While technology does not contain many of the highest-yielding dividend stocks, some of the fastest-growing dividend stocks (both in dividend growth and actual growth) can be found in this dynamic sector.

In fact, many large technology companies are in the sweet spot for dividend growth. That’s because their maturing, cash-rich business models allow for management to spend a little less on research and development, and more on returning capital to shareholders — in the form of rising dividends, of course.

Each of the tech stocks on this list have high Dividend Safety Scores, solid track records of paying higher dividends and healthy outlooks for future dividend growth. In fact, almost all of these businesses have grown their payouts by at least 10% annually in recent years, and one is set to join the elite ranks of the Dividend Aristocrats next year.

In order of yield, here are the 10 best dividend stocks in tech right now.

Showing posts with label NTAP. Show all posts

Showing posts with label NTAP. Show all posts

My Favorite Dividend Paying Buyback Hero Stocks

As you might know, I am a big fan of dividend growth and stock buybacks. Each action is a shareholder friendly way to give money back to the owner of the company.

Dividends are direct and share buybacks are indirect and more tax efficient. Both activities only make sense if the management team has a clear view about the valuation and growth perspectives or potential of the corporation. If there is an opportunity to grow with low risk, dividends shouldn't be paid in a big way. The same is neccessary for buybacks. There must be a mix of both in balance with growth.

Today I like to share a sheet of interesting stocks with good outstanding buyback programs. I've focused my research on growth and dividends while the valuation level doesn't exceed critical levels.

Here are my results...

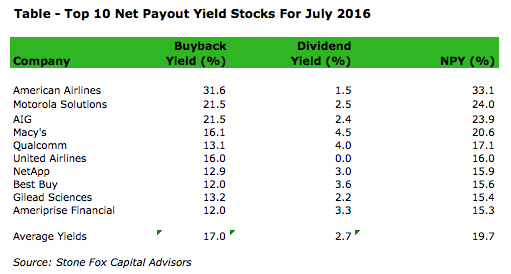

10 Top Stocks With The Highest Shareholder Yield In The S&P 500

Dividends are good but they need to be paid from real earnings. Sometimes, companies pay more than they have on their bank accounts due to growth costs or reinvestments.

You will also find often stocks that pay only a small amount of their annual income back to shareholders.

Good companies with no growth costs will consider paying the rest of the income via share buybacks.

Within the financial scene we discuss the theme shareholder yield, a ratio that quantifies the dividend yield and buyback yield as a whole.

It's quite simple, the bigger the shareholder yield, the more money being paid back to the owners of the company.

Attached you will find the 10 stocks with the highest shareholder yield of the current month.

These are the results...

You will also find often stocks that pay only a small amount of their annual income back to shareholders.

Good companies with no growth costs will consider paying the rest of the income via share buybacks.

Within the financial scene we discuss the theme shareholder yield, a ratio that quantifies the dividend yield and buyback yield as a whole.

It's quite simple, the bigger the shareholder yield, the more money being paid back to the owners of the company.

Attached you will find the 10 stocks with the highest shareholder yield of the current month.

These are the results...

10 Best Stocks By Shareholder Yield As Of June 2016

The top 10 list saw very minor shifts for June typical of the months when a limited amount of quarterly updates exist on stock buybacks.

In fact, no stock shifted more than one spot on the list with American Airlines topping the list for a second consecutive month.

With the increased position of United Airlines, the list is now highly focused on the airline, technology, and financial sectors. The average yield gained without any new company joining the list due in part to the monthly loss. The amazing part is that the top four yielding stocks exceed 20% yields.

These are the 10 Top stocks by net payout yield as of June 2016...

In fact, no stock shifted more than one spot on the list with American Airlines topping the list for a second consecutive month.

With the increased position of United Airlines, the list is now highly focused on the airline, technology, and financial sectors. The average yield gained without any new company joining the list due in part to the monthly loss. The amazing part is that the top four yielding stocks exceed 20% yields.

These are the 10 Top stocks by net payout yield as of June 2016...

The Best Dividend Ideas From The Buyback Achievers Index

There are a number of ways in which a company can return wealth to its shareholders.

Although stock price appreciation and dividends are the two most common ways of doing this, there are other useful, and often overlooked, ways for companies to share their wealth with investors: Dividends and share buybacks.

Buybacks is one way to build values for investors. It's a kind of income usage. Buying back own shares increases future eps when the net income is constant.

Today I would like to introduce a number of stocks with interesting fundamentals and price ratios that have bought own shares in a significant amount back.

Each of the attached stocks have fulfilled all of the following criteria:

- Share reduction over the past year over 5%

- Forward P/E under 15

- Debt-to-equity under 1

- Positive ROA

- EPS growth for the next five years over 5%

- Dividend yield at least 2%

Here are the results...

Although stock price appreciation and dividends are the two most common ways of doing this, there are other useful, and often overlooked, ways for companies to share their wealth with investors: Dividends and share buybacks.

Buybacks is one way to build values for investors. It's a kind of income usage. Buying back own shares increases future eps when the net income is constant.

Today I would like to introduce a number of stocks with interesting fundamentals and price ratios that have bought own shares in a significant amount back.

Each of the attached stocks have fulfilled all of the following criteria:

- Share reduction over the past year over 5%

- Forward P/E under 15

- Debt-to-equity under 1

- Positive ROA

- EPS growth for the next five years over 5%

- Dividend yield at least 2%

Here are the results...

A List Of The Top Dividend Payer From The Nasdaq 100

You might not think of “Nasdaq” as synonymous with big dividends. The Nasdaq Composite index, which essentially consists of every domestic and foreign stock that trades on the exchange, has long been heavy on technology.

And technology companies have historically shown a bias for reinvesting their profits to finance future growth, rather than returning cash to shareholders. None of the FANGs — Facebook (symbol FB), Amazon.com (AMZN), Netflix (NFLX) and Google (GOOGL), now called Alphabet — pays a dividend but delivered one of the best returns in the past decade.

But dividends could give you a small hedge if a new game changer destroys the business model.

If you own a great Amazon or Facebook for a decade and you don't get money from them, you might be happy for a while if your stock positing skyrocked but what if your investment comes back to your initial investment amount? Right, you have nothing earned. That's the reason why dividends matter.

I've attached a list of the highest yielding stocks from the Nasdaq 100. If you like my news and dividend yield lists, you can easily subscribe my daily dividend newsletter for free. Just put your email in the subscription box and confirm the first mail.

And technology companies have historically shown a bias for reinvesting their profits to finance future growth, rather than returning cash to shareholders. None of the FANGs — Facebook (symbol FB), Amazon.com (AMZN), Netflix (NFLX) and Google (GOOGL), now called Alphabet — pays a dividend but delivered one of the best returns in the past decade.

But dividends could give you a small hedge if a new game changer destroys the business model.

If you own a great Amazon or Facebook for a decade and you don't get money from them, you might be happy for a while if your stock positing skyrocked but what if your investment comes back to your initial investment amount? Right, you have nothing earned. That's the reason why dividends matter.

I've attached a list of the highest yielding stocks from the Nasdaq 100. If you like my news and dividend yield lists, you can easily subscribe my daily dividend newsletter for free. Just put your email in the subscription box and confirm the first mail.

20 Stocks With Sustainable Dividend Growth Potential And Yields Up To 5.17%

Did you ever wonder why some companies pay dividends while others don't?

There are several factors that influence whether or not a company pays a dividend and how much it chooses to pay.

While there are too many possible factors to list here, these are some of the most influential.

- Payout Ratio

- Debt Level

- Growth (growing profits)

- Economic Environment

- Busines Model

- Less need of investment

Dividend payments are very complicated. These are a few hundrets that pay dividends regular over decades. A fewer number of stocks have grown dividends over decades.

Income stability is one of the top factors in determining dividend policies. Specifically, established companies with stable, predictable income streams are more likely to pay dividends than companies with growing or volatile income.

Newer and rapidly growing companies rarely pay dividends, as they prefer to invest their profits back into the company to fuel even more future growth. And, companies with unstable revenue streams often choose not to pay dividends, or pay small dividends in order to make sure the payout will be sustainable.

It looks terrible to investors when companies are forced to suspend or reduce dividend payments, so most like to err on the side of caution when deciding to implement a new dividend, waiting for several years of stable profits before doing so.

I think that a comibation of dividend growth on a sustainable dividend output could give all interest groups of the company large benefits.

Attached I've compiled a couple of great dividend stocks with a big potential to hike dividends in the future.

Here are my 10 favorite stocks from the screen in detail...

There are several factors that influence whether or not a company pays a dividend and how much it chooses to pay.

While there are too many possible factors to list here, these are some of the most influential.

- Payout Ratio

- Debt Level

- Growth (growing profits)

- Economic Environment

- Busines Model

- Less need of investment

Dividend payments are very complicated. These are a few hundrets that pay dividends regular over decades. A fewer number of stocks have grown dividends over decades.

Income stability is one of the top factors in determining dividend policies. Specifically, established companies with stable, predictable income streams are more likely to pay dividends than companies with growing or volatile income.

Newer and rapidly growing companies rarely pay dividends, as they prefer to invest their profits back into the company to fuel even more future growth. And, companies with unstable revenue streams often choose not to pay dividends, or pay small dividends in order to make sure the payout will be sustainable.

It looks terrible to investors when companies are forced to suspend or reduce dividend payments, so most like to err on the side of caution when deciding to implement a new dividend, waiting for several years of stable profits before doing so.

I think that a comibation of dividend growth on a sustainable dividend output could give all interest groups of the company large benefits.

Attached I've compiled a couple of great dividend stocks with a big potential to hike dividends in the future.

Here are my 10 favorite stocks from the screen in detail...

The Best Portfolio Of Cloud Storage Stocks And Which The Best Dividends Pay

The forecasts for burgeoning industries including the cloud and the Internet of Things (IoT) vary, but the common theme is undeniable: We are in the early stages of what are quickly becoming game-changing markets. The two cutting-edge technologies share a common thread: IoT amasses almost unfathomable amounts of data, while the cloud is the primary means of storing it.

If you are interested in technology stocks with focus on modern themes like cloud computing or social media, you should look at the following selection of stocks from the cloud storage industry.

Over the past decade, stocks from the portfolio generated a total return of 18.83% yearly. In 2014 alone, the return of the dividend paying stocks was 27.2%. Today it would deliver an inital yield of 2.77%. In 2005, the inital yield was only at 0.56%.

Even as cloud technologies and services remain in their early stages, it has become abundantly clear that revenue -- at least significant revenue -- is not going to come from hosting. Many of the big-time cloud providers have essentially made cloud data hosting a commodity, which is ideal for Microsoft and other companies from the field.

Here are the top yielding stocks...

If you are interested in technology stocks with focus on modern themes like cloud computing or social media, you should look at the following selection of stocks from the cloud storage industry.

Over the past decade, stocks from the portfolio generated a total return of 18.83% yearly. In 2014 alone, the return of the dividend paying stocks was 27.2%. Today it would deliver an inital yield of 2.77%. In 2005, the inital yield was only at 0.56%.

Even as cloud technologies and services remain in their early stages, it has become abundantly clear that revenue -- at least significant revenue -- is not going to come from hosting. Many of the big-time cloud providers have essentially made cloud data hosting a commodity, which is ideal for Microsoft and other companies from the field.

Here are the top yielding stocks...

Ex-Dividend Dogs Of The Next Week

Attached is a sheet of higher capitalized ex-dividend stocks with a cheap forward P/E. Potash, AT&T, GAP, Cisco and Comcast are my favorites.

The initial yield of the 20 top yielding cheap ex-dividend stocks starts at 3.56% and ends at 14.35%.

Here are the results. Please let me know if you have some comments about the list. Do you like some of the ex-dividend dogs?

The initial yield of the 20 top yielding cheap ex-dividend stocks starts at 3.56% and ends at 14.35%.

Here are the results. Please let me know if you have some comments about the list. Do you like some of the ex-dividend dogs?

|

| Ex-Dividend Dogs Of The Next Week October 05 - 11, 2015 (click to enlarge) |

7 Of The Most Underestimated Dividend Stocks

It's hard to define a solid

investing criterion which could bring you solid gains while excluding the big

risks.

I personally

believe in dividends as a safe haven criteria because cash you have received in the past could

compensate a potential loss.

For sure, this is not a good return driver,

especially when we are talking about yields of 1-2 percent yearly, but each

penny sums to dollars if you compile enough of them.

Today I run my

daily screen about cheap dividend paying stocks with double-digit earnings growth

forecasts for the next five years.

In addition, the stocks have a very

comfortable debt situation, measured by a debt-to-equity ratio of less than

0.5.

These are my

favorites from the screening results:

Ex-Dividend Stocks: Best Dividend Paying Shares On October 17, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 13 stocks go ex dividend

- of which 2 yield more than 3 percent. Here is a full list of all stocks with ex-dividend

date within the current week.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stock:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Dorchester

Minerals LP

|

745.40M

|

18.41

|

6.68

|

11.47

|

6.50%

|

|

Main

Street Capital Corporation

|

1.05B

|

9.56

|

1.59

|

10.19

|

6.39%

|

|

Caterpillar

Inc.

|

55.73B

|

13.53

|

3.16

|

0.92

|

2.80%

|

|

McGrath

Rentcorp

|

887.90M

|

20.48

|

2.29

|

2.35

|

2.74%

|

|

RPM

International Inc.

|

4.77B

|

29.26

|

3.96

|

1.14

|

2.44%

|

|

WD-40

Company

|

1.01B

|

25.43

|

5.57

|

2.81

|

1.90%

|

|

Hormel

Foods Corp.

|

11.27B

|

22.91

|

3.70

|

1.31

|

1.60%

|

|

CVS

Caremark Corporation

|

72.47B

|

17.47

|

1.86

|

0.59

|

1.52%

|

|

NetApp,

Inc.

|

14.28B

|

28.46

|

3.55

|

2.23

|

1.47%

|

|

Home Federal Bancorp of Louisiana

|

35.55M

|

12.89

|

0.85

|

2.69

|

1.43%

|

|

Graco

Inc.

|

4.68B

|

25.11

|

8.36

|

4.40

|

1.31%

|

|

CR

Bard Inc.

|

9.45B

|

56.41

|

6.05

|

3.17

|

0.71%

|

Next Week's Top Yielding Ex-Dividend Shares

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading week.

In total, 37 stocks go ex dividend

- of which 8 yield more than 3 percent. Here is a full list of all stocks with ex-dividend

date within the upcoming week.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Senior

Housing Properties Trust

|

4.55B

|

31.82

|

1.62

|

6.26

|

6.45%

|

|

Vale

S.A.

|

79.93B

|

19.15

|

1.14

|

1.71

|

4.84%

|

|

Cracker Barrel Old Country Store

|

2.51B

|

21.56

|

5.19

|

0.95

|

2.84%

|

|

Foot

Locker, Inc.

|

4.91B

|

12.13

|

2.03

|

0.78

|

2.43%

|

|

Colgate-Palmolive

Co.

|

57.34B

|

25.71

|

37.47

|

3.32

|

2.21%

|

|

Franco-Nevada

Corporation

|

6.02B

|

78.85

|

1.96

|

14.29

|

1.76%

|

|

Hormel

Foods Corp.

|

11.40B

|

23.17

|

3.74

|

1.33

|

1.58%

|

|

CVS

Caremark Corporation

|

73.09B

|

17.62

|

1.88

|

0.59

|

1.51%

|

|

NetApp,

Inc.

|

14.59B

|

29.07

|

3.63

|

2.28

|

1.44%

|

|

Pall

Corp.

|

8.66B

|

26.77

|

4.77

|

3.27

|

1.43%

|

|

Graco

Inc.

|

4.65B

|

24.94

|

8.31

|

4.37

|

1.32%

|

|

Thor

Industries Inc.

|

3.05B

|

20.13

|

3.42

|

0.94

|

1.25%

|

|

Apache

Corp.

|

34.48B

|

13.96

|

1.09

|

2.02

|

0.91%

|

|

HB

Fuller Co.

|

2.28B

|

23.59

|

2.72

|

1.13

|

0.87%

|

|

PerkinElmer

Inc.

|

4.16B

|

59.14

|

2.24

|

1.95

|

0.75%

|

|

Acuity

Brands, Inc.

|

4.15B

|

33.04

|

4.17

|

1.99

|

0.53%

|

|

Lennar

Corp.

|

6.64B

|

17.59

|

1.85

|

1.24

|

0.46%

|

|

EOG

Resources, Inc.

|

48.33B

|

48.77

|

3.36

|

3.67

|

0.42%

|

Subscribe to:

Comments (Atom)