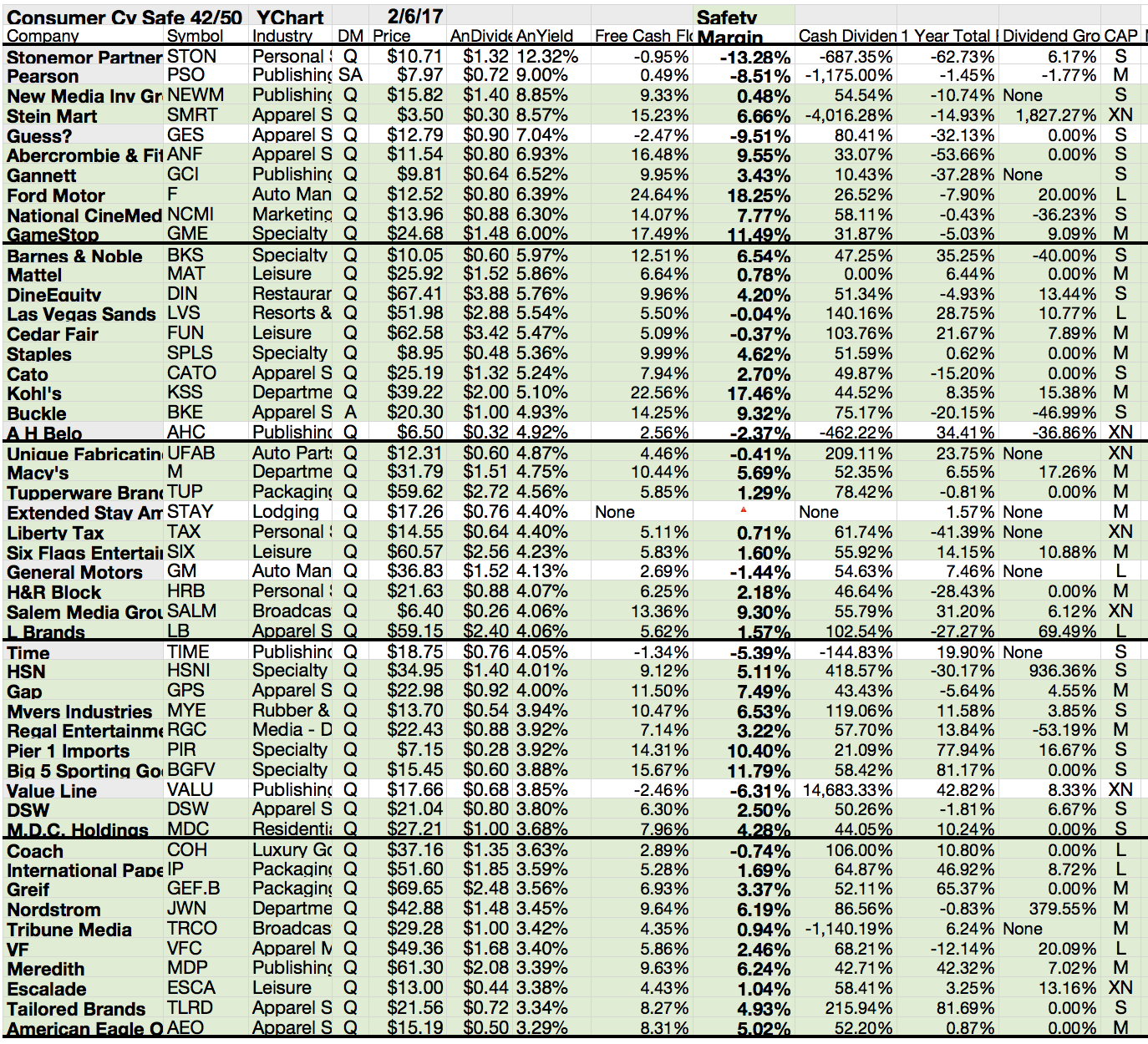

16 Oversold Dividend Stocks Are Now Cheap Enough To Buy Now

As the markets reached recently fresh new highs, income investors are on the lookout for stocks with solid dividend yields that have strong fundamentals and are oversold due to the year's volatility.

It's hard to find cheaply priced stocks in such a hot priced environment.

Looking at the stocks' technical charts can help determine whether the fundamentals can be further supported.

Not surprisingly, this year's market volatility has wreaked havoc on many strong dividend stocks.

Today we've screened the market by cheap stocks (forward P/E under 15) with an oversold definition by RSI 40.

We also excluded all stocks with a market capitalization over 2 billion. In addition, the ROA is positive and the debt-to equity under 1.

16 stocks are meeting the above mentioned criteria of which 2 a High-Yields.

These are the results in detail...

It's hard to find cheaply priced stocks in such a hot priced environment.

Looking at the stocks' technical charts can help determine whether the fundamentals can be further supported.

Not surprisingly, this year's market volatility has wreaked havoc on many strong dividend stocks.

Today we've screened the market by cheap stocks (forward P/E under 15) with an oversold definition by RSI 40.

We also excluded all stocks with a market capitalization over 2 billion. In addition, the ROA is positive and the debt-to equity under 1.

16 stocks are meeting the above mentioned criteria of which 2 a High-Yields.

These are the results in detail...

10 Stocks Looking Cheap Now During The Cycle

The S&P 500 is already off more than 8%, which means the benchmark index has lost more than 1.7% per week on average for every full week of trading.

The S&P 500 is already off more than 8%, which means the benchmark index has lost more than 1.7% per week on average for every full week of trading.If anything, it’s highly unlikely that markets will keep falling so quickly — at that pace, most of the stock market would evaporate by the end of the year.

But any continued losses are unwelcome losses, so investors are rapidly fleeing to more risk-light assets. The problem is the 10-year Treasury yield now yields a mere 1.74%, and many traditional safe-haven stocks have actually enjoyed buying amid the downturn, helping to drive down their yields.

Investors do have a few options for meaningful yield, though. The very downturn that has investors scurrying to find safe-havens has created a bevy of cheap dividend stocks to buy, most of which yield about two or three times the miserable yield on the 10-year.

Here are the results...

The Best Yielding Income Opportunities From The Nasdaq

Investors always like stocks that pay large dividends. Yet for years, those who focused on the tech-heavy Nasdaq 100 Index didn't expect much in the way of dividends, since many high-growth companies didn't pay any dividends at all to their shareholders.

Investors always like stocks that pay large dividends. Yet for years, those who focused on the tech-heavy Nasdaq 100 Index didn't expect much in the way of dividends, since many high-growth companies didn't pay any dividends at all to their shareholders.Now, even tech companies have gotten on the dividend bandwagon, and you'll find some impressive yields among the Nasdaq's top 100 stocks. Let's take a look at the highest yielding stocks from the technology and growth dominated index.

The attached list is a compilation of next years estimated dividend and their estimated yields from the Nasdas index members. If you find some values in the list, please share it with your social connections.

If you like to receive more high-quality dividend income ideas, just subscribe my free newsletter.

Here are the top yielding results from the Nasdaq ...

10 Most Oversold High Yielding Dividend Payer To Look At

Investors are sometimes scared about falling stock prices. I often believe that stock prices fall because many people sell stocks. So what is the real reason for a falling stock price?

Investors are sometimes scared about falling stock prices. I often believe that stock prices fall because many people sell stocks. So what is the real reason for a falling stock price?I personally don't care about the stock prices despite the fact that I do look several times a day on the market movements. But I don't buy or sell on these price changes.

Market sell-offs could be great opportunity for investors who trust their company and know what the management team is doing.

I know that it is hard to discover the true origin circumstances that caused the stock price loss. And if you buy, don't expect that you will make quick money. You could get hard pain if you buy a falling knife.

The good news is that you will be rewarded if you stay disciplined. Return don't come in months, it will come over years.

Today I like to give you an overview about solid dividend stocks with high yields that have seen a recent sell-off in the recent week.

Here are the results...

A Quick View On The Dogs Of The Nasdaq 100

Recently, I wrote about the current

Dogs of the Dow and gave you a nice overview about the cheapest and highest

yielding stocks from the large cap index Dow Jones that offer growth potential.

Some of you have agreed

by the names I've introduced these but the index members of the Dow Jones still

offer true values and long-term growth.

However, today I

would like to share the Dogs of the NASDAQ with you.

Right, the

cheapest and highest yielding stocks from the technology exchange. A decent

number of stocks also pay dividends there. In total, there are 55 dividend

stocks, more than half of the members.

The initial yield of the technology dominated index starts at 0.75% and ends at 6.99%, paid by Mattel.

Check the top Dogs

of the NASDAQ here:

High-Yielding Ex-Dividend Stocks Of The Coming Week

Here I share all higher capitalized stocks going ex-dividend next week.

60 dividend stocks go ex-dividend in the upcoming week of which 30 are capitalized over 2 billion.

Afull list of next weeks ex-dividend stocks can be found here: Ex-Dividend Stocks of the Week September 21, 2015 – September 27, 2015. The average dividend-yield amounts to 4.55 percent.

Check out the top yielding stocks, starting at 2.11% and ending at 8.82%---

Which do you prefer? Well, on the higher yield side, there are many energy related stocks as well as REITs.

Those are also high debt loaded with enormous payouts.

I like Total, Williams, Staples, Medtronic and IFF.

60 dividend stocks go ex-dividend in the upcoming week of which 30 are capitalized over 2 billion.

Afull list of next weeks ex-dividend stocks can be found here: Ex-Dividend Stocks of the Week September 21, 2015 – September 27, 2015. The average dividend-yield amounts to 4.55 percent.

Check out the top yielding stocks, starting at 2.11% and ending at 8.82%---

|

| Highest Yielding Ex-Dividend Stocks Of The Next Week (Click to enlarge) |

Which do you prefer? Well, on the higher yield side, there are many energy related stocks as well as REITs.

Those are also high debt loaded with enormous payouts.

I like Total, Williams, Staples, Medtronic and IFF.

10 Highest Yielding NASDAQ 100 Stocks Each Yielding Over 3%

The Nasdaq 100 has historically been "overweight" the technology sector as compared to the S&P 500. The highest yielding Nasdaq 100 stocks are no exception. Eight out of the top highest yielding Nasdaq 100 stocks are in the technology sector.

I personally like technology stocks because of their high free cash flows but the great lack is the unpredictability of the technology change.

Each well established technology could be useless within the next five years. It's great potential for new companies but also a big threat for established well proven stocks.

Below is a detailed overview of the 10 top yielding stocks, each growth investor with need of cash income should know.

These are the results:

I personally like technology stocks because of their high free cash flows but the great lack is the unpredictability of the technology change.

Each well established technology could be useless within the next five years. It's great potential for new companies but also a big threat for established well proven stocks.

Below is a detailed overview of the 10 top yielding stocks, each growth investor with need of cash income should know.

These are the results:

Highest Yielding Dividend Stocks From Nasdaq 100

Did you notice that the Nasdaq hit the 5,000 yesterday?

Congratulations, what a number. The Nasdaq index compromises many growth stocks, more than the Dow Jones did.

That's also one of the reasons why the index is well-know for technology and innovation firms.

But the technology sector isn't particularly known for finding good dividends. Indeed, many of the most exciting technology stocks don't pay a dividend at all.

Assuming they're profitable (an assumption that doesn't always hold), technology companies often funnel their cash back into their business rather than pay shareholders a dividend.

You may also like my articles related to technology dividend stocks. There are a few great ideas in it. Cash, innovations and growth are main topics.

Today I would like to celebrate the 5,000 mark by highlighting some of the highest yielding stocks from the index.

Around half of the index members pay a dividend and of them has a high yield of more than 5 percent. Attached is a list of the highest yielding top 20 stocks from the Nasdaq 100.

Here are my favorites in detail:

Congratulations, what a number. The Nasdaq index compromises many growth stocks, more than the Dow Jones did.

That's also one of the reasons why the index is well-know for technology and innovation firms.

But the technology sector isn't particularly known for finding good dividends. Indeed, many of the most exciting technology stocks don't pay a dividend at all.

Assuming they're profitable (an assumption that doesn't always hold), technology companies often funnel their cash back into their business rather than pay shareholders a dividend.

You may also like my articles related to technology dividend stocks. There are a few great ideas in it. Cash, innovations and growth are main topics.

Today I would like to celebrate the 5,000 mark by highlighting some of the highest yielding stocks from the index.

Around half of the index members pay a dividend and of them has a high yield of more than 5 percent. Attached is a list of the highest yielding top 20 stocks from the Nasdaq 100.

Here are my favorites in detail:

19 Cheaply Valuated Stocks With Forces To Become The Next Top Dividend Grower On The Market

Dividend

growth stocks on the move to become a real long-term dividend grower originally

published at long-term-investments.blogspot.com. Dividend growth is a

great and powerful tool for all normal and small investors to participate in a

honest and passive way from the economic success of a corporate.

America is definitely the country with the highest amount of stocks that share profits with shareholders fairly. Believe me; I've seen thousands of companies all around the world where investors get robbed by management teams, lead investors or even the government.

My investment focus is on dividend growth stocks but over the recent months and years, we all have seen a significant increase in price multiples. Most of the best long-term dividend growers are valuated with a P/E of 20 or more. If you pay such high ratios, you will definitely not get a good inflation and risk-adjusted return over the long-run if you invest in a slow growing business.

Today, I try to find additional dividend stocks that are near to achieve a consecutive dividend growth history of at least five years.

Around 150 stocks are available with 4 years of dividend growth. With the next hike they could become a real Dividend Challenger. My hope is that some of them are cheaper than the older and well-established stocks.

You can find attached a list of all large capitalized stocks with a low forward price to earnings ratio of less than 15. Only 19 companies fulfilled these criteria of which nearly all (17 shares) are recommended to buy.

America is definitely the country with the highest amount of stocks that share profits with shareholders fairly. Believe me; I've seen thousands of companies all around the world where investors get robbed by management teams, lead investors or even the government.

My investment focus is on dividend growth stocks but over the recent months and years, we all have seen a significant increase in price multiples. Most of the best long-term dividend growers are valuated with a P/E of 20 or more. If you pay such high ratios, you will definitely not get a good inflation and risk-adjusted return over the long-run if you invest in a slow growing business.

Today, I try to find additional dividend stocks that are near to achieve a consecutive dividend growth history of at least five years.

Around 150 stocks are available with 4 years of dividend growth. With the next hike they could become a real Dividend Challenger. My hope is that some of them are cheaper than the older and well-established stocks.

You can find attached a list of all large capitalized stocks with a low forward price to earnings ratio of less than 15. Only 19 companies fulfilled these criteria of which nearly all (17 shares) are recommended to buy.

Ex-Dividend Stocks: Best Dividend Paying Shares On September 25, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 44 stocks go ex dividend - of which 13 yield more than 3 percent. Here is a full list of all stocks with ex-dividend date within the current week.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

Healthcare Trust of America

|

2.47B

|

274.00

|

1.86

|

8.09

|

5.29%

|

|

|

Hawaiian

Electric Industries Inc.

|

2.51B

|

18.43

|

1.54

|

0.76

|

4.87%

|

|

|

Canadian Imperial Bank of Comm.

|

32.40B

|

10.17

|

2.08

|

2.82

|

4.59%

|

|

|

Staples,

Inc.

|

9.64B

|

-

|

1.60

|

0.40

|

3.25%

|

|

|

Nucor

Corporation

|

15.91B

|

38.37

|

2.11

|

0.86

|

2.95%

|

|

|

Sempra

Energy

|

21.44B

|

22.12

|

2.00

|

2.05

|

2.86%

|

|

|

Bancolombia

S.A.

|

12.30B

|

14.55

|

2.06

|

2.91

|

2.86%

|

|

|

Equity

LifeStyle Properties, Inc.

|

2.93B

|

35.97

|

3.97

|

4.10

|

2.84%

|

|

|

Ryder

System, Inc.

|

3.07B

|

13.83

|

1.98

|

0.48

|

2.28%

|

|

|

ProAssurance

Corporation

|

2.85B

|

8.81

|

1.22

|

3.87

|

2.17%

|

|

|

Protective

Life Corp.

|

3.35B

|

11.09

|

0.87

|

0.92

|

1.90%

|

|

|

Weight

Watchers International

|

2.11B

|

8.85

|

-

|

1.18

|

1.86%

|

|

|

Axiall

Corporation

|

2.66B

|

12.61

|

1.10

|

0.68

|

1.68%

|

|

|

Stantec

Inc.

|

2.44B

|

19.46

|

3.18

|

1.49

|

1.21%

|

|

|

Regal

Beloit Corporation

|

3.06B

|

16.14

|

1.53

|

0.99

|

1.17%

|

|

|

Canadian

Pacific Railway Limited

|

21.97B

|

32.05

|

4.03

|

3.81

|

1.08%

|

|

|

Ralph

Lauren Corporation

|

14.98B

|

20.86

|

3.98

|

2.14

|

0.97%

|

|

|

Zimmer

Holdings, Inc.

|

14.17B

|

20.67

|

2.41

|

3.14

|

0.95%

|

|

|

Flowserve

Corp.

|

8.89B

|

20.17

|

5.18

|

1.84

|

0.90%

|

|

|

Whole

Foods Market, Inc.

|

21.63B

|

40.17

|

5.72

|

1.68

|

Ex-Dividend Stocks: Best Dividend Paying Shares On June 26, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks June 26,

2013. In total, 117 stocks and

preferred shares go ex dividend - of which 59 yield more than 3 percent. The

average yield amounts to 4.64%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

Canadian Imperial Bank of Commerce

|

28.82B

|

9.35

|

1.88

|

2.54

|

5.25%

|

|

|

TransCanada

Corp.

|

30.19B

|

22.74

|

1.96

|

3.80

|

4.23%

|

|

|

The

Dow Chemical Company

|

38.21B

|

39.94

|

2.25

|

0.68

|

3.96%

|

|

|

Kraft

Foods Group, Inc.

|

31.86B

|

23.50

|

8.52

|

1.73

|

3.72%

|

|

|

Nucor

Corporation

|

13.74B

|

31.03

|

1.82

|

0.73

|

3.41%

|

|

|

Avalonbay

Communities Inc.

|

15.98B

|

62.40

|

1.85

|

14.47

|

3.21%

|

|

|

Staples,

Inc.

|

10.10B

|

-

|

1.66

|

0.42

|

3.12%

|

|

|

Edison

International

|

15.05B

|

9.64

|

1.58

|

1.25

|

2.92%

|

|

|

Xerox

Corp.

|

10.97B

|

9.73

|

0.95

|

0.49

|

2.57%

|

|

|

Wipro

Ltd.

|

19.38B

|

18.53

|

3.96

|

3.07

|

2.56%

|

|

|

Deere

& Company

|

31.53B

|

9.96

|

3.81

|

0.84

|

2.52%

|

|

|

Agrium

Inc.

|

12.58B

|

8.86

|

1.81

|

0.77

|

2.37%

|

|

|

Illinois

Tool Works Inc.

|

30.33B

|

12.57

|

2.95

|

1.74

|

2.26%

|

|

|

St.

Jude Medical Inc.

|

12.79B

|

18.01

|

3.42

|

2.35

|

2.23%

|

|

|

Western

Digital Corp.

|

13.99B

|

7.43

|

1.66

|

0.85

|

1.71%

|

|

|

Stryker

Corp.

|

24.59B

|

19.80

|

2.91

|

2.83

|

1.64%

|

|

|

Humana

Inc.

|

13.44B

|

9.47

|

1.47

|

0.34

|

1.28%

|

|

|

Canadian

Pacific Railway Limited

|

20.36B

|

38.05

|

3.80

|

3.66

|

1.18%

|

|

|

Zimmer

Holdings, Inc.

|

12.70B

|

17.18

|

2.22

|

2.84

|

1.06%

|

|

|

Danaher

Corp.

|

42.67B

|

17.72

|

2.17

|

2.32

|

Subscribe to:

Comments (Atom)