|

Company

|

Ticker

|

New Yield

|

New Dividend

|

Old Dividend

|

Payment Period

|

Date Of Release

|

Dividend Growth in %

|

|

Fifth Street Finance

|

FSC

|

11.09

|

0.125

|

0.02

|

Quarterly

|

15.03.2017

|

525.00%

|

|

Pacific Coast Oil Trust

|

ROYT

|

16.27

|

0.02617

|

0.00487

|

Monthly

|

29.03.2017

|

437.37%

|

|

Carlyle Group

|

CG

|

7.74

|

0.42

|

0.1

|

Quarterly

|

03.08.2017

|

320.00%

|

|

Pacific Coast Oil Trust

|

ROYT

|

19.71

|

0.02776

|

0.00673

|

Monthly

|

05.07.2017

|

312.48%

|

|

Mesabi Trust

|

MSB

|

14.38

|

0.55

|

0.14

|

Quarterly

|

19.04.2017

|

292.86%

|

|

OCI Partners

|

OCIP

|

10.45

|

0.23

|

0.06

|

Quarterly

|

08.05.2017

|

283.33%

|

|

Pacific Coast Oil Trust

|

ROYT

|

7.65

|

0.00931

|

0.00266

|

Monthly

|

28.08.2017

|

250.00%

|

|

Alon USA Partners

|

ALDW

|

14.48

|

0.38

|

0.11

|

Quarterly

|

09.05.2017

|

245.45%

|

|

Blue Hills Bancorp

|

BHBK

|

3.34

|

0.15

|

0.05

|

Quarterly

|

07.09.2017

|

200.00%

|

|

Windstream Holdings

|

WIN

|

12.24

|

0.15

|

0.055

|

Quarterly

|

04.05.2017

|

172.73%

|

|

VOC Energy Trust

|

VOC

|

17.61

|

0.21

|

0.08

|

Quarterly

|

21.04.2017

|

162.50%

|

|

Enduro Royalty Trust

|

NDRO

|

11

|

0.0362

|

0.01398

|

Monthly

|

23.01.2017

|

158.94%

|

|

Cabot Oil&Gas

|

COG

|

0.85

|

0.05

|

0.02

|

Quarterly

|

04.05.2017

|

150.00%

|

|

Ormat Technologies

|

ORA

|

1.17

|

0.17

|

0.07

|

Quarterly

|

03.03.2017

|

142.86%

|

|

Ares Management

|

ARES

|

6.81

|

0.31

|

0.13

|

Quarterly

|

07.08.2017

|

138.46%

|

|

Ares Management

|

ARES

|

6.81

|

0.31

|

0.13

|

Quarterly

|

08.08.2017

|

138.46%

|

|

Hugoton Royalty Trust Un

|

HGT

|

4.3

|

0.00609

|

0.00257

|

Monthly

|

22.08.2017

|

136.96%

|

|

Enduro Royalty Trust

|

NDRO

|

14.23

|

0.0409

|

0.01733

|

Monthly

|

22.03.2017

|

136.01%

|

|

Permian Basin Royalty Tr

|

PBT

|

12.77

|

0.10191

|

0.04801

|

Monthly

|

21.02.2017

|

112.27%

|

|

Marine Petroleum Trust Un

|

MARPS

|

9.49

|

0.09574

|

0.04577

|

Quarterly

|

22.05.2017

|

109.18%

|

|

MV Oil Trust

|

MVO

|

14.6

|

0.25

|

0.12

|

Quarterly

|

05.04.2017

|

108.33%

|

|

Aetna

|

AET

|

1.58

|

0.5

|

0.25

|

Quarterly

|

21.02.2017

|

100.00%

|

|

Children's Place

|

PLCE

|

1.35

|

0.4

|

0.2

|

Quarterly

|

08.03.2017

|

100.00%

|

|

Eaton Vance Global Income

|

EVGBC

|

1.2

|

0.1

|

0.05

|

Monthly

|

01.05.2017

|

100.00%

|

|

First Mid-Illinois Bcsh

|

FMBH

|

1.91

|

0.32

|

0.16

|

SemiAnnual

|

02.05.2017

|

100.00%

|

|

Och-Ziff Capital Mgmt

|

OZM

|

3.25

|

0.02

|

0.01

|

Quarterly

|

03.05.2017

|

100.00%

|

|

Systemax

|

SYX

|

2.39

|

0.1

|

0.05

|

Quarterly

|

08.05.2017

|

100.00%

|

|

InnSuites Hospitality

|

IHT

|

1.03

|

0.01

|

0.005

|

SemiAnnual

|

23.06.2017

|

100.00%

|

|

Citigroup

|

C

|

1.93

|

0.32

|

0.16

|

Quarterly

|

20.07.2017

|

100.00%

|

Showing posts with label FSC. Show all posts

Showing posts with label FSC. Show all posts

These Stocks Doubled Their Dividends This Year

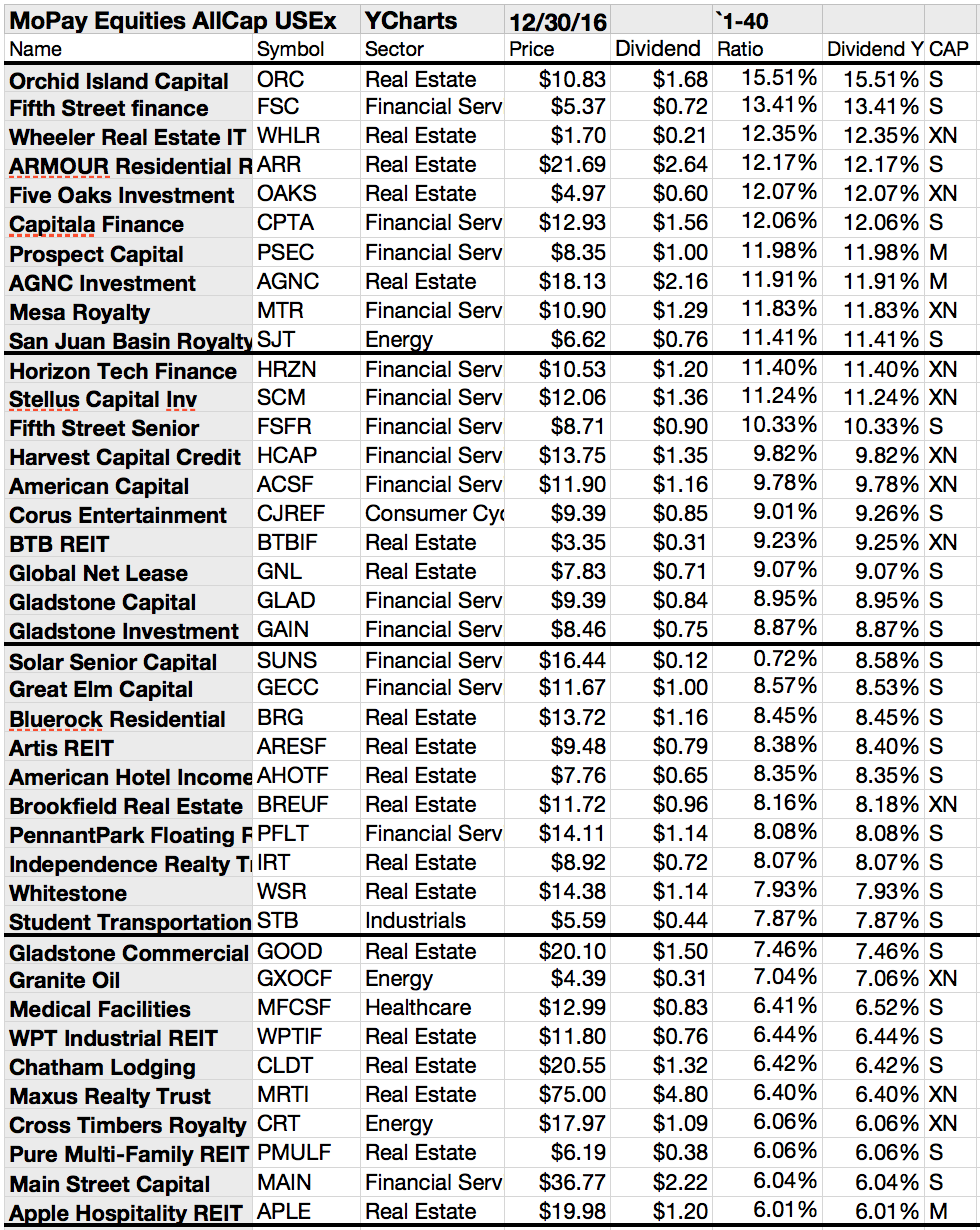

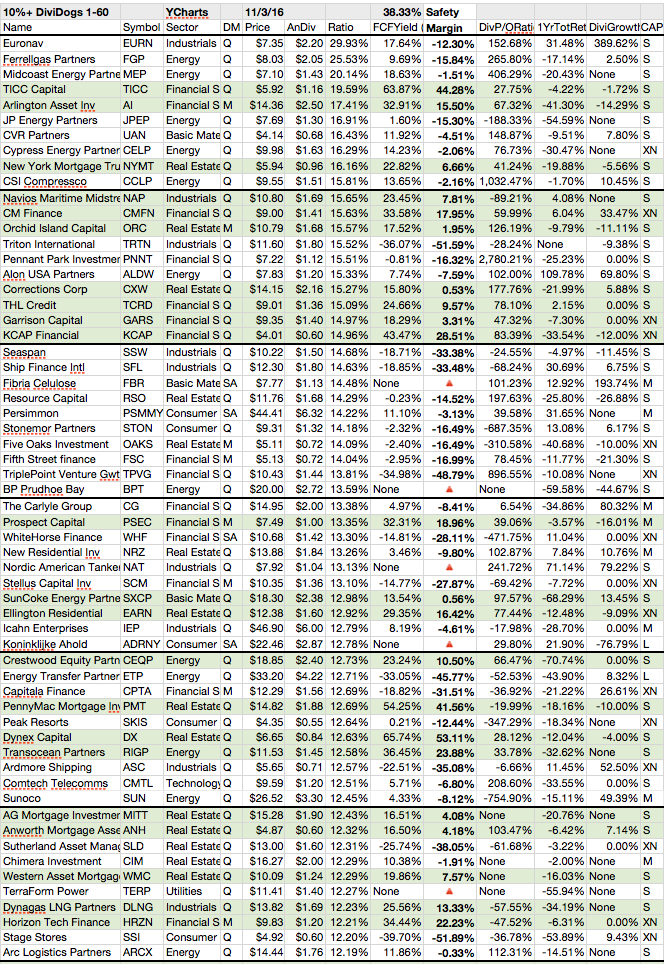

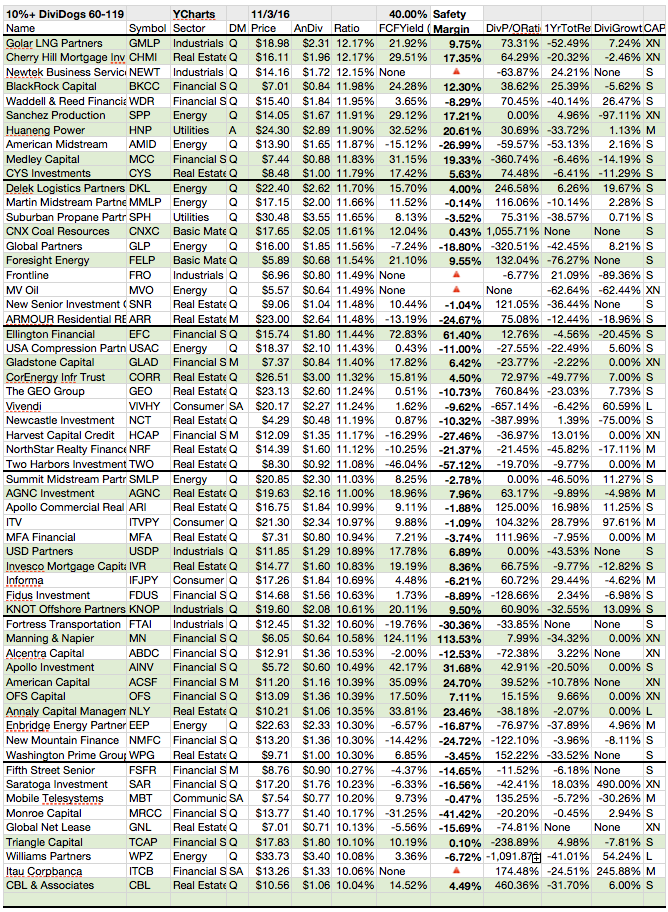

20 Highest Yielding Monthly Payout Stocks

Are you buying stocks only for the

dividend? That's the wrong way in my view but many do it because they like to

get a regular income like a paycheck.

Dividends come

normally 4 times a year, that's a quarterly check but some do pay on a monthly

basis.

I'm blogging for

some years and know that some of my readers are deeply interested in stocks

that give investors a monthly payout.

I've ever

announced that it doesn't matter if you get each month .5 percent or 4 times

1.5 percent. In addition, lower yielding stocks with higher growth rates do

perform better over the long-term.

However, Today I

like to show you the highest yielding stocks with a monthly dividend payout. Which do you like?

Here are the higher capitalized stocks in detail:

Here are the higher capitalized stocks in detail:

Top Monthly Income Stocks: These 10 Stocks Pay You Every Month

I know that you like dividend and

you also like stocks that pay often dividends. Monthly dividends are very

popular because for many people, it looks like monthly payment check. Your

bills also come each month and must be paid.

Regretless there

are only a few amounts of stocks that pay dividends on a monthly basis and let

me mention one thing about these stocks: They are not the best ones on the

market.

However, Today I

like to show you 10 names on the market with 12 dividends a year.

You may also be interested in those stocks with the fastest dividend growth from the S&P 500.

You may also be interested in those stocks with the fastest dividend growth from the S&P 500.

These are the results:

Ex-Dividend Stocks: Best Dividend Paying Shares On July 11, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks July 11,

2013. In total, 27 stocks and

preferred shares go ex dividend - of which 17 yield more than 3 percent. The

average yield amounts to 5.78%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

ARMOUR

Residential REIT, Inc.

|

1.48B

|

5.53

|

0.54

|

4.01

|

19.22%

|

|

|

Fifth

Street Finance Corp.

|

1.14B

|

10.13

|

1.08

|

5.99

|

10.71%

|

|

|

Consolidated

Communications

|

723.46M

|

60.66

|

5.72

|

1.28

|

8.52%

|

|

|

Associated

Estates Realty Corp.

|

818.46M

|

126.85

|

2.03

|

4.50

|

4.61%

|

|

|

Freeport-McMoRan Copper & Gold

|

26.26B

|

9.00

|

1.46

|

1.46

|

4.52%

|

|

|

Mid-America Apartment Comm.

|

2.87B

|

42.41

|

3.08

|

5.59

|

4.10%

|

|

|

Shaw

Communications, Inc.

|

10.86B

|

15.21

|

2.95

|

2.25

|

4.01%

|

|

|

AbbVie

Inc.

|

68.79B

|

12.78

|

23.29

|

3.71

|

3.69%

|

|

|

AuRico

Gold Inc.

|

1.18B

|

-

|

0.59

|

6.06

|

3.51%

|

|

|

City

Holding Co.

|

655.59M

|

17.36

|

1.79

|

5.57

|

3.49%

|

|

|

SAIC,

Inc.

|

4.74B

|

9.94

|

2.06

|

0.43

|

3.40%

|

|

|

Harsco

Corporation

|

1.99B

|

-

|

2.42

|

0.66

|

3.32%

|

|

|

Rouse

Properties, Inc.

|

999.96M

|

-

|

2.01

|

4.21

|

2.57%

|

|

|

Chesapeake

Energy Corporation

|

13.76B

|

-

|

1.09

|

1.03

|

1.66%

|

|

|

Abbott

Laboratories

|

54.50B

|

70.90

|

2.41

|

2.52

|

1.61%

|

|

|

Buckle

Inc.

|

2.60B

|

15.91

|

8.12

|

2.30

|

1.47%

|

|

|

Trinity

Industries Inc.

|

2.82B

|

10.78

|

1.32

|

0.73

|

1.42%

|

|

|

Ryland

Group Inc.

|

1.78B

|

30.31

|

3.29

|

1.21

|

0.31%

|

Subscribe to:

Comments (Atom)