The market’s had its ups and downs this year, but there is sure to be more volatility ahead of us in 2017. There is a lot of speculation over the health of the global economy. Will China keep falling behind growth expectations? Will the high market valuation cause a short-term sell off?

As long as the market has big questions with no concrete answers, there is sure to be more volatility ahead of us. When the global environment is uncertain, it is wise to reduce your market exposure by picking up some low beta stocks. Stocks with a low beta tend to see a lower magnitude of price changes compared to the broader market.

The secret sauce behind high performance is low volatility. Stock portfolios built with low beta stocks tend to outperform high-beta growth stocks. And you sleep at night without having to worry about big swings in the market.

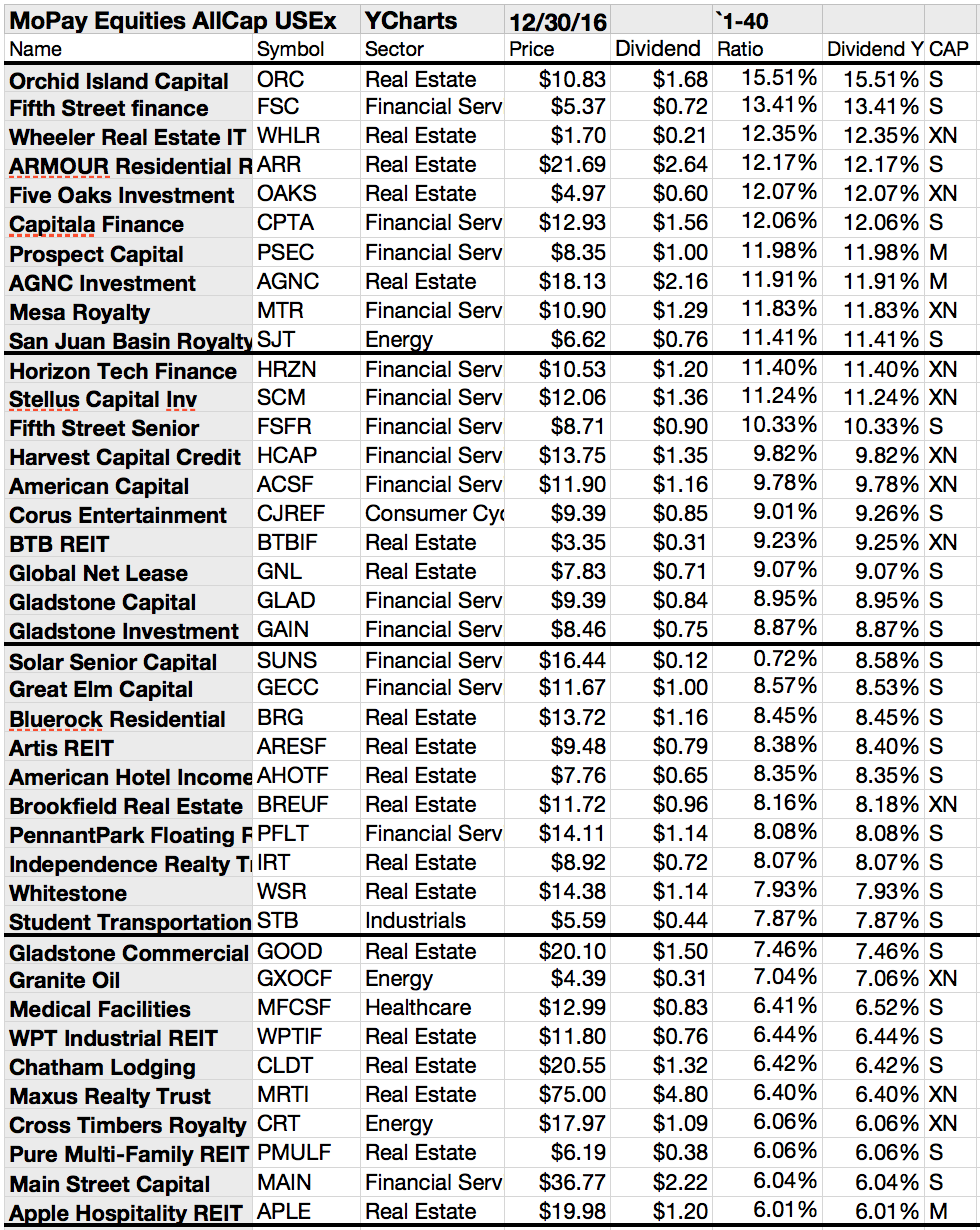

It is foolish to assume that taking on more risk will produce higher returns. We all want the sure thing in business with no risk, but this is nearly impossible to find. But it possible to find low-beta stocks with steadily rising dividends or high dividends. I've done some research in order to find the best high-yield dividend stocks with low beta ratios.

These 20 stocks have high yields at low beta ratios...

These Companies Announced Dividend Increases In The Past Week

One way to identify dividend growth stocks for further analysis is to monitor dividend increases.

Companies that regularly increase dividends show confidence in future earnings growth potential.

In the past weeks, 18 companies announced dividend increases. The table below presents a summary of these increases.

Here are the results...

Companies that regularly increase dividends show confidence in future earnings growth potential.

In the past weeks, 18 companies announced dividend increases. The table below presents a summary of these increases.

Here are the results...

10 Best Dividend Stocks Ideas For 2017

To that end we believe that shares of high quality stocks purchased at a historically repetitive area of low-price/high-yield offers the greater potential for downside protection and upside appreciation.

The Timely Ten, therefore, is not just another ‘best of, right now’ list. Rather, it is our reasoned expectation — based on our methodology and experience — that these ten currently Undervalued stocks offer the greatest real total-return potential over the next five years.

Whether you are building a portfolio from scratch, are partially invested and seeking new positions, or are fully invested and in need of some affirmation and hand holding, The Timely Ten represents our top ten current recommendations.

The Timely Ten is comprised of stocks from the Undervalued category that generally have an S&P Dividend & Earnings Quality ranking of A- or better and a rating for exemplary long-term dividend growth.

These stocks also have a P/E ratio of 15 or less, a payout ratio of 50% or less, and technical characteristics that suggest the potential for imminent capital appreciation.

Our latest Timely Ten selections are:

The Timely Ten, therefore, is not just another ‘best of, right now’ list. Rather, it is our reasoned expectation — based on our methodology and experience — that these ten currently Undervalued stocks offer the greatest real total-return potential over the next five years.

Whether you are building a portfolio from scratch, are partially invested and seeking new positions, or are fully invested and in need of some affirmation and hand holding, The Timely Ten represents our top ten current recommendations.

The Timely Ten is comprised of stocks from the Undervalued category that generally have an S&P Dividend & Earnings Quality ranking of A- or better and a rating for exemplary long-term dividend growth.

These stocks also have a P/E ratio of 15 or less, a payout ratio of 50% or less, and technical characteristics that suggest the potential for imminent capital appreciation.

Our latest Timely Ten selections are:

8 Top Picks With Buy Ratings Seen Out Of Merrill Lynch

The year-end prices are actually Merrill Lynch reference prices here rather than actual formal year-end prints on the NYSE or other exchanges. These are 8 top picks with Buy ratings seen out of Merrill Lynch as a kick-off to 2016.

Texas Instruments Inc. (NASDAQ: TXN) closed out 2016 at $72.97, and Merrill Lynch has a price objective of $82.00. If you consider the 2.7% dividend yield, Merrill Lynch is calling for Texas Instruments to generate a return of 15%. What investors might want to consider is that the consensus analyst target price is $74.89, very close to the current price, but Merrill Lynch’s price objective is exactly $10 less than the most aggressive price target on Wall Street. Texas Instruments has a 52-week range of $46.73 to $75.25. RBC was also positive here on Texas Instruments and other large caps.

Norfolk Southern Corp. (NYSE: NSC) is another top pick from Merrill Lynch, with the firm’s $122.00 price objective being higher than the $108.82 most recent price. Norfolk Southern’s consensus analyst price target of $105.19 is actually lower than the current share price. That makes Merrill Lynch much more positive than the street even if they are just calling for 13% upside. Norfolk Southern has a 52-week range of $64.51 to $111.43.

Hess Corp. (NYSE: HES) was last at $62.90, and Merrill Lynch’s price objective was last seen at $80.00. Hess has a 52-week range of $32.41 to $65.56 and its consensus analyst price target is just at $64.75. What matters here is that Merrill Lynch actually has the highest seen street price target of major analysts.

General Dynamics Corp. (NYSE: GD) was last trading at $173.21 versus a Merrill Lynch price objective of $200.00 for the company. That implies a gain of 15% if Merrill Lynch is right, and then there is the 1.8% dividend yield to consider for total return investors. General Dynamics has a consensus analyst target price of $186.06 and a 52-week range of $121.61 to $180.09.

Aetna Inc. (NYSE: AET) closed out the year at $124.45, and the firm has a $149 price objective. Aetna has a consensus analyst target of $138.93 and has a 52-week range of $92.42 to $136.50. That is still down 10% from a peak, and it remains unknown if the Trump administration will be more tolerant of insurance mergers versus that Obama administration.

Dover Corp. (NYSE: DOV) was at $75.19 at the end of 2016 and the firm has a $85.00 price objective. This is 13% in implied upside for Dover, before considering its 2.3% dividend yield.

MGM Resorts International (NYSE: MGM) is also a top pick for the first quarter, and Merrill Lynch’s price objective of $33.00 was versus a recent price of $28.50. The consensus analyst target price is a tad higher at $33.86.

SVB Financial Group (NASDAQ: SIVB) has a Buy rating at the firm, and this top pick among the bank stocks has a price objective of $190 versus a current $170.38 close. The parent of Silicon Valley Bank has a consensus analyst price target of $176.19, and its 52-week range is $77.87 to $176.77.

Texas Instruments Inc. (NASDAQ: TXN) closed out 2016 at $72.97, and Merrill Lynch has a price objective of $82.00. If you consider the 2.7% dividend yield, Merrill Lynch is calling for Texas Instruments to generate a return of 15%. What investors might want to consider is that the consensus analyst target price is $74.89, very close to the current price, but Merrill Lynch’s price objective is exactly $10 less than the most aggressive price target on Wall Street. Texas Instruments has a 52-week range of $46.73 to $75.25. RBC was also positive here on Texas Instruments and other large caps.

Norfolk Southern Corp. (NYSE: NSC) is another top pick from Merrill Lynch, with the firm’s $122.00 price objective being higher than the $108.82 most recent price. Norfolk Southern’s consensus analyst price target of $105.19 is actually lower than the current share price. That makes Merrill Lynch much more positive than the street even if they are just calling for 13% upside. Norfolk Southern has a 52-week range of $64.51 to $111.43.

Hess Corp. (NYSE: HES) was last at $62.90, and Merrill Lynch’s price objective was last seen at $80.00. Hess has a 52-week range of $32.41 to $65.56 and its consensus analyst price target is just at $64.75. What matters here is that Merrill Lynch actually has the highest seen street price target of major analysts.

General Dynamics Corp. (NYSE: GD) was last trading at $173.21 versus a Merrill Lynch price objective of $200.00 for the company. That implies a gain of 15% if Merrill Lynch is right, and then there is the 1.8% dividend yield to consider for total return investors. General Dynamics has a consensus analyst target price of $186.06 and a 52-week range of $121.61 to $180.09.

Aetna Inc. (NYSE: AET) closed out the year at $124.45, and the firm has a $149 price objective. Aetna has a consensus analyst target of $138.93 and has a 52-week range of $92.42 to $136.50. That is still down 10% from a peak, and it remains unknown if the Trump administration will be more tolerant of insurance mergers versus that Obama administration.

Dover Corp. (NYSE: DOV) was at $75.19 at the end of 2016 and the firm has a $85.00 price objective. This is 13% in implied upside for Dover, before considering its 2.3% dividend yield.

MGM Resorts International (NYSE: MGM) is also a top pick for the first quarter, and Merrill Lynch’s price objective of $33.00 was versus a recent price of $28.50. The consensus analyst target price is a tad higher at $33.86.

SVB Financial Group (NASDAQ: SIVB) has a Buy rating at the firm, and this top pick among the bank stocks has a price objective of $190 versus a current $170.38 close. The parent of Silicon Valley Bank has a consensus analyst price target of $176.19, and its 52-week range is $77.87 to $176.77.

Subscribe to:

Posts (Atom)