| Ticker | Company | P/E | Fwd P/E | P/S | P/B | Dividend | Price | Target Price |

| PMT | PennyMac Mortgage Investment Trust | 15.26 | 11.78 | 2.6 | 1.00 | 9.20% | 20.83 | 19.83 |

| FRO | Frontline Ltd. | - | 19.73 | 1.89 | 1.1 | 8.17% | 7.39 | 5.10 |

| OHI | Omega Healthcare Investors, Inc. | 78.51 | 19.9 | 7.63 | 1.85 | 8.06% | 34.68 | 31.11 |

| BXMT | Blackstone Mortgage Trust, Inc. | 13.76 | 12.53 | 5.81 | 1.2 | 7.26% | 34.50 | 35.19 |

| MPW | Medical Properties Trust, Inc. | 16.06 | 15.11 | 7.17 | 1.46 | 6.52% | 15.96 | 14.50 |

| HCP | HCP, Inc. | 69.7 | 50 | 7.15 | 2.56 | 5.36% | 28.36 | 27.20 |

| NNN | National Retail Properties, Inc. | 33.97 | 29.34 | 12.19 | 2.13 | 4.27% | 48.11 | 47.58 |

| KO | The Coca-Cola Company | 30.67 | 21.55 | 6.29 | 11.19 | 3.25% | 48.69 | 51.44 |

| MCD | McDonald's Corporation | 23.48 | 21.47 | 6.5 | - | 2.63% | 180.74 | 191.81 |

| CLX | The Clorox Company | 26.6 | 22.92 | 3.19 | 29.09 | 2.49% | 156.95 | 140.53 |

| JBGS | JBG Smith Properties | - | - | 7.14 | 1.5 | 2.40% | 39.34 | 37.00 |

| KDP | Keurig Dr Pepper Inc. | 5.98 | 18.22 | 5.37 | 1.76 | 2.25% | 26.82 | 24.86 |

| LXFR | Luxfer Holdings PLC | 47.43 | 16.48 | 1.45 | 3.92 | 1.88% | 26.89 | 15.00 |

| TDS | Telephone and Data Systems, Inc. | - | 25.68 | 0.76 | 0.85 | 1.86% | 33.69 | 35.25 |

| HRL | Hormel Foods Corporation | 26.33 | 23.44 | 2.44 | 4.25 | 1.74% | 43.93 | 37.00 |

| HCKT | The Hackett Group, Inc. | 24.16 | 18.63 | 2.19 | 5.4 | 1.52% | 22.65 | 21.80 |

| MKC | McCormick & Company, Incorporated | 32.54 | 26.65 | 3.54 | 6.09 | 1.45% | 146.36 | 128.82 |

| FFIN | First Financial Bankshares, Inc. | 29.58 | 26.08 | 14.64 | 4.18 | 1.36% | 61.51 | 52.50 |

| CHD | Church & Dwight Co., Inc. | 29.68 | 26.86 | 3.95 | 6.9 | 1.32% | 67.14 | 59.61 |

| ICE | Intercontinental Exchange, Inc. | 24.36 | 19.68 | 9.14 | 2.61 | 1.25% | 78.35 | 85.84 |

Creating such high-quality content is hard work and takes a lot of time. You might have noticed that we don't display ads or get paid for our posts. We deliver this information to you for free.

To keep this blog running free without ads, we need your help. For a small donation by using this link or clicking the paypal donation button below, you can help us to keep this blog alive.

As gift for your support, we send you our full Dividend Growth Stock Factbook Collection with over 800+ long-term dividend growth stocks in PDF and Excel. You can also join our distribution list to receive these tools every month.

Here is an example of our open Excel Database for your own research:

If you donate now, you will also get a fresh updated copy of our dividend growth database. The Excel File contains all dividend growth stocks and major buyback stock announcements since 2004.

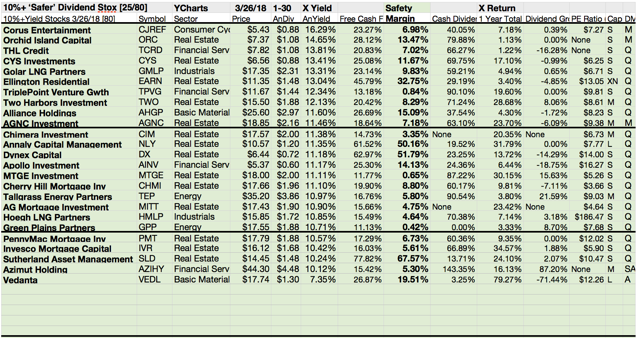

Here is a preview:

Finally, you will get every month a fresh update of our Foreign Yield Factbook. The PDF sorts dividend stocks from the most important economies in the world by yield. - Over 60 Pages!

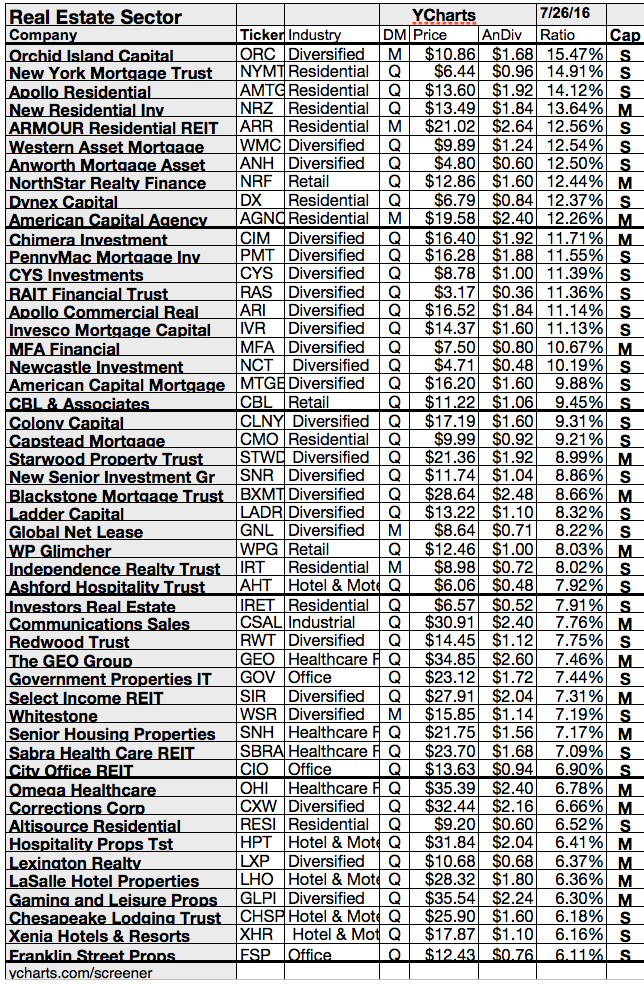

Here is the preview:

Support us now with a small donation and get all of these PDF's and Excel Files every month!

Thank you!