|

| Source: Seeking Alpha |

Showing posts with label CCP. Show all posts

Showing posts with label CCP. Show all posts

10 Top Yielding And Cheap Healthcare REITs For Income Seeking Investors

Real estate investment trusts, or REITs, can give investors exposure to real estate without the challenges and risks of buying property.

The senior population (65+) is expected to grow 80% between 2010 and 2030, and 85+ cohort by over 60%, increasing patient acuity.

It is estimated that ~70% of Americans who reach age 65 will require some form of long-term care for an average of 3 years.

Healthcare policy is the primary driver in which patients are being treated in low cost settings.

Here is a great overview of property-owning REITs that can give you excellent dividends and lots of growth potential, listed in no particular order:

The senior population (65+) is expected to grow 80% between 2010 and 2030, and 85+ cohort by over 60%, increasing patient acuity.

It is estimated that ~70% of Americans who reach age 65 will require some form of long-term care for an average of 3 years.

Healthcare policy is the primary driver in which patients are being treated in low cost settings.

Here is a great overview of property-owning REITs that can give you excellent dividends and lots of growth potential, listed in no particular order:

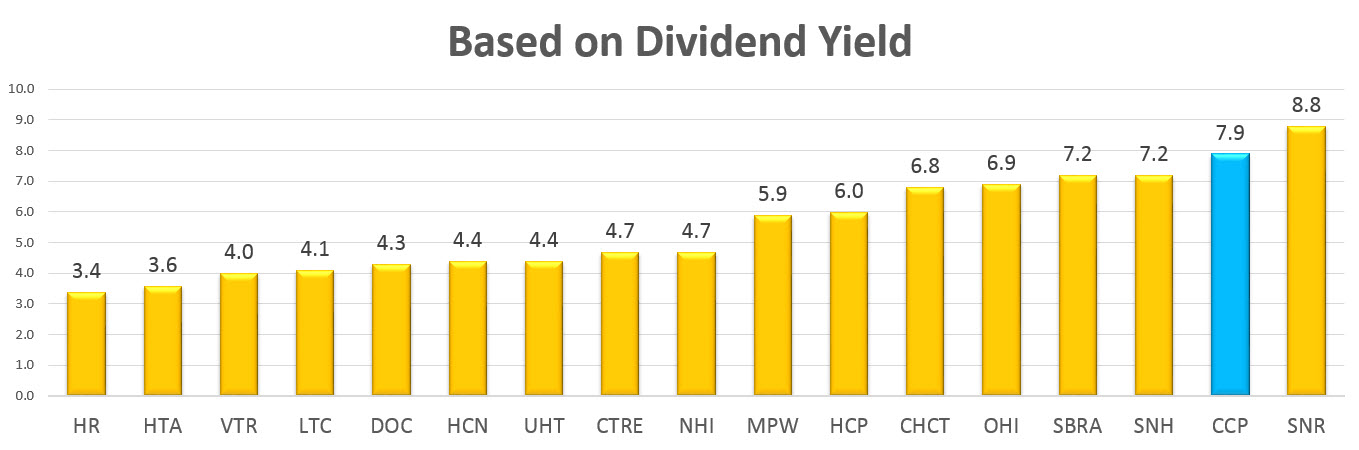

|

| Dividend Yield of Major REITs (click to enlarge) Source: Seeking Alpha |

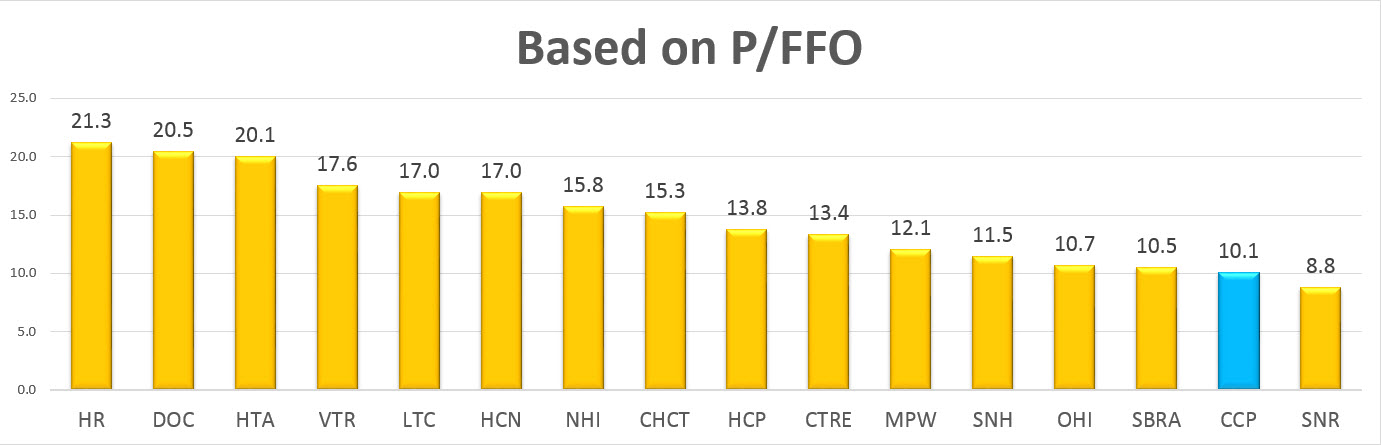

|

| Price to FFO of Major REITs (click to enlarge) Source: Seeking Alpha |

9 Attractively Priced, High Quality Dividend Growth Stocks To Consider Now

If you are looking for an attractive investment with income for your portfolio, you should look for cheaply valuated dividend growth stocks with potential to grow in the near term.

What Do I Mean by an Attractively Priced, High Quality DGI Stock?

What Do I Mean by an Attractively Priced, High Quality DGI Stock?

To preface my choices, I define high quality DGI stocks as those having:

- Solid financial strength - I require an S&P credit rating of at least BBB or better and a debt-to-total capital ratio of less than 50%.

- A consistent track record of growing dividends - I prefer 10 years of dividend growth, but I will consider relatively new DGI stocks with shorter records. In addition, I look for an historical 5-year dividend compound annual growth rate (i.e., CAGR) of at least 4%.

- The ability to continue to grow the dividend in the future - I look for a forecast 3-year dividend CAGR of at least 4% and a dividend payout ratio of less than 80%.

In terms of value, I look for the following:

- Is the stock trading at or below its historical 10-year P/E?

- Is the stock's dividend yield at or near its 5-year high?

- Is the stock trading at or below Morningstar's fair value estimate? S&P's fair value estimate? Valuentum's fair value estimate?

- Is the stock trading below S&P's 12-month target?

There are nine top results that came into my minds. For sure I've not included long-term dividend growth as essential criteria. That's the reason why you might find Apple and Gilead in the results.

These are the results from the screen...

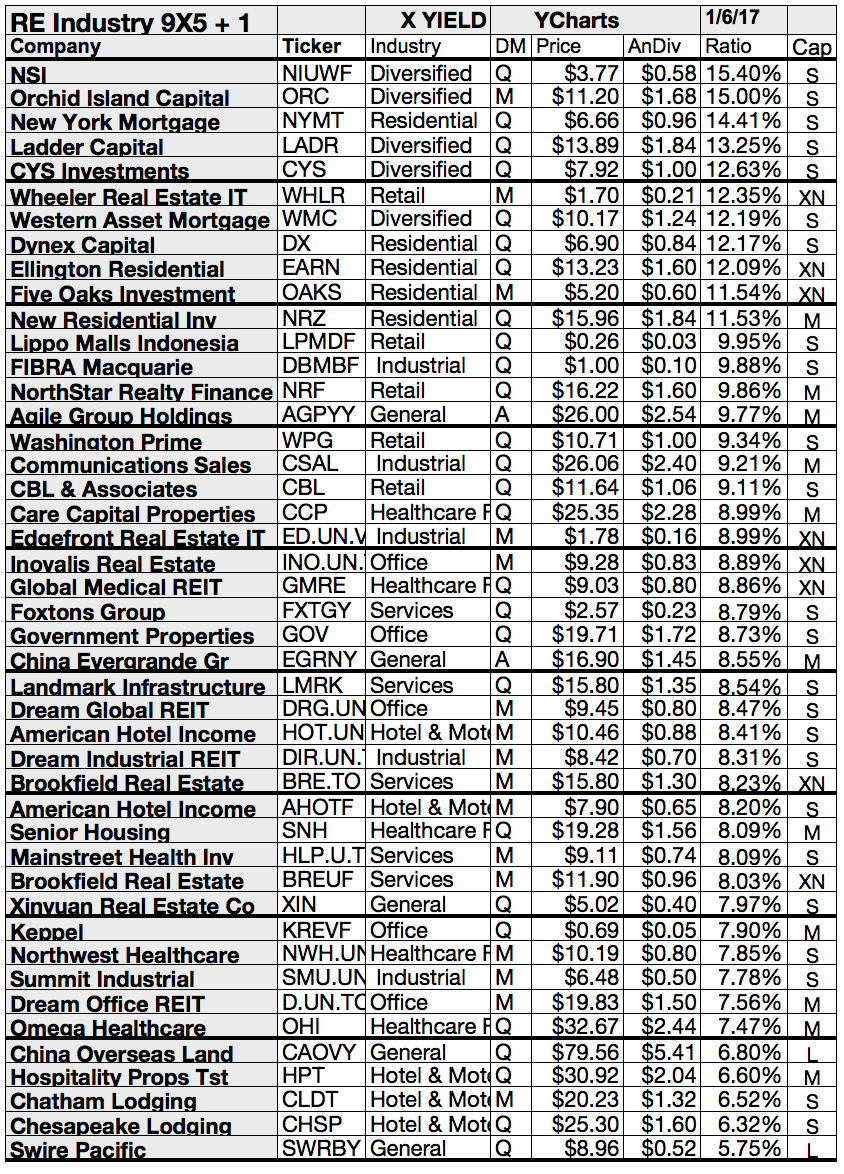

15 REITs With FFO Yields Over Dividend Yield

FFO is meant to provide the best measurement of a REIT’s cash flow available for dividend payments.

If you are thinking about a REIT purchase, you need to consider the company’s ability to maintain or raise its dividend, because a dividend cut could hurt the stock price terribly, and income is your main objective.

There are 92 REITs in the S&P 1500 Composite Index and some of them still have room to grow dividend payments. Here are the 15 with the highest dividend yields that also have “headroom” to raise dividends:

If you are thinking about a REIT purchase, you need to consider the company’s ability to maintain or raise its dividend, because a dividend cut could hurt the stock price terribly, and income is your main objective.

There are 92 REITs in the S&P 1500 Composite Index and some of them still have room to grow dividend payments. Here are the 15 with the highest dividend yields that also have “headroom” to raise dividends:

Watch Over On Australian Dividend Paying Stocks | 5 Top Foreign Yield Ideas

The history

of a stock market explains when fund manager’s pours their money into the market and stock prices performing well.

In the end, investors are highly interested in companies which have a good profit and could develop into a great investment opportunity. Today I'm sharing five stocks which have a good dividend history and a listing on the Australian Stock Exchange ASX:

In the end, investors are highly interested in companies which have a good profit and could develop into a great investment opportunity. Today I'm sharing five stocks which have a good dividend history and a listing on the Australian Stock Exchange ASX:

- Ardent

Leisure Group (ASX:

AAD) is an Australian based leisure company. It’s operating portfolio has over 100 assets across Australia, New Zealand and the United States. Originally it was known as the Macquarie

Leisure Trust. AAD’s portfolio of operations includes theme parks, ten pin

bowling center, marinas, health clubs and the US-based Main Event family

entertainment center. The market capitalization is 576.77 million. The P/E

ratio is 38.16 with a dividend yield of 8.14%.

- AMP

Limited (ASX:

AMP) is a financial services company in Australia. Initially it operates

in Australia and New Zealand. Its subsidiary AMP Capital has a growing

international presence with offices in Bahrain, China, Hong Kong, India, Japan,

Luxembourg, Singapore, the United Kingdom and the United States. In 1849 it was formed to the Australian Mutual Provident Society, a non-profit life insurance

company. It provides advice regarding finances, banking, life insurance. It also has managed funds, superannuation, property, listed assets and infrastructure. These are AMP's three major business units: Amp financial service provider, AMP capital

manager, AMP self-managed superannuation funds (SMSF). The market

capitalization is 14.60 billion. The P/E ratio is 20.63 with a dividend yield of 4.92%.

- Lend

Lease Group (ASX:

LLC) is a multinational property and infrastructure company. It’s

headquartered in situated Sydney, Australia. They create vibrant residential

communities, productive workplaces and retail destinations. This company

operates in more than 40 countries around the world. They run their business in

markets, including apartment development, Greenfield residential development,

investment management of unlisted property funds, property management, Real

Estate sales and leasing, Public Private Partnerships, Infrastructure

Development and Venture Capital investment in innovative technologies. The

market capitalization is 5.68 billion. The P/E ratio is 10.17 with a dividend

yield of 4.21%.

- Credit

Corp Group (ASX:

CCP) is an Australian management company based on debt purchase and

collection in Sydney, Australia. They purchase consumers and small

entrepreneur’s debt from Australian and New Zealand banks, finance companies

and telecommunication companies. Since 2000 the company is listed on the Australian

Securities Exchange (ASX). The market capitalization is 409.03 million. The P/E

ratio is 13.45 with a dividend yield of 4.04%.

- Australian

Leaders Fund Limited (ASX:

ALF) is an Australian based investment company. The company makes

investments in listed and unlisted companies. The investment objective is to deliver returns over the medium term within acceptable risk parameters

while preserving the company’s capital. It has a market capitalization of

106.61 million, P/E ratio is 5.44 and the dividend yield is 8.11%.

In Gist

The

stock market gives the fundamental and technical analysis which is used by the

investment professionals or analysts to explain the valuation and direction of

equity markets. Generally, an economist uses a stock market report as a tool to

understand the situation of the financial markets and their effects on the domestic economy.

Review of stock market report

The

major objective of the stock market report is to provide a summary of the

equity market so that investors get different views and options. In the

report of stock market texts and charts are incorporated with data on a daily

basis. This report helps investors

to improve their knowledge regarding shares and stocks.

For more

information regarding Australian

dividend stocks data you can visit the site Dividend Investor.

Labels:

AAD,

ALF,

AMP,

Australia,

CCP,

Dividends,

Foreign,

Foreign Stocks,

High Yield,

LLC

Subscribe to:

Comments (Atom)