Apple has tons of cash, right, but the technology giant also owns massive debt.

If you subtract those burdens from the cash account, you see that Apples cash is much smaller as many might think. A useful way to evalueate this problem is to calculate the cash-to-debt ratio.

Cash To Debt Ratio compares a company's operating cash flow to its total debt, which, for purposes of this ratio, is defined as the sum of short-term borrowings, the current portion of long-term debt and long-term debt.

This ratio provides an indication of a company's ability to cover total debt with its yearly cash flow from operations. The higher the percentage ratio, the better the company's ability to carry its total debt.

Attached I've made the effort to select those stocks from the S&P 500 with the lowest cash to debt ratio.

These are the 10 stocks with the lowest ratio...

Showing posts with label JBHT. Show all posts

Showing posts with label JBHT. Show all posts

19 Dividend Contenders With The Highest Potential To Double Dividends

Dividend stocks can be the foundation of a great retirement portfolio. Not only do the payments put money in your pocket, which can help hedge against any dips in the stock market, but they're usually a sign of a financially sound company.

Dividends also give investors a painless opportunity to reinvest in a stock, thus compounding gains over time. However, not all income stocks live up to their full potential.

Using the payout ratio -- i.e., the percentage of profits a company returns to its shareholders as dividends -- we can get a good bead on whether a company has room to increase its dividend. Ideally, we like to see healthy payout ratios less than 30%.

Attached you will find those Dividend Contenders with the highest possibility to raise dividends by more than 100% for the years to come.

Each of the stocks fulfilled the following criteria:

- Dividend Growth over 10 consecutive years and less than 25 years

- Payout Ratio under 30%

- Debt to Equity under 0.5

- EPS Growth for the next five years expected at 5% yearly.

19 stocks fulfilled the above mentioned criteria of which 12 got a buy or better rating by analysts.

Here are the best yielding results in detail...

Dividends also give investors a painless opportunity to reinvest in a stock, thus compounding gains over time. However, not all income stocks live up to their full potential.

Using the payout ratio -- i.e., the percentage of profits a company returns to its shareholders as dividends -- we can get a good bead on whether a company has room to increase its dividend. Ideally, we like to see healthy payout ratios less than 30%.

Attached you will find those Dividend Contenders with the highest possibility to raise dividends by more than 100% for the years to come.

Each of the stocks fulfilled the following criteria:

- Dividend Growth over 10 consecutive years and less than 25 years

- Payout Ratio under 30%

- Debt to Equity under 0.5

- EPS Growth for the next five years expected at 5% yearly.

19 stocks fulfilled the above mentioned criteria of which 12 got a buy or better rating by analysts.

Here are the best yielding results in detail...

20 Low Yielding Dividend Achievers That Might Deliver A Better Total Return Than High-Yield Stocks

This

blog is mainly focused on high-quality dividend paying stocks that delivered a

solid trustful dividend growth history in the past.

This

blog is mainly focused on high-quality dividend paying stocks that delivered a

solid trustful dividend growth history in the past.

I'm also focused on higher yielding stocks because I

do believe that those companies offer a better risk compensation and their

business model allows it to generate a higher amount of free cash which could

be distributed to shareholders.

But you need to look more into the balance sheets and

income statements of a company in order to identify such a cash flow strength.

A high yield doesn't mean that you will also get a high total return. If you get big dividends but the stock price falls, your return will turn negative.

A high yield doesn't mean that you will also get a high total return. If you get big dividends but the stock price falls, your return will turn negative.

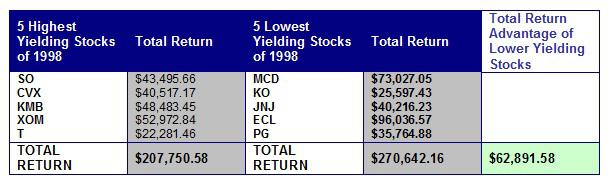

The attached chart spells out the cost to the investor of focusing on yield over a long period of investing history.

Investors who emphasized yield when purchasing stocks from this group of beloved cherry-picked Dividend Growth stocks missed out on earning the equivalent of a year's worth of a nice middle-class salary over the 18 years studied here.

You might see that a portfolio with lower yielding stocks delivered more total return due to a larger stock price appreciation than higher yielding stocks with lower growth possibilities.

Today I would like to introduce a few lower yielding Dividend Achievers with a fantastic future prediction. The attached list ranks midcap plus Dividend Achievers by its future EPS growth forecast. Only stocks with a debt to equity ratio under 1 were observed.

Here are the 20 top results, sorted by growth...

|

| 20 Low Yielding Dividend Achievers That Might Deliver A Better Total Return Than High-Yield Stocks (click to enlarge) |

These Dividend Contenders May Rise Dividends Within The Next 3 Months

Recently, I wrote about DividendChampions that may rise dividends within the next 3 months in order to keep

their status as dividend grower alive.

It's fantstic to know what companies should hike it's dividends because the current yields are so low that each investor get tears in his eyes.

A potential dividend hike could lift the current dividend yield on a new level.

Today I like to

introduce some Dividend Contenders with potential to hike dividends over the

next quarter. As a result, I found 20 companies; nine of them yield over 3

percent.

Dividend Growth is a wonderful investing space on which I personally spend a lot of time.

I love it to see dividends grow but it's only possible if a company grows and has low debt ratios.

These are my 6 highlights...

15 Dividend Contenders With Over 20% Return on Equity and Return on Investment

Dividend

growth stocks with very high returns on equity and returns on investment

originally published at long-term-investments.blogspot.com. A solid investment

delivers also solid returns over the time. Dividend growth is not the only

criteria for a good investment. There are also many dividend growth stocks outside

with low or negative return on investments and return on equity ratios.

Today I screened the Dividend Contenders Database by stocks with high return ratios. I fixed the 20 percent level in order to get the best results.

Only 15 companies fulfilled both, a return on equity as well as a return on investment over 20 percent. The difference between those two ratios is that the return on investment does not include the leverage effect. A corporate with high debts will automatically generate high returns on equity. The second ratio is a performance measure that looks only at the investment by dividing the investment return by the costs of the investment.

One High-Yield is below the results and 10 stocks got a buy or better rating by brokerage firms. Leverage is the key for high returns in my screen. As you might see in the attached sheet, the debt ratios are modestly high but in the end, the investor will pay a higher price for a leveraged company.

Today I screened the Dividend Contenders Database by stocks with high return ratios. I fixed the 20 percent level in order to get the best results.

Only 15 companies fulfilled both, a return on equity as well as a return on investment over 20 percent. The difference between those two ratios is that the return on investment does not include the leverage effect. A corporate with high debts will automatically generate high returns on equity. The second ratio is a performance measure that looks only at the investment by dividing the investment return by the costs of the investment.

One High-Yield is below the results and 10 stocks got a buy or better rating by brokerage firms. Leverage is the key for high returns in my screen. As you might see in the attached sheet, the debt ratios are modestly high but in the end, the investor will pay a higher price for a leveraged company.

Labels:

ARLP,

Debt Ratio,

Dividend Contenders,

Dividend Growth,

ERIE,

FDS,

IBM,

JBHT,

LLTC,

LMT,

MSFT,

NUS,

NVO,

PII,

Return on Equity,

Return on Investment,

RHI,

ROL,

ROST,

TJX

Stocks With Dividend Growth From Last Week 5/2012

Stocks With Biggest Dividend Hikes From Last Week by Dividend Yield – Stock, Capital, Investment. Here is a current sheet of companies that have announced a dividend increase within the recent week. In total, 31 stocks and funds raised dividends of which 23 have a dividend growth of more than 10 percent. The average dividend growth amounts to 24.69 percent. The biggest hike was announced by Blackstone Group (BX). The company raised dividends from $0.1 to $0.22, representing a growth of 120 percent. The highest yielding stock is Pitney Bowes (PBI) who offers a yield of 7.67 percent. The new dividend yield is now 7.8 percent.

Subscribe to:

Comments (Atom)