Showing posts with label COH. Show all posts

Showing posts with label COH. Show all posts

20 Undervalued Dividend-Paying Stocks

If you are concerned that current valuations may cast a shadow over the future returns of equity-income strategies, you're not alone. There's no telling how long dividend stocks' recent run of outperformance will continue.

But there are plenty of reasons to think that investing in steady dividend-paying stocks, particularly high-quality stocks that are healthy enough to not only sustain but possibly even increase their dividend, won't go out of style completely.

Investors still have need for income, and although interest rates are likely to rise, they are still very low by historical standards and are not expected to shoot up dramatically anytime soon.

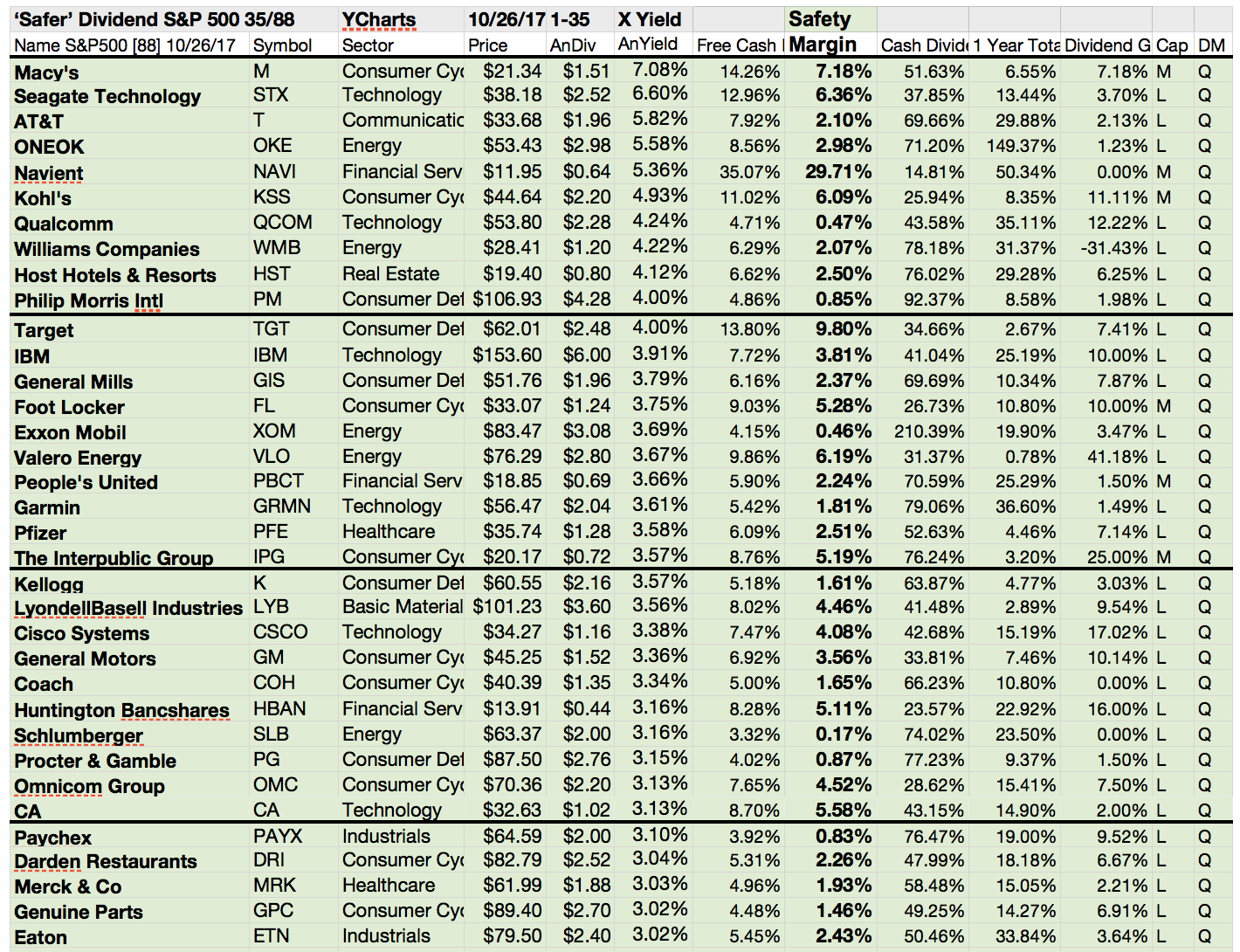

To get a better sense of how over- or undervalued dividend-paying stocks are today, we run a screen with selection of dividend yield, P/E and growth and filtered those stocks with attractive ratios in most of the areas.

Here are the top results from our screen...

But there are plenty of reasons to think that investing in steady dividend-paying stocks, particularly high-quality stocks that are healthy enough to not only sustain but possibly even increase their dividend, won't go out of style completely.

Investors still have need for income, and although interest rates are likely to rise, they are still very low by historical standards and are not expected to shoot up dramatically anytime soon.

To get a better sense of how over- or undervalued dividend-paying stocks are today, we run a screen with selection of dividend yield, P/E and growth and filtered those stocks with attractive ratios in most of the areas.

Here are the top results from our screen...

20 High Yielding Stocks With A Low Risk Profile To Consider

I want to talk today to a specific audience: current or soon-to-be retirees who have done a great job of saving for retirement but don't want to see their nest egg disappear as they enjoy their golden years.

The backbone of any retirement portfolio is a collection of solid, dividend-paying stocks. It's all the better if those stocks are relatively low-risk. Here I'm going to look at three different stocks that are as boring as they get. They deal with soup, jellies, and paint, among other things.

But for low-risk investors, boring is good. And so is an uber-safe dividend payout. Attached you will find a couple of stocks from my safe heaven list, which is basicly focussed on large caps with low beta ratios and high dividend payments, all with a low debt leverage.

These are the 20 highest yielding results...

The backbone of any retirement portfolio is a collection of solid, dividend-paying stocks. It's all the better if those stocks are relatively low-risk. Here I'm going to look at three different stocks that are as boring as they get. They deal with soup, jellies, and paint, among other things.

But for low-risk investors, boring is good. And so is an uber-safe dividend payout. Attached you will find a couple of stocks from my safe heaven list, which is basicly focussed on large caps with low beta ratios and high dividend payments, all with a low debt leverage.

These are the 20 highest yielding results...

Is Traditional Apparel Retailing A Buying Opportunity?

Given the recent negative performance of many apparel retailers and some calls that traditional apparel retailing is dead, we are addressing our thoughts on these issues and discussing which subsectors and companies we see as positioned best for long-term success.

In our opinion, there has been a secular shift in apparel retailing that is a persistent force.

We believe the current trend toward value over brand is here to stay. Unless a product can perform notably better than the competition (keep you warmer, keep you drier, perform better in athletic situations), consumers appear unwilling to pay a premium simply to own a brand.

We also think that shifts in wallet share are here to stay, with experience (travel, restaurants) valued over apparel, and other costs--including healthcare, education, and housing--rising in share.

Finally, we think the shift in distribution channel toward digital will persist.

As a result, we agree that apparel retail growth is not likely to return to historical levels. Having acknowledged that, we do believe that we are at a low point in the apparel retail cycle and there is future upside.

We do not believe brick-and-mortar apparel retailing is dead; however, it will look much different in the future. We think there is a place for stores where consumers can touch fabrics, try sizes, and see fit.

However, the apparel industry has experienced much self-inflicted near-term malaise. Many management teams have been overly optimistic regarding inventory levels and have not converted to more modern, responsive supply chains.

This has resulted in a highly promotional retail environment that has forced even well-run companies to discount to remain competitive. Also, we think we are nearing the end of the athleisure fashion trend.

With consumers having enough skinny and yoga pants to clothe themselves for a while and no new fashion must-haves, nothing is driving discretionary purchases.

Check out a summary of the big fishes in traditional retailing:

In our opinion, there has been a secular shift in apparel retailing that is a persistent force.

We believe the current trend toward value over brand is here to stay. Unless a product can perform notably better than the competition (keep you warmer, keep you drier, perform better in athletic situations), consumers appear unwilling to pay a premium simply to own a brand.

We also think that shifts in wallet share are here to stay, with experience (travel, restaurants) valued over apparel, and other costs--including healthcare, education, and housing--rising in share.

Finally, we think the shift in distribution channel toward digital will persist.

As a result, we agree that apparel retail growth is not likely to return to historical levels. Having acknowledged that, we do believe that we are at a low point in the apparel retail cycle and there is future upside.

We do not believe brick-and-mortar apparel retailing is dead; however, it will look much different in the future. We think there is a place for stores where consumers can touch fabrics, try sizes, and see fit.

However, the apparel industry has experienced much self-inflicted near-term malaise. Many management teams have been overly optimistic regarding inventory levels and have not converted to more modern, responsive supply chains.

This has resulted in a highly promotional retail environment that has forced even well-run companies to discount to remain competitive. Also, we think we are nearing the end of the athleisure fashion trend.

With consumers having enough skinny and yoga pants to clothe themselves for a while and no new fashion must-haves, nothing is driving discretionary purchases.

Check out a summary of the big fishes in traditional retailing:

20 Attactive Low Volatility Consumer Goods Stocks

When I'm thinking about how to arrange a portfolio, I think there is a uniquely human aspect to the process.

The ideal dividend portfolio depends on the risk factors an investor feels comfortable accepting.

After the year is over, any investor can easily see which companies delivered the best returns, but when the period is starting, the goal is for an investor is to be carrying a portfolio that meets their individual objectives.

This piece is going to focus on the dividend champions of the consumer staples sector.

Given the relatively high valuation of the market, I believe it is more rational to focus investments on sectors with less volatility in their ability to generate sales.

Attached you will find a compilation of stocks from the consumer goods sector with solid yields, modest growth predictions and low beta ratios.

These are my favorites...

The ideal dividend portfolio depends on the risk factors an investor feels comfortable accepting.

After the year is over, any investor can easily see which companies delivered the best returns, but when the period is starting, the goal is for an investor is to be carrying a portfolio that meets their individual objectives.

This piece is going to focus on the dividend champions of the consumer staples sector.

Given the relatively high valuation of the market, I believe it is more rational to focus investments on sectors with less volatility in their ability to generate sales.

Attached you will find a compilation of stocks from the consumer goods sector with solid yields, modest growth predictions and low beta ratios.

These are my favorites...

20 Top Picks From My Safe Haven High-Yield Large Cap Screen

Every month, I run a screen to find value stocks with high dividends. Well, it's not easy to find a bargain and if you found a stock that looks like one, you could also wait years until the market detects the value.

Today I like to share a list of 20 stocks with a low beta ratio and yields over 2.77%. You will find the complete list at the end of this article. Below is also a detail view of the top yielding stocks. I hope you will find some values in it.

In addition to the screening criteria, each stock from the screen had a positive sales growth over the past five years while earnings are expected to grow by more than 5% for the next five years.

The debt-to-equity ratio is also under one and the market capitalization over 10 billion USD.

Here are the top yielding results...

Today I like to share a list of 20 stocks with a low beta ratio and yields over 2.77%. You will find the complete list at the end of this article. Below is also a detail view of the top yielding stocks. I hope you will find some values in it.

In addition to the screening criteria, each stock from the screen had a positive sales growth over the past five years while earnings are expected to grow by more than 5% for the next five years.

The debt-to-equity ratio is also under one and the market capitalization over 10 billion USD.

Here are the top yielding results...

20 Best Performing Dividend Stocks Year-To-Date 2016

The

start in the year was not as perfect as we have expected. At the end of last

year, we saw a small bounce back to all-time highs but during the first month

of the year 2016 we saw a small disaster.

The Dow Jones is down 7.29% and the

S&P 500 6.88% for the first 4 weeks of the year. Despite the bad start into

the year, a dozen of stocks gained more than 10 percent.

If this is a small signal for the rest of the year or a simple different reaction, we will see it over the next months.

If this is a small signal for the rest of the year or a simple different reaction, we will see it over the next months.

Today I like to show you the 20 best

performing dividend stocks since the start of the year 2016. They gained from

11.23% to 50.57% in the first 30 days of the year 2016.

Here are the best dividend stocks since

the start of the year 2016...

13 Dividend Income Stocks On Which Dividend Re-Investing Works (Value At Deep Discounts)

My personal

portfolio goal is to create an income stream from dividends paid out by low

risk, financially strong (high-quality) companies. Reinvesting your portfolio

income is also an essential part for your financial freedom.

Reinvesting

your dividends received from high-quality dividend growth stocks is a great,

relatively conservative and proven way to build wealth over the long term.

This is

especially true and appropriate for investors in the accumulation phase that

are planning for future retirement. Accumulating additional shares of dividend

growth stocks can, and will, provide an increasing and eventually larger stream

of income available at retirement when income is needed most.

Attached

you can find a list of stocks that might be interesting for long-term investors

who like to reinvest their dividends in their portfolio while looking at

raising dividends.

My main

focus was on valuation. If you buy a stock at a moderate valuation, your

initial yield should help you to get a solid starting yield.

Every stock

on the attached list has a dividend yield of more than 3 percent.

Debt-to-equity ratio is under 1, EPS growth for the next five years over 5% and

the forward P/E under 15

As a

result, 13 stocks remained on my screen. Some of them might also be

interesting. It's a first step for further research but good to find value

stocks with a decent income as inflation hedge.

Here are 13 top

stocks for re-investing...

14 High-Yielding Value Picks

Value investors are focused on deep values. They can identify values by looking at the cashflows from the company. If they are strong and reliable, there seems to be good values.

What if we combine the value with high yields in the future? I've tried to select several stocks that are classified by Reuters with high yields in the future.

In addition, those stocks have a good finance situation, a very solid and predictable business and comfortable profitability. 14 stocks fulfilled my criteria. Attached is also a sheet of all results with the most important fundamentals.

These are the results....

What if we combine the value with high yields in the future? I've tried to select several stocks that are classified by Reuters with high yields in the future.

In addition, those stocks have a good finance situation, a very solid and predictable business and comfortable profitability. 14 stocks fulfilled my criteria. Attached is also a sheet of all results with the most important fundamentals.

These are the results....

16 Dividend Paying Growth Stocks That Could Double Sales and Income

As a long-term investor, I'm

seeking stocks that grow over the long-term. My optimum case by selecting a

stock is that the company is acting within a positive business environment and

could grow sales over the past decade by around 100 percent.

There are a lot of

companies out there who have doubled sales and over doubled net income within

the recent 10 years. That’s no joke and quiet possible.

Today I like to

show you 16 growth stocks with a good growth history that pay currently solid

dividends and have no or nearly no debt. In addition, analysts predict a 5+

percent EPS growth for the next five years.

I love stocks with

financial flexibility because those stocks have one problem less and could

focus themselves more on business development.

8 Stocks With Nearly Safe Dividends

A good example how debt destroys

the dreams of dividend growth investors is Tesco. The company cut its dividend

payments yesterday by 75 percent.

The major reasons

for the trigger were worsening earnings as well as a high debt burden.

Warren Buffett also bought a small stake in Tesco a few years ago and most of us thought it was a safe haven but as

I saw the huge debt amount of 10 billion British pounds, I was shocked. Am I

wrong? Did I oversee something my analysis? No! Now we see the bitter result of

a weakening business with high debt.

|

| Quick Tesco Income Statement Source: MSN Money |

I personally love

companies with strong growth and low debt ratios. In my blog I've also often

published hundreds of stock ideas and some of them performed very well.

The market is full

of high dividend payer with a big long-term debt portfolio. Below are eight

large cap dividend stocks with very low debt-to-equity ratios.

I've focused my

thoughts on stocks with a yield over 2 percent but you must consider the full

amount of cash which the company owns. The higher the cash per share, the

better the premium you can pay but in the end, it’s the operational business that

drives the stock up or down.

Only a good

growing company with better developing business perspectives can lift up your

asset. I know that it is hard to look into the future and nobody has the

ability to do this but with a small piece of unclouded thoughts, your

investment should become a clear target or trash.

Before we move forward, I have a small pleasure to you: Please share this article to friends who might be interested in this story or give us a facebook like.

Our blog can only exist when we get support from our readers via sharing or donation. Please choose one of these options if you have enjoyed reading this work.

8 solid dividend stocks with very low debt in order to avoid dividend cuts in the future are...

Before we move forward, I have a small pleasure to you: Please share this article to friends who might be interested in this story or give us a facebook like.

Our blog can only exist when we get support from our readers via sharing or donation. Please choose one of these options if you have enjoyed reading this work.

8 solid dividend stocks with very low debt in order to avoid dividend cuts in the future are...

Labels:

ACN,

CAJ,

CHL,

CME,

COH,

Debt Ratio,

Dividends,

Growth,

High Yield,

PAYX,

QCOM,

Safe Haven

Dividends And Growth Combined: 5 Top Stock Picks That Could Outperform The Market

Who’s not dreaming

about a long-term orientated portfolio that increases in value and pays you each

year a higher dividend that beats inflation? I do!

The good think is

that it's possible to create such a big income source with small money. I've

also created a virtual portfolio with income focus in order show how dividend

growth investing can look like.

Back to my daily

stock idea that I often publish on this blog. I've created some ideas what

stocks delivered good returns in the past and can also possibly outperform the

overall market within the next years. It’s a combination of growth and

dividends. These are my main criteria:

- Market cap is

greater than $100 million.

- Dividend yield

is greater than the dividend yield of the industry.

- The payout ratio

is less than 100%.

- Past 5 years

dividend growth rate is bigger than the dividend growth of the industry.

- Average annual

earnings growth estimates for the next 5 years is greater than 10%.

- Past 5 years EPS

growth is greater than the average industry value.

Attached are my

five favorite picks with more fundamentals. The screen delivered some more results like the luxury

brand company Coach, the German industrial conglomerate Siemens or the home

improvement stock Leggett & Platt.

Ex-Dividend Stocks: Best Dividend Paying Shares On September 05, 2013

The best yielding and biggest ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 25 stocks go ex dividend

- of which 11 yield more than 3 percent. The average yield amounts to 3.42%.

Here is a full list of all stocks with ex-dividend

date within the current week.

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Frontier

Communications

|

4.34B

|

43.75

|

1.10

|

0.89

|

9.14%

|

|

SeaDrill

Limited

|

22.05B

|

9.92

|

2.97

|

4.56

|

7.49%

|

|

Tower

Group Inc.

|

643.23M

|

-

|

0.54

|

0.33

|

5.35%

|

|

REGAL

ENTERTAINMENT GROUP

|

2.79B

|

23.42

|

-

|

0.96

|

4.66%

|

|

Landauer

Inc.

|

452.13M

|

-

|

7.44

|

3.06

|

4.59%

|

|

Westar

Energy, Inc.

|

3.88B

|

12.82

|

1.32

|

1.66

|

4.46%

|

|

Quad/Graphics,

Inc.

|

1.48B

|

90.29

|

1.29

|

0.34

|

3.80%

|

|

Ensco

plc

|

12.57B

|

9.92

|

1.02

|

2.73

|

3.67%

|

|

SY

Bancorp Inc.

|

377.23M

|

14.13

|

1.71

|

4.39

|

3.01%

|

|

Kaydon

Corporation

|

908.72M

|

-

|

2.68

|

1.97

|

2.80%

|

|

Coach,

Inc.

|

14.97B

|

14.73

|

6.21

|

2.95

|

2.54%

|

|

Lancaster

Colony Corporation

|

1.94B

|

17.86

|

3.88

|

1.67

|

2.25%

|

|

First

American Financial

|

2.34B

|

8.86

|

1.00

|

0.48

|

2.22%

|

|

Becton,

Dickinson and Company

|

18.96B

|

17.47

|

4.02

|

2.39

|

2.03%

|

|

Albany

International Corp.

|

1.02B

|

47.50

|

2.13

|

1.32

|

1.86%

|

|

Canadian

National Railway

|

40.03B

|

16.83

|

3.64

|

4.15

|

1.72%

|

|

Kansas

City Southern

|

11.66B

|

38.82

|

3.67

|

5.12

|

0.81%

|

|

State

Bank Financial Corporation

|

496.98M

|

91.59

|

1.17

|

3.05

|

0.77%

|

|

Fair

Isaac Corp.

|

1.75B

|

21.54

|

3.40

|

2.37

|

0.16%

|

A full list of all stocks from September 05, 2013 can be found here: 5 Top Yielding Ex-Dividend Stocks On September 05, 2013.

Next Week's 20 Top Yielding Ex-Dividend Shares

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 127 stocks go ex dividend

- of which 39 yield more than 3 percent. The average yield amounts to 4.32%.

Here is a full list of all stocks with ex-dividend

date within the upcoming week.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

Telefonica

Brasil, S.A.

|

22.16B

|

12.57

|

1.17

|

1.51

|

7.81%

|

|

|

Reynolds

American Inc.

|

26.02B

|

17.32

|

5.11

|

3.15

|

5.29%

|

|

|

PPL

Corporation

|

18.11B

|

12.38

|

1.66

|

1.57

|

4.79%

|

|

|

Public Service Enterprise Group

|

16.40B

|

13.45

|

1.48

|

1.66

|

4.44%

|

|

|

TELUS

Corporation

|

20.06B

|

16.45

|

2.83

|

1.88

|

4.29%

|

|

|

BHP

Billiton plc

|

154.58B

|

14.27

|

2.19

|

2.34

|

3.93%

|

|

|

Dominion

Resources, Inc.

|

33.73B

|

104.20

|

3.07

|

2.58

|

3.86%

|

|

|

CNOOC

Ltd.

|

89.52B

|

8.30

|

1.66

|

2.04

|

3.70%

|

|

|

Waste

Management, Inc.

|

18.92B

|

22.22

|

2.91

|

1.38

|

3.61%

|

|

|

BHP

Billiton Ltd.

|

168.42B

|

15.55

|

2.38

|

2.55

|

3.60%

|

|

|

Ensco

plc

|

12.82B

|

10.12

|

1.04

|

2.78

|

3.60%

|

|

|

Kimberly-Clark

Corporation

|

35.96B

|

19.89

|

8.22

|

1.70

|

3.47%

|

|

|

Banco

Bradesco S.A.

|

48.69B

|

9.85

|

1.51

|

2.41

|

3.44%

|

|

|

Newmont

Mining Corp.

|

15.79B

|

-

|

1.41

|

1.73

|

3.15%

|

|

|

Occidental

Petroleum

|

71.00B

|

16.10

|

1.70

|

2.93

|

2.90%

|

|

|

Pepsico,

Inc.

|

123.42B

|

18.80

|

5.45

|

1.87

|

2.85%

|

|

|

Baxter

International Inc.

|

37.77B

|

17.30

|

5.19

|

2.63

|

2.82%

|

|

|

Genuine

Parts Company

|

11.94B

|

17.31

|

3.88

|

0.89

|

2.79%

|

|

|

Banco

Bradesco S.A.

|

59.85B

|

10.56

|

1.85

|

2.37

|

2.60%

|

|

|

Coach,

Inc.

|

14.87B

|

14.63

|

6.17

|

2.93

|

2.56%

|

Subscribe to:

Comments (Atom)