|

| Source: Seeking Alpha |

Showing posts with label CMO. Show all posts

Showing posts with label CMO. Show all posts

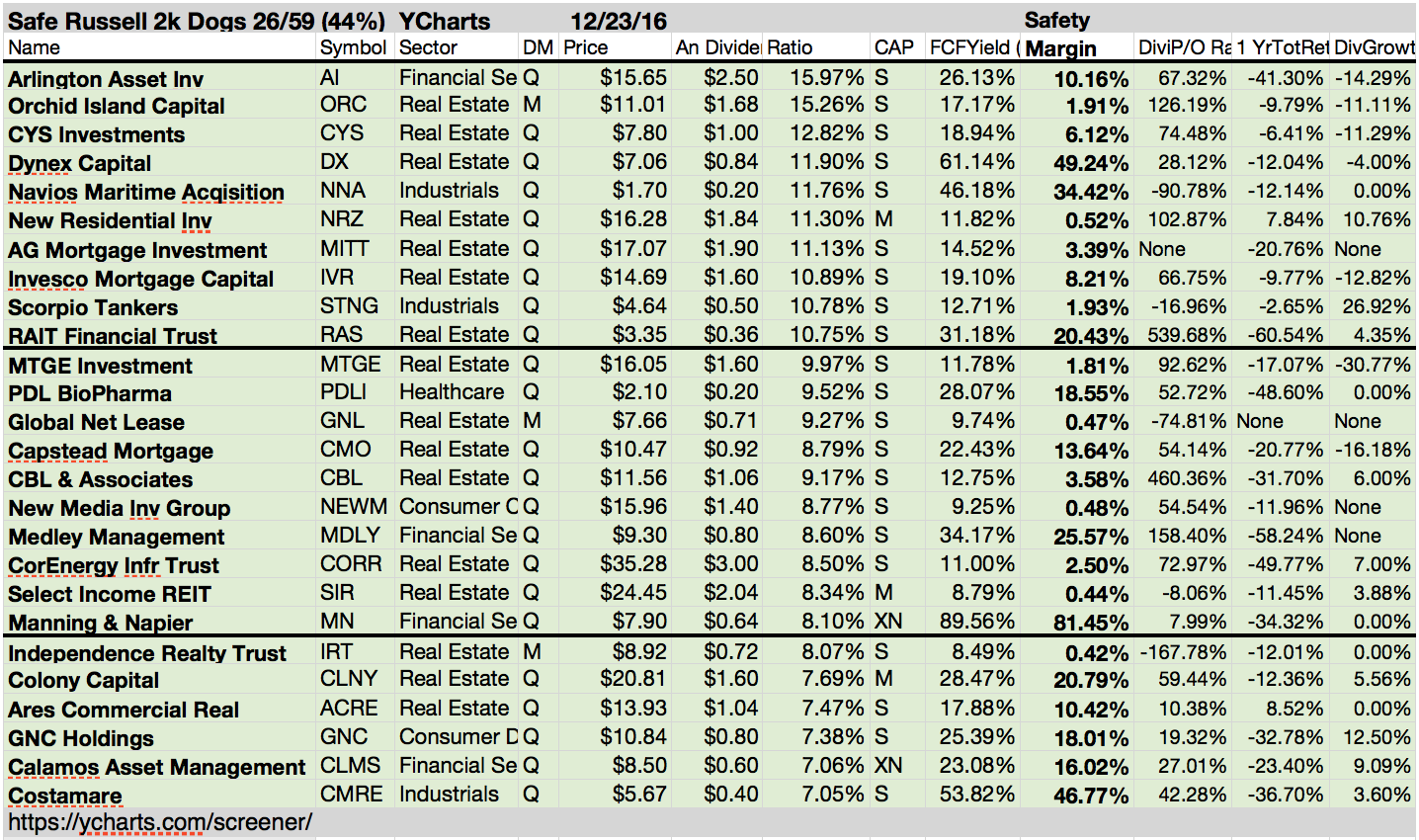

Russell 2000 Dogs With Hard Safe Yields

Dividend investors face a constant battle of choosing between dividend yield and sustainability.

Generally speaking, low yields are often sustainable but may be undesirable for investors looking to pad their portfolio with dividend income or reinvestment opportunities.

On the other end of the spectrum, high yields (let's say 5% and higher) are extremely attractive for income-seeking investors, but they're also often far more dangerous than lower yields due to a possible lack of sustainability.

Remember that dividend yields are a function of payout divided by share price, and if a stock's share price has been tumbling, its yield will rise. Thus, dividend investors have to be diligent to ensure that a yield isn't inflated solely because a company's business model is in trouble.

Attached you will find a list of stocks from the Russell 2000 with high yields. Most of them have free cashflow yield exceeding the dividend yield.

Here are the results...

Generally speaking, low yields are often sustainable but may be undesirable for investors looking to pad their portfolio with dividend income or reinvestment opportunities.

On the other end of the spectrum, high yields (let's say 5% and higher) are extremely attractive for income-seeking investors, but they're also often far more dangerous than lower yields due to a possible lack of sustainability.

Remember that dividend yields are a function of payout divided by share price, and if a stock's share price has been tumbling, its yield will rise. Thus, dividend investors have to be diligent to ensure that a yield isn't inflated solely because a company's business model is in trouble.

Attached you will find a list of stocks from the Russell 2000 with high yields. Most of them have free cashflow yield exceeding the dividend yield.

Here are the results...

Make A Wise Investment With New Zealand Stocks

The New Zealand is

a very straightforward place to do business. It has an efficient, market

oriented economy, a stable and secure business environment with zero

corruption.

Investing in New Zealand offers unique opportunities of leverage

dynamic ideas and creative intellect in specialized high value industries such

as Information and communication Technology, Biotechnology, Screen production,

Niche manufacturing, Wood processing and Call centers. Below are some New Zealand dividend stocks which have a good yield and can play a safe

investment for the investors.

Methven Limited (NZE:

MVN) –

Methven Limited

is New Zealand’s longest established, largest supplier and leading designer of

showerheads, faucets and hot water valves to home renovators, plumber and the

building industry. The company designs, manufactures and supplies shower ware,

tap ware and water control valves. Its shower skincare includes the four-step

process, aromatherapy, NZ Botanicals, Water Purity, Skin Cleansing, Skin

Conditioning and Skin Nourishing. Its kitchen and laundry products include

sink, mixer, sink faucets, sink taps and washing machine taps.

The company has

a market capitalization of 82.59 Million, EPS is 0.08, P/E ratio is 14.80 and

the dividend yield is 7.26% at the annual dividend payout of 0.05.

The Colonial Motor Company Limited (NZE:

CMO) –

The Colonial

Motor Company Limited is a New Zealand company. It is engaged in operating

franchised motor vehicle dealerships. It operates in New Zealand. The company

owns motor vehicle dealerships. As of June 30, 2011 it had 12 dealerships whose

primary focus is Ford, seven of these dealerships also had the Mazda franchise.

Its subsidiaries include Southpac Stevens Motors Ltd, Capital City Motors Ltd,

M.S Motors Ltd, Hutchinson Motors, Ltd, Avon City Motors Ltd, Avon City

Motorcycles Ltd, Timaru Motors Ltd, Southland Tractors Ltd, Advance Agricentre

Ltd, Dunedin City Motors Ltd and Macaulay Motors Ltd.

It has a market

capitalization of 119.34 Million, EPS is 0.50, P/E ratio is 7.36 and the

dividend yield is 6.85% at the annual dividend payout of 0.09.

Contact Energy Limited (NZE:

CEN) –

Contact Energy

Limited is a New Zealand electricity generator, natural gas wholesaler and

electricity, natural gas, and LPG retailer. It is the second largest electricity

generator in New Zealand which is generating 22% of electricity in the year

ending 31 December 2011. The company has the second-largest market share of

electricity retailers. The company’s power stations consist of three gas

turbine facilities, in Auckland, Hamilton and Taranaki; four geothermal

stations north of Taupo; two hydroelectric dams on the Clutha River, a gas

fired peaker in Taranaki and a diesel fired peaker in Hawkes Bay.

It has a market

capitalization of 3.73 Billion, EPS is 0.29, P/E ratio is 17.32 and the

dividend yield is 4.52% at the annual dividend payout of 0.11.

Opus International Consultants Ltd (NZE:

OIC) –

Opus

international Consultants Limited is a supplier of multidisciplinary

consultancy and project management services across a range of disciplines

including civil, mechanical and electrical engineering and planning,

environmental, architectural and property management. It has four business

segments: New Zealand, United Kingdom, Australia and Canada. On February 29,

2012, it acquired 100% interest of the Australian based rail engineering

consultancy, Coffey Rail Pty Ltd and its related company, Asia Pacific Rail Pty

Ltd.

It has a market

capitalization of 256.84 Million, EPS is 0.16, P/E ratio is 10.77 and the

dividend yield is 5.09% at the annual dividend payout of 0.05.

Comvita Limited (NZE:

CVT) –

Comvita Limited

is a New Zealand-based company which is engaged in the manufacturing and

marketing natural health and beauty products. The company operates in five

segments: New Zealand, Australia, Asia, Europe and Medical. Its Subsidiaries

include Comvita New Zealand Limited, Comvita Taiwan Limited, Comvita landowner

Share Scheme Trustee Limited, Kiwi Extracts Limited, Kiwi Bee Medical Limited

and Jonno Development Limited.

It has a market

capitalization of 105.33 Million, EPS is 0.28, P/E ratio is 13.27 and the

dividend yield is 3.78% at the annual dividend payout of 0.09.

To get additional data related to New

Zealand dividend please visit the site Dividendinvestor.com

Labels:

CEN,

CMO,

CVT,

Dividends,

Foreign,

Foreign Stocks,

High Yield,

MVN,

New Zealand,

OIC

25 Stocks Increased Dividends Last Week

Stocks with dividend hikes from last week originally

published at “long-term-investments.blogspot.com”.

Last week, 25 companies announced to raise their dividend distributions to

shareholders. Many REITs and closed-end funds are on the list of the growth

stocks.

My favorite is General Mills. GIS increased its

dividends by 15.2 percent. That’s a pretty good value in my view especially when you

consider that General Mills is not a fast growing stock. I also put shares of GIS

into my Dividend

Yield Passive Income Portfolio. With the latest hike, the current yield is

back above the 3 percent mark.

Another stock with monthly paying dividends is Realty

Income. It seems ambitious how fast they grow dividends. The latest hike was

0.2 percent on a monthly basis. The dividend payments of Realty Income are still higher

than the earnings per share income – How long could this go on?

From 25 stocks with dividend growth from last week are

15 with a dividend growth of more than 10 percent. The average dividend growth

amounts to 34.58 percent. Linked is a full free list of all companies and funds

with some price ratios to compare.

Below the results are 4 High-Yields; 13 companies have

a current buy or better rating.

The Biggest Ex-Dividend Stocks On October 16, 2012

The Best And Biggest

Ex-Dividend Stocks Researched By Dividend Yield - Stock, Capital, Investment. Dividend Investors should have

a quiet overview of stocks with upcoming ex-dividend dates. The ex-dividend

date is the final date on which the new stock buyer couldn’t receive the next

dividend. If you like to receive the dividend, you need to buy the stock before

the ex-dividend date. I made a little screen of the best yielding stocks with a

higher capitalization that have their ex-dividend date on the next trading day.

A full list of all stocks

with ex-dividend date can be found here: Ex-Dividend Stocks on October

16, 2012. In total, 4 stocks and

preferred shares go ex-dividend - of which 1 yield more than 3 percent. The

average yield amounts to 3.77%.

Here is the sheet of the best yielding, higher

capitalized Ex-Dividend stocks:

Labels:

AYI,

CMO,

Ex-Div Date,

WDFC,

ZEP

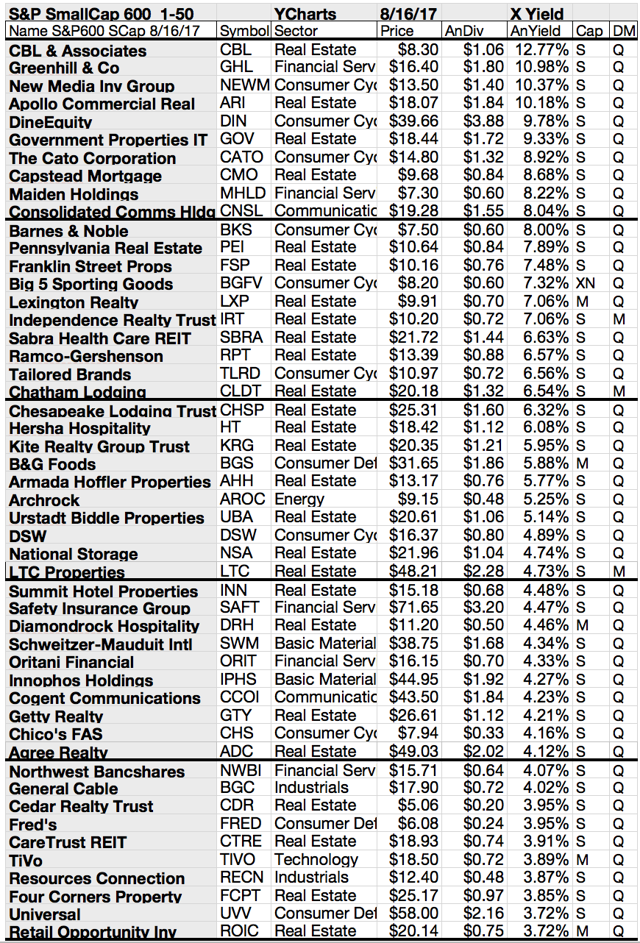

13 High Yield Stocks At New 52-Week Highs

High Dividend Yield Stocks Close To New Highs By Dividend Yield – Stock, Capital, Investment. Here is a current sheet

of high yield stocks (yield over 5 percent) that have marked a new 52-Week High

within the recent days. Despite the turmoil’s at the markets, there are 46

companies at one-year highs and 13 of them pay very high dividends. I screened

the best performing stocks and analyzed all with a yield over 5 percent. Thirteen companies fulfilled these criteria of which eleven have a buy or better

recommendation. The highest yielding stock from the results is ARMOUR Residential

(ARR) with a yield over 16 percent. The company is followed by Two Harbors Investment

(TWO) who has a yield of 14.16 percent.

The Best Dividends On April 17, 2012

Here is a current overview of best yielding stocks that have their ex-dividend date on the next trading day. If your broker settles your trade today, you will receive the next dividend. A full list of all stocks with ex-dividend date can be found here: Ex-Dividend Stocks April 17, 2012. In total, 5 stocks and preferred shares go ex-dividend of which 3 yielding above 3 percent. The average yield amounts to 4.69 percent.

Ex-Dividend Date Reminder For January 17, 2012

Here is a current overview of best yielding stocks that have their ex-dividend date tomorrow. If your broker settles your trade today, you will receive the next dividend. A full list of all stocks with ex-dividend date can be found here: Ex-Dividend Stocks On January 17, 2011. In total, 4 stocks and preferred shares go ex-dividend of which 1 yielding above 3 percent. The average yield amounts to 4.39 percent.

The ex-dividend date is a major date related to the payment of dividends. If you purchase a stock on its ex-dividend date or later, you will not receive the next dividend payment. Instead, the seller gets the dividend. If you purchase before the ex-dividend date, you get the dividend. It is important that your broker settle your trade before the ex-dividend date.

These are the results of the best yielding stocks:

Capstead Mortgage (CMO) has a market capitalization of USD 1.08 Billion and operates within the “REIT - Diversified” industry. These are the market ratios of the company:

P/E Ratio: 7.70,

Forward P/E Ratio: 8.14,

Price/Sales Ratio: 4.70,

Price/Book Ratio: 0.87,

Dividend Yield: 13.54%.

Goldcorp (GG) has a market capitalization of USD 36.79 Billion and operates within the “Gold” industry. These are the market ratios of the company:

P/E Ratio: 20.10,

Forward P/E Ratio: 15.72,

Price/Sales Ratio: 7.12,

Price/Book Ratio: 1.76,

Dividend Yield: 1.19%.

Potash Corp. of Saskatchewan, Inc. (POT) has a market capitalization of USD 38.41 Billion and operates within the “Agricultural Chemicals” industry. These are the market ratios of the company:

P/E Ratio: 13.56,

Forward P/E Ratio: 10.17,

Price/Sales Ratio: 4.43,

Price/Book Ratio: 5.14,

Dividend Yield: 0.63%.

The ex-dividend date is a major date related to the payment of dividends. If you purchase a stock on its ex-dividend date or later, you will not receive the next dividend payment. Instead, the seller gets the dividend. If you purchase before the ex-dividend date, you get the dividend. It is important that your broker settle your trade before the ex-dividend date.

These are the results of the best yielding stocks:

Capstead Mortgage (CMO) has a market capitalization of USD 1.08 Billion and operates within the “REIT - Diversified” industry. These are the market ratios of the company:

P/E Ratio: 7.70,

Forward P/E Ratio: 8.14,

Price/Sales Ratio: 4.70,

Price/Book Ratio: 0.87,

Dividend Yield: 13.54%.

| 1-Year Chart Of Capstead Mortgage Corp. (Click to enlarge) |

| Long-Term Dividend History of Capstead Mortgage Corp. (Click to enlarge) |

Goldcorp (GG) has a market capitalization of USD 36.79 Billion and operates within the “Gold” industry. These are the market ratios of the company:

P/E Ratio: 20.10,

Forward P/E Ratio: 15.72,

Price/Sales Ratio: 7.12,

Price/Book Ratio: 1.76,

Dividend Yield: 1.19%.

| 1-Year Chart Of Goldcorp Inc. (Click to enlarge) |

| Long-Term Dividend History of Goldcorp Inc. (Click to enlarge) |

Potash Corp. of Saskatchewan, Inc. (POT) has a market capitalization of USD 38.41 Billion and operates within the “Agricultural Chemicals” industry. These are the market ratios of the company:

P/E Ratio: 13.56,

Forward P/E Ratio: 10.17,

Price/Sales Ratio: 4.43,

Price/Book Ratio: 5.14,

Dividend Yield: 0.63%.

| 1-Year Chart Of Potash Corp. of Saskatchewan, Inc. (Click to enlarge) |

| Long-Term Dividend History of Potash Corp. of Saskatchewan, Inc. (Click to enlarge) |

Labels:

CMO,

Ex-Div Date,

GG,

POT

Subscribe to:

Comments (Atom)