If you are concerned that current valuations may cast a shadow over the future returns of equity-income strategies, you're not alone. There's no telling how long dividend stocks' recent run of outperformance will continue.

But there are plenty of reasons to think that investing in steady dividend-paying stocks, particularly high-quality stocks that are healthy enough to not only sustain but possibly even increase their dividend, won't go out of style completely.

Investors still have need for income, and although interest rates are likely to rise, they are still very low by historical standards and are not expected to shoot up dramatically anytime soon.

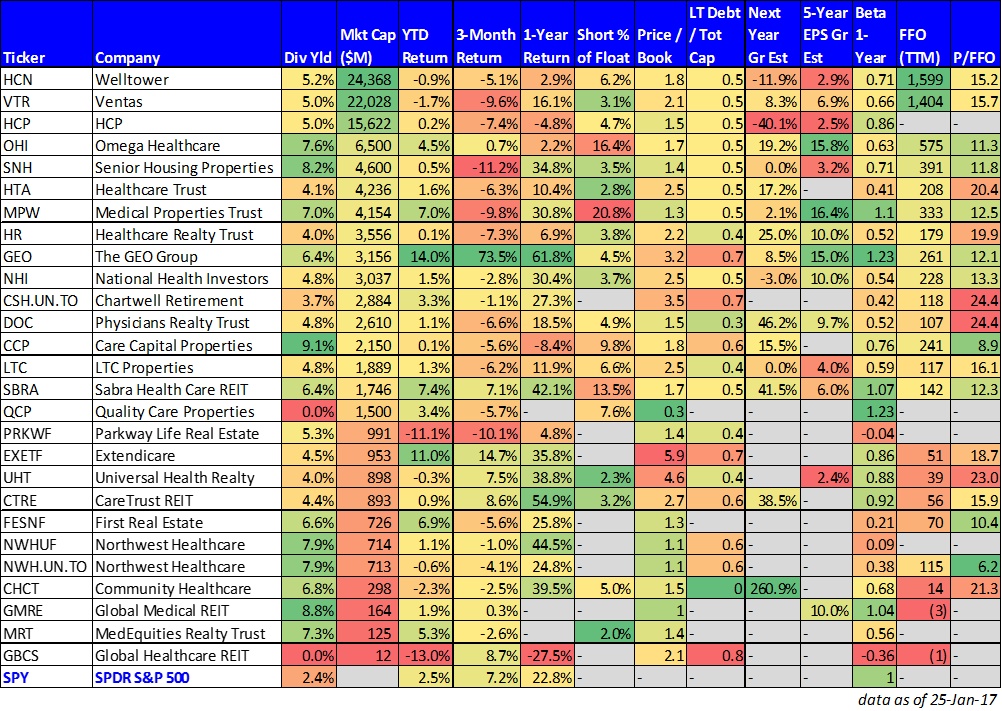

To get a better sense of how over- or undervalued dividend-paying stocks are today, we run a screen with selection of dividend yield, P/E and growth and filtered those stocks with attractive ratios in most of the areas.

Here are the top results from our screen...

7 Good Dividend Stock Opportunities In The Retail Sector

There’s really nothing better than finding solid dividend stocks on the cheap.

The stability offered by a stable income stream, coupled with attractive upside stemming from a low stock price, can provide investors with an extremely rare mix of safety and growth. But the problem is that these opportunities are few and far between. Why?

Well, it’s simple: investors love companies that pay consistently rising dividends so much that they’re hardly ever trading at cheap valuations.

Furthermore, it’s nearly impossible to just accidentally come across inexpensive dividend stocks. Unless you’re closely paying attention to the market on a day-to-day basis, you’ll simply never know when a solid dividend stock falls in price enough to enter “buy” territory.

Luckily for readers, monitoring the market for attractive dividend opportunities is all we do here at Income Investors. And you better believe we took notice when the retail sector plunged on Friday, taking down several interesting dividend stocks in the process.

These are the results I'm talking about...

The stability offered by a stable income stream, coupled with attractive upside stemming from a low stock price, can provide investors with an extremely rare mix of safety and growth. But the problem is that these opportunities are few and far between. Why?

Well, it’s simple: investors love companies that pay consistently rising dividends so much that they’re hardly ever trading at cheap valuations.

Furthermore, it’s nearly impossible to just accidentally come across inexpensive dividend stocks. Unless you’re closely paying attention to the market on a day-to-day basis, you’ll simply never know when a solid dividend stock falls in price enough to enter “buy” territory.

Luckily for readers, monitoring the market for attractive dividend opportunities is all we do here at Income Investors. And you better believe we took notice when the retail sector plunged on Friday, taking down several interesting dividend stocks in the process.

These are the results I'm talking about...

My Favorite Master Limited Partnerships - High Yields and Low Taxes

MLPs are publicly traded limited partnerships that derive at least 90% of their cash flows from real estate, commodities or natural resources. In the US there are about 120 MLPs with a combined value around $875 billion.

There are three classes of MLPs: upstream (resource extractors like oil and gas partnerships), midstream (those that transport and process resources, like pipeline operators), and downstream (refiners and distributors).

Rather than paying dividends to shareholders, they pay distributions to unit holders. Another difference is that most midstream MLPs have a general partner, who runs the partnership.

Limited partners (investors) don't have a say in how the MLP is run. In addition, general partners typically hold incentive distribution rights (IDRs), which means that a higher proportion of the MLPs marginal cash flow goes to them as the distribution grows (up to 50% of marginal cash flow).

There are three main drawbacks to MLPs. The first is that those partnerships with a general partner will experience slower distribution growth over time, as IDRs increase. Second, MLPs issue K-1 forms which are used instead of 1099's and can add a bit of complexity during tax preparation.

Finally is the fact that they shouldn't be used in tax deferred accounts such as IRAs. This is because they can generate what's known as UBTI (unrelated business taxable income) that can result in you owing taxes even though the investment is in a tax deferred account.

Attached I've compiled a couple of MLP's I like for a deeper research. Each of them pays a high dividend and has a higer market capitalization, over 300 million.

These are the names I like from the MLP space...

There are three classes of MLPs: upstream (resource extractors like oil and gas partnerships), midstream (those that transport and process resources, like pipeline operators), and downstream (refiners and distributors).

Rather than paying dividends to shareholders, they pay distributions to unit holders. Another difference is that most midstream MLPs have a general partner, who runs the partnership.

Limited partners (investors) don't have a say in how the MLP is run. In addition, general partners typically hold incentive distribution rights (IDRs), which means that a higher proportion of the MLPs marginal cash flow goes to them as the distribution grows (up to 50% of marginal cash flow).

There are three main drawbacks to MLPs. The first is that those partnerships with a general partner will experience slower distribution growth over time, as IDRs increase. Second, MLPs issue K-1 forms which are used instead of 1099's and can add a bit of complexity during tax preparation.

Finally is the fact that they shouldn't be used in tax deferred accounts such as IRAs. This is because they can generate what's known as UBTI (unrelated business taxable income) that can result in you owing taxes even though the investment is in a tax deferred account.

Attached I've compiled a couple of MLP's I like for a deeper research. Each of them pays a high dividend and has a higer market capitalization, over 300 million.

These are the names I like from the MLP space...

Subscribe to:

Posts (Atom)