Showing posts with label CBL. Show all posts

Showing posts with label CBL. Show all posts

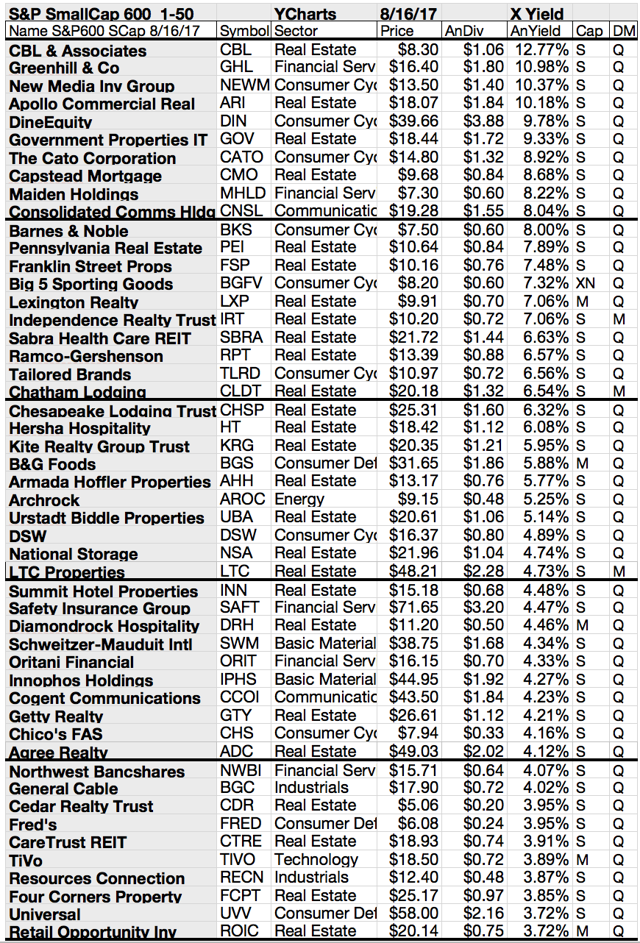

40 Highest Yielding Ex-Dividend Stocks Of The Coming Week

Here I share all higher capitalized stocks going ex-dividend next week. A huge number of stocks plan to go ex-dividend, in total 271 dividend stocks. 132 of them are capitalized over 2 billion. Attached you can find those stocks with the highest payment

A full list of next weeks ex-dividend stocks can be found here: Ex-Dividend Stocks Of The Next Week Sep. 28 – Oct. 04, 2015.

If we focus more on cheap stocks than on high yields, Dow Chemical, Toronto-Dominion Bank, Nucor, Agrium, Cisco, Steel Dynamics, PG&E, are the top picks. Not included are REITs. Those pay typically high dividends but offer also huge debt burdens.

A full list of next weeks ex-dividend stocks can be found here: Ex-Dividend Stocks Of The Next Week Sep. 28 – Oct. 04, 2015.

If we focus more on cheap stocks than on high yields, Dow Chemical, Toronto-Dominion Bank, Nucor, Agrium, Cisco, Steel Dynamics, PG&E, are the top picks. Not included are REITs. Those pay typically high dividends but offer also huge debt burdens.

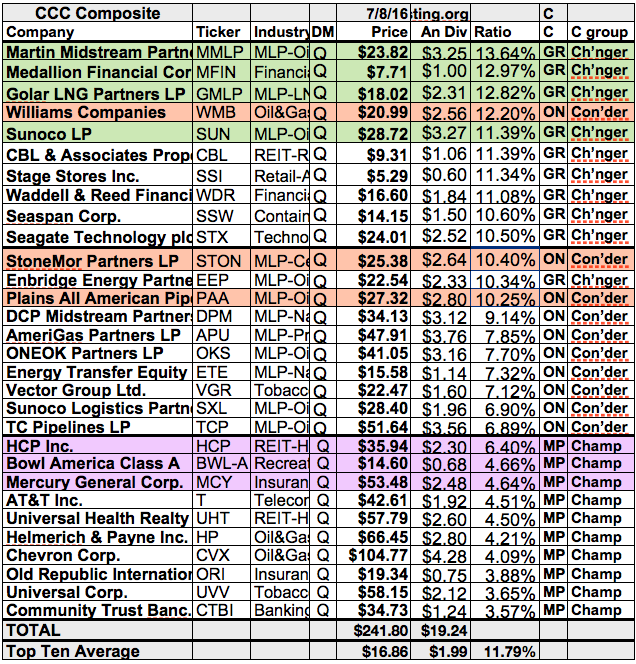

5 Best Dividend Growth And Buyback Stocks Of The Week

One of my main thought related to

investments is "how fast can the company pay my money back".

It's one of the

basic principals in investing. Put your money into stocks that drive you cash

back in a very short period of time. The smaller the pace, the bigger your

return will be.

Warren Buffett

bought BNSF Railway in November 3, 2009 for around USD 44 billion. It sounds

like a huge amount of money but the railroad company who travelled 169 million

miles in 2010 paid warren since his acquisition around $15 billion in

dividends. Not bad for an old-school business.

Below I've

compiled like each week stocks that have raised dividends during the past week.

In addition, you can also find a list of those stocks which have released a

share buyback program.

Receiving money,

direct or indirect should help passive investors like me to hedge a minimum amount of return.

Ex-Dividend Stocks: Best Dividend Paying Shares On June 27, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks June 27,

2013. In total, 28 stocks and

preferred shares go ex dividend - of which 8 yield more than 3 percent. The

average yield amounts to 4.49%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Liberty

Property Trust

|

4.24B

|

35.02

|

1.97

|

6.10

|

5.32%

|

|

CBL

& Associates Properties

|

3.41B

|

30.55

|

2.54

|

3.23

|

4.36%

|

|

Air

Products & Chemicals Inc.

|

19.72B

|

19.04

|

3.10

|

1.97

|

3.00%

|

|

Republic

Services, Inc.

|

12.14B

|

22.17

|

1.57

|

1.49

|

2.81%

|

|

CubeSmart

|

2.10B

|

-

|

2.12

|

7.05

|

2.79%

|

|

American

Eagle Outfitters, Inc.

|

3.49B

|

14.60

|

2.89

|

1.01

|

2.76%

|

|

Cardinal

Health, Inc.

|

15.90B

|

13.92

|

2.33

|

0.16

|

2.59%

|

|

Ingredion

Incorporated

|

4.90B

|

11.18

|

1.97

|

0.75

|

2.40%

|

|

Dell

Inc.

|

23.48B

|

12.67

|

2.19

|

0.41

|

2.38%

|

|

Choice

Hotels International Inc.

|

2.28B

|

19.89

|

-

|

3.27

|

1.87%

|

|

Mondelez

International, Inc.

|

51.06B

|

28.91

|

1.60

|

1.45

|

1.82%

|

|

EMC

Corporation

|

49.72B

|

19.23

|

2.19

|

2.26

|

1.69%

|

|

AmTrust

Financial Services, Inc.

|

2.30B

|

11.10

|

1.96

|

1.14

|

1.63%

|

|

State

Street Corp.

|

29.46B

|

15.04

|

1.45

|

10.03

|

1.60%

|

|

HCC

Insurance Holdings Inc.

|

4.18B

|

10.32

|

1.17

|

1.64

|

1.56%

|

|

Raymond

James Financial Inc.

|

5.86B

|

18.25

|

1.69

|

1.30

|

1.32%

|

|

Wolverine

World Wide Inc.

|

2.51B

|

32.47

|

3.73

|

1.28

|

0.92%

|

Ex-Dividend Stocks: Best Dividend Paying Shares On March 27, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks March 27,

2013. In total, 28 stocks and

preferred shares go ex dividend - of which 10 yield more than 3 percent. The

average yield amounts to 4.51%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Dynex

Capital Inc.

|

591.76M

|

8.08

|

0.96

|

5.21

|

10.63%

|

|

Spirit

Realty Capital, Inc

|

1.63B

|

-

|

1.30

|

5.75

|

6.52%

|

|

Realty

Income Corp.

|

8.57B

|

58.17

|

2.45

|

18.03

|

4.91%

|

|

Liberty

Property Trust

|

4.75B

|

37.82

|

2.25

|

6.93

|

4.78%

|

|

Hersha

Hospitality Trust

|

1.16B

|

-

|

1.40

|

3.23

|

4.12%

|

|

CBL

& Associates Properties

|

3.81B

|

35.22

|

2.87

|

3.68

|

3.90%

|

|

Prudential

plc

|

41.98B

|

12.48

|

2.68

|

0.50

|

3.81%

|

|

Maiden

Holdings, Ltd.

|

770.55M

|

16.89

|

0.76

|

0.41

|

3.38%

|

|

BankUnited,

Inc.

|

2.66B

|

12.62

|

1.36

|

3.69

|

3.25%

|

|

Republic

Services, Inc.

|

11.84B

|

21.06

|

1.53

|

1.46

|

2.88%

|

|

CubeSmart

|

2.11B

|

-

|

2.10

|

7.45

|

2.79%

|

|

Cardinal

Health, Inc.

|

14.33B

|

12.74

|

2.19

|

0.14

|

2.62%

|

|

Pebblebrook

Hotel Trust

|

1.55B

|

210.00

|

1.17

|

4.07

|

2.54%

|

|

Dell

Inc.

|

25.35B

|

10.75

|

2.36

|

0.45

|

2.21%

|

|

ProAssurance

Corporation

|

2.87B

|

10.48

|

1.27

|

4.02

|

2.14%

|

|

International

Bancshares

|

1.39B

|

14.85

|

0.97

|

3.69

|

1.94%

|

|

State

Street Corp.

|

27.10B

|

14.19

|

1.30

|

8.99

|

1.75%

|

|

Mondelez

International, Inc.

|

53.14B

|

34.74

|

1.65

|

1.52

|

1.74%

|

|

AmTrust

Financial Services, Inc.

|

2.34B

|

12.70

|

2.05

|

1.25

|

1.61%

|

|

HCC

Insurance Holdings Inc.

|

4.18B

|

10.85

|

1.18

|

1.65

|

1.59%

|

Subscribe to:

Comments (Atom)