|

| Source: Seeking Alpha |

Showing posts with label CBRL. Show all posts

Showing posts with label CBRL. Show all posts

20 Best Dividend Paying Restaurants

Restaurant stocks are a little risky, since they're subject to food scares, seasons and recessions, but they're fun, especially if they have dividends.

Yet some analysts are predicting a bear market will impact restaurant stocks in the near future, since consumers cut their discretionary dining budgets when times are tight.

The sector is on the front lines when the bear market appears. But others say the public might head toward affordable food, so restaurants with lower priced menus might do well. And, with consumer confidence in July at one of the highest points since the recovery, at 97, and unemployment claims so low, these may be signals of a healthy economy.

Making income through dividend investing involves searching for solid companies that have a good chance of increasing the dividend year after year. As the company's sales and profits grow, dividends usually grow also, and the money you make can be reinvested or used as cash.

Attached you will find a list of all dividend payers in the restaurant business.

Here are the best dividend paying restaurants on the market...

Yet some analysts are predicting a bear market will impact restaurant stocks in the near future, since consumers cut their discretionary dining budgets when times are tight.

The sector is on the front lines when the bear market appears. But others say the public might head toward affordable food, so restaurants with lower priced menus might do well. And, with consumer confidence in July at one of the highest points since the recovery, at 97, and unemployment claims so low, these may be signals of a healthy economy.

Making income through dividend investing involves searching for solid companies that have a good chance of increasing the dividend year after year. As the company's sales and profits grow, dividends usually grow also, and the money you make can be reinvested or used as cash.

Attached you will find a list of all dividend payers in the restaurant business.

Here are the best dividend paying restaurants on the market...

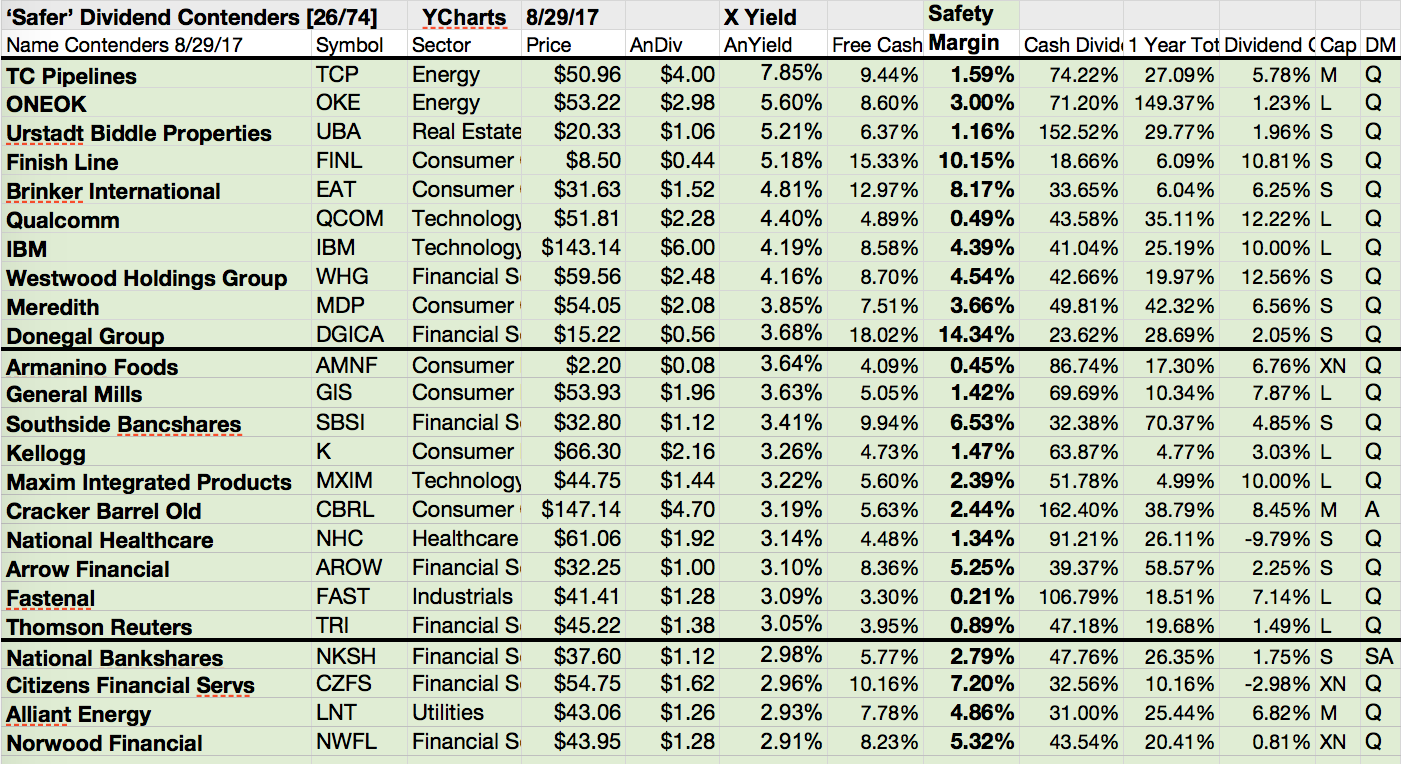

Which Stocks To Buy In Market Corrections - 40 Best Dividend Growth Ideas Now!

When the market falls, it tends to drag everything down -- good or bad companies. I think that companies that have increased their dividends by 10% or higher in the last 10-years should be considered good companies.

When the market falls, it tends to drag everything down -- good or bad companies. I think that companies that have increased their dividends by 10% or higher in the last 10-years should be considered good companies. One way to combat the market downturn is to buy high growth dividend-growth companies that are fairly valued or undervalued.

These companies are expected to grow earnings per share at a rate higher than 5% in the foreseeable future and have a history of increasing dividends with payout ratios of less than 60%.

In addition, I like to invest into low leveraged companies. If rates rise or money is needed for investments, the company doesn’t need to raise capital. It's also a hedge for rising dividends.

I also look for stocks with a midcap market valuation or higher. I love the diversification and developed status of those companies.

63 stocks fulfilled my criteria. I like to show you only the 20 best yielding. Half of them have a beta higher than the market. They seem to be more risky.

For safe heaven investors, I also attached a list of the 20 best yielding stocks with a beta below one. Hope you have some fun by discovering the lists. If you like my work, please subscribe to my free newsletter by leaving your email in the right box above. Thank you for reading.

These are the results...

These 7 Dividend Growth Stocks Pay Your Investment In 9 To 13 Years Back

Companies with a very short payback are often troubled or have been highly discounted due to the market’s lack of faith in them. At the other extreme, do you really want to wait 30, 40 or 50 years to earn back your initial investment?

As a compromise, a 9 to 13 year payback should be acceptable for most long-term investors. Once you earn back your investment, some might say you are in a no-lose situation. I wouldn’t go quite that far, but you have found an investment that that has provided you a good historical revenue stream, and hopefully it will continue to do so in the future.

Attached you can find 7 dividend growth stocks with a 9 to 13 year payback (at the current yield and dividend growth rate) and a yield between 2.5% to 6.0%.

A combined portfolio delivered a total return of 25% in 2014. At the end of the article, you can find more about this fact.

As a compromise, a 9 to 13 year payback should be acceptable for most long-term investors. Once you earn back your investment, some might say you are in a no-lose situation. I wouldn’t go quite that far, but you have found an investment that that has provided you a good historical revenue stream, and hopefully it will continue to do so in the future.

Attached you can find 7 dividend growth stocks with a 9 to 13 year payback (at the current yield and dividend growth rate) and a yield between 2.5% to 6.0%.

A combined portfolio delivered a total return of 25% in 2014. At the end of the article, you can find more about this fact.

Here are the results....

5 Best Stocks For Retirement Investors (Yield And Value)

If you are in retirement, it’s important to have multiple income streams, such as Social Security and savings and investments you built up on your own. For the lucky, there are pensions, but those are fast disappearing. Investing in stocks that pay a dividend is another way to generate income while you're in retirement.

Dividend stocks offer investors an attractive alternative to traditional fixed-income investments. Dividend-paying stocks have the potential to generate income in two ways: first, through the regular dividend payment, and second, through potential appreciation of the stock price itself. Investors can expect to receive an annual dividend ranging from 2.5 percent to 3 percent of the stock’s value.

Below is a selection of stocks with solid yields that could be interesting for traders and investors.

Here are the detailed results...

Dividend stocks offer investors an attractive alternative to traditional fixed-income investments. Dividend-paying stocks have the potential to generate income in two ways: first, through the regular dividend payment, and second, through potential appreciation of the stock price itself. Investors can expect to receive an annual dividend ranging from 2.5 percent to 3 percent of the stock’s value.

Below is a selection of stocks with solid yields that could be interesting for traders and investors.

Here are the detailed results...

6 Mid Capitalized Dividend Achievers For Growth And Income Seeking Investors

Recently, I wrote about foreign small cap dividend stocks with growth potential. Small- and midcaps offer investors a higher opportunity because sales could grow faster from a low basis.

But there is no free lunch. Those stocks are also much riskier than large caps. Generally, smaller cap securities are more volatile, but often offer a higher rate of return over the long-term.

Today I like to show you 6 small and mid capitalized stocks form the Dividend Achievers list that have risen dividends over more than 10 years in a row.

But there is no free lunch. Those stocks are also much riskier than large caps. Generally, smaller cap securities are more volatile, but often offer a higher rate of return over the long-term.

Today I like to show you 6 small and mid capitalized stocks form the Dividend Achievers list that have risen dividends over more than 10 years in a row.

These are the results:

Labels:

CBRL,

CINF,

CLX,

Dividend Champions,

Dividend Contenders,

Dividend Growth,

Dividends,

GPC,

Growth,

HAS,

International Dividend Achievers,

Midcaps,

SJM

13 Fastest Growing Restaurant Dividend Stocks By EPS

13 Fastest Growing Restaurant Dividend Stocks By EPS originally appeard on long-term-investments. American's restaurant operators are

very competitive and offer real values for dividend investors.

Some stocks from the sector hit

recently All-Time highs and they are steadily growing.

Today I would like

to highlight some of the best dividend paying growth picks from the restaurant

industry.

Below I've

highlighted those stocks with the highest expected EPS growth for the next five

years.

Here are the 5 Top

results in detail and eight summarized in a table below...

7 Top Dividend Growth And Share Buyback Stocks Of The Week

As you might have noticed, my blog covers dividend growth stocks and companies with fresh stock buyback announcements.

It's not a real investment strategy but both are activities for investors.

You can find each week a list of all dividend growth stocks and share buyback companies on this site. It's the only source who compiles this on the internet.

Within the past week, only eight companies raised their dividend payments and additional nine stocks announced a stock buyback program.

It's not a real investment strategy but both are activities for investors.

You can find each week a list of all dividend growth stocks and share buyback companies on this site. It's the only source who compiles this on the internet.

Within the past week, only eight companies raised their dividend payments and additional nine stocks announced a stock buyback program.

Both are

shareholder-friendly activities which could be helpful for normal investors

like me and you.

Back to dividend

growth: No large-cap stock was in the list of the latest dividend grower. The

biggest fish in the pool was the insurer American Financial Group who raised

dividends by 13.64 percent.

7 of my favorite dividend growth stocks and share buyback announcements of the past week are...

Ex-Dividend Stocks: Best Dividend Paying Shares On October 16, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 19 stocks go ex dividend

- of which 3 yield more than 3 percent. Here is a full list of all stocks with ex-dividend

date within the current week.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stock:

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

Physicians

Realty Trust

|

154.20M

|

-

|

8.45

|

11.77

|

7.00%

|

|

|

Comtech

Telecommunications

|

450.48M

|

28.86

|

1.11

|

1.41

|

4.01%

|

|

|

Bridge

Bancorp, Inc.

|

204.44M

|

15.59

|

1.74

|

3.69

|

3.99%

|

|

|

Friedman

Industries Inc.

|

68.81M

|

14.25

|

1.09

|

0.54

|

3.16%

|

|

|

Procter

& Gamble Co.

|

216.24B

|

20.40

|

3.23

|

2.57

|

3.06%

|

|

|

Cracker Barrel Old Country Store

|

2.53B

|

21.67

|

5.22

|

0.96

|

2.83%

|

|

|

Foot

Locker, Inc.

|

4.92B

|

12.14

|

2.03

|

0.78

|

2.43%

|

|

|

US

Ecology, Inc.

|

567.30M

|

20.69

|

4.66

|

3.07

|

2.34%

|

|

|

Luxfer

Holdings PLC

|

477.00M

|

12.02

|

4.38

|

0.97

|

2.25%

|

|

|

Bon-Ton

Stores Inc.

|

203.14M

|

151.50

|

4.09

|

0.07

|

1.89%

|

|

|

Resource

America, Inc.

|

182.67M

|

-

|

1.24

|

2.90

|

1.78%

|

|

|

Pall

Corp.

|

8.69B

|

26.88

|

4.79

|

3.28

|

1.42%

|

|

|

Thor

Industries Inc.

|

3.08B

|

20.32

|

3.45

|

0.95

|

1.24%

|

|

|

Oxford

Industries Inc.

|

1.13B

|

30.16

|

4.56

|

1.27

|

1.05%

|

|

|

PerkinElmer

Inc.

|

4.15B

|

59.10

|

2.23

|

1.95

|

0.75%

|

|

|

Core

Laboratories NV

|

8.04B

|

36.40

|

44.41

|

7.85

|

0.73%

|

|

|

Acuity

Brands, Inc.

|

4.20B

|

33.45

|

4.23

|

2.01

|

0.53%

|

|

|

Lennar

Corp.

|

6.55B

|

17.69

|

1.76

|

1.22

|

0.47%

|

Next Week's Top Yielding Ex-Dividend Shares

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading week.

In total, 37 stocks go ex dividend

- of which 8 yield more than 3 percent. Here is a full list of all stocks with ex-dividend

date within the upcoming week.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Senior

Housing Properties Trust

|

4.55B

|

31.82

|

1.62

|

6.26

|

6.45%

|

|

Vale

S.A.

|

79.93B

|

19.15

|

1.14

|

1.71

|

4.84%

|

|

Cracker Barrel Old Country Store

|

2.51B

|

21.56

|

5.19

|

0.95

|

2.84%

|

|

Foot

Locker, Inc.

|

4.91B

|

12.13

|

2.03

|

0.78

|

2.43%

|

|

Colgate-Palmolive

Co.

|

57.34B

|

25.71

|

37.47

|

3.32

|

2.21%

|

|

Franco-Nevada

Corporation

|

6.02B

|

78.85

|

1.96

|

14.29

|

1.76%

|

|

Hormel

Foods Corp.

|

11.40B

|

23.17

|

3.74

|

1.33

|

1.58%

|

|

CVS

Caremark Corporation

|

73.09B

|

17.62

|

1.88

|

0.59

|

1.51%

|

|

NetApp,

Inc.

|

14.59B

|

29.07

|

3.63

|

2.28

|

1.44%

|

|

Pall

Corp.

|

8.66B

|

26.77

|

4.77

|

3.27

|

1.43%

|

|

Graco

Inc.

|

4.65B

|

24.94

|

8.31

|

4.37

|

1.32%

|

|

Thor

Industries Inc.

|

3.05B

|

20.13

|

3.42

|

0.94

|

1.25%

|

|

Apache

Corp.

|

34.48B

|

13.96

|

1.09

|

2.02

|

0.91%

|

|

HB

Fuller Co.

|

2.28B

|

23.59

|

2.72

|

1.13

|

0.87%

|

|

PerkinElmer

Inc.

|

4.16B

|

59.14

|

2.24

|

1.95

|

0.75%

|

|

Acuity

Brands, Inc.

|

4.15B

|

33.04

|

4.17

|

1.99

|

0.53%

|

|

Lennar

Corp.

|

6.64B

|

17.59

|

1.85

|

1.24

|

0.46%

|

|

EOG

Resources, Inc.

|

48.33B

|

48.77

|

3.36

|

3.67

|

0.42%

|

Subscribe to:

Comments (Atom)