|

| Source: Seeking Alpha |

Showing posts with label SJT. Show all posts

Showing posts with label SJT. Show all posts

19 Monthly Dividend Paying Stocks With Yields Over 3%

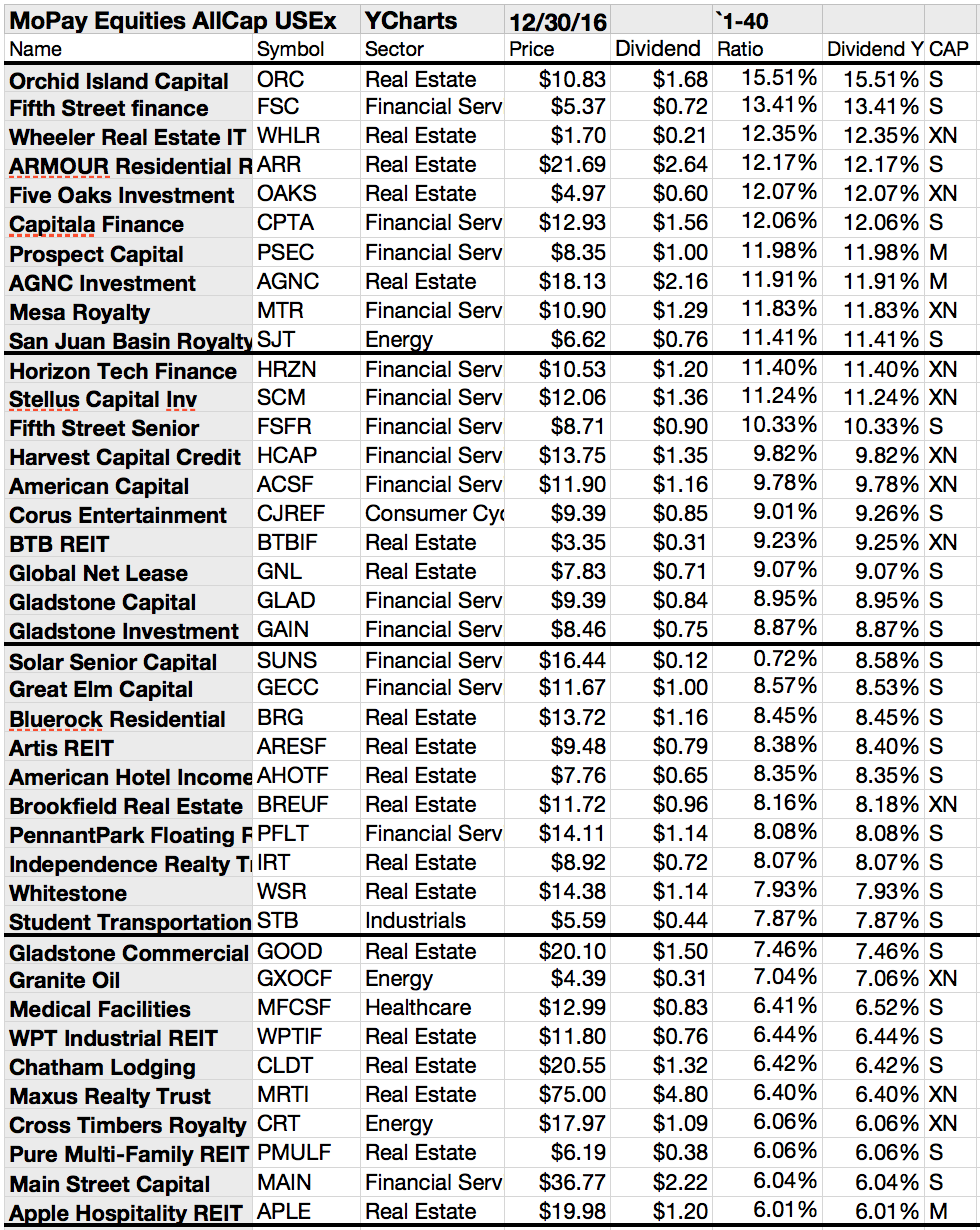

Attached you will find another portfolio of high yielding monthly dividend paying stocks.

Each of the stocks offer a yield over 3%. Reits and Oil and Gas companies dominating the screening results.

Here is the portfolio...

Each of the stocks offer a yield over 3%. Reits and Oil and Gas companies dominating the screening results.

Here is the portfolio...

10 Stocks With Higher Dividends In The Past Week

Let's take a look at last week's dividend growth stocks. In total, only 10 stocks raised dividend payments. The biggest and well-known names are Accenture, Lockheed Martin. Both stocks also announced a buyback programe.

Which of the stocks do you like? Are they fairly priced in your view?

Attached is a small sheet of all stocks with Ex-Dates, Payment Date, increasing rate and total payment amount. You will also find a sheet with the latest Buyback announcements of the past week.

Bed Bath & Beyond, Paccar, Metlife, AmerisourceBergen were the biggest stocks on the list.

These are the results...

Which of the stocks do you like? Are they fairly priced in your view?

Attached is a small sheet of all stocks with Ex-Dates, Payment Date, increasing rate and total payment amount. You will also find a sheet with the latest Buyback announcements of the past week.

Bed Bath & Beyond, Paccar, Metlife, AmerisourceBergen were the biggest stocks on the list.

These are the results...

13 Stocks With Dividend Growth In The Past Week

13 companies raised their dividends

during the recent week. Dividend is so important for investors who like to grow

their investments.

Below is a full

list of all stocks that have raised their dividend payments within the past

week. Five of the firms have a current yield of more than 3 percent.

Kroger, DTE

Energy, Matson, Disney and Worthington Industries were the biggest stocks, all

with a market capitalization above the one billion Mark.

Disney is for me

the most impressive stocks. It has grown more to a merchandise company and licensing

business than to an entertainment company, which is in general good.

I've missed the

chance to buy the stock. I still believe that the current prices are too high

but they truly reflect the strong growth which did not disappoint. Maybe I get

some shares within the next market correction.

These are the

latest dividend growers, sorted by yield....

14 Top Dividend Growers From Last Week

Stocks with dividend hikes from last week originally

published at long-term-investments.blogspot.com.

Only 14 stocks raised their dividend payments within the recent week. Despite

the low number of growth stocks, the quality is still available.

Big names are again on the list. The biggest player is

Lockheed Martin. The military group announced to boost dividends by 15.7

percent. I love this stock that is so deeply integrated into the U.S. economy.

Five High-Yields are part of the latest dividend

growth stocks but only three companies are currently valuated with a forward

P/E of less than 15. Also three of fourteen shares are currently recommended to

buy.

Basic material stocks as well as financial stocks are

dominating the results – A fact that we’ve also seen over the recent weeks. For

the financial sector it’s reasonable because of the abnormal dividend cuts in

2008 but basic or raw material stocks? It’s really hard to explain why these stocks

hike dividends when the whole sector is under pressure due to falling prices in

anticipation of a slowing Chinese economy.

We will see how it develops over the time. I’ve

attached, like every week, the full list of the latest dividend growth stocks.

You can also find attached the current price ratios in order to find and

compare the cheapest stocks from the list.

The Latest Dividend Growth Stocks | LRR Energy

Linked is a current list of the latest Dividend Growth Stocks. The list contains six companies that have raised their cash distributions on the last trading day. Five of them pay dividends on a monthly basis and three have a double-digit dividend yield. Only one stock has a market cap over USD 1 billion.

The highest yielding stock from the list has a dividend yield ratio of 12.22 percent and comes from the independent oil & gas industry. It's the limited Partnership LRR Energy L.P. The company announced to boost its future quarterly dividend payments by 0.52 percent.

The highest yielding stock from the list has a dividend yield ratio of 12.22 percent and comes from the independent oil & gas industry. It's the limited Partnership LRR Energy L.P. The company announced to boost its future quarterly dividend payments by 0.52 percent.

These are the latest Dividend Growth Stocks

Company

|

Dividend Yield in %

|

Dividend Growth

|

Payment Period

|

Ex-Dividend Date

|

Dividend Payment Date

|

Cross Timbers Royalty Tr

|

8.82

|

1.73%

|

Monthly

|

7/29/2013

|

8/14/2013

|

Enduro Royalty Trust

|

10.59

|

3.97%

|

Monthly

|

7/29/2013

|

8/14/2013

|

Home Loan Servicing Sols

|

7.21

|

7.14%

|

Monthly

|

7/29/2013

|

8/12/2013

|

Hugoton Royalty Tr Un

|

13.35

|

26.88%

|

Monthly

|

7/29/2013

|

8/14/2013

|

LRR Energy

|

12.29

|

0.52%

|

Quarterly

|

7/26/2013

|

8/14/2013

|

San Juan Basin

Royalty Tr

|

7.56

|

28.87%

|

Monthly

|

7/29/2013

|

8/14/2013

|

Do you like this article? If yes, please support us and hit the button for a Facebook Like, make a tweet or post a comment in the Dividend Yield

community! Thank you so much, we really appreciate it.

20 Stocks And Funds With Dividend Growth

Stocks with dividend hikes from last week originally

published at “long-term-investments.blogspot.com”.

I enjoy it really to see how dividends grow. One company with monthly payments that

hiked its dividends with an impressive speed is the retail real estate trust Realty

Income. Last week they announced only a small hike of 0.2 percent but this bigger

dividend will be paid every month.

I personally don’t like REITs and financials because of

the high debt. They also invested huge amounts into assets of which I have no idea

how they could perform. I stay by my core research competence and let them do their

work.

Last week, 19 companies and one fund announced a dividend hike. Only half of them have a current buy or better rating. The average dividend growth of the top dividend growers from last week amounts to 53.73 percent.

7 High-Yield Canadian Energy Trusts With Monthly Dividend Payments

Canadian Energy Trusts with very high yields and monthly dividends originally published at "long-term-investments.blogspot.com". Investing money into stocks is hard work and very painful if you make the wrong choices. If you have a focus on dividends like me then you should have a quiet overview of the best dividend paying stocks.

You should also know some of the stocks that pay money to investors on a monthly basis. More than 300 companies pay dividends each month but most of them are trash. I introduced some higher yielding stocks with monthly payments in the past and like to proceed today with seven Canadian Energy Trusts.

Let me clarify one thing. It doesn’t matter how often a company pays its shareholders. It is more important to have a high quality growth stock with a trustful management than a company with a high yield and monthly dividend payments.

Labels:

BPT,

BTE,

Canadian Energy Trust,

Dividends,

ERF,

High Yield,

PBT,

PGH,

PWE,

SJT

Subscribe to:

Comments (Atom)