Showing posts with label LTC. Show all posts

Showing posts with label LTC. Show all posts

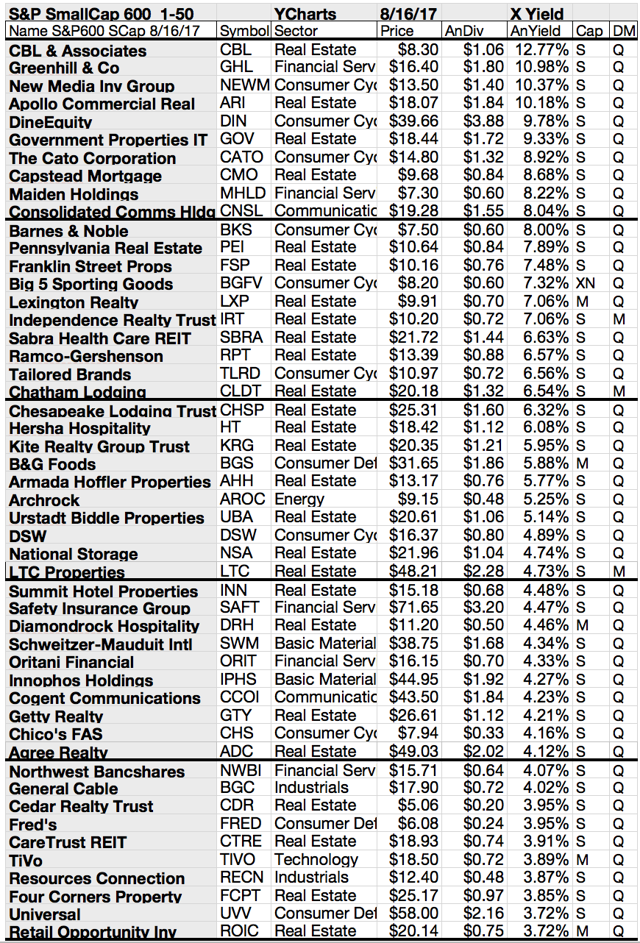

16 High-Yield Dividend Growth Stocks

More often than not, dividend stocks are what form the foundation of any great retirement portfolio. Not only have dividend stocks handily outperformed non-dividend-paying stocks over the long run, but they also offer a number of other advantages that income investors are bound to like.

To begin with, dividend-paying companies often have time-tested business models. A business is unlikely to pay a recurring dividend to investors if its management team didn't believe profits would grow in the future. Thus, dividend stocks are often a beacon of profitability and stability that attract income seekers.

Dividend stocks also help to hedge against inevitable stock market corrections -- there have been 35 stock market corrections of at least 10% since 1950 in the S&P 500 -- and payouts can be reinvested back into more shares of stock via a Dividend Reinvestment Plan, or DRIP. Purchasing more shares of dividend-paying stock with your payout in a repeating cycle can help your nest egg quickly compound in value over time.

Unfortunately, dividend stocks can also harbor a dark side. Income seekers would like the highest dividend yield possible, but they also have to ensure that a payout is sustainable. Dividend yields are a function of a stock's price, meaning a plunging stock price can dramatically lift dividend yields, making them seem attractive, at least on the surface. But, as we know, a plunging stock price could signify a business model that's in trouble. Thus, high-yield dividends, or those with yields of 4% or higher, should be heavily scrutinized by investors.

The yields on dividend stocks rise when their share prices become depressed. That’s an opportunity to chase extra yield. Besides, the best dividend-paying stocks do their most good when they are held for long periods of time. Ideally, the holding period includes many dividend hikes and market cycles.

In the beginning of this New Year, many investors review their portfolios. We all hope for a good year on the market and, most importantly, steady dividend growth increase among our portfolio. I selected some high yielding long term dividend growth stocks I think will perform well in 2017 and will increase their dividend payouts.

These are the results...

To begin with, dividend-paying companies often have time-tested business models. A business is unlikely to pay a recurring dividend to investors if its management team didn't believe profits would grow in the future. Thus, dividend stocks are often a beacon of profitability and stability that attract income seekers.

Dividend stocks also help to hedge against inevitable stock market corrections -- there have been 35 stock market corrections of at least 10% since 1950 in the S&P 500 -- and payouts can be reinvested back into more shares of stock via a Dividend Reinvestment Plan, or DRIP. Purchasing more shares of dividend-paying stock with your payout in a repeating cycle can help your nest egg quickly compound in value over time.

Unfortunately, dividend stocks can also harbor a dark side. Income seekers would like the highest dividend yield possible, but they also have to ensure that a payout is sustainable. Dividend yields are a function of a stock's price, meaning a plunging stock price can dramatically lift dividend yields, making them seem attractive, at least on the surface. But, as we know, a plunging stock price could signify a business model that's in trouble. Thus, high-yield dividends, or those with yields of 4% or higher, should be heavily scrutinized by investors.

The yields on dividend stocks rise when their share prices become depressed. That’s an opportunity to chase extra yield. Besides, the best dividend-paying stocks do their most good when they are held for long periods of time. Ideally, the holding period includes many dividend hikes and market cycles.

In the beginning of this New Year, many investors review their portfolios. We all hope for a good year on the market and, most importantly, steady dividend growth increase among our portfolio. I selected some high yielding long term dividend growth stocks I think will perform well in 2017 and will increase their dividend payouts.

These are the results...

The Best Monthly Paying Dividend Stocks

Monthly dividend paying stocks have become increasingly popular over the years, and investors are constantly on the lookout for the best monthly dividend stocks good reason.

A monthly dividend can be a great way to help pay for living expenses in retirement, or simply act as a way to compound one’s wealth faster through more frequent dividend reinvestment.

But while the number of monthly dividend stocks has grown well into the hundreds in recent years, investors need to be extremely selective about where they invest their hard earned money.

Attached you will find seven of the best monthly dividend stocks that potentially represent attractive long-term investments and discover three types of monthly dividend stocks to avoid.

Here are the results...

A monthly dividend can be a great way to help pay for living expenses in retirement, or simply act as a way to compound one’s wealth faster through more frequent dividend reinvestment.

But while the number of monthly dividend stocks has grown well into the hundreds in recent years, investors need to be extremely selective about where they invest their hard earned money.

Attached you will find seven of the best monthly dividend stocks that potentially represent attractive long-term investments and discover three types of monthly dividend stocks to avoid.

Here are the results...

6 Triple-Net REITs For A Suitable Portfolio

The following 6 triple-net real estate investment trusts (REITs) are suitable for a portfolio that requires dependable income.

A triple net lease is a lease agreement that designates the lessee, which is the tenant, as being solely responsible for all the costs relating to the asset being leased, in addition to the rent fee applied under the lease.

The structure of this type of lease requires the lessee to pay the net amount for three types of costs, including net real estate taxes on the leased asset, net building insurance and net common area maintenance. This type of lease can also be referred to as a net-net-net (NNN) lease.

Here are the results...

A triple net lease is a lease agreement that designates the lessee, which is the tenant, as being solely responsible for all the costs relating to the asset being leased, in addition to the rent fee applied under the lease.

The structure of this type of lease requires the lessee to pay the net amount for three types of costs, including net real estate taxes on the leased asset, net building insurance and net common area maintenance. This type of lease can also be referred to as a net-net-net (NNN) lease.

Here are the results...

7 High Yielding Monthly Paying Dividend Stocks

One of the main motivations for income investors is to earn monthly dividends by investing in companies which provide a stable and predictable dividend income.

Buying a stock with monthly dividend rather than a quarterly payout has an added advantage: you can multiply your income faster by more frequently reinvesting in the company’s stock.

It works exactly the same way as compounding works in an interest-paying bank account, where you can multiply your income by reinvesting your profit. But most of the blue-chip companies included in the S&P-500 index pay quarterly dividends.

Investors seeking a monthly dividend income are usually left with real estate income trusts (REITs) or business development companies with a basket of risky portfolios.

If you’re looking for a stable monthly income from your stock investing, here are the seven top monthly dividend stocks.

Buying a stock with monthly dividend rather than a quarterly payout has an added advantage: you can multiply your income faster by more frequently reinvesting in the company’s stock.

It works exactly the same way as compounding works in an interest-paying bank account, where you can multiply your income by reinvesting your profit. But most of the blue-chip companies included in the S&P-500 index pay quarterly dividends.

Investors seeking a monthly dividend income are usually left with real estate income trusts (REITs) or business development companies with a basket of risky portfolios.

If you’re looking for a stable monthly income from your stock investing, here are the seven top monthly dividend stocks.

7 Best Monthly Paying Dividend Stocks

Social Security pays retirement income every month, and so do many company benefit plans. Why not dividends?

Credit card bills and housing and insurance costs are due every month, and financial professionals agree that managing cash flow is a big challenge.

For sure, only because a company pays a monthly dividend is not the most important reason. More important are cash flows, growth persectices, price ratios and other fundamentals.

Today I like to introduce 7 top stocks that pay dividends each month and each of them offer a solid ground for further research.

These are the results...

For sure, only because a company pays a monthly dividend is not the most important reason. More important are cash flows, growth persectices, price ratios and other fundamentals.

Today I like to introduce 7 top stocks that pay dividends each month and each of them offer a solid ground for further research.

These are the results...

5 Great Dividend Stocks With Top-Shelf Management And Solid Financials

Market whims and whispers can cause stocks to trade violently in the short term, but strong companies with top-shelf management and rock-solid financials can deliver returns that trounce the market long term.

Because investing for longer periods has proven to outperform shorter periods of trading in and out of stocks, we asked us to give us their best ideas of stocks to buy in multi-decade portfolios.

These are the five stocks that came in our minds...

Because investing for longer periods has proven to outperform shorter periods of trading in and out of stocks, we asked us to give us their best ideas of stocks to buy in multi-decade portfolios.

These are the five stocks that came in our minds...

12 Best REITs With Solid Fundamentals To Finance Profitable Growth

Owning such things as office buildings and self-storage facilities, real estate investment trusts rake in rents and must pay at least 90 percent of their taxable income to shareholders.

As long as they can keep raising rents and dividend payments, the stocks should fare well.

Indeed, REITs’ underlying properties should post a 4.5 percent average gain in operating income this year, fueling dividend growth in the “high single-digit” range, says investment firm Lazard, and yields in the range of 2 percent to 6 percent.

Attached you will find a selection of Reits with Return on Assests over 5 percent and solid debt ratios.

This is in my view the best way to discover stocks with potential for profitable growth in the future.

Here are the results...

As long as they can keep raising rents and dividend payments, the stocks should fare well.

Indeed, REITs’ underlying properties should post a 4.5 percent average gain in operating income this year, fueling dividend growth in the “high single-digit” range, says investment firm Lazard, and yields in the range of 2 percent to 6 percent.

Attached you will find a selection of Reits with Return on Assests over 5 percent and solid debt ratios.

This is in my view the best way to discover stocks with potential for profitable growth in the future.

Here are the results...

17 Best Rated Monthly Dividend Paying Stocks With Big Yields

While most dividend paying stocks that trade on exchanges in the US pay quarterly, there are some stocks that pay their dividends on other schedules.

A handful pay their dividends semi-annually while there is a larger population of monthly dividend stocks.

While only one aspect that should be considered in selecting stocks for investment, monthly dividend payments can be advantageous for building wealth over time and to smooth out a dividend retirement income stream.

Attached you will find a compilation of monthly paying stocks that met the following criteria:

- Pay dividends of 6% (plus or minus)

- Are growing those dividends

- Have solid balance sheets

A handful of these businesses even have investment grade credit ratings. The table below provides a list of 17 monthly dividend stocks sorted on dividend yield.

These are the results...

A handful pay their dividends semi-annually while there is a larger population of monthly dividend stocks.

While only one aspect that should be considered in selecting stocks for investment, monthly dividend payments can be advantageous for building wealth over time and to smooth out a dividend retirement income stream.

Attached you will find a compilation of monthly paying stocks that met the following criteria:

- Pay dividends of 6% (plus or minus)

- Are growing those dividends

- Have solid balance sheets

A handful of these businesses even have investment grade credit ratings. The table below provides a list of 17 monthly dividend stocks sorted on dividend yield.

These are the results...

| 17 Monthly Dividend Stocks (click to enlarge), Source: Valuewalk.com |

The Best Monthly Dividend Stocks For High-Yield Income Investors

The table below provides a list of 17 monthly dividend stocks sorted on dividend yield.

A handful of these businesses even have investment grade credit ratings.

It should be noted that this list is not all inclusive of monthly dividend paying stocks as there were a few monthly distribution paying master limited partnerships (MLPs) and a couple of crude oil production trusts that I chose to leave off this initial list of stocks.

MLPs and crude oil trusts are not stocks and their accounting and financial reporting is sufficiently different that they should be covered separately.

If you like to receive more list and high yield dividend tables, you should subscribe to my daily newsletter here. It's completly free for everyone. Thank you.

Here is the list...

A handful of these businesses even have investment grade credit ratings.

It should be noted that this list is not all inclusive of monthly dividend paying stocks as there were a few monthly distribution paying master limited partnerships (MLPs) and a couple of crude oil production trusts that I chose to leave off this initial list of stocks.

MLPs and crude oil trusts are not stocks and their accounting and financial reporting is sufficiently different that they should be covered separately.

If you like to receive more list and high yield dividend tables, you should subscribe to my daily newsletter here. It's completly free for everyone. Thank you.

Here is the list...

6 Monthly High-Yield Dividend Stocks To Cover

While income-oriented investors obviously make a point of seeking out reliable dividend stocks, sometimes regular quarterly payouts just won’t cut it.

Those persons who use these dividend payments to help pay monthly bills know a quarterly payout can be more than a little inconvenient at times simply because the incoming and outgoing cash flows aren’t evenly aligned.

Luckily, a few companies actually dish out cash every month rather than every three months.

And there’s a lot more of these monthly dividend stocks than you might think. If you’re looking for a consistent income stream for your portfolio, read on as we look at nine of the top monthly dividend stocks out there.

Here are the results...

Those persons who use these dividend payments to help pay monthly bills know a quarterly payout can be more than a little inconvenient at times simply because the incoming and outgoing cash flows aren’t evenly aligned.

Luckily, a few companies actually dish out cash every month rather than every three months.

And there’s a lot more of these monthly dividend stocks than you might think. If you’re looking for a consistent income stream for your portfolio, read on as we look at nine of the top monthly dividend stocks out there.

Here are the results...

19 Monthly Dividend Paying Stocks With Yields Over 3%

Attached you will find another portfolio of high yielding monthly dividend paying stocks.

Each of the stocks offer a yield over 3%. Reits and Oil and Gas companies dominating the screening results.

Here is the portfolio...

Each of the stocks offer a yield over 3%. Reits and Oil and Gas companies dominating the screening results.

Here is the portfolio...

7 Best Monthly Dividend Paying Stocks Each Income Investor Should Consider Now For 2016

The problem with traditional dividend stocks and bonds is that the cash flows are lumpy. Our expenses tend to be monthly, yet bond interest is generally paid twice per year and most dividends are paid quarterly.

The problem with traditional dividend stocks and bonds is that the cash flows are lumpy. Our expenses tend to be monthly, yet bond interest is generally paid twice per year and most dividends are paid quarterly.But some of the very best dividend stocks are those that pay 12 times a year. While you should never buy a stock purely because of its payout schedule, there is quite a lot to like about monthly dividend stocks. When they commit to paying monthly, management is showing very ostentatiously that they are giving their shareholders what they want.

Attached I've compiled a few, good and interesting looking stocks with monthly dividend payments for investors who need more monthly cash on his investment account.

Maybe you find some fresh new investment ideas on the results. I hope it helps you to structure your investments. If you like you can get more stock ideas direct into your email inbox. You just need to subscribe our free newsletter via this link or the subscription box in the sidebar.

Here are the results...

7 Stocks That Pay High Monthly Dividends And Yields Up To 13.16%

While most companies pay dividends on a quarterly basis, monthly dividend stocks make their dividend payouts each month. Some investors find a monthly payout schedule more appealing, as it makes it easier to derive regular income from dividends.

One way to create the most steady income stream possible in your portfolio is to buy stocks that pay a monthly dividend. However, not every stock with a monthly payout is a suitable investment for every investor. Some monthly dividend stocks are quite safe, while others are more speculative and should be avoided by risk-averse investors.

A regular paycheck isn’t the only way to ensure a steady flow of income. Whether you are already retired or simply planning ahead for retirement, by carefully selecting stocks that pay dividends on the right schedule, you can build a portfolio that guarantees cash every month. But be careful. You should never buy a stock purely because its dividend is paid monthly. Dividend safety and growth are far more important considerations.

In General, mostly Master Limited Partnerships or Limited Partnerships pay monthly dividends. Those are located to the REIT, Pipeline, Oil and Gas sector. Which do you like?

You may also like this article: 15 Higher Capitalized Monthly Dividend Paying Stocks

Here are eleven great stocks that do just that...

One way to create the most steady income stream possible in your portfolio is to buy stocks that pay a monthly dividend. However, not every stock with a monthly payout is a suitable investment for every investor. Some monthly dividend stocks are quite safe, while others are more speculative and should be avoided by risk-averse investors.

Monthly Dividends Not The Only Thing To Care About

A regular paycheck isn’t the only way to ensure a steady flow of income. Whether you are already retired or simply planning ahead for retirement, by carefully selecting stocks that pay dividends on the right schedule, you can build a portfolio that guarantees cash every month. But be careful. You should never buy a stock purely because its dividend is paid monthly. Dividend safety and growth are far more important considerations.

Who Pay Monthly Dividends Normally?

In General, mostly Master Limited Partnerships or Limited Partnerships pay monthly dividends. Those are located to the REIT, Pipeline, Oil and Gas sector. Which do you like?

You may also like this article: 15 Higher Capitalized Monthly Dividend Paying Stocks

Here are eleven great stocks that do just that...

6 High-Yielding Stocks With Monthly Dividend Payments

There’s just one

problem with normal investing: If you’re living off of your investments, you

normally get paid on a very different timeframe. Often your dividends come

yearly or quarterly and bond interest is usually paid semi-annually.

Even if you have a

diversified portfolio of bonds and dividend stocks, this schedule is going to

make your monthly cash flows lumpy. I don’t know about you, but I don’t like

trying to plan my expenses three to six months in advance.

For a retiree, I

can’t think of too many things scarier than running out of money in between

quarterly dividend payments. Well, fear not. There is a solution: Monthly

dividend stocks.

Monthly paying

stocks are not better than quarterly payers. There is a huge limitation in

terms of quality stocks but if you have a strong focus on companies with

monthly payments, you should look at the following selection of high yieldingstocks.

Here are the results...

18 Stocks With Higher Dividend Payments Of The Past Week

Attached is a nice compilation of

stocks with dividend growth from the past week. Only a few stocks, in total 18

companies, announced a higher dividend.

The best known

stocks are Clarcor, Thor, DineEquity, Masco, LTC Properties, Enterprise

Products Partners and Bank or Ozarks.

The biggest hike came

from Synnex followed by Riverview Bancorp and American Financial.

Here is the full

compilation....

|

| 18 Stocks With Higher Dividend Payments Of The Past Week (click to enlarge), Source: long-term-investments.blogspot.com |

These 4 High-Yield Stocks Pay Monthly Dividends

My readers looking for dividend

paying stocks and some of them also look for stocks that pay more regular. I'm

talking about monthly dividend paying stocks.

I've written in

the past some great articles about the foolish thoughts about the myth of

monthly dividend paying stocks but they still have a huge fan base.

Today, I’m going

to share four monthly dividend stocks that you can bank on to pay your monthly

bills, but with a very important note first: You should never buy a stock

purely because its dividend is paid monthly. Dividend safety and growth are far

more important considerations.

These are the

results:

Labels:

Dividends,

High Yield,

LTC,

MAIN,

Monthly Dividends,

O,

PSEC

20 Highest Yielding Monthly Payout Stocks

Are you buying stocks only for the

dividend? That's the wrong way in my view but many do it because they like to

get a regular income like a paycheck.

Dividends come

normally 4 times a year, that's a quarterly check but some do pay on a monthly

basis.

I'm blogging for

some years and know that some of my readers are deeply interested in stocks

that give investors a monthly payout.

I've ever

announced that it doesn't matter if you get each month .5 percent or 4 times

1.5 percent. In addition, lower yielding stocks with higher growth rates do

perform better over the long-term.

However, Today I

like to show you the highest yielding stocks with a monthly dividend payout. Which do you like?

Here are the higher capitalized stocks in detail:

Here are the higher capitalized stocks in detail:

8 Dividend Stocks To Buy And Hold For The Next 10 Years

Today, I’m going to recommend 10 of the best stocks you can safely buy and hold for the next 10 years.

I'm not talking about technology stocks. Remeber the AOL-Time-Warner Desaster in 2000? Sure, technology offers value but from the time perspective of now, it's hard to discover who owns the must have technology of the next decade.

To make this list of best stocks, the company should meet the following criteria:

- They must be supported by strong underlying macro trends — economic forces that are powerful and highly predictable.

- They should pay a good current dividend, or we should reasonably expect them to pay one on the very near future.

- They must be reasonably priced with an appropriate margin of safety.

- Paying a dividend of more than 3 percent of its market cap.

These are my results:

I'm not talking about technology stocks. Remeber the AOL-Time-Warner Desaster in 2000? Sure, technology offers value but from the time perspective of now, it's hard to discover who owns the must have technology of the next decade.

To make this list of best stocks, the company should meet the following criteria:

- They must be supported by strong underlying macro trends — economic forces that are powerful and highly predictable.

- They should pay a good current dividend, or we should reasonably expect them to pay one on the very near future.

- They must be reasonably priced with an appropriate margin of safety.

- Paying a dividend of more than 3 percent of its market cap.

These are my results:

Subscribe to:

Posts (Atom)