Showing posts with label PNNT. Show all posts

Showing posts with label PNNT. Show all posts

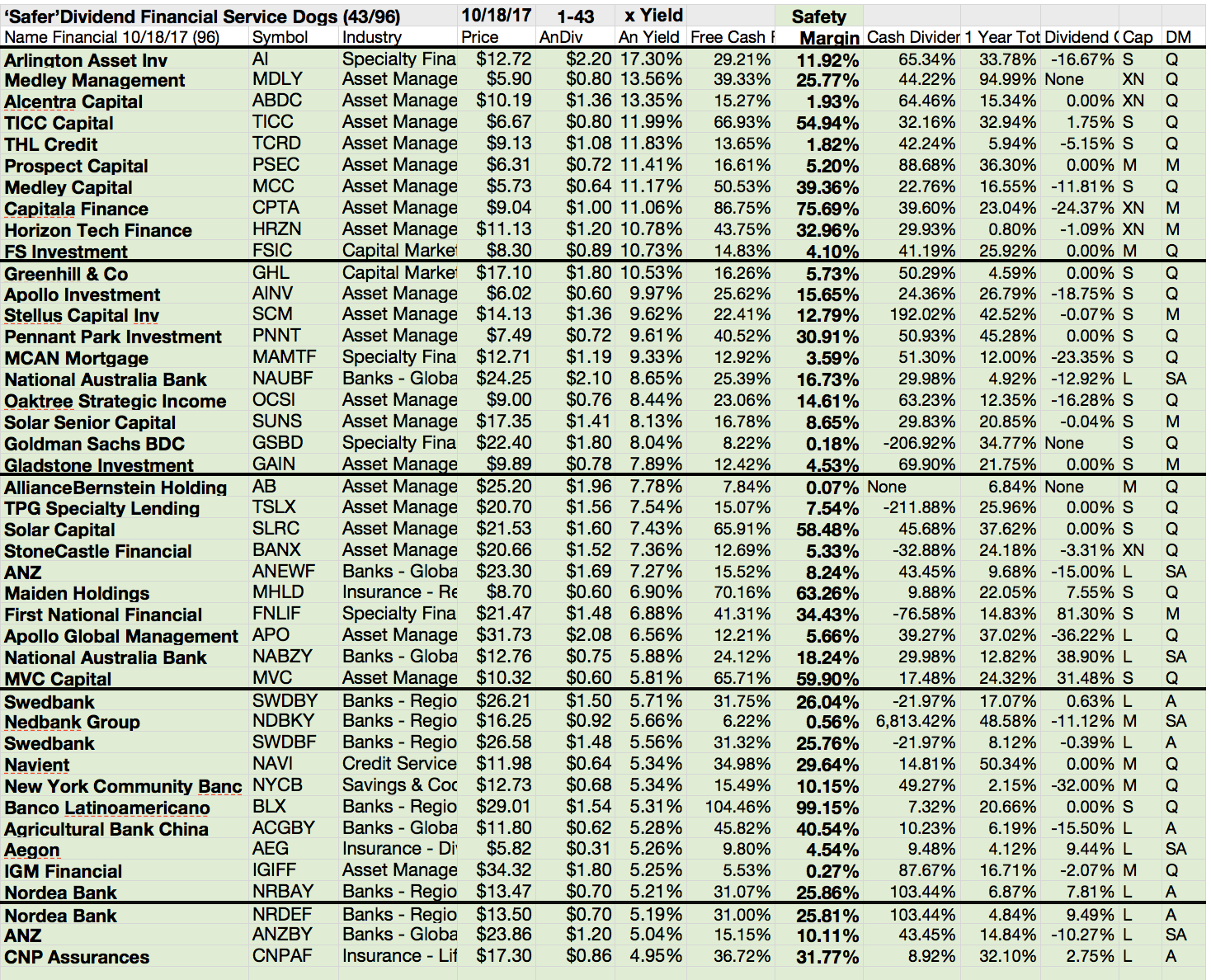

5 Higher Yielding Financial Stocks With Low Debt Figures

Dividends are a powerful income source if you use it

wisely. I personally prefer stocks with solid growth potential but don't like to

overpay a stock.

But as investor with a small pocket and a high desire

of big yielding stocks, I also need to look at companies with yields far above

the 5 percent mark.

Today I've discovered some stock ideas from the

financial sector. I know, it’s not the best place to hunt for opportunities

because the assets are often strange in terms of asset volatility. In addition,

the financial sector often life from interest arbitrage, a risky and low margin

business (in a market with full information). However, you can find a

compilation about financial stocks with high yields and "normal" debt

ratios beow.

These are my criteria:

Market cap is greater than Over 100 million.

Dividend yield is greater than 8.5%.

The payout ratio is less than 100%.

Total debt to equity is less than 1.00.

Five higher yielding stocks from the financial sector fulfilled these

criteria. The most of the results are low capitalized.

Labels:

ARCC,

Debt Ratio,

Dividends,

Financial,

GAIN,

High Yield,

NMFC,

PNNT,

TICC

Ex-Dividend Stocks: Best Dividend Paying Shares On September 18, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 57 stocks,

preferred shares or funds go ex dividend - of which 17 yield more than 3

percent. The average yield amounts to 5.94%. Here is a full list of all stocks with ex-dividend

date within the current week.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Apollo

Investment Corporation

|

1.78B

|

13.95

|

0.97

|

5.90

|

9.56%

|

|

PennantPark

Investment

|

779.46M

|

8.62

|

1.12

|

6.07

|

9.55%

|

|

Main

Street Capital Corporation

|

1.04B

|

9.52

|

1.59

|

10.14

|

6.42%

|

|

Douglas

Dynamics, Inc.

|

327.93M

|

87.53

|

2.20

|

2.42

|

5.58%

|

|

LTC

Properties Inc.

|

1.22B

|

23.82

|

2.05

|

12.28

|

5.01%

|

|

Electro

Rent Corp.

|

435.33M

|

18.78

|

1.91

|

1.75

|

4.58%

|

|

Ramco-Gershenson

Properties

|

928.02M

|

129.08

|

1.55

|

6.40

|

4.33%

|

|

Greif,

Inc.

|

2.41B

|

18.47

|

1.98

|

0.56

|

3.31%

|

|

American

Railcar Industries, Inc.

|

771.02M

|

9.63

|

1.93

|

1.06

|

2.77%

|

|

SeaWorld

Entertainment, Inc.

|

2.73B

|

91.06

|

4.37

|

1.90

|

2.58%

|

|

Republic

Bancorp Inc.

|

565.27M

|

12.20

|

1.04

|

4.08

|

2.57%

|

|

Hudson

Pacific Properties, Inc.

|

1.13B

|

-

|

1.31

|

6.21

|

2.48%

|

|

Las

Vegas Sands Corp.

|

52.45B

|

27.92

|

6.99

|

4.25

|

2.20%

|

|

TriCo

Bancshares

|

336.43M

|

13.72

|

1.41

|

3.20

|

2.10%

|

|

The

Chubb Corporation

|

23.02B

|

12.53

|

1.48

|

1.66

|

1.99%

|

|

Hawkins

Inc.

|

395.94M

|

22.27

|

2.26

|

1.12

|

1.91%

|

|

Tiffany

& Co.

|

10.09B

|

23.36

|

3.71

|

2.58

|

1.72%

|

|

Hill-Rom

Holdings, Inc.

|

2.17B

|

20.19

|

2.69

|

1.27

|

1.53%

|

|

Convergys

Corporation

|

1.94B

|

18.47

|

1.45

|

0.96

|

1.29%

|

|

Brown

Shoe Co. Inc.

|

927.44M

|

19.34

|

2.18

|

0.36

|

1.25%

|

Ex-Dividend Stocks: Best Dividend Paying Shares On June 19, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks with payment dates can be found here: Ex-Dividend Stocks June 19, 2013. In total, 13 stocks and preferred shares go ex dividend - of which 6 yield more than 3 percent. The average yield amounts to 4.75%.

A full list of all stocks with payment dates can be found here: Ex-Dividend Stocks June 19, 2013. In total, 13 stocks and preferred shares go ex dividend - of which 6 yield more than 3 percent. The average yield amounts to 4.75%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

PennantPark

Investment Corporation

|

785.52M

|

9.78

|

1.13

|

6.32

|

9.47%

|

|

Ship

Finance International Limited

|

1.48B

|

7.90

|

1.39

|

4.91

|

9.01%

|

|

PennantPark Floating Rate Capital

|

-

|

-

|

-

|

-

|

7.09%

|

|

Total

SA

|

115.65B

|

10.15

|

1.20

|

0.48

|

4.24%

|

|

Nicholas

Financial Inc.

|

180.24M

|

9.14

|

1.41

|

2.55

|

3.20%

|

|

Republic

Bancorp Inc.

|

475.70M

|

9.50

|

0.88

|

3.44

|

3.07%

|

|

Federal

Realty Investment Trust

|

6.81B

|

47.65

|

5.24

|

11.00

|

2.77%

|

|

Cohu,

Inc.

|

286.02M

|

-

|

1.08

|

1.28

|

2.07%

|

|

The

Chubb Corporation

|

23.02B

|

13.83

|

1.44

|

1.68

|

2.01%

|

|

Convergys

Corporation

|

1.93B

|

53.76

|

1.43

|

0.97

|

1.31%

|

|

QCR

Holdings Inc.

|

74.86M

|

8.17

|

0.53

|

0.98

|

0.53%

|

|

World

Fuel Services Corp.

|

2.84B

|

14.94

|

1.82

|

0.07

|

0.38%

|

|

Advance

Auto Parts Inc.

|

6.04B

|

16.27

|

4.75

|

0.96

|

0.29%

|

19 High Yielding Income Growth Stocks With Low Debt Ratios

High-Yield

dividend growth stocks with low debt originally published at "long-term-investments.blogspot.com". I often tell that

growth and income growth are two major items in wealth creating.

Another criterion is the debt level. A company with an indebtedness has much more possibilities to grow or to create something special. Companies with a huge debt load must create management teams to handle this debt and look for new finance rounds.

I love it when stocks have a low debt to equity ratio. But it’s only an additional stone in the wall of corporate finance and valuation.

Today I like to highlight the highest dividend paying stocks (over five percent dividend yield) with more than five years of consecutive dividend growth and a debt to equity ratio of less than one. The ratio is not really low but it’s ok for a higher yielding company in my view. What matters in this area is the expected growth. Growth destroys debt. A growing income makes it easier to pay back the loans.

Nineteen companies fulfilled these criteria of which seven have a buy or better rating. Oil and gas pipeline stocks and drilling companies are the dominating industries in this screen.

Another criterion is the debt level. A company with an indebtedness has much more possibilities to grow or to create something special. Companies with a huge debt load must create management teams to handle this debt and look for new finance rounds.

I love it when stocks have a low debt to equity ratio. But it’s only an additional stone in the wall of corporate finance and valuation.

Today I like to highlight the highest dividend paying stocks (over five percent dividend yield) with more than five years of consecutive dividend growth and a debt to equity ratio of less than one. The ratio is not really low but it’s ok for a higher yielding company in my view. What matters in this area is the expected growth. Growth destroys debt. A growing income makes it easier to pay back the loans.

Nineteen companies fulfilled these criteria of which seven have a buy or better rating. Oil and gas pipeline stocks and drilling companies are the dominating industries in this screen.

Ex-Dividend Stocks: Best Dividend Paying Shares On March 20, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks March 20,

2013. In total, 17 stocks and

preferred shares go ex dividend - of which 8 yield more than 3 percent. The

average yield amounts to 3.24%.

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

PennantPark

Investment Corporation

|

435.00M

|

9.24

|

1.16

|

3.64

|

9.33%

|

|

|

PennantPark Floating Rate Capital Ltd.

|

-

|

-

|

-

|

-

|

7.28%

|

|

|

HSBC

Holdings plc

|

201.19B

|

14.75

|

1.15

|

3.55

|

6.62%

|

|

|

Aviva

plc

|

4.45B

|

20.72

|

0.68

|

0.84

|

6.47%

|

|

|

SmartPros

Ltd.

|

7.11M

|

-

|

0.65

|

0.44

|

3.97%

|

|

|

LS

Starrett Co.

|

64.90M

|

-

|

0.57

|

0.26

|

3.73%

|

|

|

Nicholas

Financial Inc.

|

159.75M

|

7.57

|

1.29

|

2.28

|

3.64%

|

|

|

EarthLink

Inc.

|

567.81M

|

78.71

|

0.79

|

0.42

|

3.63%

|

|

|

Intercontinental

Hotels Group

|

8.09B

|

15.79

|

26.46

|

4.41

|

2.85%

|

|

|

JMP

Group Inc.

|

147.96M

|

54.58

|

1.17

|

1.03

|

2.14%

|

|

|

Hawkins

Inc.

|

414.06M

|

25.46

|

2.44

|

1.20

|

1.73%

|

|

|

Convergys

Corporation

|

1.80B

|

67.96

|

1.35

|

0.90

|

1.41%

|

|

|

Mentor

Graphics Corp.

|

1.95B

|

14.58

|

2.01

|

1.81

|

1.04%

|

|

|

Computer

Task Group Inc.

|

425.33M

|

26.05

|

4.14

|

1.02

|

0.88%

|

|

|

Financial

Engines, Inc.

|

1.67B

|

94.14

|

6.34

|

9.01

|

0.57%

|

|

|

World

Fuel Services Corp.

|

2.84B

|

14.88

|

1.87

|

0.07

|

0.38%

|

|

|

Advance

Auto Parts Inc.

|

5.94B

|

15.46

|

4.89

|

0.96

|

0.30%

|

Subscribe to:

Comments (Atom)