|

| Source: Seeking Alpha |

Showing posts with label NRF. Show all posts

Showing posts with label NRF. Show all posts

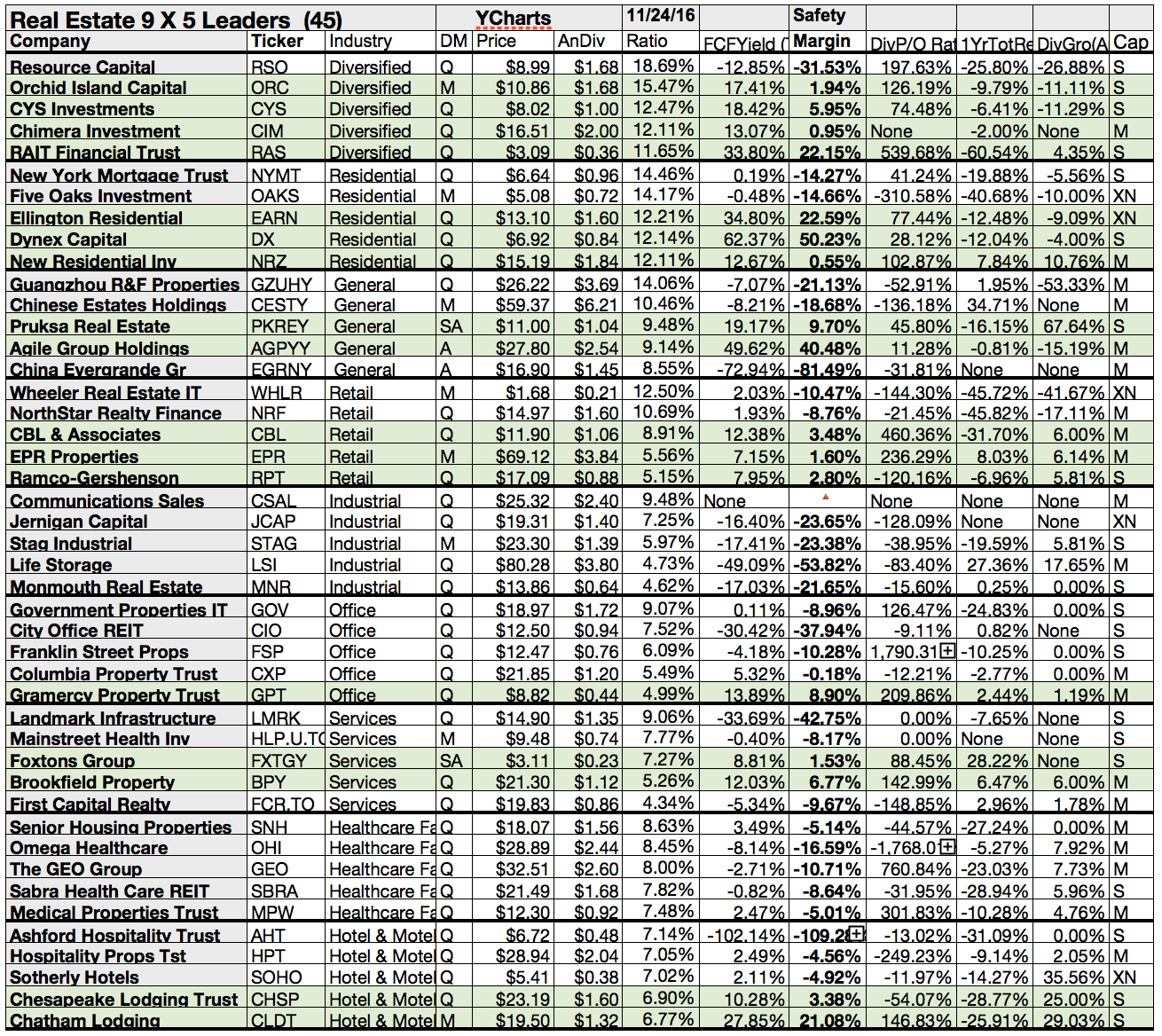

20 Cheap Stocks With The Highest Yields On The Market

In the seven years since the Federal Reserve slashed interest rates virtually to zero, investors have struggled to find income amid a low-yield landscape.

That's why stocks with high dividend yields are particularly appealing right now to income investors and savers -- double-digit yields, even more so.

Recently I wrote about the highest yielding stocks on the market with a buy or better rating. The yields from the results were all over 8 percent.

Today I like to share those stocks with you that offer the cheapest P/E, price-to-earnings ratios while having the highest yields on the market.

I've also include those stocks with a 2+ billion market capitalization. Limited Partnerships, Oil drillers, REITs and Telecoms are mostly higher yielding stocks, giving investors a large share of its annual profits back via dividends.

Here are the results...

That's why stocks with high dividend yields are particularly appealing right now to income investors and savers -- double-digit yields, even more so.

Recently I wrote about the highest yielding stocks on the market with a buy or better rating. The yields from the results were all over 8 percent.

Today I like to share those stocks with you that offer the cheapest P/E, price-to-earnings ratios while having the highest yields on the market.

I've also include those stocks with a 2+ billion market capitalization. Limited Partnerships, Oil drillers, REITs and Telecoms are mostly higher yielding stocks, giving investors a large share of its annual profits back via dividends.

Here are the results...

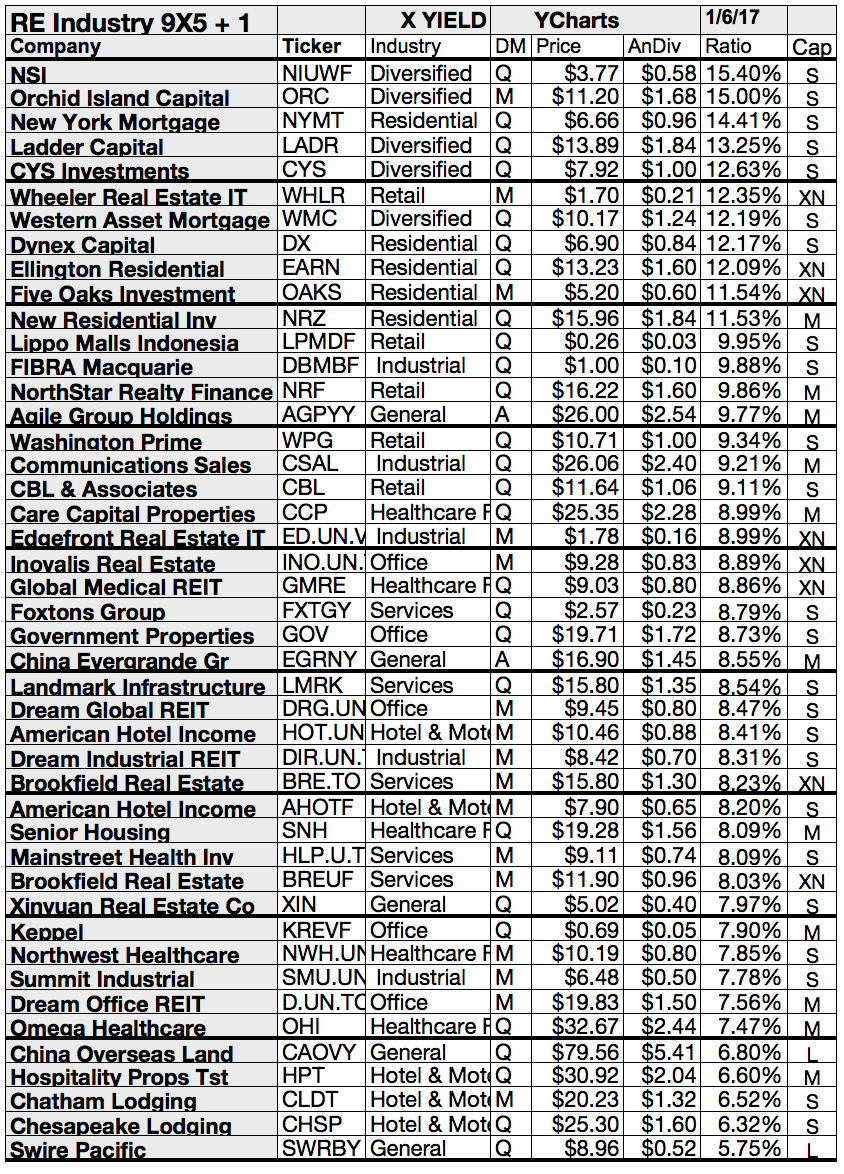

20 Buy Rated Dividend Stocks With Yields Over 8%

One group of investors that has had more than their fill of quantitative easing (QE) is income investors, who rely on investments that pay steady and dependable dividends or distributions that help supplement other sources of income.

The whole point of QE was to drive down interest rates to make higher risk assets more attractive.

While that has worked out pretty well for growth stock investors with long time horizons, income and growth and income investors were left with very little to cheer about.

In the early 2000s, large money center banks were offering certificates of deposit, guaranteed for principal up to $250,000, that yielded anywhere from 5% to 7%. Currently that is in the 2%-plus range.

It's sad but we needed to say goodbye to higher yields with low risks. Today we get only low yields with high risk.

Attached you can find 20 stocks with a buy or better rating that offer you a 8% yield or more.

I've only included those stocks with a market cap over 2 billion in order to avoid the really big risks.

Here are my results....

The whole point of QE was to drive down interest rates to make higher risk assets more attractive.

While that has worked out pretty well for growth stock investors with long time horizons, income and growth and income investors were left with very little to cheer about.

In the early 2000s, large money center banks were offering certificates of deposit, guaranteed for principal up to $250,000, that yielded anywhere from 5% to 7%. Currently that is in the 2%-plus range.

It's sad but we needed to say goodbye to higher yields with low risks. Today we get only low yields with high risk.

Attached you can find 20 stocks with a buy or better rating that offer you a 8% yield or more.

I've only included those stocks with a market cap over 2 billion in order to avoid the really big risks.

Here are my results....

14 Stocks With Dividend Yields Over 10% And An Expected Single P/E

It seems

that every story you read about these days is geared toward day traders or

those looking for long-term growth in retirement portfolios. But there are

millions of investors who need or want current income, and low interest rates

have made that strategy largely a losing one. Some of us developed to yield

seekers, looking for cheap and high yielding stocks

.

.

I’m not

talking about a yield income of 1 or 2 percent yearly. No, that’s boring. I’m

talking about a 2.5 percent yield per quarter or a sum of 10% or more per year.

Attached

you can find a selection of stocks with yields over 10 percent. The valuation of

the selected stocks is cheap with a forward P/E of less than 10.

Most of the

14 results are off mainstream: Asset Managers, Oil & Gas Refining &

Marketing, REITs and finally Telecoms are the main groups that pay those big dividends

while having a cheap valuation.

Are they cheap

for a reason or a bargain?

The market

is always looking forward, so that fact that those stocks are trading below

their book value suggests investors expect the companies to underperform. While

there are several reasons why this is could be the case, one of the most

apparent is tighter spreads.

Here are

the results in detail....

20 Highly Shorted Financial Dividend Stocks And Which 11 Are Wrong

Financial dividend stocks with highest float

short ratio originally published at "long-term-investments.blogspot.com". Financials are in

focus of many investors because they have a great possibility to leverage profits and they benefit if the

economy starts to grow.

But the whole sector is also very vulnerable for systematic risks. Due to the concatenation of many firms, a bail in of one company can hurt the whole system deeply.

But the whole sector is also very vulnerable for systematic risks. Due to the concatenation of many firms, a bail in of one company can hurt the whole system deeply.

This is also one of the reasons why financial

stocks are very popular targets for short sellers. If there develops a rumor, it ends

in a bank run.

Today I like to show you which stocks from the

financial sector (excluded by ETFs) have the highest float short ratio. My only

restriction is a market capitalization of more than USD 300 million.

The 20 top results have a float short ratio between 11.56

and 28.67 percent. The Insuring industry is the biggest industry followed by

REITs. Despite the negative view of the investors, eleven of the results have a

current buy or better recommendation.

Ex-Dividend Date Reminder For February 23, 2012

Here is a current overview of best yielding stocks that have their ex-dividend date on the next trading day. If your broker settles your trade today, you will receive the next dividend. A full list of all stocks with ex-dividend date can be found here: Ex-Dividend Stocks February 23, 2012. In total, 15 stocks and preferred shares go ex-dividend of which 5 yielding above 3 percent. The average yield amounts to 2.68 percent.

Ex-Dividend Date Reminder For Next Week February 20 - 26, 2012

Here is a current overview of best yielding stocks with a market capitalization over USD 300 million that have their ex-dividend date on the next trading week. If your broker settles your trade before the ex-date, you will receive the next dividend. A full list of all stocks with ex-dividend date can be found here: Ex-Dividend Stocks February 20 -26, 2012. In total, 86 stocks and preferred shares go ex-dividend of which 32 yielding above 3 percent. The average yield amounts to 3.20 percent.

Subscribe to:

Comments (Atom)