Showing posts with label IVR. Show all posts

Showing posts with label IVR. Show all posts

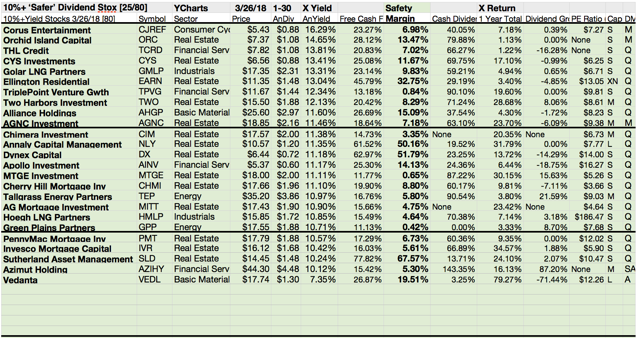

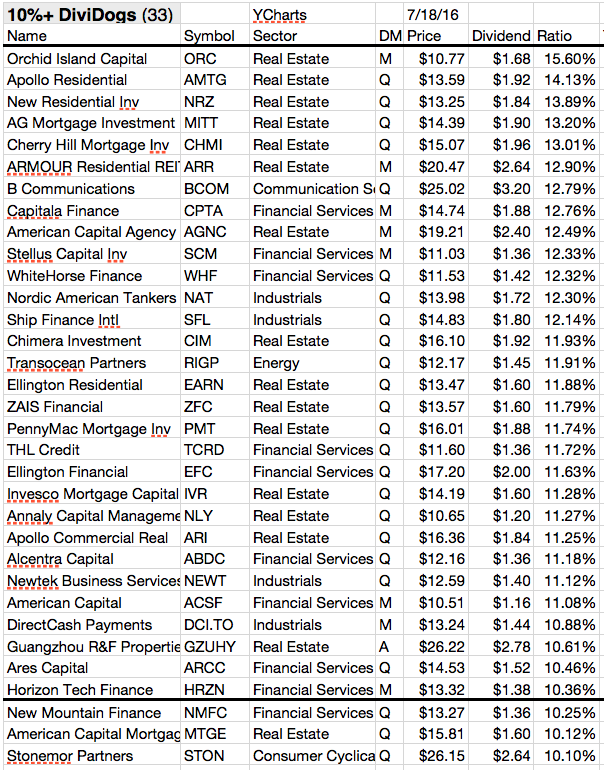

12 Higher Capitalized Stocks With Yields Over 10% You Might Like...

Puhhh...this interest environment

is boring. You need a huge amount of money to receive a low yield. That's crazy

but you can Thank Ben Bernanke and the current Fed Chairman Janet Yellen.

Most people don't

know it but there are still high yields and stocks that pay double digit

dividend yields on your investment. For sure those companies are more risky but

you get also compensated by higher cash returns.

Attached is a

small list of all mid and large capitalized stocks that offer currently a

double-digit dividend yield or a yield over 10 percent yearly.

Most of the stocks

also have a low valuation by forward price to earnings. Nearly all of the

results come from the financial and basic material sector.

These are the

three companies with a buy or better rating in detail....

Ex-Dividend Stocks: Best Dividend Paying Shares On September 24, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 16 stocks go ex dividend

- of which 7 yield more than 3 percent. Here is a full list of all stocks with ex-dividend

date within the current week.

Here is the sheet of the best yielding ex-dividend stocks:

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

Invesco

Mortgage Capital Inc.

|

2.19B

|

5.40

|

0.90

|

3.52

|

16.05%

|

|

|

Two

Harbors Investment Corp.

|

3.62B

|

4.40

|

0.94

|

6.65

|

11.32%

|

|

|

Chambers

Street Properties

|

2.28B

|

57.50

|

1.49

|

10.66

|

5.43%

|

|

|

Ark

Restaurants Corp.

|

70.42M

|

17.36

|

2.21

|

0.53

|

4.61%

|

|

|

Philip

Morris International, Inc.

|

147.56B

|

17.53

|

-

|

1.88

|

4.16%

|

|

|

Getty

Realty Corp.

|

666.27M

|

35.00

|

1.74

|

6.77

|

4.01%

|

|

|

Cypress

Semiconductor

|

1.69B

|

-

|

10.00

|

2.26

|

3.82%

|

|

|

Frisch's

Restaurants Inc.

|

125.51M

|

17.98

|

1.50

|

0.62

|

2.90%

|

|

|

Gazit-Globe,

Ltd.

|

2.32B

|

10.75

|

1.12

|

1.21

|

2.72%

|

|

|

Salem

Communications Corp.

|

209.03M

|

-

|

1.09

|

0.90

|

2.49%

|

|

|

International

Flavors & Fragrances

|

6.76B

|

24.74

|

4.93

|

2.35

|

1.88%

|

|

|

Analogic

Corporation

|

1.01B

|

33.25

|

2.07

|

1.83

|

0.49%

|

|

|

Embraer

SA

|

6.14B

|

28.66

|

1.88

|

1.03

|

0.24%

|

|

|

Citigroup,

Inc.

|

155.71B

|

16.36

|

0.81

|

2.39

|

0.08%

|

|

|

Gordmans

Stores, Inc.

|

266.71M

|

16.69

|

2.48

|

0.43

|

-

|

|

|

Quintiles

Transnational Holdings

|

5.49B

|

30.22

|

-

|

1.12

|

-

|

12 Stocks With Dividend Yields Over 10% And Low Forward P/E’s

Cheaply

valuated shares with very high dividend yields originally published at long-term-investments.blogspot.com. Today I would like to

show you some of the highest yielding stocks on the market with low earnings

multiples. I choose stocks with a dividend yield of more than 10% with a

forward P/E of less than 15. In order to eliminate the lower capitalized

companies who have definitely a higher risk, I need to look at companies with a

market cap over $2 billion.

Only twelve shares on the market met these restrictions. I believe that a high dividend yield will help investors to get a quick cash return and should boost the passive income but it’s also very dangerous to buy those stocks. Most of the high yielders come from the Financial or REIT sector. Most of them are highly loaded with debt and they are no long-term dividend growers like Procter and Coca Cola.

Six of the twelve results have a current buy or better rating. The yields are between 11.38 percent and 20.32 percent.

Only twelve shares on the market met these restrictions. I believe that a high dividend yield will help investors to get a quick cash return and should boost the passive income but it’s also very dangerous to buy those stocks. Most of the high yielders come from the Financial or REIT sector. Most of them are highly loaded with debt and they are no long-term dividend growers like Procter and Coca Cola.

Six of the twelve results have a current buy or better rating. The yields are between 11.38 percent and 20.32 percent.

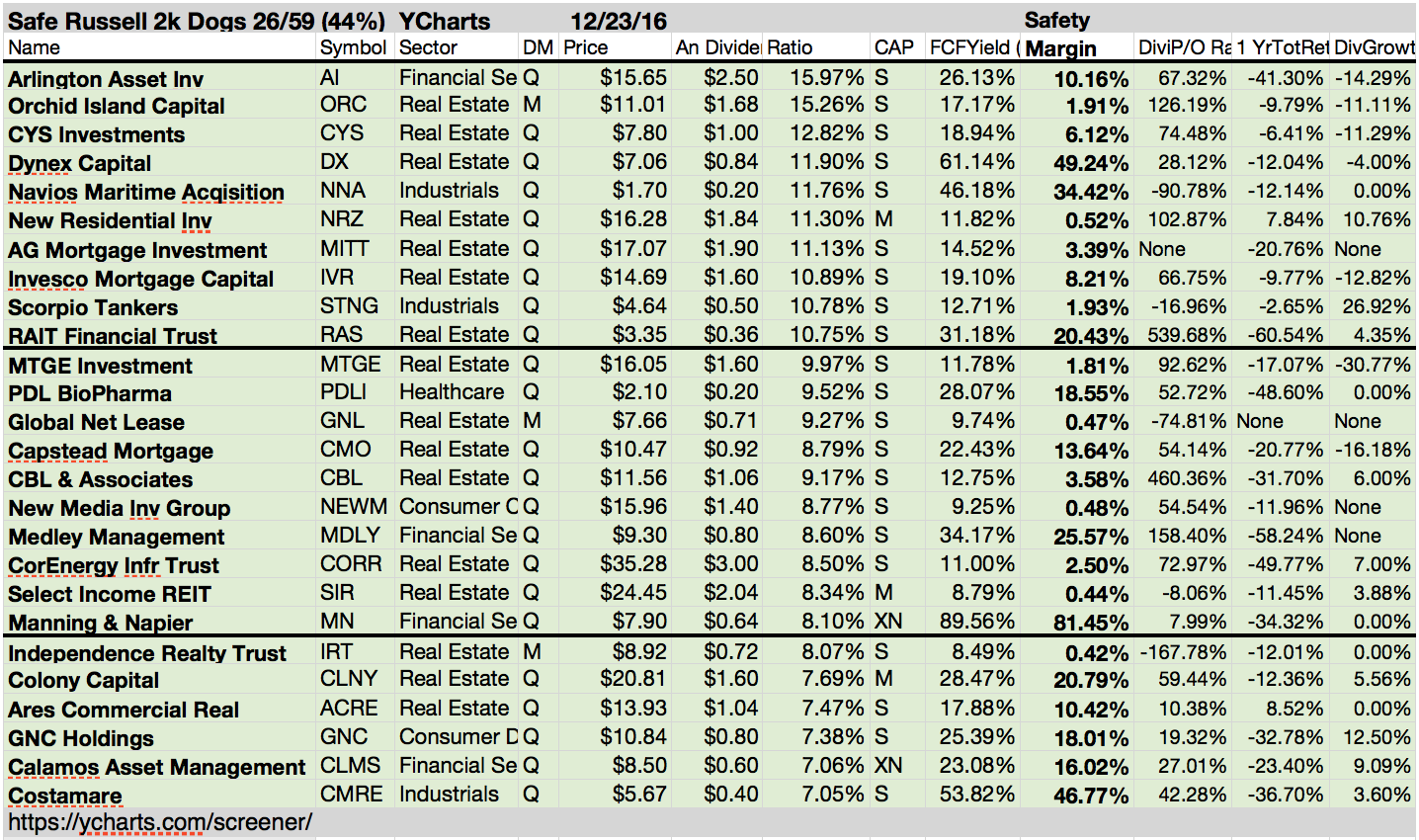

16 High Yielding Dividend Stocks With Singe P/E Ratios

High

yielding Mid- and Large capitalized dividend stocks with cheap price ratios originally

published at long-term-investments.blogspot.com. I often write about

stocks with cheap fundamentals, mostly about those with a low forward P/E. I

believe that this is a great first step to find good bargains at the stock market.

But you need also a good initial dividend yield

if you like to build a passive dividend income to live off.

Today I would like

to create a screen which combines both, yield and cheapness at a very high

level.

I’m looking for High-Yield dividend stocks with

single-digit P/E ratios. In order to limit my screening results, I observed

only higher capitalized companies with a market capitalization over USD 2 billion.

Sixteen stocks fulfilled my criteria. Seven of

them have a current buy or better rating and fifteen yielding over 10 percent!

REITs, asset managers and communication stocks are dominating the screen.

That’s where you can find the highest dividend yields but the risk is also much

higher.

9 Stocks With Yields Over 10% And Buy Or Better Rating

Stocks

with very high dividend yields and buy or better recommendations originally published

at long-term-investments.blogspot.com. Some of my readers like you

have a huge desire for income stocks. Not enough, they should have a good payout

in terms of initial yields and offer you a great opportunity with price hikes.

It’s hard to find the perfect dividend stock that delivers you a great return at a low risk and the higher the initial yield, the bigger the risk seems.

Today I would like to introduce you some of the highest yielding stocks at the stock market with current buy or better ratings by brokerage firms.

At the market are around a hundred stocks with double-digit dividend yields but most of them, 78 percent, are small capitalized. I don’t like stocks with a small market cap because of the low diversification and high sensitivity when trading volume comes into the stock. In my current screen, I observe only stocks with a USD 2 billion or more capitalization. Below is a list of the 9 highest yielding stocks with a buy or better rating.

It’s hard to find the perfect dividend stock that delivers you a great return at a low risk and the higher the initial yield, the bigger the risk seems.

Today I would like to introduce you some of the highest yielding stocks at the stock market with current buy or better ratings by brokerage firms.

At the market are around a hundred stocks with double-digit dividend yields but most of them, 78 percent, are small capitalized. I don’t like stocks with a small market cap because of the low diversification and high sensitivity when trading volume comes into the stock. In my current screen, I observe only stocks with a USD 2 billion or more capitalization. Below is a list of the 9 highest yielding stocks with a buy or better rating.

9 Stocks With Double-Digit Yields And Buy Or Better Recommendations

Stocks with very high dividend yields and buy or better

ratings originally published at long-term-investments.blogspot.com. Boost your dividend

income wisely. The easiest way is to look for stocks with extraordinary high

yields but there is still a huge risk to receive the dividend one time and no more further.

There is no solution for this problem because no

return exists without a risk. Today I’ve screened stocks with very high dividend

yields (over 10 percent). Around 100 companies have a current yield over 10 percent but most of

them are low capitalized or they will pay no high dividends in the future. In

order to eliminate the real big risks from the screening results, I observed

only those companies with a market capitalization over USD 2 billion. In addition, the stock should have a buy or better rating. Only nine stocks fulfilled these criteria with a

dividend yield between 10 percent and 20 percent.

12 Really Cheap Stocks With Extraordinary High Yields - Over 10%

Stocks with very high yields and low price

ratios originally published at "long-term-investments.blogspot.com". A good cash return

on your in investment is the basis for all dividend investors who want to build up a passive income stream.

If you are focused on low yielding stocks with a

yield around the one percent mark, I can tell you that you won’t get a bigger

cash return if you have only a few shares. You need higher yielding stocks with

a yield of more than five percent or even over 10 percent.

I personally prefer stocks with a yield of 2-3

percent that have a solid growth history and could grow further. In addition,

its ever cool when the company has low debt and payout ratios. This gives the

company the possibility to hike the next dividends far above the magic 3 percent

mark.

However, let’s come back to my daily theme: I

like to show the highest yielding stocks with a P/E of less than 15 and a market capitalization over USD 2 billion. Twelve

companies fulfilled these criteria of which eight are recommended to buy.

Pitney Bowes is the star below the results. Its yield is still over 10 percent

but the stock gained nearly 40 percent this year. PBI fights with a changing

business environment and investors are more confident about the success of this battle.

11 Cheap Stocks With Unbelievable High Dividends

Stocks

with very high yields and low price ratios originally published at "long-term-investments.blogspot.com". Some of my readers

often ask themselves what are the highest yielding stocks at the market. When

they read articles about the highest dividend paying shares they noticed Pitney

Bowes, who is also a S&P 500 member, or Annaly Capital Management.

Both have a double digit yield at a higher market capitalization and investors of the early round have made their first money with these stocks. The market is still in doubt and I am too because I don’t like stocks with a very high yield and huge debt loads. I'm a believer of dividend growth and I like stocks with a yield between 1-2 percent much more when they increase them with a double-digit rate.

PBI has gained 44 percent over the recent quarter and has now a yield below the 10 percent mark but the P/E ratio is still in a single-digit range. Today I like to publish all higher capitalized dividend stocks (over $2 billion market capitalization) with a low P/E ratio (under 15). Eleven stocks fulfilled these criteria of which eight have a buy or better recommendation.

Both have a double digit yield at a higher market capitalization and investors of the early round have made their first money with these stocks. The market is still in doubt and I am too because I don’t like stocks with a very high yield and huge debt loads. I'm a believer of dividend growth and I like stocks with a yield between 1-2 percent much more when they increase them with a double-digit rate.

PBI has gained 44 percent over the recent quarter and has now a yield below the 10 percent mark but the P/E ratio is still in a single-digit range. Today I like to publish all higher capitalized dividend stocks (over $2 billion market capitalization) with a low P/E ratio (under 15). Eleven stocks fulfilled these criteria of which eight have a buy or better recommendation.

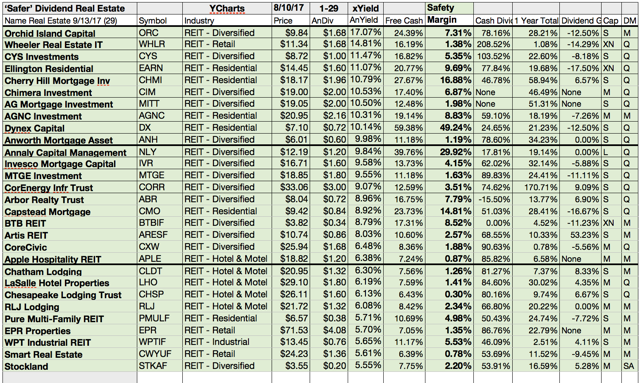

12 Highest Dividend Paying Mortgage Stocks

Stocks from the mortgage investment industry

with highest dividend yields originally published at "long-term-investments.blogspot.com".

The mortgage investment industry is a very complex looking investment field. Many people lost huge amounts of money during the financial crises if they were invested in this area. But the industry is also liquid for traders and has some of the best yielding stocks on the market. The mortgage industry is small but is still one of the highest dividend paying industries within the financial sector.

The mortgage investment industry is a very complex looking investment field. Many people lost huge amounts of money during the financial crises if they were invested in this area. But the industry is also liquid for traders and has some of the best yielding stocks on the market. The mortgage industry is small but is still one of the highest dividend paying industries within the financial sector.

The average industry yield amounts to 4.66

percent and the P/E ratio is at 15.10. With a recovering house market, mortgage

firms see improvements of their accounted assets. Everything goes slowly but I

believe that the turnaround is definitely done.

12 listed mortgage firms pay dividends to

investors. Five of them have an actual dividend yield of more than 10 percent

and 10 are currently recommended to buy. Most stocks from the results are lower

capitalized. Its very risky to put money into those stocks. Linked is a list of

the 12 highest dividend paying stocks from the mortgage industry.

11 Most Recommended Stocks With +10% Yields

The Most Recommended Higher Capitalized Stocks

With Yields Over 10 Percent and Buy Rating Originally Published At “long-term-investments.blogspot.com”. Stocks with very high

yields could boost your dividend income onto the next level. Especially if you

have only a few thousand dollars of investment budget it makes these to take a

look at the highest yields at the market. I know what I am talking about. In my

first years of investing, I starred often at such stocks with unbelievable high

yields. I talk about yields of over 10 percent. But the most of the results are

not sustainable and databases are not well-kept. Especially in the case of

lower capitalized stocks, the risk of a dividend cuts is very high. Some of you

ask me which stock to buy or which are the best +10 percent yielding stocks to buy

now. I made a little list of the highest yielding stocks, starting at 10

percent dividend yield. You won’t believe it but there are more than a hundred

companies with such a high yield. In order to reduce my results, I selected

only those with a market capitalization of more than USD 2 billion and a

current buy or better recommendation. Eleven stocks remain. Five of the results

come from the REIT industry.

These 14 Stocks With Very High Yields (Over 10%) Are Close To 52-Week Highs

Stocks With Very High Yields Close To One-Year Highs

Researched By “long-term-investments.blogspot.com”. I love stocks with very high

yields, yields of more than ten percent yearly and 2.5 percent quarter dividend

but I also hate stocks with a bad stock performance.

I made a screen of stocks with very high yields as

well as a stock price close to 52-Week Highs (up to 5 percent below high). 14 companies fulfilled the screening criteria. From

the results are 10 stocks with a current buy or better recommendation.

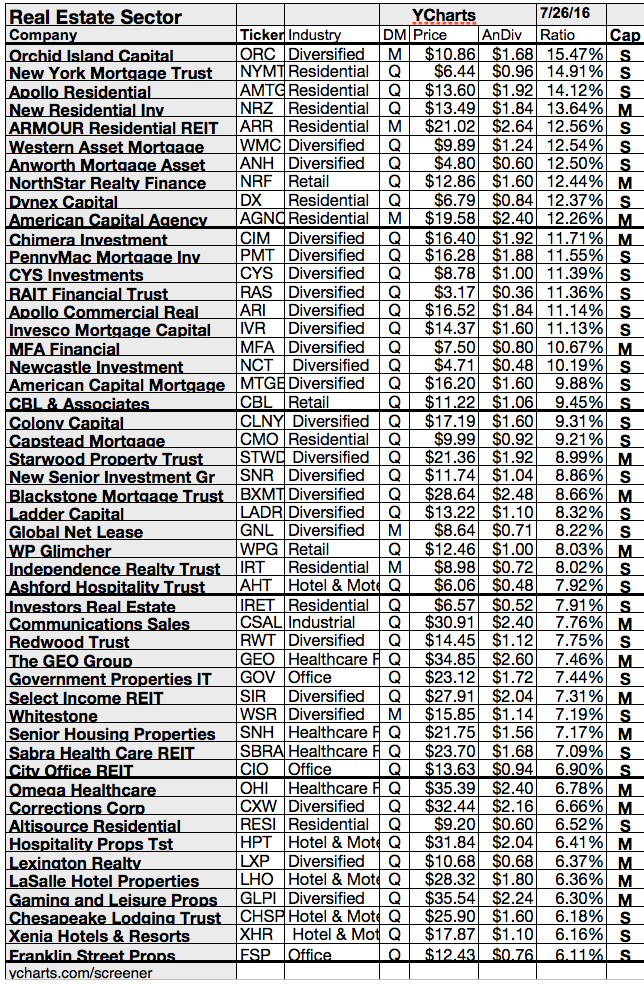

17 Higher Capitalized Stocks With Really Huge Dividend Yields (Over 10%)

Higher Capitalized Stocks With Double-Digit Yields

Researched By “long-term-investments.blogspot.com”. Stocks with very high yields are attractive for dividend and income investors.

If you own a stock with a double-digit yield, you should expect a quarter dividends

of at least 2.5 percent.

I screened all stocks with a dividend yield over

10 percent. 126 stocks have such a high yield but most of the companies are low

capitalized and they have not sustained dividends. In order to get only higher capitalized

stocks, I selected those with a market capitalization over USD 2 billion. Seventeen companies remained of which eleven are recommended to buy.

13 High Yield Stocks At New 52-Week Highs

High Dividend Yield Stocks Close To New Highs By Dividend Yield – Stock, Capital, Investment. Here is a current sheet

of high yield stocks (yield over 5 percent) that have marked a new 52-Week High

within the recent days. Despite the turmoil’s at the markets, there are 46

companies at one-year highs and 13 of them pay very high dividends. I screened

the best performing stocks and analyzed all with a yield over 5 percent. Thirteen companies fulfilled these criteria of which eleven have a buy or better

recommendation. The highest yielding stock from the results is ARMOUR Residential

(ARR) with a yield over 16 percent. The company is followed by Two Harbors Investment

(TWO) who has a yield of 14.16 percent.

Subscribe to:

Comments (Atom)

+Dividends.png)

+Dividends.png)

+Logo.png)