Showing posts with label TICC. Show all posts

Showing posts with label TICC. Show all posts

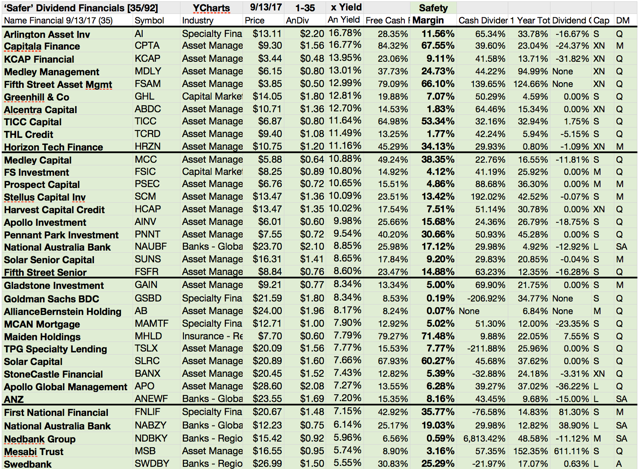

19 Stocks With Yields Over 10% And Positive Earnings Growth

The following stocks have high dividend yields (over 10%) and positive expected earnings growth forecasts....Each of the results have a positive return on assets.

Here are the 19 stocks...

Here are the 19 stocks...

5 Higher Yielding Financial Stocks With Low Debt Figures

Dividends are a powerful income source if you use it

wisely. I personally prefer stocks with solid growth potential but don't like to

overpay a stock.

But as investor with a small pocket and a high desire

of big yielding stocks, I also need to look at companies with yields far above

the 5 percent mark.

Today I've discovered some stock ideas from the

financial sector. I know, it’s not the best place to hunt for opportunities

because the assets are often strange in terms of asset volatility. In addition,

the financial sector often life from interest arbitrage, a risky and low margin

business (in a market with full information). However, you can find a

compilation about financial stocks with high yields and "normal" debt

ratios beow.

These are my criteria:

Market cap is greater than Over 100 million.

Dividend yield is greater than 8.5%.

The payout ratio is less than 100%.

Total debt to equity is less than 1.00.

Five higher yielding stocks from the financial sector fulfilled these

criteria. The most of the results are low capitalized.

Labels:

ARCC,

Debt Ratio,

Dividends,

Financial,

GAIN,

High Yield,

NMFC,

PNNT,

TICC

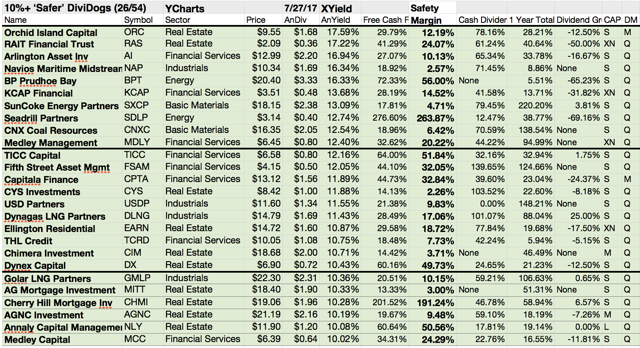

20 Stocks With Yields Over 10% And Highest Buy Ratings

Most

recommended stocks with very high yields originally published at "long-term-investments.blogspot.com". I love stocks with

high dividend yields but there are only a few with sustainable payments. I

think about Altria or Lorillard. Other stocks have a huge potential for a

dividend cut, also if they are a Dividend Champion or a stock with a very long

dividend growth history. I made this investment mistake with Avon Products. The

company was highly leveraged and became some operations problems. Finally they reduced

the dividend dramatically.

Most of the people need stocks with very high yields. I don’t because my private wealth is high enough to catch the dividend payments and live off it. In the past, I often thought it would be the only solution to put all my money into the highest yielding stocks with the most attractive fundamentals. This strategy failed and I lost much money within the closed-end shipping industry. That was a big mistake from which I learned and I like to share this with you.

Please don’t put all your money into one stock or make a single bet on a high-yield stock. This is very risky. That’s all I can say. Make a good research and try to avoid an overweighting of a stock or asset theme.

Each month, I made a regular screen about the stocks with the highest dividend yields because I believe there is a lot of value information in it for my readers. This month, I like to show you the 20 most recommended stocks with a double-digit dividend yield and a higher market capitalization (over USD 300 million). Out there are 95 companies with a very high yield but only 35 have a buy or better recommendation. The REIT industry is still a big player on my screen with 6 representatives.

Most of the people need stocks with very high yields. I don’t because my private wealth is high enough to catch the dividend payments and live off it. In the past, I often thought it would be the only solution to put all my money into the highest yielding stocks with the most attractive fundamentals. This strategy failed and I lost much money within the closed-end shipping industry. That was a big mistake from which I learned and I like to share this with you.

Please don’t put all your money into one stock or make a single bet on a high-yield stock. This is very risky. That’s all I can say. Make a good research and try to avoid an overweighting of a stock or asset theme.

Each month, I made a regular screen about the stocks with the highest dividend yields because I believe there is a lot of value information in it for my readers. This month, I like to show you the 20 most recommended stocks with a double-digit dividend yield and a higher market capitalization (over USD 300 million). Out there are 95 companies with a very high yield but only 35 have a buy or better recommendation. The REIT industry is still a big player on my screen with 6 representatives.

Best Dividend Paying Ex-Dividend Shares On December 13, 2012

The Best Yielding And

Biggest Ex-Dividend Stocks Researched By ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates. The ex dividend

date is the final date on which the new stock buyer couldn’t receive the next

dividend. If you like to receive the dividend, you need to buy the stock before

the ex dividend date. I made a little screen of the best yielding stocks with a

higher capitalization that have their ex date on the next trading day.

A full list of all stocks

with ex-dividend date can be found here: Ex-Dividend Stocks on December

13, 2012. In total, 23 stocks and

preferred shares go ex dividend - of which 11 yield more than 3 percent. The

average yield amounts to 4.69%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

TICC

Capital Corp.

|

415.17M

|

6.02

|

1.02

|

6.49

|

11.54%

|

|

Equity

One Inc.

|

2.55B

|

306.86

|

1.73

|

7.98

|

4.10%

|

|

Merck

& Co. Inc.

|

137.38B

|

20.54

|

2.47

|

2.87

|

3.81%

|

|

Western

Union Co.

|

7.89B

|

6.58

|

6.92

|

1.39

|

3.78%

|

|

Rayonier

Inc.

|

6.23B

|

24.90

|

4.39

|

4.08

|

3.48%

|

|

Gazit-Globe,

Ltd.

|

1.98B

|

8.96

|

0.91

|

1.00

|

3.42%

|

|

Endurance

Specialty Holdings

|

1.73B

|

13.06

|

0.62

|

0.79

|

3.10%

|

|

DDR

Corp.

|

4.82B

|

-

|

1.45

|

6.13

|

3.08%

|

|

Dr Pepper Snapple Group, Inc.

|

9.48B

|

15.60

|

4.10

|

1.59

|

2.99%

|

|

ACE

Limited

|

27.15B

|

10.17

|

1.01

|

1.53

|

2.45%

|

|

MTS

Systems Corp.

|

781.36M

|

15.51

|

3.44

|

1.44

|

2.41%

|

|

Taubman

Centers Inc.

|

4.83B

|

53.99

|

-

|

6.66

|

2.36%

|

|

Methanex

Corp.

|

2.96B

|

23.26

|

2.09

|

1.11

|

2.31%

|

|

Telephone

& Data Systems

|

2.36B

|

21.14

|

0.60

|

0.44

|

2.17%

|

|

Globe

Specialty Metals, Inc.

|

1.14B

|

41.11

|

2.28

|

1.56

|

1.64%

|

|

Home Bancshares

|

928.15M

|

15.64

|

1.83

|

5.34

|

1.57%

|

|

DSW

Inc.

|

2.93B

|

20.72

|

3.41

|

1.35

|

1.10%

|

|

Thermo

Fisher Scientific, Inc.

|

23.51B

|

20.79

|

1.54

|

1.90

|

0.92%

|

|

First

Citizens Bancshares Inc.

|

1.64B

|

11.40

|

0.83

|

1.64

|

0.75%

|

10% Yielding Dividend Stocks With Strongest Expected Earnings Growth

Stocks With Very High Yields And Fastest Earnings Per Share Growth Researched By Dividend Yield - Stock, Capital, Investment. 134 stocks and funds are listed at the capital markets with dividend yields over ten percent and 84 of them are classical equity investments. Stocks with very high yields are interesting because of the high quarter cash payments you could receive but they are also very dangerous and should be treated with a special attention.

In order to find some great opportunities, I screened all 10 percent yielding stocks with earnings per share growth of more than 10 percent yearly for the upcoming five years. Fifteen stocks remained of which ten are currently recommended to buy.

Ex-Dividend Date Reminder For March 19, 2012

Here is a current overview of best yielding stocks that have their ex-dividend date on the next trading day. If your broker settles your trade today, you will receive the next dividend. A full list of all stocks with ex-dividend date can be found here: Ex-Dividend Stocks March 19, 2012. In total, 10 stocks and preferred shares go ex-dividend of which 5 yielding above 3 percent. The average yield amounts to 4.44 percent.

14 High Yield Stocks With Low Debt Ratios That Are Still Cheap In Terms Of Coming Growth

Stocks With Low PEG Ratios And Low Debt To Equity Researched By Dividend Yield - Stock, Capital, Investment. Sometimes, people only watch at the single P/E ratio which measures the price valuation of a company in relation to its earnings. A high P/E leads similar to a "not buy" decision. But high P/E ratios also express the growth of the company. A stock that doubles earnings every three years is it worth to pay 20 times of earnings. The price-earnings to growth (PEG) ratio is a figure that solves this problem. However, I’ve tried so screen the market by stocks that look cheap in terms of growth (a PEG ratio below one). In addition, the stocks should have a low debt to equity ratio (ratio below 0.3) and a dividend yield of more than five percent (high yields). Fourteen stocks fulfilled these criteria of which six have a double digit yield. Ten stocks have a buy or better recommendation.

Subscribe to:

Comments (Atom)