Dear Reader, find below a list of The Top Yielding Canadian Dividend Growth Stocks For October 2019. I used the Wallmine Stock Screener to get these results.

For more details about the screening results or stocks, please check out the Wallmine Stock Screener here. There is a free sign-in for new members to check your favorite stocks and for looking how the screener is working. It's the best fundamental screener I've seen for years.

----

Creating such high-quality content is hard work and takes a lot of time. You might have noticed that we don't display ads or get paid for our posts. We deliver this information to you for free and acting independent.

To keep this blog running free without ads, we need your help. For a small donation by using this link or clicking the paypal donation button below, you can help us to keep this blog alive. It would be great if you support us on a monthly basis.

Showing posts with label AI. Show all posts

Showing posts with label AI. Show all posts

Cheap And High Yielding Stocks From The NYSE - #Buckeye #Norbord #Cypress #Avianca

Dear Reader, find below a list of Cheap And High Yielding Stocks From The NYSE. Creating such high-quality content is hard work and takes a lot of time. You might have noticed that we don't display ads or get paid for our posts. We deliver this information to you for free.

To keep this blog running free without ads, we need your help. For a small donation by using this link or clicking the paypal donation button below, you can help us to keep this blog alive.

As gift for your support, we send you our full Dividend Growth Stock Factbook Collection with over 800+ long-term dividend growth stocks in PDF and Excel. You can also join our distribution list to receive these tools every month.

Here is an example of our open Excel Database for your own research:

Get our Database now for a small donation to keep this blog working. Thank you so much for supporting us!

To keep this blog running free without ads, we need your help. For a small donation by using this link or clicking the paypal donation button below, you can help us to keep this blog alive.

As gift for your support, we send you our full Dividend Growth Stock Factbook Collection with over 800+ long-term dividend growth stocks in PDF and Excel. You can also join our distribution list to receive these tools every month.

Here is an example of our open Excel Database for your own research:

| Ticker | Company | P/E | Fwd P/E | P/S | P/B | Dividend | Price | Target Price |

| OSB | Norbord Inc. | 4.1 | 7.39 | 0.93 | 1.90 | 52.33% | 26.37 | 35.18 |

| HCLP | Hi-Crush Partners LP | 4.24 | 3.9 | 0.94 | 0.91 | 33.86% | 8.86 | 15.20 |

| NAP | Navios Maritime Midstream Partners L.P. | - | 4.58 | 0.59 | 0.23 | 21.10% | 2.37 | 4.75 |

| NNA | Navios Maritime Acquisition Corporation | - | 5.47 | 0.3 | 0.14 | 20.91% | 0.38 | 1.00 |

| AI | Arlington Asset Investment Corp. | - | 4.53 | 2.69 | 0.8 | 17.69% | 8.48 | 10.33 |

| SMLP | Summit Midstream Partners, LP | - | 12.41 | 2.24 | 1.19 | 15.57% | 14.77 | 18.40 |

| BCRH | Blue Capital Reinsurance Holdings Ltd. | - | 8.63 | 1.59 | 0.58 | 14.63% | 8.20 | 13.00 |

| BPL | Buckeye Partners, L.P. | 11.43 | 11.13 | 1.28 | 1.11 | 14.63% | 34.52 | 39.85 |

| AVH | Avianca Holdings S.A. | - | 3.37 | 0.05 | 0.58 | 14.15% | 5.44 | 7.69 |

| EARN | Ellington Residential Mortgage REIT | 27.7 | 9.36 | 2.56 | 0.77 | 13.95% | 10.61 | 11.25 |

| ORC | Orchid Island Capital, Inc. | - | 4.6 | 5.74 | 0.89 | 13.91% | 6.90 | 8.25 |

| ECC | Eagle Point Credit Company Inc. | 10.46 | 9.21 | 5.49 | 1.05 | 13.86% | 17.32 | 20.38 |

| USDP | USD Partners LP | 12.28 | 12.08 | 2.37 | 3.52 | 13.67% | 10.39 | 12.00 |

| CELP | Cypress Energy Partners, L.P. | 9.47 | 7.02 | 0.26 | 2.39 | 13.44% | 6.25 | 7.67 |

| CVRR | CVR Refining, LP | 9.25 | 5.45 | 0.45 | 2.06 | 13.36% | 19.16 | 22.00 |

| MBT | Public Joint-Stock Company Mobile TeleSystems | 9.2 | 8.2 | 1.2 | 4.88 | 13.10% | 8.40 | 11.08 |

| PRT | PermRock Royalty Trust | - | 5.95 | - | 1.57 | 13.06% | 12.02 | 18.75 |

| EEP | Enbridge Energy Partners, L.P. | 18.78 | 14.14 | 1.51 | 3.17 | 12.81% | 10.93 | 11.93 |

| ANH | Anworth Mortgage Asset Corporation | 14.06 | 9.89 | 2.76 | 0.82 | 12.73% | 4.40 | 4.75 |

| WMC | Western Asset Mortgage Capital Corporation | 6.14 | 7.84 | 2.54 | 0.89 | 12.55% | 9.88 | 9.00 |

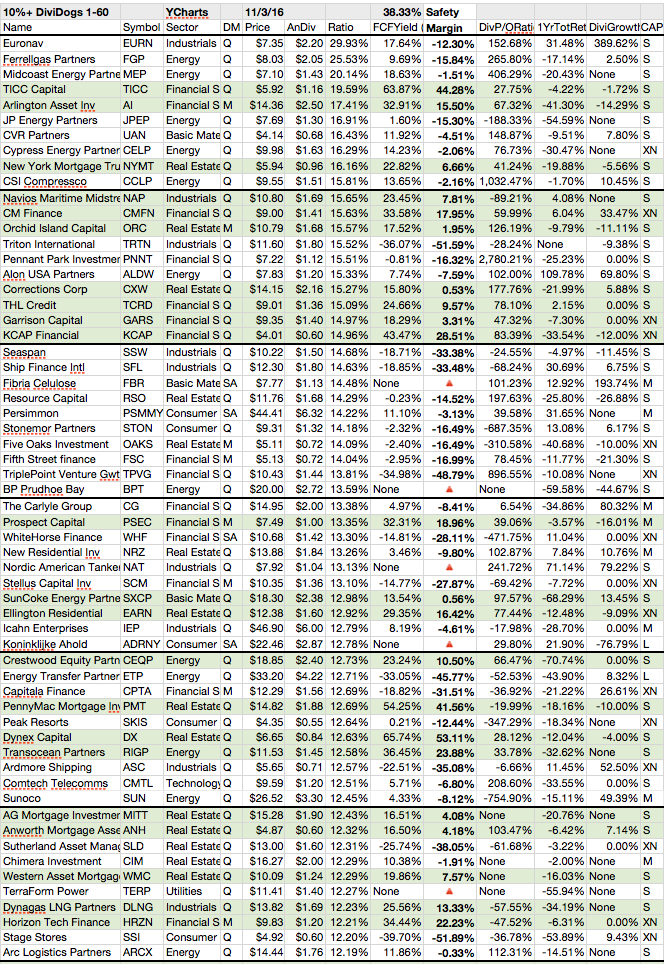

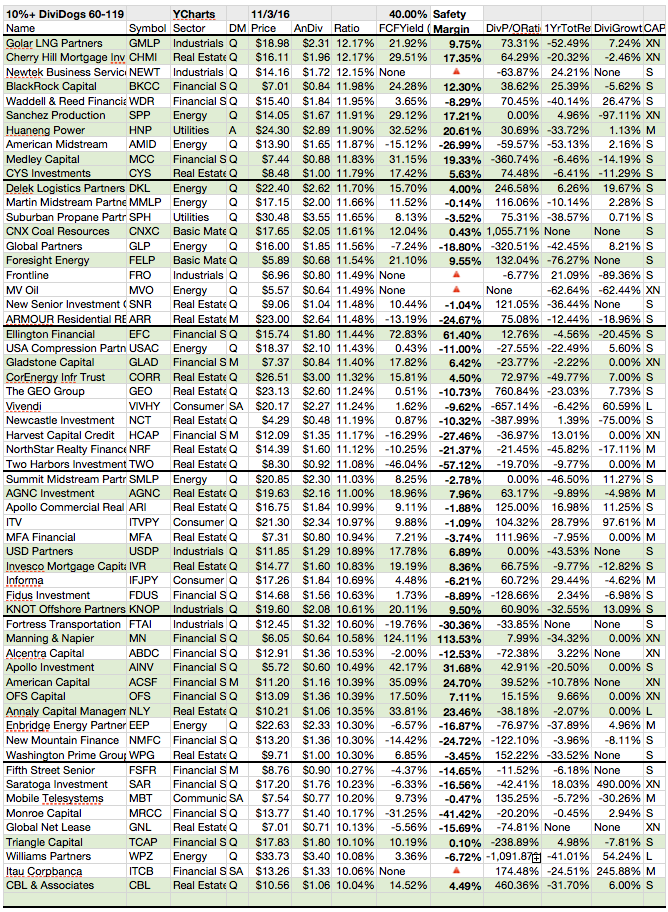

100 Stocks With Dividend Yields Over 10%

Please find attached the latest Yield Factbook of stocks with dividend yields over 10%. There is a lot of trash on the market and several stocks are close to cut their payment. Check it out if it helps you to find essential information. If you like to receive those books with fresh updates direct to your e-mail, please make a small donation to support our work. Thank you.

This is only a small part of the full Dividend Yield Investor Fact Book Package. The full package contains excel sheets of essential financial ratios from all 113 Dividend Champions (over 25 years of constant dividend growth) and 204 Dividend Contenders (10 to 24 years of consecutive dividend growth). It's an open version, so you can work with it very easily.

A small donation from you can help me to develop this books and improve the quality of the work. Together we can make the world a better and smarter place. A place with no information advantage between poor and rich persons who have enough budget to buy the expensive data from Reuters and Bloomberg.

As a gift, you will get the Dividend Yield Investor Fact Book Package each month. This compilation contains the following books and one Excel Sheet with financial ratios form all Dividend Champions and Dividend Contenders. Here is what you get for your donation:

- Foreign Yield Fact Book (updated weekly)

- Dividend Growth Stock Fact Book (updated

monthly)

- 10 Percent Yielding Stock Compilation (updated weekly)

- Dividend Growth Excel Sheet (updated

weekly)

These books and Excel Sheets are regular updated and keeps you up-to date with current yield figures from the best Dividend Growth Stocks.

Every donation, even a tiny one, helps us to keep this blog free available for everyone. Help us to support people with no income or big budget to get free and easy information on the web.

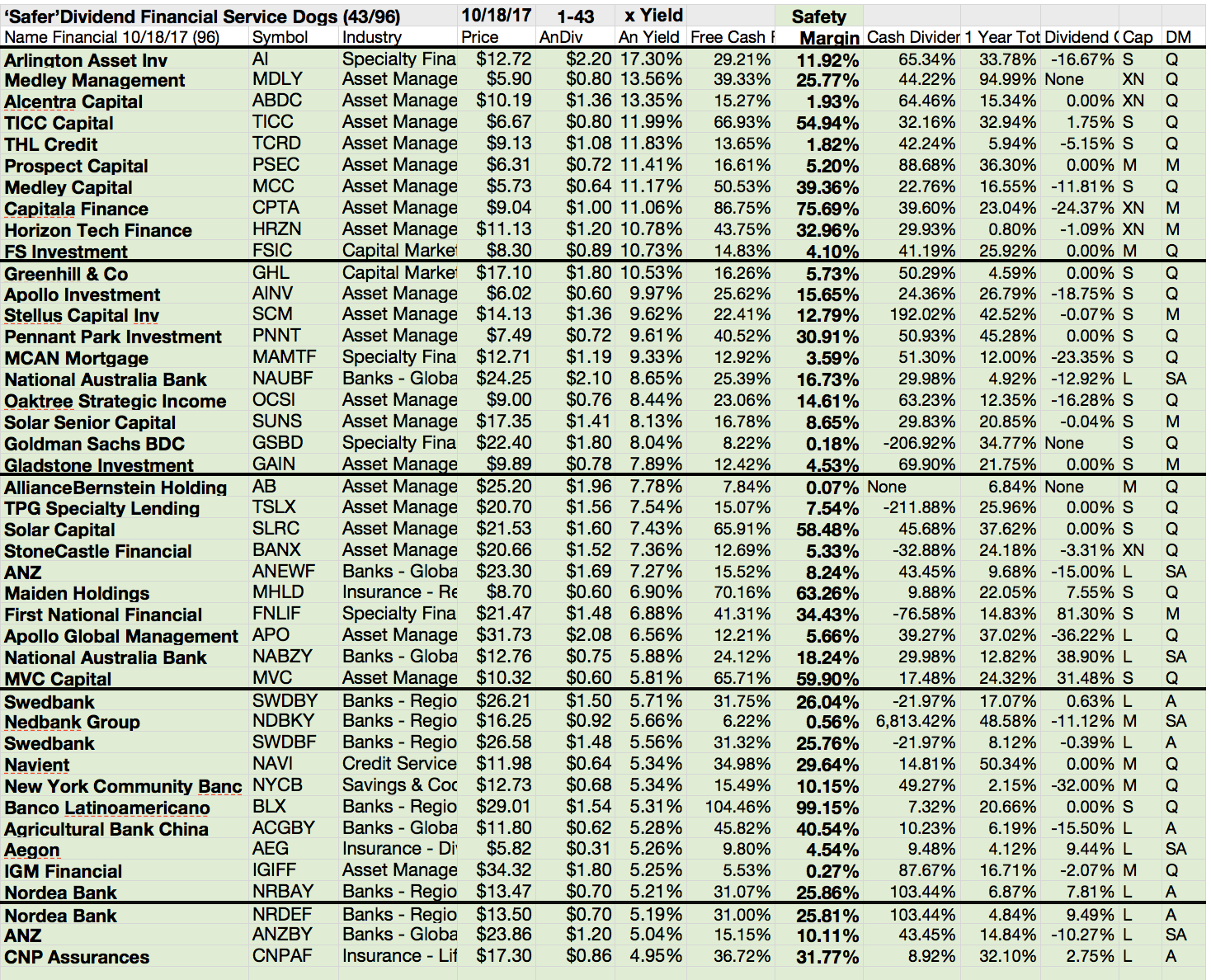

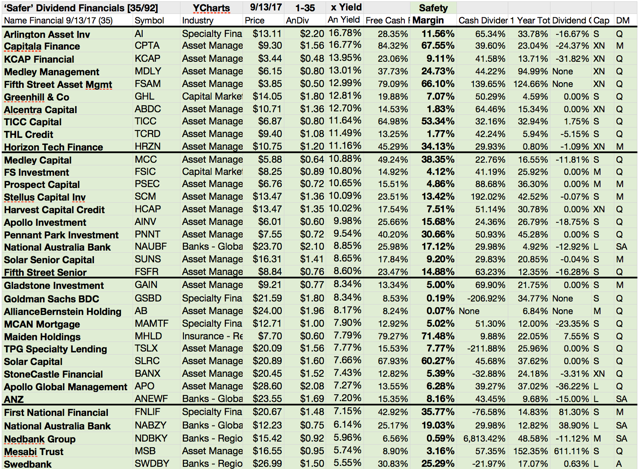

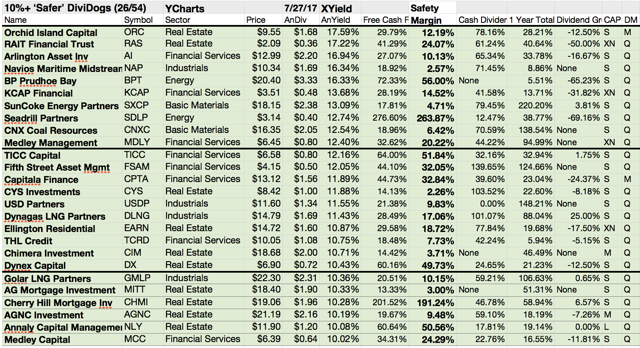

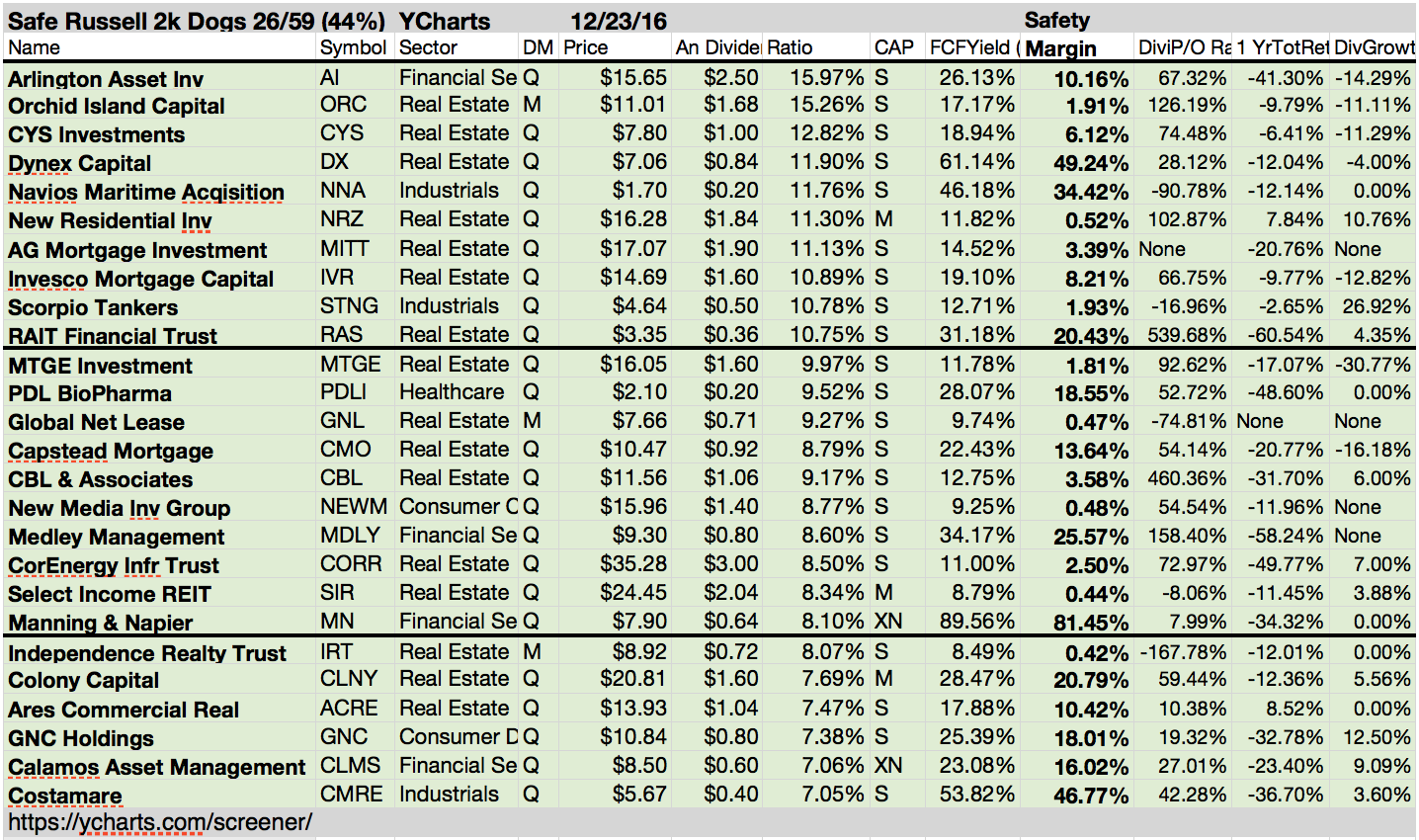

Here is a view of the content tables:

Thank you very much for your help. Thank YOU, it's a great pleasure!!!

4 Dividend Payer With 10% Yields And Promising Fundamentals

Big dividends are dead? No, I don't

think so. Despite the fact that the FED and other national banks killed the

interest rates, there are still high and stable dividend payments.

Today I like to

focus my thoughts on higher risk stocks with bigger dividends. Those stocks

have a really low market capitalization, a high payout ratio and cheap valuation.

As a result, dividend yield ratios explode. Attached is a list of the top 20 results by yield who met my criteria.

As a result, dividend yield ratios explode. Attached is a list of the top 20 results by yield who met my criteria.

These are my

criteria in detail:

- Market Cap over

$300 million

- Positive 5Y

Earnings Growth Forecast

- Low Forward P/E

- Debt/Equity

under 0.5

- Buy Rating from

Analysts

These are the 5

top yielding results...

Labels:

AI,

Cheap Stock,

CYS,

Debt Ratio,

Dividends,

DX,

Growth,

High Yield,

Midcaps,

PMT,

PZN,

Small Cap,

VIV

17 High Yields With Additional Potential To Grow Dividends

High yielding stocks with low payout and debt

ratios originally published at "long-term-investments.blogspot.com". Yesterday, I made a

screen of Dividend Contenders with low long-term debt to equity ratios as well

as slim payouts.

Today I like to widen the latest screen to High-Yields

with a market capitalization over USD 300 million. Most of the high yielding

stocks are full of debt. The only companies with a smaller amount of loans are such with a lower

capitalization. The risks are much higher for those shares. I also needed to

lower my screening guidance because of the small amount of results. These are

my new criteria:

- Market Capitalization over USD 300 million

- Dividend Yield over 5 percent

- Long-term debt to equity above 0.6

- Payout ratio under 50 percent

9 High-Yield Stocks With Strong Buy Rating

High yielding dividend paying stocks with

strongest buy rating originally published at "long-term-investments.blogspot.com". I'm often asked if I

would recommend to buy high-yielding stocks. I answer them that it makes sense

to buy stocks with a yield over five percent but don’t expect that they will

pay the dividend to the end of your lifetime and don’t expect that they will

hike their payments each year or with a higher growth rate.

I personally bought several high yielding stocks

around the world and nearly each investment was a disaster. Sure I also made some profits with stocks from the tobacco industry but they were the only investment ideas that worked

for me. If I draw a line and make a calculation about my High-Yield activities,

it would result in a very bad performance. That is my personal experience with

the investment category.

Stocks with a higher yield are risky but it

makes sense to look for them. Today I like to discover the most recommended

High-Yields with a market capitalization over USD 300 million. Nine companies

with a yield over 5 percent have a strong buy rating.

12 Highest Dividend Paying Mortgage Stocks

Stocks from the mortgage investment industry

with highest dividend yields originally published at "long-term-investments.blogspot.com".

The mortgage investment industry is a very complex looking investment field. Many people lost huge amounts of money during the financial crises if they were invested in this area. But the industry is also liquid for traders and has some of the best yielding stocks on the market. The mortgage industry is small but is still one of the highest dividend paying industries within the financial sector.

The mortgage investment industry is a very complex looking investment field. Many people lost huge amounts of money during the financial crises if they were invested in this area. But the industry is also liquid for traders and has some of the best yielding stocks on the market. The mortgage industry is small but is still one of the highest dividend paying industries within the financial sector.

The average industry yield amounts to 4.66

percent and the P/E ratio is at 15.10. With a recovering house market, mortgage

firms see improvements of their accounted assets. Everything goes slowly but I

believe that the turnaround is definitely done.

12 listed mortgage firms pay dividends to

investors. Five of them have an actual dividend yield of more than 10 percent

and 10 are currently recommended to buy. Most stocks from the results are lower

capitalized. Its very risky to put money into those stocks. Linked is a list of

the 12 highest dividend paying stocks from the mortgage industry.

5 Valuable High Dividend Yield Stocks

The following article was provided by our guest author Richard from Dividend Investor. We publish the article because we think it contains much value for our readers.

High dividend yield stocks are stocks

that consistently pay a high dividend yield average of any chosen standard.

How can you choose high dividend yield stocks?

- First you should decide your goal and

according to them do research on stocks by stock screener or brokerage web

sites.

- Then research the performance of the

company like their past few years’ achievements. Analyze the trend of market or

market price.

- Next step should be to look into the

dividend yield. Dividend yield is dividing the amount of dividend paid by the

price. The best dividend yield rate is from 5% to 10%.

- After that set the goal on the number

of shares, which we you want to buy. If you have more shares, you get more

dividends. Well, the number of shares is dependent on your available funds.

However, it is good to diversify the shares you are to investing in – may be

two or three companies.

Arlington asset investment (NYSE:AI): - It is a publicly traded

investment firm which acquires and holds mortgage related assets. It’s also

acquire residential mortgage securities issued by U.S. government agencies,

U.S. government sponsored agencies and private organizations. It has a low

trailing P/E ratio of 1.37, the payout ratio is 23.2% and dividend yield is

13.63%.

AT & T Inc. (NYSE:T): - it is a holding company provider

of telecommunications services in the U.S. and all over the world. Its serves

wireless communications, local exchange services and long-distance services.

Generally, it works in four segments: Wireless, Wire line, Advertising

Solutions and Other. It has P/E been 29.20, EPS IS 1.21 and dividend yield is

5.08%.

3M Company (NYSE:MMM): - It is a diversified global company that provides products in

different sectors like electronics, health care, industrial, consumer, office,

telecommunications, safety & security and other markets via coatings,

sealants, adhesives, and other chemical additives. This is showing improvement

in four major geographical areas: U.S., Asia-Pacific, and Latin America/Canada.

In 2013 it will prove beneficial in U.S., China and Japan. This is a good

company with a better future. It has forward P/E ratio is 13.52, PEG ratio is 1.51,

P/S is 2.31, P/B is 3.83, payout ratio 35% and annual dividend yield is 3% to

4%.

HCP Inc. (NYSE:HCP): - It is a fully integrated real estate investment trust (REIT)

serving the healthcare industry. It is the first health care company which is

selected in S&P 500 Dividend Aristocrats Index. Continuously for 28 years

its increase their dividends. It has P/E ratio is 25.73, P/B is 2.059 and

dividend yield range is 4 to 5%.

BCE, Inc. (NYSE:BCE): - It provides wireless, wire line, internet and television

services to residential, wholesale business in Canada. It has P/E ratio is

12.89, the payout ratio is 67% and dividend yield is 5.17%.

Besides these there are many companies

which have good dividend yield such as Altria Group Inc. (MO) dividend yield is

4.98%, Pembina Pipeline Corporation dividend yield is 5.56%, Permian Basin

Royalty Trust dividend yield is 4.20%, Baytex Energy dividend yield is 6%. Currently

the S&P dividend payout ratio is 37% with long term average of 50%.

In conclusion, investors should

carefully assess the high-yielding monthly distributions or dividends when they

choose stocks. The security has cash distributions or dividends that are

significantly affected by fluctuations in the prices of commodities, which

suggest that there is an elevated risk inherent in investing in these

securities.

Author Bio:

If you would like additional German dividend yield

stocks data, information or screening tools, we encourage you to visit our

website. http://de.dividendinvestor.com/

A leading

source for in-depth research & analysis on dividend

paying stocks.

Subscribe to:

Comments (Atom)