|

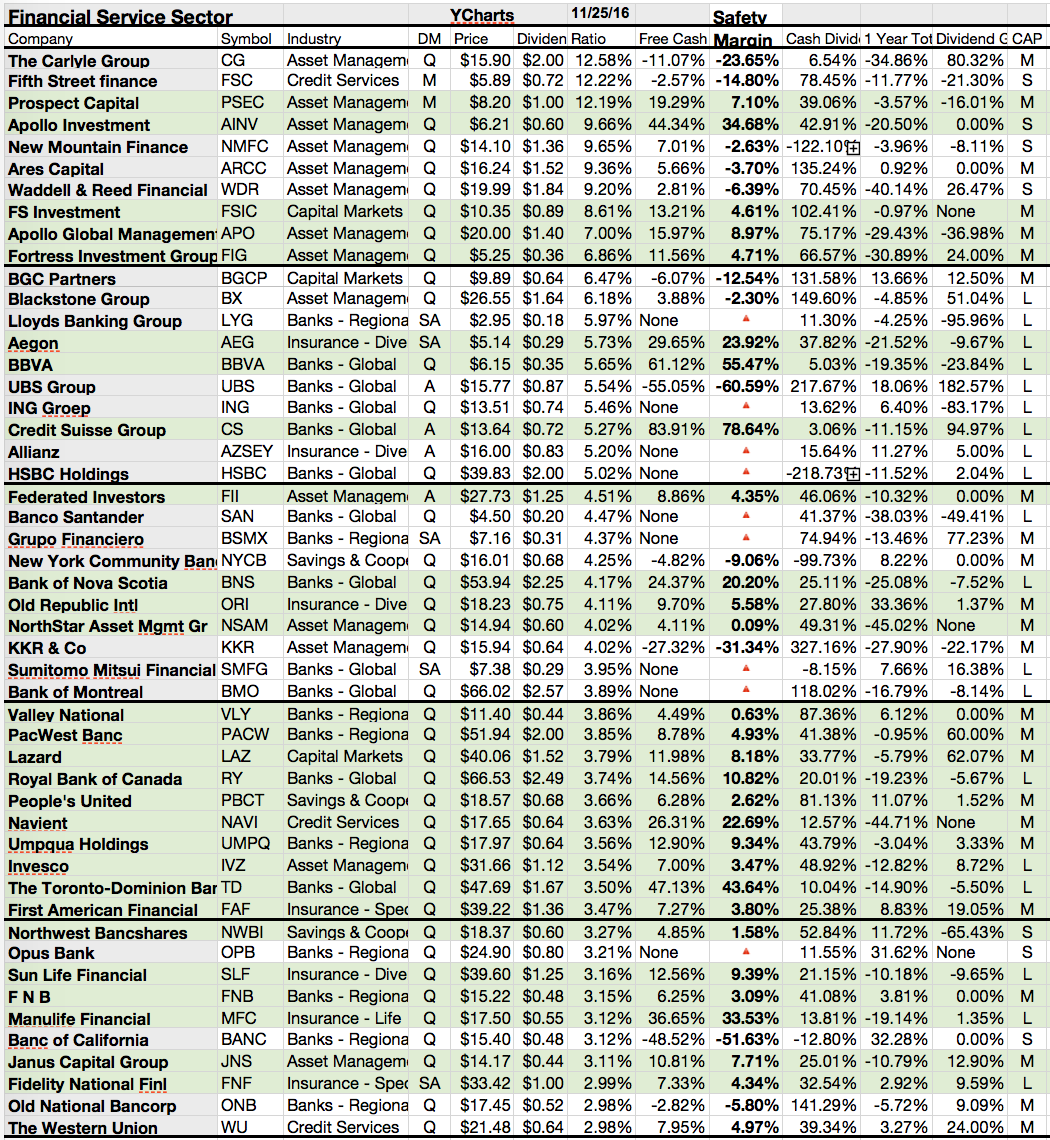

| 50 Financial Dividend Financial Dogs (Source: Seeking Alpha) |

Showing posts with label FNF. Show all posts

Showing posts with label FNF. Show all posts

15 Cheap Stocks With Strong Growth Prospects

Dividend stocks as a group have started to trade in a range as investors contemplate the effect that the upcoming interest rate hike will have on their valuation.

Dividend stocks as a group have started to trade in a range as investors contemplate the effect that the upcoming interest rate hike will have on their valuation.From our perspective, the decision on whether dividend stocks are a good hold in a rising-interest-rate environment is a moot point — as long as we’re looking for the right stocks.

The “right” dividend stocks in our book not only pay healthy dividends, but also have strong growth prospects. Focusing on strong balance sheets and growing revenue helps to avoid investing in companies that may be at risk of decreasing or cutting their dividends.

Attached you can find a few dividend stocks with double-digit earnings growth predictions for the next five years.

Each of the stocks has a market cap over 2 billion, a debt to equity ratio under 0.5 and a beta below the market average.

15 stocks fulfilled our criteria of which two are High-Yields. 13 of the results got a buy or better rating by analysts.

Here are the top results...

11 Stocks With Strong Potential To Double Dividends

Dividend stocks are often the foundation for a great retirement portfolio. Dividend payments not only put money in your pocket, which can help hedge against any downward move in the stock market, but they're usually a sign of a financially sound company.

Dividend stocks are often the foundation for a great retirement portfolio. Dividend payments not only put money in your pocket, which can help hedge against any downward move in the stock market, but they're usually a sign of a financially sound company.Dividend payments also give investors the opportunity to reinvest into more shares of stock, thus boosting future dividend payments and compounding gains over time.

Yet not all income stocks are living up to their full potential. Utilizing the payout ratio, or the percentage of profits a company returns in the form of a dividend to its shareholders, we can get a good bead on whether or not a company has room to increase its dividend.

Ideally, we like to see healthy payout ratios between 50% and 75%. Here are a few income stocks with payout ratios currently far below 50% that could potentially double their dividends.

Stocks to double dividend payments are....

66 Dividend Growth Stocks Of The Week

Attached is a full list of the latest Dividend Growers. Those stocks have announced a dividend hike during the past trading week.

66 stocks raised their dividends within the past week. 19 of them have a cheap forward P/E of less than 15.

You can find the biggest stocks in the attached list. Regional Banks are the cheapest growth stocks with expected EPS growth over 5 percent for the next half-decade.

The best yielding stocks with a 2 billion+ market cap can be found the following list. Oil and gas pipeline stocks dominating.

Mondelez, Siomon Property, Energy Transfer Partners, Amphenol, Stanley Black & Decker, Magellan Midstream and Republic Services are the biggest stocks with dividend growth. Which stocks do you like?

Here are the all of the 66 dividend growers of the past week....

66 stocks raised their dividends within the past week. 19 of them have a cheap forward P/E of less than 15.

You can find the biggest stocks in the attached list. Regional Banks are the cheapest growth stocks with expected EPS growth over 5 percent for the next half-decade.

The best yielding stocks with a 2 billion+ market cap can be found the following list. Oil and gas pipeline stocks dominating.

|

| 66 Dividend Growth Stocks Of The Week |

Mondelez, Siomon Property, Energy Transfer Partners, Amphenol, Stanley Black & Decker, Magellan Midstream and Republic Services are the biggest stocks with dividend growth. Which stocks do you like?

Here are the all of the 66 dividend growers of the past week....

10 Cheaply Valuated Stocks Boosting Earnings For The Next Years

Companies delivering superior growth in sales and earnings tend to be winning names over the long term. However, these companies rarely sell for low valuations, so you generally need to pay premium prices for top-growth stocks. With this in mind, it makes sense to look for strong-growth companies going through temporary challenges and trading at convenient valuations.

I've created a screen of dividend paying stocks with a solid growth momentum. Those stocks have shown investors increasing sales over years while analysts predicting a rosy future. Earnings should grow for the mid-term at double-digit rates.

In addition, my focus is on higher capitalized stocks with a lower beta and debt. Twelve stocks fulfilled my criteria of which one has a yield of more than 3 percent and ten are recommended to buy.

These are the highest yielding results:

I've created a screen of dividend paying stocks with a solid growth momentum. Those stocks have shown investors increasing sales over years while analysts predicting a rosy future. Earnings should grow for the mid-term at double-digit rates.

In addition, my focus is on higher capitalized stocks with a lower beta and debt. Twelve stocks fulfilled my criteria of which one has a yield of more than 3 percent and ten are recommended to buy.

These are the highest yielding results:

Ex-Dividend Stocks: Best Dividend Paying Shares On September 12, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 192 stocks, preferred

shares or funds go ex dividend - of which 95 yield more than 3 percent. The

average yield amounts to 6.02%. Here is a full list of all stocks with ex-dividend

date within the current week.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Ares

Capital Corporation

|

4.72B

|

8.33

|

1.09

|

5.87

|

8.57%

|

|

Altria

Group Inc.

|

70.03B

|

15.97

|

19.65

|

2.88

|

5.49%

|

|

BCE,

Inc.

|

33.62B

|

14.49

|

3.10

|

1.74

|

5.12%

|

|

Garmin

Ltd.

|

8.34B

|

15.80

|

2.48

|

3.12

|

4.22%

|

|

Equity

One Inc.

|

2.54B

|

-

|

1.78

|

7.45

|

4.07%

|

|

DTE

Energy Co.

|

11.61B

|

16.47

|

1.54

|

1.25

|

3.93%

|

|

Extra

Space Storage Inc.

|

4.82B

|

33.60

|

3.15

|

10.27

|

3.69%

|

|

Northeast

Utilities

|

12.91B

|

16.58

|

1.37

|

1.80

|

3.59%

|

|

Merck

& Co. Inc.

|

144.42B

|

28.56

|

3.04

|

3.22

|

3.58%

|

|

Rayonier

Inc.

|

7.12B

|

21.25

|

4.56

|

4.33

|

3.47%

|

|

Dr Pepper Snapple Group, Inc.

|

9.09B

|

15.25

|

3.95

|

1.51

|

3.41%

|

|

Prologis,

Inc.

|

18.12B

|

-

|

1.32

|

9.46

|

3.00%

|

|

UGI

Corp.

|

4.44B

|

16.32

|

1.78

|

0.63

|

2.91%

|

|

The

Coca-Cola Company

|

171.75B

|

20.44

|

5.33

|

3.61

|

2.90%

|

|

Taubman

Centers Inc.

|

4.41B

|

46.12

|

-

|

5.80

|

2.89%

|

|

NYSE

Euronext, Inc.

|

10.26B

|

23.73

|

1.68

|

2.72

|

2.84%

|

|

Owens

& Minor Inc.

|

2.18B

|

21.10

|

2.21

|

0.24

|

2.76%

|

|

Western

Union Co.

|

10.31B

|

11.75

|

11.11

|

1.86

|

2.69%

|

|

Fidelity

National Financial, Inc.

|

5.60B

|

9.21

|

1.28

|

0.65

|

2.57%

|

|

Endurance

Specialty Holdings

|

2.17B

|

16.19

|

0.80

|

0.95

|

2.52%

|

5 Of The Best Stocks With Dividend Growth From Last Week (Oct 29 – Nov 04, 2012)

Stocks With Biggest Dividend

Hikes From Last Week by Dividend

Yield – Stock, Capital, Investment. Here is a

current sheet of companies that have announced a dividend increase within the

recent week. In total, 49 stocks and funds raised dividends of which 24 have a

dividend growth of more than 10 percent. The average dividend growth amounts to

19.91 percent. Exactly 19 stocks/funds have a yield over five percent (high

yield); 25 above three percent. 35 companies are currently recommended to buy.

The biggest dividend hike came from the beverage and softdrink company Cott (COT) and he savings and loans stock Capital Federal Finl (CFFN). Both increased their dividend distributions by 140 percent.

The biggest dividend hike came from the beverage and softdrink company Cott (COT) and he savings and loans stock Capital Federal Finl (CFFN). Both increased their dividend distributions by 140 percent.

Stocks With Dividend Growth From Last Week 6/2012

Stocks With Biggest Dividend Hikes From Last Week by Dividend Yield – Stock, Capital, Investment. Here is a current sheet of companies that have announced a dividend increase within the recent week. In total, 33 stocks and funds raised dividends of which 20 have a dividend growth of more than 10 percent. The average dividend growth amounts to 18.79 percent. The biggest hike was announced by Mastercard (MA) and Assured Guaranty (AGO). Both companies showed a growth of 100 percent. Seven stocks yielding above 3 percent and eighteen have a buy or better rating.

Subscribe to:

Comments (Atom)