Showing posts with label PSO. Show all posts

Showing posts with label PSO. Show all posts

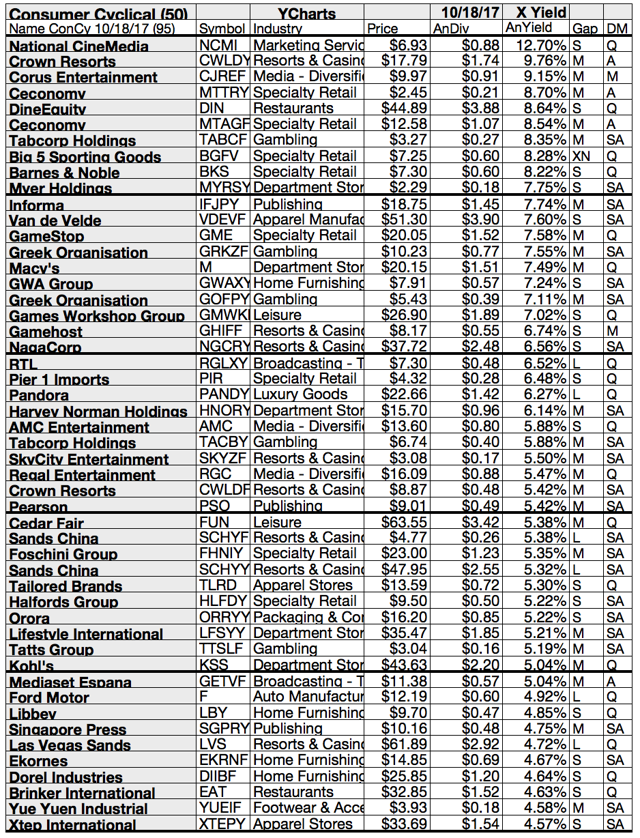

17 High Income Stocks With Yields Over 10%

If you are looking for low-risk low-reward dividend stocks, this article is not for you. However, if you're looking for high-income yields, and risks that are tilted in your favor, then you may want to consider the ideas highlighted in this article.

The ideas span a variety of investment types. REITS, Mortgage Reits and MLPs are a major class that pay high dividends but they are all with high risks.

I love high dividends because you get a nice income and your investment got a fast cash return which you can use for new investment ideas. But high yields shouldn't be the only criteria. Dividend stability is more important to look for.

Without further ado, here are the 17 attractive 10% yield opportunities...

The ideas span a variety of investment types. REITS, Mortgage Reits and MLPs are a major class that pay high dividends but they are all with high risks.

I love high dividends because you get a nice income and your investment got a fast cash return which you can use for new investment ideas. But high yields shouldn't be the only criteria. Dividend stability is more important to look for.

Without further ado, here are the 17 attractive 10% yield opportunities...

16 Oversold Dividend Stocks Are Now Cheap Enough To Buy Now

As the markets reached recently fresh new highs, income investors are on the lookout for stocks with solid dividend yields that have strong fundamentals and are oversold due to the year's volatility.

It's hard to find cheaply priced stocks in such a hot priced environment.

Looking at the stocks' technical charts can help determine whether the fundamentals can be further supported.

Not surprisingly, this year's market volatility has wreaked havoc on many strong dividend stocks.

Today we've screened the market by cheap stocks (forward P/E under 15) with an oversold definition by RSI 40.

We also excluded all stocks with a market capitalization over 2 billion. In addition, the ROA is positive and the debt-to equity under 1.

16 stocks are meeting the above mentioned criteria of which 2 a High-Yields.

These are the results in detail...

It's hard to find cheaply priced stocks in such a hot priced environment.

Looking at the stocks' technical charts can help determine whether the fundamentals can be further supported.

Not surprisingly, this year's market volatility has wreaked havoc on many strong dividend stocks.

Today we've screened the market by cheap stocks (forward P/E under 15) with an oversold definition by RSI 40.

We also excluded all stocks with a market capitalization over 2 billion. In addition, the ROA is positive and the debt-to equity under 1.

16 stocks are meeting the above mentioned criteria of which 2 a High-Yields.

These are the results in detail...

10 Stocks Looking Cheap Now During The Cycle

The S&P 500 is already off more than 8%, which means the benchmark index has lost more than 1.7% per week on average for every full week of trading.

The S&P 500 is already off more than 8%, which means the benchmark index has lost more than 1.7% per week on average for every full week of trading.If anything, it’s highly unlikely that markets will keep falling so quickly — at that pace, most of the stock market would evaporate by the end of the year.

But any continued losses are unwelcome losses, so investors are rapidly fleeing to more risk-light assets. The problem is the 10-year Treasury yield now yields a mere 1.74%, and many traditional safe-haven stocks have actually enjoyed buying amid the downturn, helping to drive down their yields.

Investors do have a few options for meaningful yield, though. The very downturn that has investors scurrying to find safe-havens has created a bevy of cheap dividend stocks to buy, most of which yield about two or three times the miserable yield on the 10-year.

Here are the results...

20 High-Yield Stocks With Extreme Low Beta Ratios (Half Of The Market)

Everyone has a different appetite for risk. Some people like to chase those high growth companies that have chances of doubling in a year or two, while others would likely never sleep at night while three out of 10 of its investments destroy the market while the other 7 crash & burn.

Everyone has a different appetite for risk. Some people like to chase those high growth companies that have chances of doubling in a year or two, while others would likely never sleep at night while three out of 10 of its investments destroy the market while the other 7 crash & burn. If you are one of those investors that don't have the sensibility to invest in those higher risk/higher reward type of companies, that's ok, there are plenty of lower risk companies that can generate good returns over time.

One ratio to measure the risk compared to the market is the beta ratio. A ratio under one shows us that the unique stock moves less than the overall market while a ratio far above one indicates that the stock is more volatile than the market.

If you look for more stability of your portfolio, you should look at low beta stocks. Mostly, you need to give up some of your return or dividend yield due to the higher safeness. But only sometimes.

Attached you can find a couple of stocks with the lowest beta ratio on the market while paying the highest available yields in their field. I've only included stocks with a market cap of more than 2 billion.

These are the results...

The Safest UK Dividend Stocks With Yields Over 4%

If you like to diversify your

portfolio, you should look at stocks abroad. The United Kingdom is a great

domicile for income orientated investors.

I've often written

about foreign high yielding dividend stocks. But you must keep an eye of the

additional currency risk of your investment.

Attached you can

find a visual list of more or less safe high yielding stocks from the FTSE 100.

It's in my view a great overview.

Here are the safest dividend stocks from the UK...

Here are the safest dividend stocks from the UK...

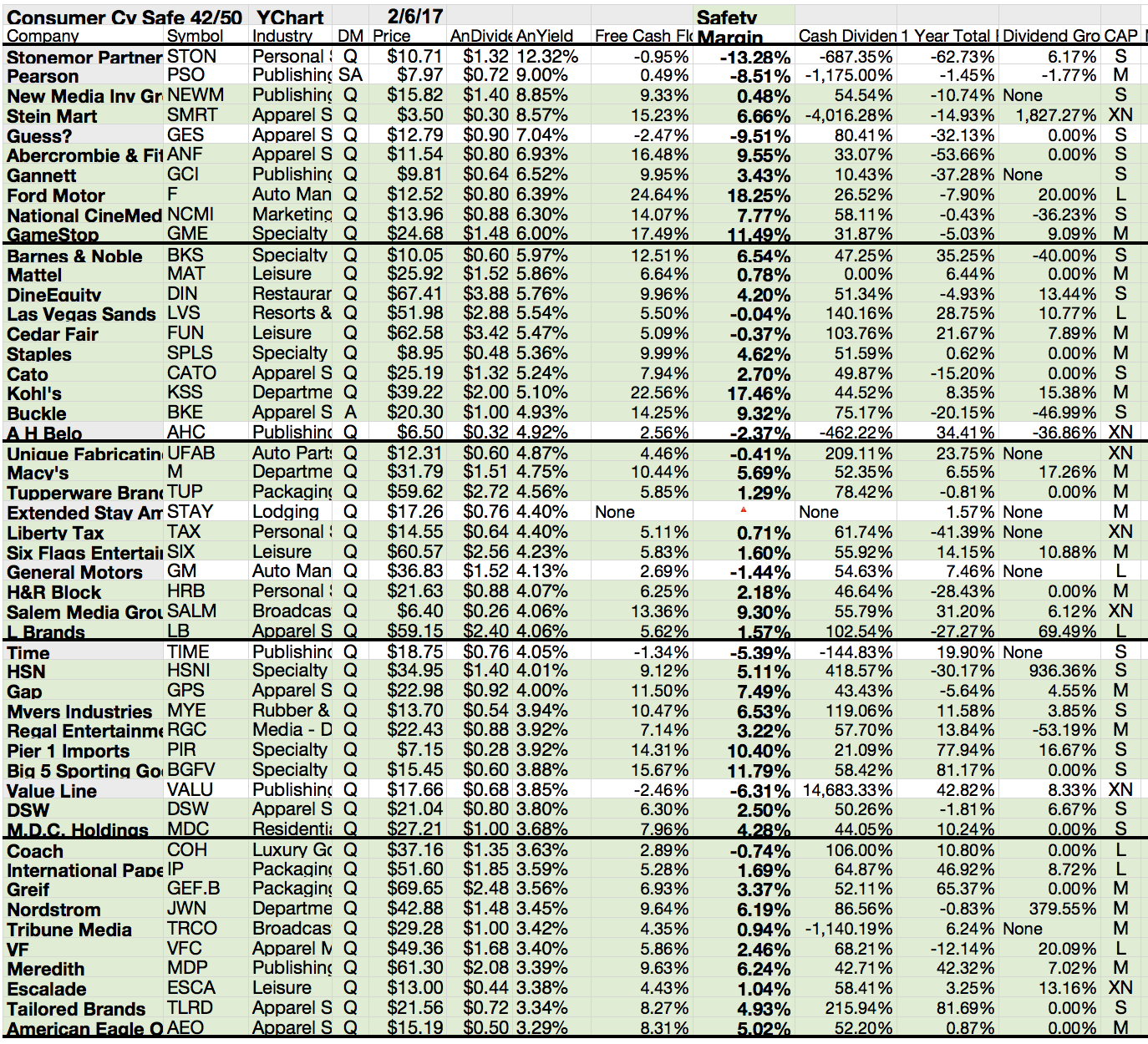

20 Dividend Stocks With Yields Over 4% And A Low Risk Profile

If a stock with a 6% dividend yield sees its price cut in half, an investor living off dividends in retirement would have been better off purchasing a lower yielding stock with less business risk and volatility, occasionally selling shares to meet his or her cash flow needs.

Remember, the market is quite efficient most of the time, so think first before chasing a high yield dividend stock that appears to be too good to be true. It often is.

With that said, we dug through our database of thousands of dividend stocks to search for companies offering a dividend yield greater than 4% with low stock price volatility, above average dividend safety and enough dividend growth to protect retirees’ purchasing power.

These characteristics don’t guarantee that these stocks won’t decline in price, but it’s a good place to start the hunt for income ideas to research on a deeper level.

Attached you can find a few of those stocks with a dividend yield of more than 4% yearly and low beta and vola ratios.

These are the highest yielding results...

40 Top Yielding Results From My Safe Haven Large Cap Screen

As a long reader of my blog, you

might know that I love dividend paying stocks, high cash compensations at low

risk.

Everything at all is not possible but I do my best to find great stock ideas each day. Today I like to move forward by taking a look into my safe heaven screen.

I run this screen several times till now. There are more stocks with an inconsistent dividend growth history but this does not mean that they are not high-quality.

Everything at all is not possible but I do my best to find great stock ideas each day. Today I like to move forward by taking a look into my safe heaven screen.

I run this screen several times till now. There are more stocks with an inconsistent dividend growth history but this does not mean that they are not high-quality.

Many oil and gas

companies jumped into the screen within the recent weeks thanks to the low oil

price. In addition, Money Center Banks are also top picks in the higher yield

area but take a look by yourself...

Ex-Dividend Stocks: Best Dividend Paying Shares On August 14, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors should

have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks August 14,

2013. In total, 57 stocks go ex

dividend - of which 15 yield more than 3 percent. The average yield amounts to 3.18%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

AstraZeneca

PLC

|

63.85B

|

13.08

|

2.75

|

2.40

|

7.45%

|

|

|

Royal

Dutch Shell plc

|

212.18B

|

8.98

|

1.20

|

0.47

|

5.11%

|

|

|

Duke

Energy Corporation

|

49.96B

|

25.19

|

1.25

|

2.07

|

4.41%

|

|

|

CenterPoint

Energy, Inc.

|

10.33B

|

54.80

|

2.47

|

1.27

|

3.44%

|

|

|

Simon

Property Group Inc.

|

48.80B

|

40.64

|

8.43

|

9.71

|

2.92%

|

|

|

Talisman

Energy Inc.

|

11.41B

|

-

|

1.20

|

2.02

|

2.44%

|

|

|

Pearson

plc

|

16.71B

|

43.15

|

1.90

|

2.09

|

2.37%

|

|

|

Phillips

66

|

36.02B

|

7.88

|

1.66

|

0.21

|

2.15%

|

|

|

The J. M. Smucker Company

|

12.07B

|

22.79

|

2.34

|

2.05

|

2.04%

|

|

|

United

Technologies Corp.

|

95.10B

|

19.22

|

3.52

|

1.54

|

2.03%

|

|

|

Amgen

Inc.

|

81.37B

|

18.19

|

3.95

|

4.61

|

1.74%

|

|

|

Diageo

plc

|

80.77B

|

21.06

|

7.57

|

4.56

|

1.71%

|

|

|

PACCAR

Inc.

|

19.96B

|

19.71

|

3.27

|

1.24

|

1.42%

|

|

|

Delphi

Automotive PLC

|

17.37B

|

16.82

|

6.89

|

1.11

|

1.22%

|

|

|

The

Sherwin-Williams Company

|

18.08B

|

27.49

|

10.05

|

1.86

|

1.12%

|

|

|

CF

Industries Holdings, Inc.

|

11.24B

|

6.65

|

2.26

|

1.91

|

0.84%

|

|

|

Visa,

Inc.

|

141.65B

|

30.99

|

5.25

|

12.28

|

0.73%

|

|

|

EQT

Corporation

|

12.58B

|

47.21

|

3.30

|

6.51

|

0.14%

|

Next Week's Best Yielding Large Cap Ex-Dividend Stocks

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors should

have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading week.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks Between August

12 - 18, 2013. In

total, 182 stocks go ex dividend - of which 61 yield more than 3 percent. The

average yield amounts to 4.28%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

AstraZeneca

PLC

|

63.54B

|

13.01

|

2.74

|

2.39

|

7.49%

|

|

|

Royal

Dutch Shell plc

|

214.51B

|

8.18

|

1.19

|

0.47

|

5.08%

|

|

|

Duke

Energy Corporation

|

49.89B

|

21.38

|

1.22

|

2.28

|

4.41%

|

|

|

Pearson

plc

|

16.79B

|

44.28

|

1.91

|

2.13

|

4.37%

|

|

|

Consolidated

Edison Inc.

|

17.66B

|

16.89

|

1.49

|

1.43

|

4.08%

|

|

|

Exelon

Corporation

|

26.73B

|

27.91

|

1.27

|

1.07

|

3.97%

|

|

|

Shaw

Communications, Inc.

|

11.26B

|

15.57

|

2.99

|

2.29

|

3.95%

|

|

|

Eli

Lilly & Co.

|

58.53B

|

12.15

|

3.84

|

2.55

|

3.62%

|

|

|

CenterPoint

Energy, Inc.

|

10.39B

|

55.11

|

2.48

|

1.28

|

3.42%

|

|

|

Chevron

Corporation

|

235.37B

|

9.93

|

1.68

|

1.01

|

3.27%

|

|

|

E. I. du Pont de Nemours

|

55.12B

|

23.52

|

4.22

|

1.56

|

3.01%

|

|

|

Simon

Property Group Inc.

|

49.01B

|

40.81

|

8.46

|

9.75

|

2.91%

|

|

|

Enbridge

Inc.

|

33.97B

|

59.81

|

5.16

|

1.32

|

2.88%

|

|

|

Microsoft

Corporation

|

272.88B

|

12.63

|

3.46

|

3.51

|

2.81%

|

|

|

Teva

Pharmaceutical Industries

|

34.57B

|

20.22

|

1.52

|

1.72

|

2.70%

|

|

|

Walgreen

Co.

|

47.02B

|

21.85

|

2.48

|

0.66

|

2.54%

|

|

|

International

Paper Co.

|

21.54B

|

21.93

|

3.21

|

0.75

|

2.50%

|

|

|

Talisman

Energy Inc.

|

11.57B

|

-

|

1.21

|

2.05

|

2.40%

|

|

|

Valero

Energy Corporation

|

20.16B

|

7.38

|

1.10

|

0.15

|

2.15%

|

|

|

Phillips

66

|

36.48B

|

7.98

|

1.68

|

0.21

|

2.12%

|

Subscribe to:

Comments (Atom)