If you are looking for low-risk low-reward dividend stocks, this article is not for you. However, if you're looking for high-income yields, and risks that are tilted in your favor, then you may want to consider the ideas highlighted in this article.

The ideas span a variety of investment types. REITS, Mortgage Reits and MLPs are a major class that pay high dividends but they are all with high risks.

I love high dividends because you get a nice income and your investment got a fast cash return which you can use for new investment ideas. But high yields shouldn't be the only criteria. Dividend stability is more important to look for.

Without further ado, here are the 17 attractive 10% yield opportunities...

Showing posts with label FTR. Show all posts

Showing posts with label FTR. Show all posts

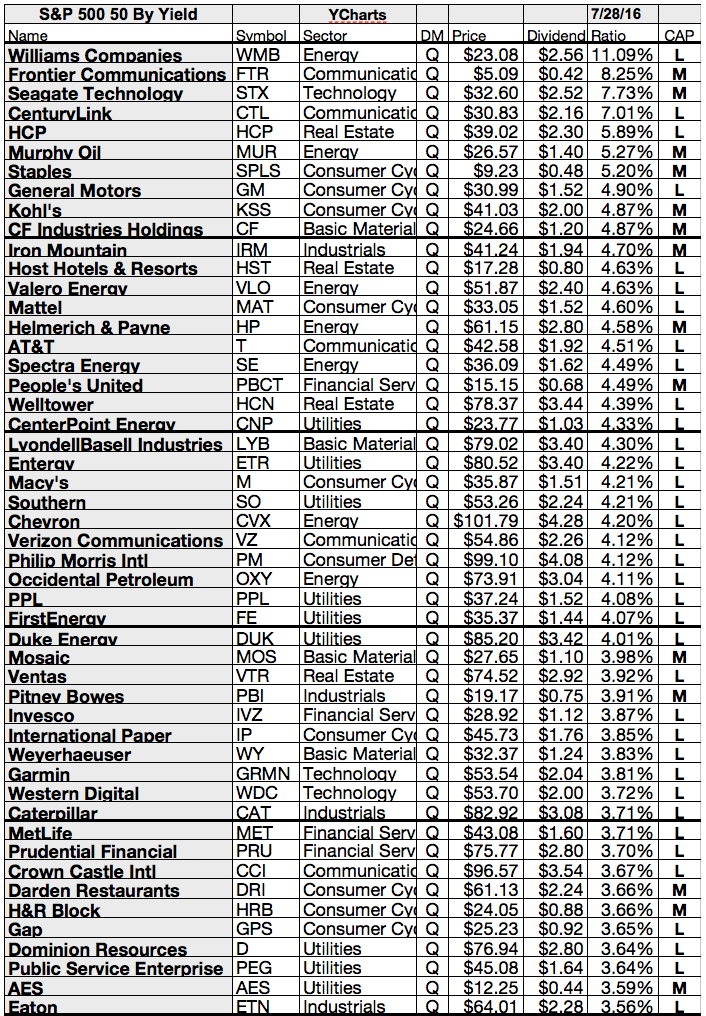

The Highest Yielding S&P 500 And The Dogs of the S&P 500

While you wait—and wait—for the Federal Reserve to raise interest rates, you can collect generous checks by investing in dividend stocks. And you don’t have to wander far to find attractive payers. Just look at Standard & Poor’s 500-stock index.

Of its 500 member companies, 84% pay dividends, up from 75% a decade ago. On top of that, many of the index’s constituents are rewarding shareholders by boosting their payouts; so far this year, 169 S&P companies have done so.

There are stocks on the S&P 500 that pay nearly 10%, but that doesn't make them great investments.

The average stock on the S&P 500 index pays a dividend yield of 2.41%, but some are paying much more. Here's a chart of the 10 highest-paying dividend stocks on the S&P 500, and which ones might be the best choices to buy and hold for the long term.

Here are the highest yielding S&P 500 and the Dogs of the S&P 500...

Of its 500 member companies, 84% pay dividends, up from 75% a decade ago. On top of that, many of the index’s constituents are rewarding shareholders by boosting their payouts; so far this year, 169 S&P companies have done so.

There are stocks on the S&P 500 that pay nearly 10%, but that doesn't make them great investments.

The average stock on the S&P 500 index pays a dividend yield of 2.41%, but some are paying much more. Here's a chart of the 10 highest-paying dividend stocks on the S&P 500, and which ones might be the best choices to buy and hold for the long term.

Here are the highest yielding S&P 500 and the Dogs of the S&P 500...

10 Highest Dividend Stocks on the S&P 500

The average stock on the S&P 500 index pays a dividend yield of 2.41%, but some are paying much more. Here's a chart of the 10 highest-paying dividend stocks on the S&P 500, and which ones might be the best choices to buy and hold for the long term.

Before moving on, it's important to mention that a high dividend doesn't necessarily translate into a good stock to invest in.

For example, Frontier Communications (NASDAQ: FTR), the highest-paying company in the S&P 500, has struggled to turn a profit for several years now. In my opinion, it's at serious risk of a dividend cut in the near future.

With that in mind, there are a few stocks on this list worth buying. Here are my three favorites in no particular order.

These are the results...

Before moving on, it's important to mention that a high dividend doesn't necessarily translate into a good stock to invest in.

For example, Frontier Communications (NASDAQ: FTR), the highest-paying company in the S&P 500, has struggled to turn a profit for several years now. In my opinion, it's at serious risk of a dividend cut in the near future.

With that in mind, there are a few stocks on this list worth buying. Here are my three favorites in no particular order.

These are the results...

9 Domestic Telecom Stocks With Yields Over 3%

Despite the outsized gains by the bond proxy sectors this year, which include telecoms, utilities and real estate investment trusts (REITs), one of those sectors still trades cheap to the S&P 500.

While utilities trade at 17.3 times estimated 2016 earnings and REITs at 18.8, telecoms trade at a low 13.8 times, which is far below the S&P 500 at 16.6%.

In addition, the telecoms have been hit by waves of profit-taking, which have knocked them down into a range that looks inviting.

In an interesting note, RBC makes the case that while the bond proxy stocks are definitely at a premium, as a group they trade in line with the S&P 500.

While acknowledging that they may be more susceptible to rising rates, the firm also cites investor appetite for them when yields remain low, which they could for some time.

We screened for quality telecom stocks that pay solid and dependable dividends. These four look very attractive now.

Here are the results...

While utilities trade at 17.3 times estimated 2016 earnings and REITs at 18.8, telecoms trade at a low 13.8 times, which is far below the S&P 500 at 16.6%.

In addition, the telecoms have been hit by waves of profit-taking, which have knocked them down into a range that looks inviting.

In an interesting note, RBC makes the case that while the bond proxy stocks are definitely at a premium, as a group they trade in line with the S&P 500.

While acknowledging that they may be more susceptible to rising rates, the firm also cites investor appetite for them when yields remain low, which they could for some time.

We screened for quality telecom stocks that pay solid and dependable dividends. These four look very attractive now.

Here are the results...

4 High-Quality Dividend Growth Stocks With Over 5% Yield

It gets harder every day to find quality yield in a world where most people are thinking that the “lower for longer” mantra is starting to become a reality.

They have good reason to think that, because U.S. Treasury rates are among the highest investment grade sovereign debt yields in the world, and the 30-year bond is at a pathetic 2.26%.

Not a very fair return for loaning the government money for 30 years. On this blog we are constantly on the lookout for stocks that pay good dividends, are not horribly overbought and are rated reasonably high by some of the top firms we cover. This week we found four companies that pay at least a 5% yield and are rated Buy.

These are the results...

They have good reason to think that, because U.S. Treasury rates are among the highest investment grade sovereign debt yields in the world, and the 30-year bond is at a pathetic 2.26%.

Not a very fair return for loaning the government money for 30 years. On this blog we are constantly on the lookout for stocks that pay good dividends, are not horribly overbought and are rated reasonably high by some of the top firms we cover. This week we found four companies that pay at least a 5% yield and are rated Buy.

These are the results...

8 Promising & High Yielding Stocks Of The S&P 500

Dividend stocks also suffer from the same macroeconomic forces that are hurting stocks this year. From a stronger dollar to lower oil prices, there’s no shortage of issues to weigh on corporate earnings and revenue.

But there is not everything bad in this world. If you believe the American economy is strong enough and capitalism is working, you should bet on stocks.

Let me mention one thing, stock investing is no game and you should invest your money wisely in order to achieve a solid gain.

High yielding stocks don't provide always a good return. You must be very selective. By selecting stocks only from great indices like the Dow Jones or the S&P 500, you should avoid the big mistakes.

That doesn’t mean that every stock on the list of the S&P 500’s highest-yielding dividend stocks is a dog — just that due diligence is as important as ever. Some of these names have a great track record of dividend payments (and loads of cash flow to boot.) Some are much more risky.

Check out my attached top picks for the moment. I've selected only high yielding stocks with a dividend yield over 5 percent. Do you like some of them? Please let me know your thoughts about the selection. I like to discuss the opportunities and risks from the stocks.

Here are the 8 top picks...

But there is not everything bad in this world. If you believe the American economy is strong enough and capitalism is working, you should bet on stocks.

Let me mention one thing, stock investing is no game and you should invest your money wisely in order to achieve a solid gain.

High yielding stocks don't provide always a good return. You must be very selective. By selecting stocks only from great indices like the Dow Jones or the S&P 500, you should avoid the big mistakes.

That doesn’t mean that every stock on the list of the S&P 500’s highest-yielding dividend stocks is a dog — just that due diligence is as important as ever. Some of these names have a great track record of dividend payments (and loads of cash flow to boot.) Some are much more risky.

Check out my attached top picks for the moment. I've selected only high yielding stocks with a dividend yield over 5 percent. Do you like some of them? Please let me know your thoughts about the selection. I like to discuss the opportunities and risks from the stocks.

Here are the 8 top picks...

Ex-Dividend Stocks: Best Dividend Paying Shares On September 05, 2013

The best yielding and biggest ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 25 stocks go ex dividend

- of which 11 yield more than 3 percent. The average yield amounts to 3.42%.

Here is a full list of all stocks with ex-dividend

date within the current week.

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Frontier

Communications

|

4.34B

|

43.75

|

1.10

|

0.89

|

9.14%

|

|

SeaDrill

Limited

|

22.05B

|

9.92

|

2.97

|

4.56

|

7.49%

|

|

Tower

Group Inc.

|

643.23M

|

-

|

0.54

|

0.33

|

5.35%

|

|

REGAL

ENTERTAINMENT GROUP

|

2.79B

|

23.42

|

-

|

0.96

|

4.66%

|

|

Landauer

Inc.

|

452.13M

|

-

|

7.44

|

3.06

|

4.59%

|

|

Westar

Energy, Inc.

|

3.88B

|

12.82

|

1.32

|

1.66

|

4.46%

|

|

Quad/Graphics,

Inc.

|

1.48B

|

90.29

|

1.29

|

0.34

|

3.80%

|

|

Ensco

plc

|

12.57B

|

9.92

|

1.02

|

2.73

|

3.67%

|

|

SY

Bancorp Inc.

|

377.23M

|

14.13

|

1.71

|

4.39

|

3.01%

|

|

Kaydon

Corporation

|

908.72M

|

-

|

2.68

|

1.97

|

2.80%

|

|

Coach,

Inc.

|

14.97B

|

14.73

|

6.21

|

2.95

|

2.54%

|

|

Lancaster

Colony Corporation

|

1.94B

|

17.86

|

3.88

|

1.67

|

2.25%

|

|

First

American Financial

|

2.34B

|

8.86

|

1.00

|

0.48

|

2.22%

|

|

Becton,

Dickinson and Company

|

18.96B

|

17.47

|

4.02

|

2.39

|

2.03%

|

|

Albany

International Corp.

|

1.02B

|

47.50

|

2.13

|

1.32

|

1.86%

|

|

Canadian

National Railway

|

40.03B

|

16.83

|

3.64

|

4.15

|

1.72%

|

|

Kansas

City Southern

|

11.66B

|

38.82

|

3.67

|

5.12

|

0.81%

|

|

State

Bank Financial Corporation

|

496.98M

|

91.59

|

1.17

|

3.05

|

0.77%

|

|

Fair

Isaac Corp.

|

1.75B

|

21.54

|

3.40

|

2.37

|

0.16%

|

A full list of all stocks from September 05, 2013 can be found here: 5 Top Yielding Ex-Dividend Stocks On September 05, 2013.

12 Stocks With Very High Yields (+10%) And Positive Growth Expectations

10% yielding stocks with future earnings growth originally

published at "long-term-investments.blogspot.com". We all look for high

dividend payments. I for myself am fixed to get a 3 percent return with good long-term

growth perspectives. Others like High-Yields with stable payments.

Today I like to show you the highest yielding stocks

at the market with positive earnings per shares growth for the next five years.

I know, stocks with yields above the 10 percent mark are very risky and they like

to reduce their payments in the future. In order to reduce the risks from lower

capitalized stocks, I selected only those companies with a market cap above 2 billion.

Only 12 companies fulfilled my mentioned criteria

of which five have a current buy or better rating. The results are dominated by

real estate trusts. Annaly Capital Management is still on the list but they needed to cut dividends last week by 11.1 percent from 0.45 to 0.4 cts per share. Die interest rate increase hurts the company.

AT&T: 5.22% Yield From A Leading Telecom Services Company For My Passive Income Portfolio

For readers

who a new to the matter and my dividend growth philosophy: I funded a virtual

portfolio with 100k on October 04, 2012 with the aim to build a passive income

stream that doubles each five to ten years. I plan to purchase each week one

stock holding until the money is fully invested. The total number of

constituents is expected at 50 – 70 companies and the dividend income should be

at least at $3,000 per year.

--------------------------------------

Let’s go

forward. The markets in are in a small turmoil. Bernanke announced to reduce

its quantitative easing at the beginning of autumn this year. The markets were surprised

about the fast mind changing views.

Let me

mention one thing: It’s always good to reduce the artificial influence from national

banks. It’s also good that the Fed is the first institution who sweeps off the enduring

mechanism of programs to improve the economy.

The economy

hasn’t shown bigger growth signals due the Fed stimulus. The only thing that

happens is that the risk of asset bubbles increases rapidly. In order to avoid

future price hikes in special markets, they needed to shut down their expansive

monetary policy.

Last Friday

I bought AT&T shares in an amount of around 1,000 for the Dividend Yield

Passive Income Portfolio. The leading telecom provider yields above the 5

percent mark and is one of the biggest companies in the world with a current

market capitalization of USD 190 billion.

|

| Portfolio Part I (Click to enlarge) |

|

| Portfolio Part II (Click to enlarge) |

|

| Latest Portfolio Transactions (Click to enlarge) |

AT&T provides

telecommunications services to consumers, businesses, and other providers in

the United States and internationally. The company operates in three segments:

Wireless, Wireline, and Other. The Wireless segment offers various wireless

voice and data communication services, including local wireless communications

services, long-distance services, and roaming services. It also sells various

handsets, wirelessly enabled computers, and personal computer wireless data

cards through its owned stores, agents, or third-party retail stores; and

accessories comprising carrying cases, hands-free devices, batteries, battery

chargers, and other items to consumers, as well as to agents and third-party

distributors.

|

| Earnings and Dividend Payments of AT&T |

As you

might have seen, I invest more and more money into telecoms. They are not cheap

but they can give me more stability for my asset allocation. In addition,

telecoms are some of the biggest losers in my portfolio. Maybe I start to

repurchase some shares of China Mobile, Rogers or Tesco if the stock performance

worsens.

I

personally believe that telecoms have a tough fight against falling prices on

higher volumes. They are something like a utility but in my view they have also

a bigger potential than electric or gas utilities. The gird of AT&T is a

real asset and it will grow. For sure this cost a lot of money and will be a

burden of the stock price.

The new

stake will give me around $50 bucks in additional dividend income. For the full

year, the income is now expected at $1,905. The current yield is at 3.33

percent while the yield on cost amounts to 3.5 percent.

The return

of the portfolio was hit badly with the recent sell-off. Because of the high

cash amount of $46.2k it’s still manageable. As of now, the life-to-date performance

is at 3.16%. The stockholdings had a performance of 4.79 percent.

|

| Portfolio Performance (Click to enlarge) |

Here is the income perspective of the portfolio:

|

Sym

|

Name

|

P/E Ratio

|

Dividend Yield

|

|

Buy

|

# Shrs

|

Income

|

Value

|

|

TRI

|

15.43

|

3.97

|

|

28.90

|

50

|

$64.50

|

$1,610.00

|

|

|

LMT

|

Lockheed Martin C

|

12.13

|

4.24

|

|

92.72

|

20

|

$89.00

|

$2,101.20

|

|

INTC

|

Intel Corporation

|

12.09

|

3.66

|

|

21.27

|

50

|

$44.25

|

$1,209.75

|

|

MCD

|

McDonald's Corpor

|

17.95

|

3.11

|

|

87.33

|

15

|

$45.15

|

$1,458.45

|

|

WU

|

Western Union Com

|

9.91

|

2.88

|

|

11.95

|

100

|

$47.50

|

$1,658.00

|

|

PM

|

Philip Morris Int

|

16.66

|

3.88

|

|

85.42

|

20

|

$67.18

|

$1,749.20

|

|

JNJ

|

Johnson & Johnson

|

22.44

|

3.01

|

|

69.19

|

20

|

$49.80

|

$1,664.00

|

|

MO

|

Altria Group Inc

|

15.89

|

5.13

|

|

33.48

|

40

|

$70.40

|

$1,397.20

|

|

SYY

|

Sysco Corporation

|

19.42

|

3.29

|

|

31.65

|

40

|

$44.00

|

$1,347.20

|

|

DRI

|

Darden Restaurant

|

15.62

|

3.9

|

|

46.66

|

30

|

$60.00

|

$1,503.60

|

|

CA

|

CA Inc.

|

13.35

|

3.62

|

|

21.86

|

50

|

$50.00

|

$1,376.00

|

|

PG

|

Procter & Gamble

|

16.86

|

3.04

|

|

68.72

|

25

|

$57.20

|

$1,935.75

|

|

KRFT

|

Kraft Foods Group

|

19.69

|

3.74

|

|

44.41

|

40

|

$80.00

|

$2,138.40

|

|

MAT

|

Mattel Inc.

|

19.14

|

2.93

|

|

36.45

|

40

|

$51.60

|

$1,764.80

|

|

PEP

|

Pepsico Inc. Com

|

20.22

|

2.76

|

|

70.88

|

20

|

$43.60

|

$1,602.60

|

|

KMB

|

Kimberly-Clark Co

|

20.59

|

3.27

|

|

86.82

|

15

|

$46.50

|

$1,436.70

|

|

COP

|

ConocoPhillips Co

|

9.79

|

4.38

|

|

61.06

|

20

|

$52.80

|

$1,207.20

|

|

GIS

|

General Mills In

|

17.66

|

2.74

|

|

42.13

|

30

|

$39.60

|

$1,459.20

|

|

UL

|

Unilever PLC Comm

|

19.83

|

3.24

|

|

39.65

|

35

|

$44.91

|

$1,384.25

|

|

NSRGY

|

NESTLE SA REG SHR

|

18.57

|

3.3

|

|

68.69

|

30

|

$65.31

|

$1,957.20

|

|

GE

|

General Electric

|

17.22

|

3.18

|

|

23.39

|

65

|

$48.10

|

$1,518.40

|

|

ADP

|

Automatic Data Pr

|

23.2

|

1.85

|

|

61.65

|

25

|

$31.63

|

$1,717.00

|

|

K

|

Kellogg Company C

|

24.59

|

2.81

|

|

61.52

|

25

|

$44.00

|

$1,581.25

|

|

KO

|

Coca-Cola Company

|

20.48

|

2.73

|

|

38.83

|

40

|

$42.80

|

$1,590.40

|

|

RTN

|

Raytheon Company

|

11.59

|

3.1

|

|

57.04

|

20

|

$41.00

|

$1,322.20

|

|

RCI

|

Rogers Communicat

|

12.57

|

3.86

|

|

51.06

|

30

|

$49.98

|

$1,328.70

|

|

GPC

|

Genuine Parts Com

|

18.47

|

2.7

|

|

77.06

|

20

|

$41.28

|

$1,526.20

|

|

TSCDY

|

TESCO PLC SPONS A

|

206

|

4.59

|

|

17.98

|

70

|

$49.63

|

$1,084.30

|

|

APD

|

Air Products and

|

16.89

|

2.79

|

|

85.71

|

15

|

$39.45

|

$1,418.85

|

|

GSK

|

GlaxoSmithKline P

|

18.1

|

4.74

|

|

52.16

|

30

|

$70.38

|

$1,473.90

|

|

WMT

|

Wal-Mart Stores

|

14.39

|

2.38

|

|

79.25

|

20

|

$34.72

|

$1,470.20

|

|

BTI

|

British American

|

16.34

|

4

|

|

114.6

|

13

|

$53.82

|

$1,348.75

|

|

CHL

|

China Mobile Limi

|

9.42

|

4.6

|

|

55.32

|

25

|

$54.95

|

$1,237.50

|

|

MMM

|

3M Company Common

|

17.16

|

2.25

|

|

110.27

|

15

|

$36.75

|

$1,643.85

|

|

TUP

|

Tupperware Brands

|

22.05

|

2.57

|

|

80.98

|

15

|

$29.40

|

$1,132.95

|

|

IBM

|

International Bus

|

13.61

|

1.77

|

|

206.35

|

8

|

$28.00

|

$1,563.68

|

|

HAS

|

Hasbro Inc.

|

17.37

|

3.29

|

|

44.09

|

30

|

$43.20

|

$1,330.20

|

|

T

|

AT&T Inc.

|

26.57

|

5.18

|

|

34.47

|

30

|

$53.40

|

$1,034.10

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$1,905.78

|

$57,283.13

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Yield

|

3.33%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yield On Cost

|

3.50%

|

Labels:

ALSK,

AT&T,

BCE,

China Mobile,

CHL,

CTL,

Dividend Champions,

Dividend Growth,

Dividends,

FTR,

High Yield,

Passive Income,

Portfolio Strategies,

Stock Trade Report,

T,

Telecom,

VZ,

WIN

Subscribe to:

Comments (Atom)