Showing posts with label GOOD. Show all posts

Showing posts with label GOOD. Show all posts

17 Best Rated Monthly Dividend Paying Stocks With Big Yields

While most dividend paying stocks that trade on exchanges in the US pay quarterly, there are some stocks that pay their dividends on other schedules.

A handful pay their dividends semi-annually while there is a larger population of monthly dividend stocks.

While only one aspect that should be considered in selecting stocks for investment, monthly dividend payments can be advantageous for building wealth over time and to smooth out a dividend retirement income stream.

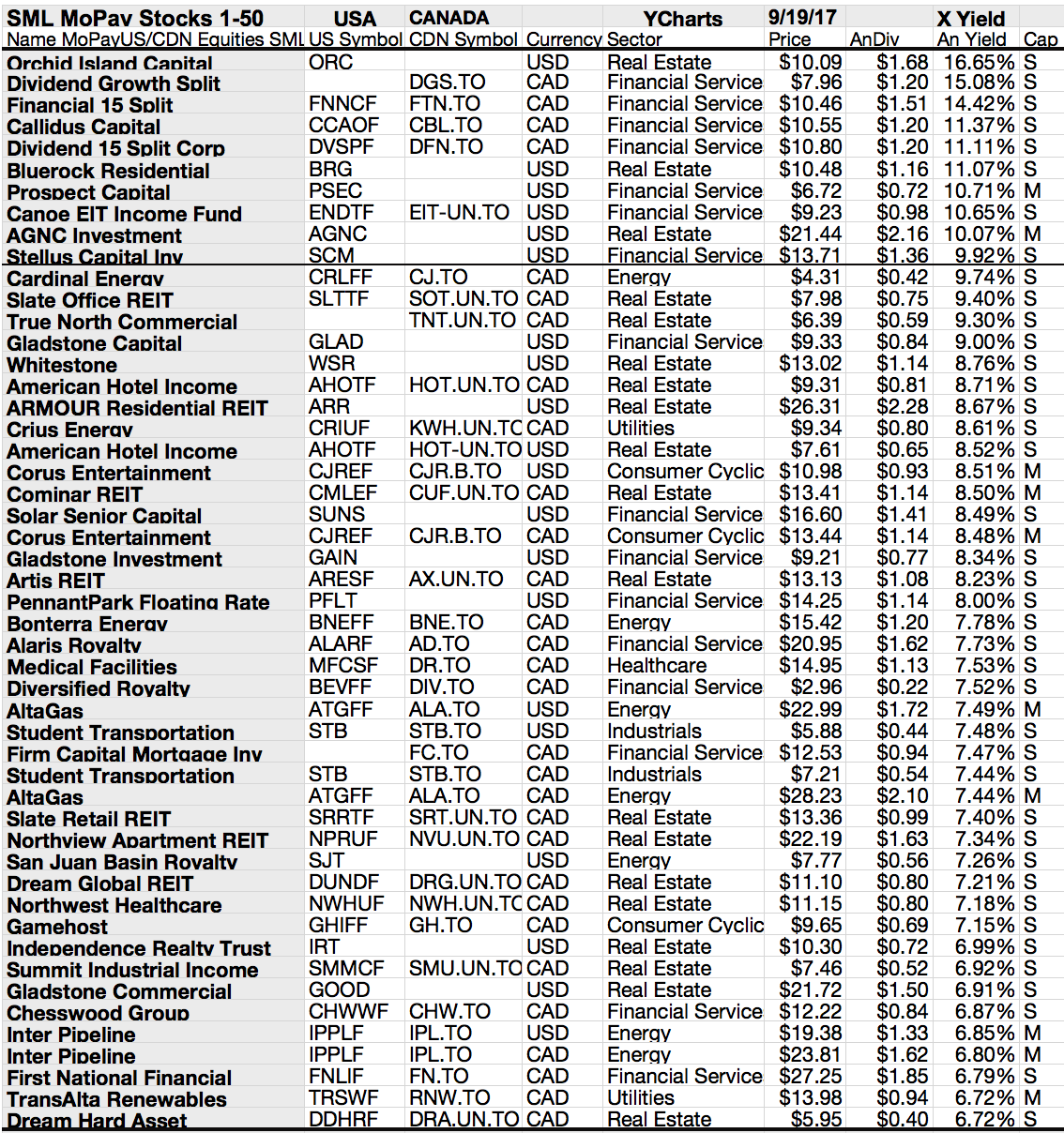

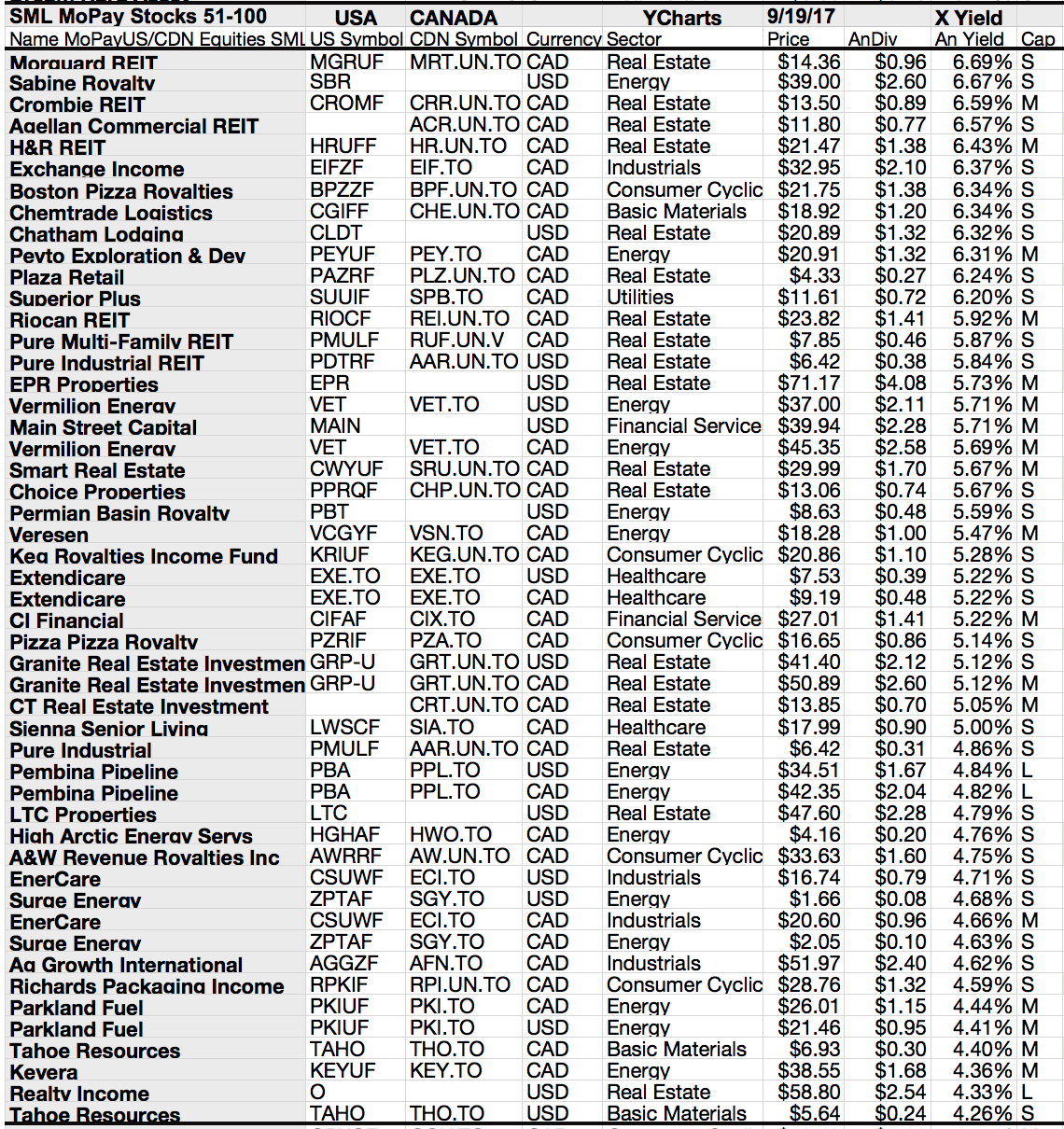

Attached you will find a compilation of monthly paying stocks that met the following criteria:

- Pay dividends of 6% (plus or minus)

- Are growing those dividends

- Have solid balance sheets

A handful of these businesses even have investment grade credit ratings. The table below provides a list of 17 monthly dividend stocks sorted on dividend yield.

These are the results...

A handful pay their dividends semi-annually while there is a larger population of monthly dividend stocks.

While only one aspect that should be considered in selecting stocks for investment, monthly dividend payments can be advantageous for building wealth over time and to smooth out a dividend retirement income stream.

Attached you will find a compilation of monthly paying stocks that met the following criteria:

- Pay dividends of 6% (plus or minus)

- Are growing those dividends

- Have solid balance sheets

A handful of these businesses even have investment grade credit ratings. The table below provides a list of 17 monthly dividend stocks sorted on dividend yield.

These are the results...

| 17 Monthly Dividend Stocks (click to enlarge), Source: Valuewalk.com |

The Best Monthly Dividend Stocks For High-Yield Income Investors

The table below provides a list of 17 monthly dividend stocks sorted on dividend yield.

A handful of these businesses even have investment grade credit ratings.

It should be noted that this list is not all inclusive of monthly dividend paying stocks as there were a few monthly distribution paying master limited partnerships (MLPs) and a couple of crude oil production trusts that I chose to leave off this initial list of stocks.

MLPs and crude oil trusts are not stocks and their accounting and financial reporting is sufficiently different that they should be covered separately.

If you like to receive more list and high yield dividend tables, you should subscribe to my daily newsletter here. It's completly free for everyone. Thank you.

Here is the list...

A handful of these businesses even have investment grade credit ratings.

It should be noted that this list is not all inclusive of monthly dividend paying stocks as there were a few monthly distribution paying master limited partnerships (MLPs) and a couple of crude oil production trusts that I chose to leave off this initial list of stocks.

MLPs and crude oil trusts are not stocks and their accounting and financial reporting is sufficiently different that they should be covered separately.

If you like to receive more list and high yield dividend tables, you should subscribe to my daily newsletter here. It's completly free for everyone. Thank you.

Here is the list...

19 Monthly Dividend Paying Stocks With Yields Over 3%

Attached you will find another portfolio of high yielding monthly dividend paying stocks.

Each of the stocks offer a yield over 3%. Reits and Oil and Gas companies dominating the screening results.

Here is the portfolio...

Each of the stocks offer a yield over 3%. Reits and Oil and Gas companies dominating the screening results.

Here is the portfolio...

Ex-Dividend Stocks: Best Dividend Paying Shares On October 18, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 11 stocks go ex dividend

- of which 5 yield more than 3 percent. Here is a full list of all stocks with ex-dividend

date within the current week.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stock:

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

Gladstone

Investment

|

190.63M

|

12.86

|

0.83

|

5.96

|

10.00%

|

|

|

Gladstone

Land

|

105.85M

|

147.36

|

1.87

|

29.40

|

8.88%

|

|

|

Gladstone

Commercial

|

231.26M

|

-

|

1.39

|

4.20

|

8.03%

|

|

|

Pengrowth

Energy

|

3.29B

|

-

|

0.85

|

2.69

|

7.38%

|

|

|

Vale

S.A.

|

84.57B

|

20.26

|

1.20

|

1.81

|

4.57%

|

|

|

Codorus

Valley Bancorp Inc.

|

92.60M

|

9.98

|

1.18

|

2.00

|

2.34%

|

|

|

Colgate-Palmolive

Co.

|

58.11B

|

26.06

|

37.98

|

3.36

|

2.18%

|

|

|

Tri-County

Financial Corporation

|

60.00M

|

10.10

|

0.98

|

1.51

|

2.00%

|

|

|

Questcor

Pharmaceuticals, Inc.

|

3.93B

|

18.04

|

15.00

|

6.34

|

1.50%

|

|

|

AAR

Corp.

|

1.06B

|

20.24

|

1.13

|

0.51

|

1.09%

|

|

|

Apache

Corp.

|

35.37B

|

14.32

|

1.12

|

2.08

|

0.89%

|

Ex-Dividend Stocks: Best Dividend Paying Shares On September 16, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 18 stocks,

preferred shares or funds go ex dividend - of which 13 yield more than 3

percent. The average yield amounts to 6.68%. Here is a full list of all stocks with ex-dividend

date within the current week.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Horizon

Technology Finance

|

128.82M

|

36.35

|

0.90

|

6.05

|

10.26%

|

|

Gladstone

Land Corporation

|

107.35M

|

149.45

|

1.89

|

29.82

|

8.76%

|

|

Gladstone

Investment Corporation

|

189.30M

|

12.77

|

0.82

|

5.92

|

8.39%

|

|

Gladstone

Commercial Corp.

|

222.22M

|

-

|

1.34

|

4.03

|

8.36%

|

|

Navios

Maritime Acquisition

|

358.16M

|

-

|

0.84

|

2.10

|

5.04%

|

|

UIL

Holdings Corporation

|

1.86B

|

16.42

|

1.62

|

1.15

|

4.74%

|

|

STMicroelectronics

NV

|

8.01B

|

-

|

1.41

|

0.96

|

3.77%

|

|

Cincinnati

Financial Corp.

|

7.57B

|

13.42

|

1.33

|

1.76

|

3.63%

|

|

Navios

Maritime Holdings Inc.

|

724.69M

|

6.03

|

0.62

|

1.31

|

3.37%

|

|

Companhia

de Bebidas Das Americas

|

116.06B

|

25.76

|

9.18

|

8.00

|

3.34%

|

|

Tupperware

Brands Corporation

|

4.41B

|

18.06

|

13.13

|

1.66

|

2.95%

|

|

Evans

Bancorp Inc.

|

81.07M

|

10.16

|

1.05

|

2.48

|

2.47%

|

|

Altra

Holdings, Inc.

|

702.54M

|

27.38

|

2.86

|

0.98

|

1.52%

|

Best Ex-Dividend Paying Stocks For Monday June 17, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks June 17,

2013. In total, 8 stocks and

preferred shares go ex dividend - of which 6 yield more than 3 percent. The

average yield amounts to 5.63%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Gladstone

Land Corporation

|

107.29M

|

74.68

|

1.82

|

31.65

|

8.76%

|

|

Gladstone

Investment

|

194.63M

|

10.97

|

0.81

|

6.37

|

8.16%

|

|

Gladstone

Commercial Corp.

|

219.46M

|

-

|

1.80

|

4.12

|

7.81%

|

|

Navios

Maritime Acquisition

|

322.70M

|

-

|

0.83

|

2.14

|

5.71%

|

|

Cincinnati

Financial Corp.

|

7.59B

|

15.58

|

1.31

|

1.80

|

3.51%

|

|

Tupperware

Brands Corporation

|

4.28B

|

23.45

|

9.86

|

1.64

|

3.07%

|

|

Symantec

Corporation

|

15.67B

|

20.82

|

2.90

|

2.27

|

2.67%

|

|

U.S. Silica Holdings, Inc.

|

1.15B

|

14.82

|

4.60

|

2.50

|

2.30%

|

Best Dividend Paying Ex-Dividend Shares On December 17, 2012

The Best Yielding And

Biggest Ex-Dividend Stocks Researched By ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates. The ex dividend

date is the final date on which the new stock buyer couldn’t receive the next

dividend. If you like to receive the dividend, you need to buy the stock before

the ex dividend date. I made a little screen of the best yielding stocks with a

higher capitalization that have their ex date on the next trading day.

A full list of all stocks

with ex-dividend date and payment dates can be found here: Ex-Dividend Stocks on December

17, 2012. In total, 18 stocks and

preferred shares go ex dividend - of which 9 yield more than 3 percent. The

average yield amounts to 5.21%.

Here is the sheet of the best yielding ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Navios

Maritime Acquisition Corporation

|

92.34M

|

-

|

0.40

|

0.65

|

8.77%

|

|

Gladstone

Investment Corporation

|

181.52M

|

87.00

|

0.78

|

7.62

|

8.62%

|

|

Gladstone

Commercial Corp.

|

217.73M

|

1763.00

|

1.58

|

4.45

|

8.51%

|

|

UIL

Holdings Corporation

|

1.84B

|

19.28

|

1.66

|

1.28

|

4.77%

|

|

KAR

Auction Services, Inc.

|

2.52B

|

30.72

|

1.74

|

1.29

|

4.12%

|

|

Cincinnati

Financial Corp.

|

6.49B

|

17.96

|

1.21

|

1.62

|

4.09%

|

|

DTE

Energy Co.

|

10.49B

|

15.35

|

1.42

|

1.21

|

4.07%

|

|

American

Greetings Corp.

|

543.69M

|

68.80

|

0.83

|

0.32

|

3.49%

|

|

SmartPros

Ltd.

|

7.13M

|

-

|

0.65

|

0.44

|

3.31%

|

|

FXCM

Inc.

|

339.90M

|

21.13

|

1.61

|

0.81

|

2.42%

|

|

Tupperware

Brands Corporation

|

3.67B

|

18.49

|

7.24

|

1.44

|

2.17%

|

|

American

Eagle Outfitters, Inc.

|

4.10B

|

18.66

|

3.20

|

1.21

|

2.12%

|

|

International

Game Technology

|

3.86B

|

16.69

|

3.23

|

1.80

|

1.93%

|

|

Brown

Shoe Co. Inc.

|

796.47M

|

48.87

|

1.85

|

0.31

|

1.51%

|

|

Vail

Resorts Inc.

|

1.91B

|

221.25

|

2.58

|

1.86

|

1.41%

|

|

Insteel

Industries Inc.

|

214.06M

|

120.80

|

1.43

|

0.59

|

0.99%

|

|

Culp

Inc.

|

178.00M

|

10.73

|

1.87

|

0.66

|

0.82%

|

|

Xueda

Education Group

|

183.69M

|

-

|

1.11

|

0.65

|

-

|

Subscribe to:

Comments (Atom)