|

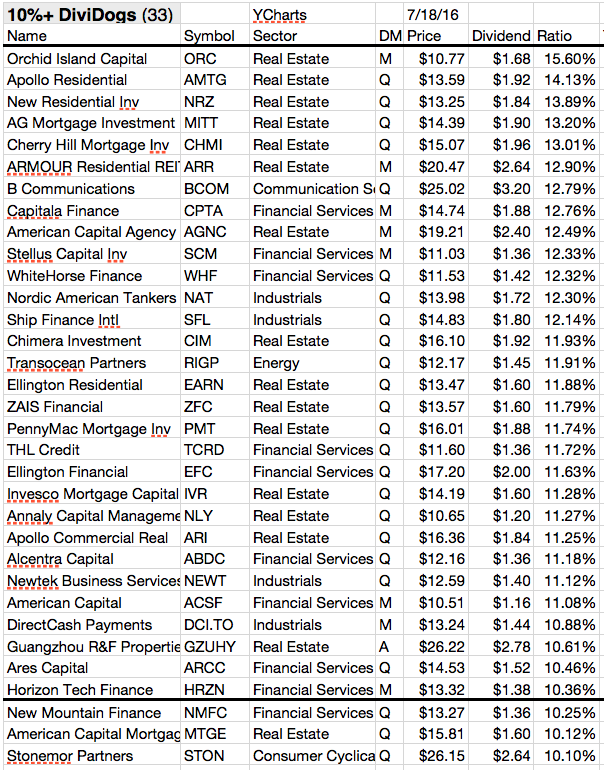

| Dividend Dogs As Of July 2016 |

Showing posts with label AMTG. Show all posts

Showing posts with label AMTG. Show all posts

17 High Yields With Additional Potential To Grow Dividends

High yielding stocks with low payout and debt

ratios originally published at "long-term-investments.blogspot.com". Yesterday, I made a

screen of Dividend Contenders with low long-term debt to equity ratios as well

as slim payouts.

Today I like to widen the latest screen to High-Yields

with a market capitalization over USD 300 million. Most of the high yielding

stocks are full of debt. The only companies with a smaller amount of loans are such with a lower

capitalization. The risks are much higher for those shares. I also needed to

lower my screening guidance because of the small amount of results. These are

my new criteria:

- Market Capitalization over USD 300 million

- Dividend Yield over 5 percent

- Long-term debt to equity above 0.6

- Payout ratio under 50 percent

10 Top High-Yield Dividend Stocks to Make Your Portfolio More Attractive

Dividend investing has become very popular

in today’s world. It often takes place when investors choose stocks to gain the

promised dividends from the companies underlying the stocks. Investors start

dividend investing because it allows them a source of income even at the time

when the stock market is struggling. It is one of the best ways to earn income

for retirement and also investors can protect themselves against the

volatility. If the value of the underlying stock drops dividends will still be

paid.

The stocks which show a higher yield tend

to offer greater returns over time than lower or no-yield

stocks. Here I am sharing the top 10 high dividend yield stocks:

TAL

Education Group (NYSE: XRS) –

Tal Education Group is operating as a

training institution in china. It provides training for primary school

mathematical Olympiad, English language, Chinese language, middle and high

school Mathematics, Physic, Chemistry and one-to-one personal training.

It has a market capitalization of 706.61

Million, EPS is 0.44, P/E ratio is 20.85 and the dividend yield is 21.93% at

the annual dividend payout of 0.50.

Box

Ships (NYSE: TEU) –

Box ships Inc. is an international shopping

company. It was formed by Paragon Shipping Inc., which is a global provider of

shipping transportation services. The company is engaged in the seaborne

transportation of containers worldwide.

Its market capitalization is 74.94 Million,

EPS is 0.76, P/E ratio is 6.07 and the dividend yield is 19.17 at the annual

dividend payout of 0.22.

Sandridge

Mississippian Trust I (NYSE: SDT) –

SandRidge Mississippian Trust I is a

statutory trust. It was created to acquire and hold Royalty Interests for the

benefit of Trust unit holders. The trust has a market capitalization of 383.32

Million, EPS is 2.99, P/E ratio is 4.58 and the dividend yield is 19.01% at the

annual dividend payout of 0.65.

Northern

Tier Energy (NYSE: NTI) –

Northern Tier Energy is an independent

downstream energy company. It has the refining, retail and pipeline operations

that serves PADD II region of the United States. Northern Tier Energy LP

operates in two business segments: the refining business and the retail

business.

It has a market capitalization of 2.98

Billion, EPS is 0.73, P/E ratio is 36.90 and the dividend yield is 18.81% at

the annual dividend payout of 1.27.

Portugal

Telecom (NYSE: PT) –

This is a holding and largest

telecommunication service providing company based in Portugal. It provides a

wide range of telecommunications and multimedia services, such as fixed line

and mobile telecommunication, pay television distribution, internet service

provider services and data transmission.

The company has a market capitalization of

4.48 billion, EPS is 0.32, P/E ratio is 16.51 and the dividend yield is

currently 15.57% at the annual dividend payout of 0.54.

AG

Mortgage Investment Trust (NYSE: MITT) –

This is a real estate investment trust that

is focusing on investing in acquiring and managing a diversified portfolio of

residential assets, other real estate-related securities and financial assets,

which it refers to as its target assets.

It has a market capitalization of 690.60

Million, EPS is 7.34, P/E ratio is 3.42 and the dividend yield is currently

12.72% at the annual dividend payout of 0.80.

Apollo

Residential Mortgage (NYSE: AMTG) –

Apollo Residential Mortgage Inc. is a real

estate investment trust that invests in finances. The company manages

residential mortgage-backed securities, residential mortgage loans and other

residential mortgage assets throughout the United States.

It has a market capitalization of 538.13

Million, EPS is 8.18, P/E ratio is 2.72 and the dividend yield is 12.60% at the

annual dividend payout of 0.70.

Ellington

Financial (NYSE: EFC) –

This is a financial company which

specializes in acquiring and managing mortgage-related assets and other types

of financial assets such as residential whole mortgage loans, asset-backed

securities, backed by consumer and commercial assets, non-mortgage-related

derivatives and real property.

It has a market capitalization of 508.87

Million, EPS is 5.44, P/E ratio is 4.59 and the dividend yield is 12.35% at the

annual dividend payout of 0.77.

Resource

Capital (NYSE: RSO) –

Resource Capital Corporation is also a

financial company. It focuses primarily on commercial real estate and

commercial finance. Its operations are conducted as a real estate investment

trust. The company has a market capitalization of 705.47 Million, EPS is 0.77,

P/E ratio is 8.46 and the current dividend yield is 12.25% at the annual

dividend payout of 0.20.

CYS

Investments (NYSE: CYS) –

CYS Investments, Inc. is financial company

that was created with the objectives of achieving consistent risk-adjusted

investment income. The company’s investment guidelines permit investments in

collateralized mortgage obligations that are issued by a government agency or

government entity.

It has a market capitalization of 2.12

Billion, EPS is 2.75, P/E ratio is 4.41 and the dividend yield is 10.57% at the

annual dividend payout of 0.32.

Summary

–

These are the top ten high dividend yield

stocks which can be a helpful in making a dividend portfolio more attractive.

You need to search carefully and should focus on all the points while selecting

these stocks.

For more information regarding high dividend yield stocks

data you can visit the site Dividend Investor.

20 Stocks With Yields Over 10% And Highest Buy Ratings

Most

recommended stocks with very high yields originally published at "long-term-investments.blogspot.com". I love stocks with

high dividend yields but there are only a few with sustainable payments. I

think about Altria or Lorillard. Other stocks have a huge potential for a

dividend cut, also if they are a Dividend Champion or a stock with a very long

dividend growth history. I made this investment mistake with Avon Products. The

company was highly leveraged and became some operations problems. Finally they reduced

the dividend dramatically.

Most of the people need stocks with very high yields. I don’t because my private wealth is high enough to catch the dividend payments and live off it. In the past, I often thought it would be the only solution to put all my money into the highest yielding stocks with the most attractive fundamentals. This strategy failed and I lost much money within the closed-end shipping industry. That was a big mistake from which I learned and I like to share this with you.

Please don’t put all your money into one stock or make a single bet on a high-yield stock. This is very risky. That’s all I can say. Make a good research and try to avoid an overweighting of a stock or asset theme.

Each month, I made a regular screen about the stocks with the highest dividend yields because I believe there is a lot of value information in it for my readers. This month, I like to show you the 20 most recommended stocks with a double-digit dividend yield and a higher market capitalization (over USD 300 million). Out there are 95 companies with a very high yield but only 35 have a buy or better recommendation. The REIT industry is still a big player on my screen with 6 representatives.

Most of the people need stocks with very high yields. I don’t because my private wealth is high enough to catch the dividend payments and live off it. In the past, I often thought it would be the only solution to put all my money into the highest yielding stocks with the most attractive fundamentals. This strategy failed and I lost much money within the closed-end shipping industry. That was a big mistake from which I learned and I like to share this with you.

Please don’t put all your money into one stock or make a single bet on a high-yield stock. This is very risky. That’s all I can say. Make a good research and try to avoid an overweighting of a stock or asset theme.

Each month, I made a regular screen about the stocks with the highest dividend yields because I believe there is a lot of value information in it for my readers. This month, I like to show you the 20 most recommended stocks with a double-digit dividend yield and a higher market capitalization (over USD 300 million). Out there are 95 companies with a very high yield but only 35 have a buy or better recommendation. The REIT industry is still a big player on my screen with 6 representatives.

These 14 Stocks With Very High Yields (Over 10%) Are Close To 52-Week Highs

Stocks With Very High Yields Close To One-Year Highs

Researched By “long-term-investments.blogspot.com”. I love stocks with very high

yields, yields of more than ten percent yearly and 2.5 percent quarter dividend

but I also hate stocks with a bad stock performance.

I made a screen of stocks with very high yields as

well as a stock price close to 52-Week Highs (up to 5 percent below high). 14 companies fulfilled the screening criteria. From

the results are 10 stocks with a current buy or better recommendation.

The Best Yielding Dividend Stocks At New Highs

High Dividend Yield Stocks Close To New Highs By Dividend Yield – Stock, Capital, Investment. Here is a current sheet

of stocks with a positive dividend yield that have crossed a new

52-Week High within the recent days. Despite the turmoil’s at the markets,

there are 44 companies at one-year highs and some of them pay very good

dividends. I screened the best performing stocks and analyzed all with a positive

yield. Sixteen companies fulfilled these criteria of which nine have a buy or

better recommendation. The best yielding stock is Apollo Residential Mortgage (AMTG)

with a yield over 15 percent. Two additional stocks have a double-digit yield.

The Highest Yielding Stocks With Strong Overbought Signals

Dividend Stocks With Fast Stock Price Increase By Dividend Yield – Stock, Capital, Investment. Stocks with a strong increase in its share price, especially in the case of unjustifiably pushes, are overbought if the fundamentals don’t support the price change. Here are the best yielding stocks with strong signals to be overbought. Short-term, investors should be careful to buy stocks with such a warning signal. On the other hand, it could be a sign for better future perspectives.

Subscribe to:

Comments (Atom)